David Alexander II

@Mega_Fund

Partner @anagramxyz | prev MD @BinanceLabs, OG @ConsenSys | Research @MetricsDAO | Chaotic Neutral 🌑

Pectra is here and quietly paves the way for real-world usage, meaningful consumer applications, optimized staking, and more. Let's explore what's ahead 😈

2/ Pectra: Towards Endgame Account Abstraction and Staking Optimization blog.anagram.xyz/pectra-towards…

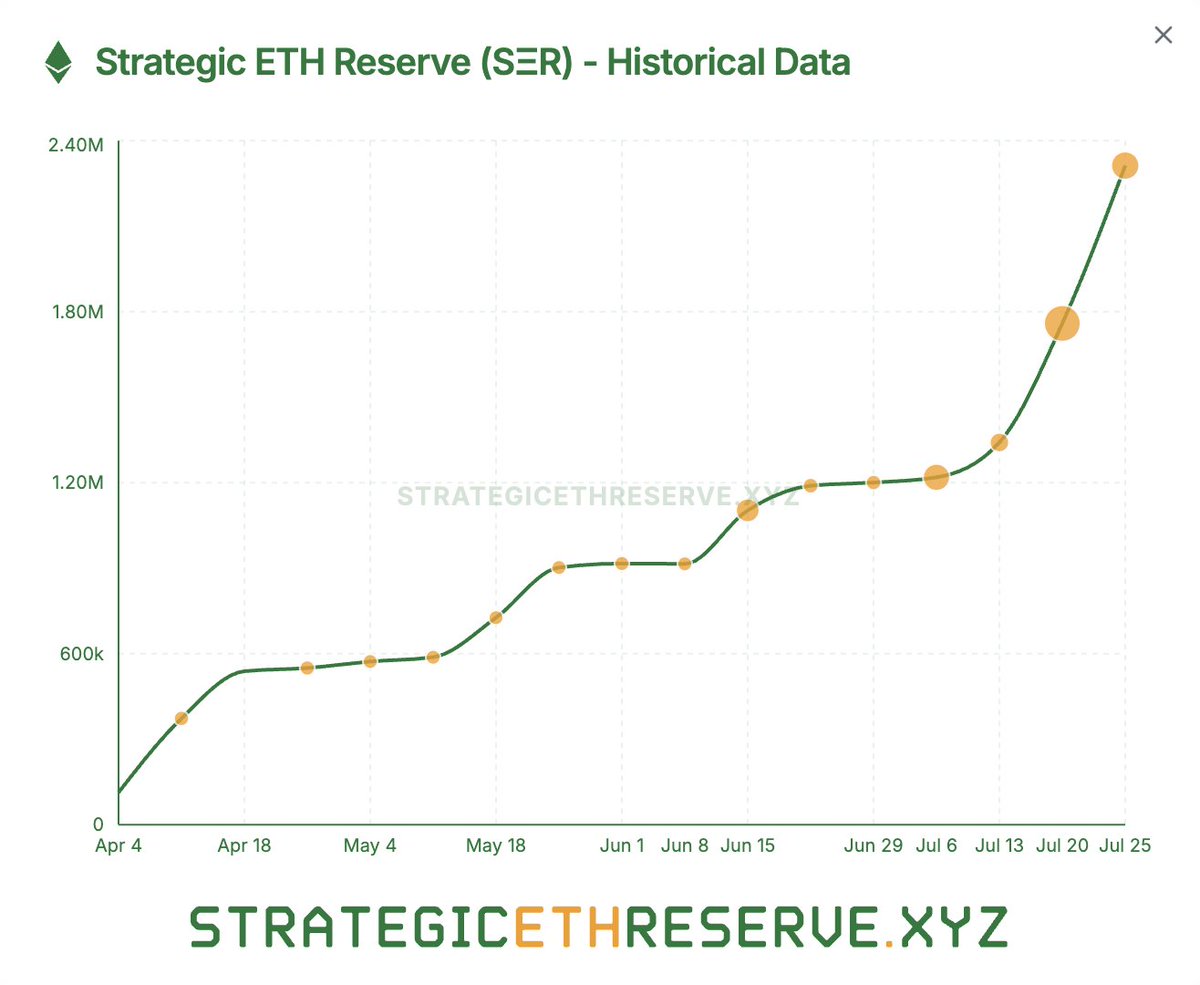

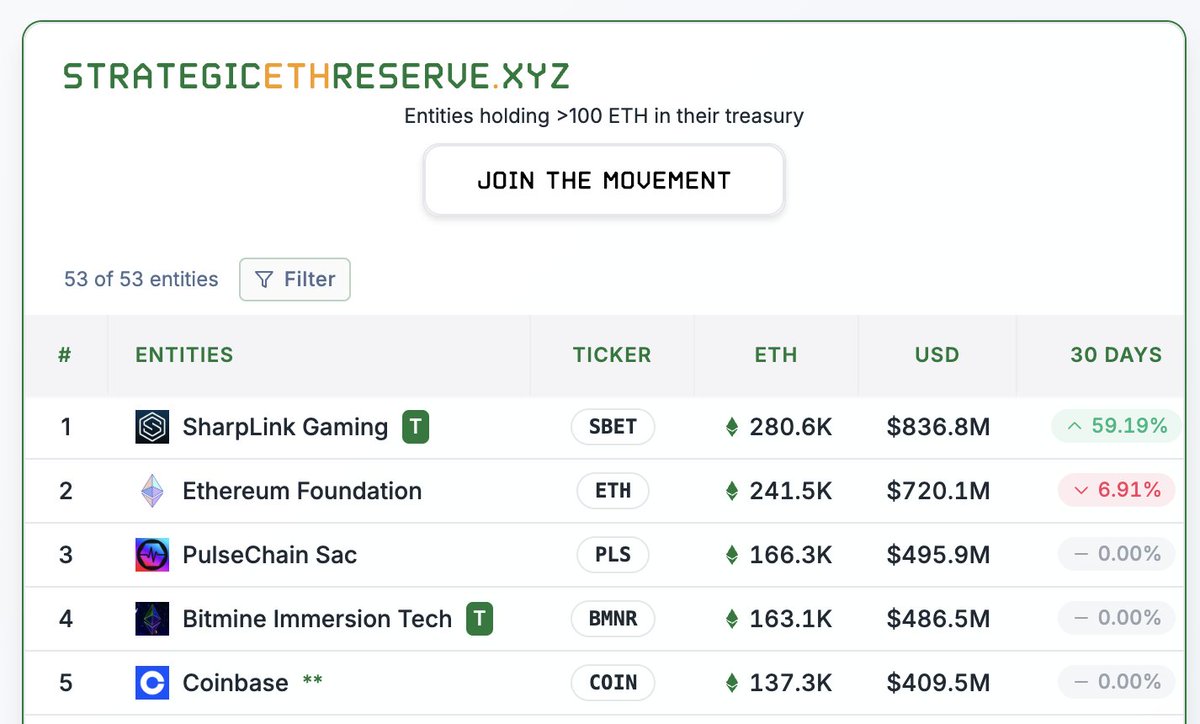

Meanwhile, $ETH treasury strategies have grown to 2,300,000 ETH (~$8.1B) and have nearly doubled over the last two weeks, now accounting for 2% of the entire supply. Collectively, the top 3 private treasury strategies @BitMNR (567K ETH), @SharpLinkGaming (361K ETH), and…

Validator exit queues continue to grow, surpassing 705,000 $ETH (~$2.8B) and are 32% higher than the previous peak in January 2024. Wait times are now approaching 13 days. Interestingly, validator entry queues also remain elevated, with over 280,000 ETH (~$1B) waiting to enter…

There is now more than 670,000 $ETH (~$2.5B) in queue to exit the network, with the wait time to exit at nearly 12 days. Capital rotation, profit taking, treasury strategies. Thank you for the mention @CoinDesk @sndr_krisztian 💪 coindesk.com/tech/2025/07/2…

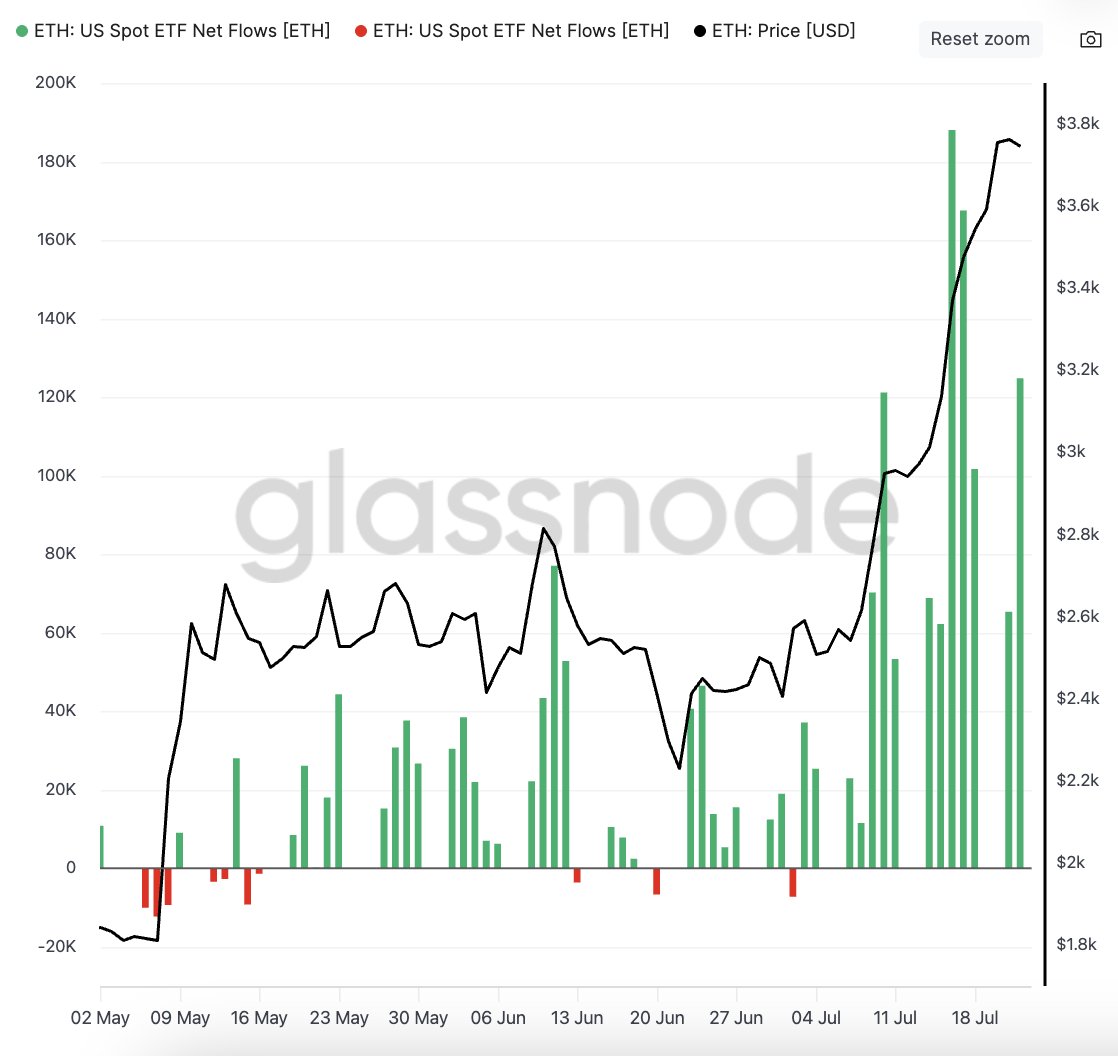

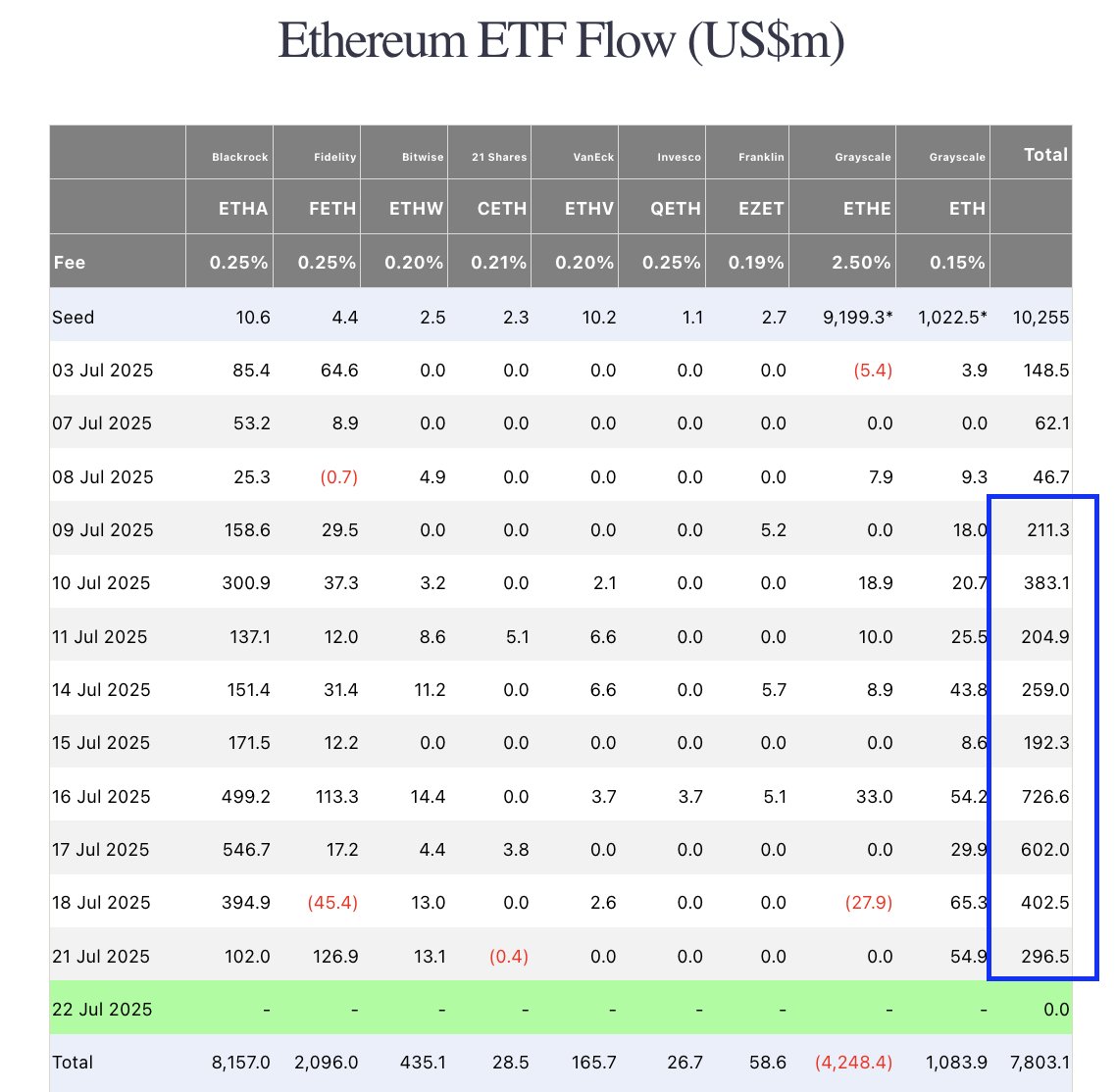

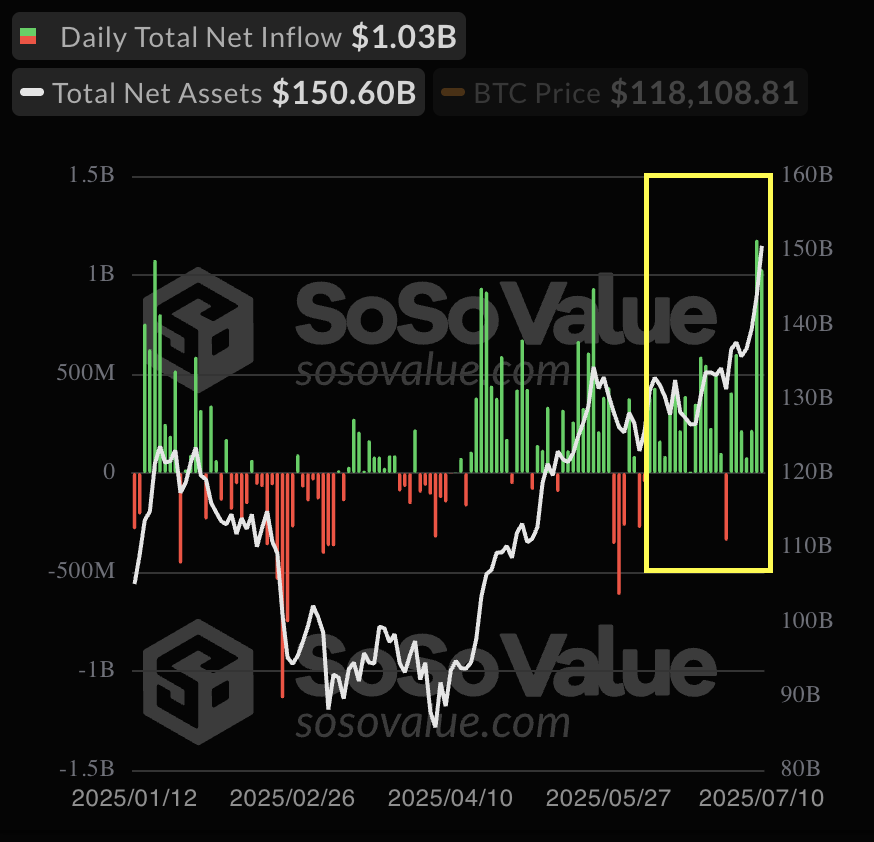

While $BTC ETFs experienced their second consecutive day of net outflows (-$68M), $ETH ETFs had their third-best day ever with $533M in net inflows. ETH ETFs have already added $830B this week compared with BTC's -$199M. In July, ETH ETF inflows have been positive on all but…

9 straight days of 9-figure $ETH ETF inflows, with over $3.2B pouring in. Spot ETH ETFs now collectively hold over 5 million ETH, accounting for more than 4% of the total supply. Buckle up. h/t @FarsideUK

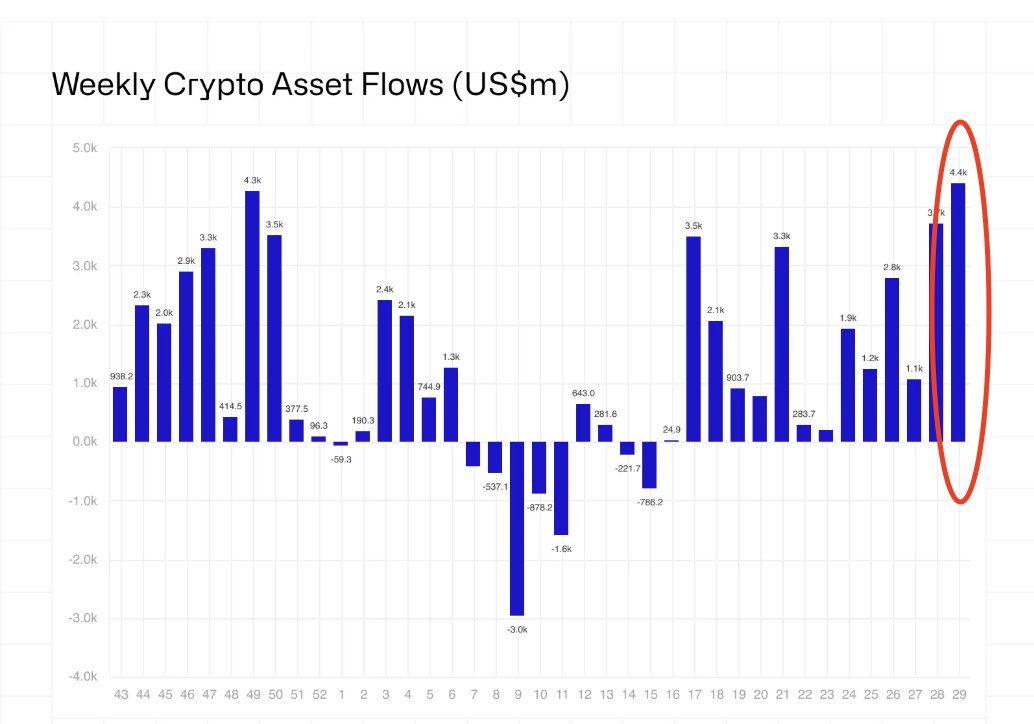

A record-breaking $4.4B of institutional inflows into digital assets last week. This marks the 14th straight week of positive net inflows and pushes the total for July to $9.2B. Perhaps more striking is that $ETH inflows ($2.1B) are now on par with $BTC's ($2.2B). Another…

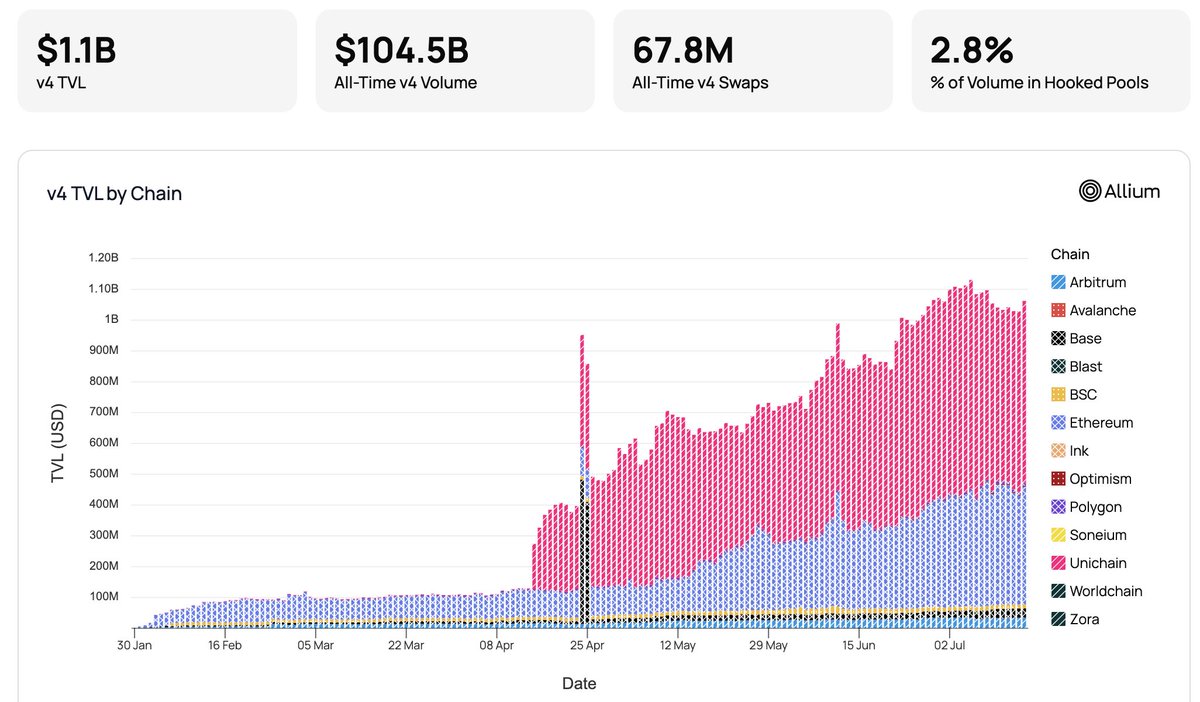

In less than 6 months after launching, @Uniswap V4 has surpassed $100B of volume. Programmable finance. All onchain. h/t @AlliumLabs

A lot of LITTLE BUD VCs bottom-ticked $ETH ahead of Pectra. Probably the easiest trade I've made all year. Thanks for playing and welcome to my domain 😈

Pectra is here and quietly paves the way for real-world usage, meaningful consumer applications, optimized staking, and more. Let's explore what's ahead 😈

And just like that, BitMine Immersion Technologies has emerged as the largest $ETH treasury strategy, purchasing another $500M worth of ETH and boosting their holdings by 85% this month. @BitMNR now holds over $1.1B worth of ETH (~301,000 ETH). Yet @fundstrat aims to scale…

In less than 2 months, @SharpLinkGaming has become the largest ETH treasury on the planet, amassing over 280,000 $ETH (~$836M) and surpassing @ethereumfndn. In June alone, SharpLink increased their ETH holdings by a staggering 59%. Meanwhile, the underlying $SBET stock is up…

Another day, another record smashed: $726M poured into $ETH ETFs, the highest daily inflow ever. This is more than the entire monthly net inflows for April ($66M) and May ($564M), combined. Meanwhile, daily trading volumes also hit a record $2.66B, shattering the $1.8B high…

Open interest on $ETH futures has surged by $13B (36%) this week to reach record highs, now standing at $48B. That’s 66% higher than when ETH traded above $4,000 in December 2024, and over 4x higher than the total open interest at ETH’s all-time high in November 2021. This…

In less than 2 months, @SharpLinkGaming has become the largest ETH treasury on the planet, amassing over 280,000 $ETH (~$836M) and surpassing @ethereumfndn. In June alone, SharpLink increased their ETH holdings by a staggering 59%. Meanwhile, the underlying $SBET stock is up…

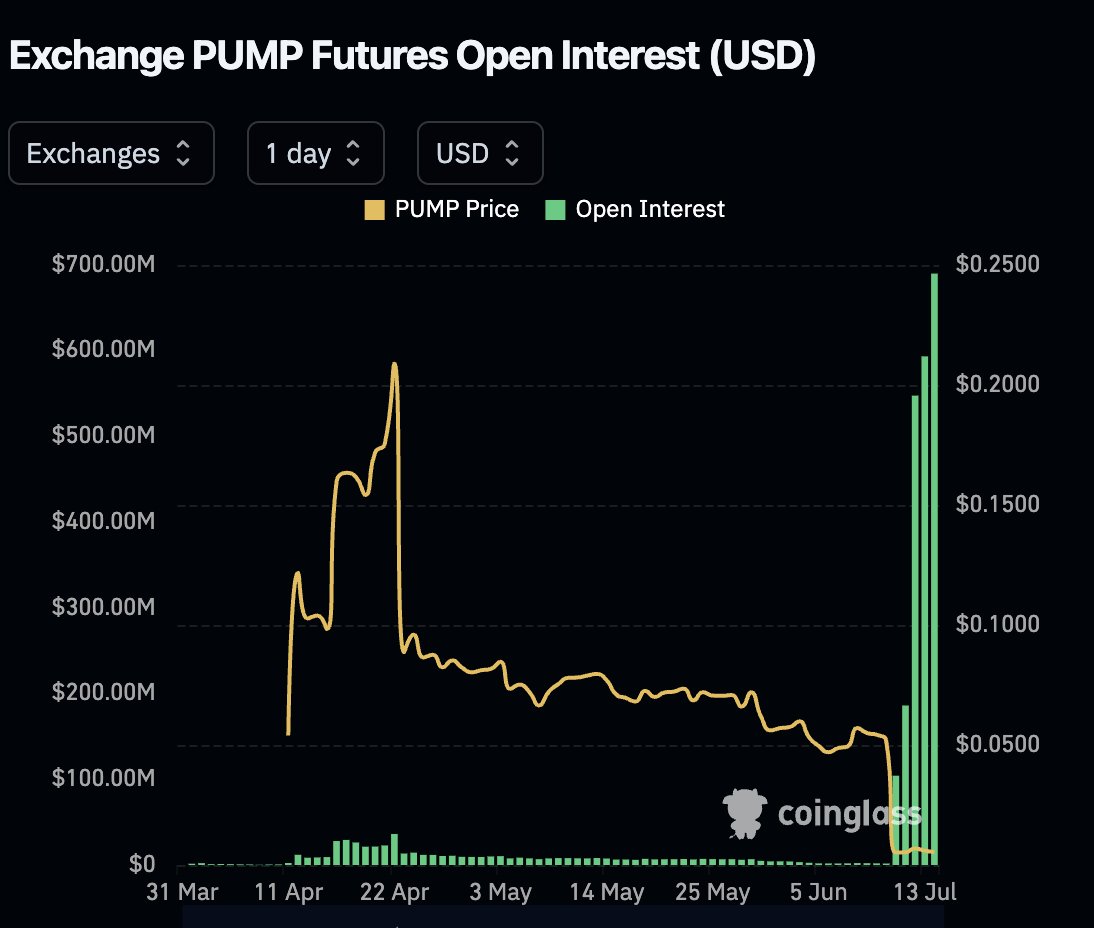

Open interest on $PUMP futures jumped 275% over the weekend, surpassing $690M, and is now the 13th highest across all digital assets, just behind $AAVE ($729M) and $LINK ($742M). Every VC whomst missed $HYPE and bottom-ticked $ETH ahead of Pectra is in a FULL SPRINT to capture…

Historic week for $BTC ETFs. For the first time ever, Bitcoin ETFs had back-to-back days with over $1B in net inflows: Thursday, July 10th: $1.17B Friday, July 11th: $1.03B Notably, @BlackRock's $IBIT accounted for 84% ($1.85B) of all inflows during this period. This pushes…

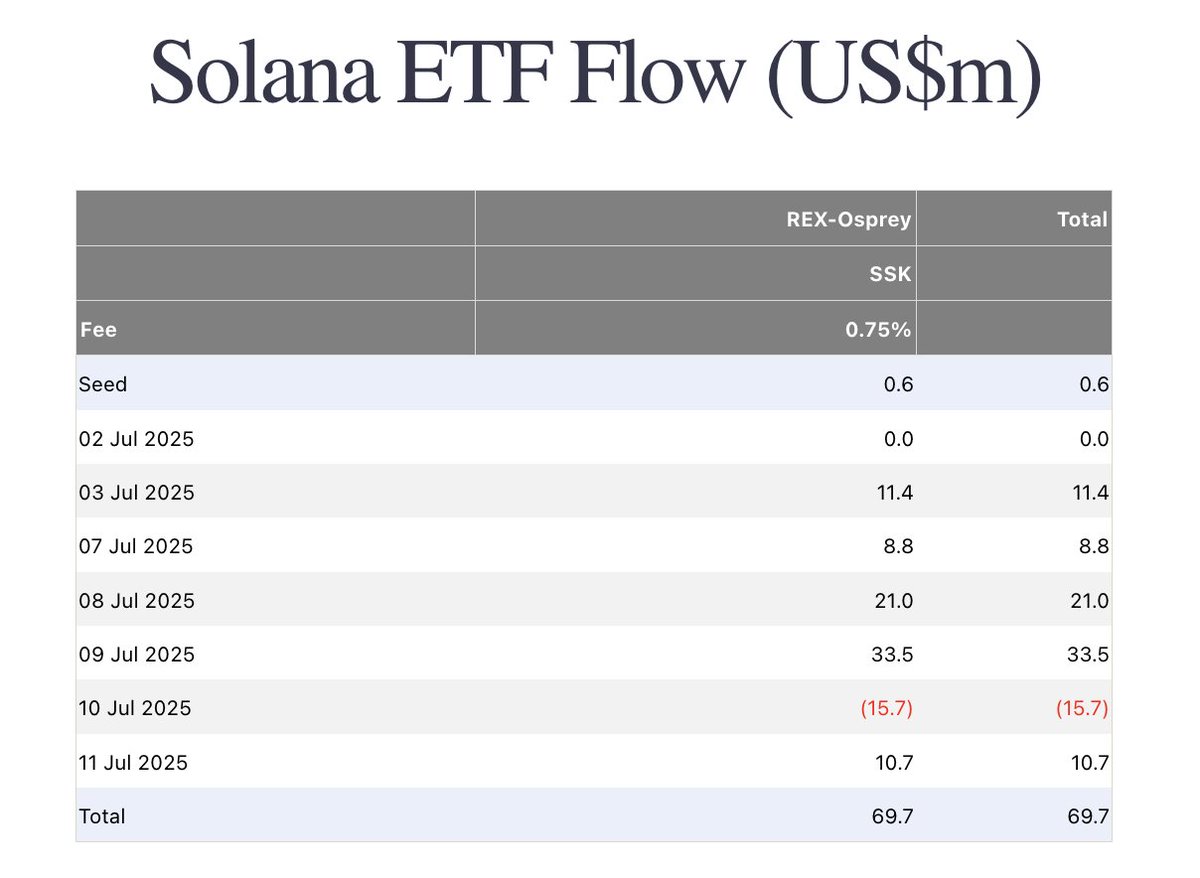

The first US-listed $SOL ETF offering exposure to Solana staking rewards, REX-Osprey's $SSK, experienced $58M of inflows in its first full week of trading. ETFs with imbedded staking yield are a powerful model: investors benefit from compounding rewards, while issuers can…