Matt Fiedler

@MattAFiedler

Senior Fellow, Center on Health Policy, The Brookings Institution. Former Chief Economist for Council of Economic Advisers.

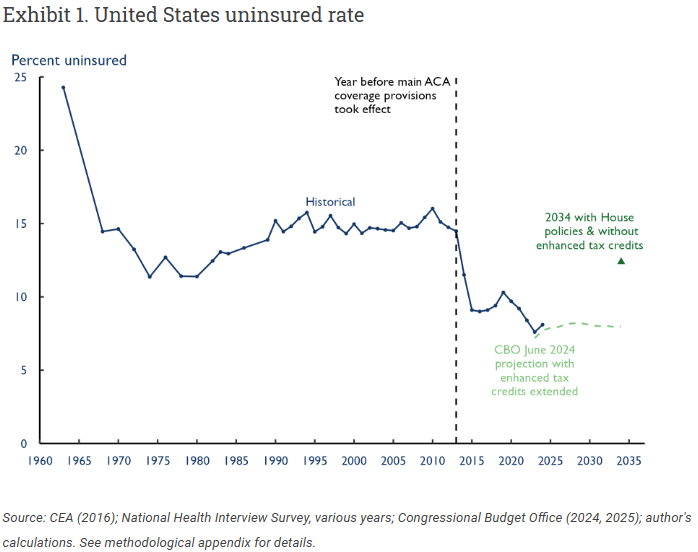

My new piece @Health_Affairs Forefront finds that if the House bill becomes law and enhanced premium tax credits expire on schedule, the US will see an unprecedented increase in the uninsured rate, wiping out about ~3/4 of the post-2013 decline.

Once again, I'm disappointed to see Autor and co inappropriately extrapolating their DiD results to make conclusions about aggregate effects, and I'm disappointed in the media for giving these unwarranted conclusions space. [1/x] nytimes.com/2025/07/14/opi…

Amy Finkelstein is tired of people misinterpreting the Oregon Health Insurance Experiment to support Medicaid cuts, she writes in @statnews First Opinion: statnews.com/2025/07/03/ore…

The Senate reconciliation bill, at least in its current form, appears likely to reduce coverage about as much as the House bill. If it becomes law, that would mean reversing most of recent years' insurance coverage gains: x.com/MattAFiedler/s…

My new piece @Health_Affairs Forefront finds that if the House bill becomes law and enhanced premium tax credits expire on schedule, the US will see an unprecedented increase in the uninsured rate, wiping out about ~3/4 of the post-2013 decline.

New-to-me nugget on work requirements implementation in here: Pinging Equifax's The Work Number — which states are likely to rely on to get recent-enough employment data — "sometimes costs over $20 per person per query" donmoynihan.substack.com/p/how-medicaid…

From a first look at the Senate drafts, the cuts to Medicaid & the Marketplaces are similar to the House’s, maybe even a bit deeper on net. Upshot: these drafts, like the House bill, wld put the US on course for an unprecedented rise in the uninsured rate. x.com/MattAFiedler/s…

My new piece @Health_Affairs Forefront finds that if the House bill becomes law and enhanced premium tax credits expire on schedule, the US will see an unprecedented increase in the uninsured rate, wiping out about ~3/4 of the post-2013 decline.

My new piece @Health_Affairs Forefront finds that if the House bill becomes law and enhanced premium tax credits expire on schedule, the US will see an unprecedented increase in the uninsured rate, wiping out about ~3/4 of the post-2013 decline.

More tariffs, more @The_Budget_Lab analysis. Incl last night's Canada hike -- we are now up to effective tariff rate of 18.7%, up more than 16 percentage points since January.

New @The_Budget_Lab tariff analysis incorporating the 35% Canada tariffs, which go into effect August 1 (along with the 22 letters and the copper tariffs). In brief... 1/10

Chip Roy and the House Freedom Caucus will likely vote for the bill. People are going to call this a “cave.” It isn’t. They have successfully rolled their moderate colleagues and achieved larger Medicaid, SNAP, and clean energy cuts than anyone thought likely six months ago.

CHIP ROY just now in the Capitol said he's still examining many parts of the bill and trying to understand whether he can vote for it. He said he needs to understand the Medicaid provisions. He needs to understand the "flows of tariff dollars" On IRA credits: "If the subsidies…

This sort of fund can certainly help rural hospitals, but does little for the 11.8 million expected to lose health insurance as a result of the legislation.

The $50b rural hospital fund Sen. Collins has been asking for appears to be in the final version of the Senate bill.

In theory, the GOP see environmental harm as an acceptable cost of making electricity cheap and American industries competitive. In reality, the GOP is acting as though ecological destruction is an end in itself -- one worth sacrificing affordability and competitiveness to

The latest from @The_Budget_Lab on reconciliation: distributional analysis of the Senate bill (including Scott FMAP proposal) vs. House. Key takeaways:

This is an interesting initiative. Broader, but targeted use of prior authorization in Traditional Medicare has long struck me as low-hanging fruit. (The model's emphasis on "enhanced technologies" strikes me as mostly just marketing, but the underlying idea is sound.)

Announced today: learn how the WISeR (Wasteful and Inappropriate Service Reduction) Model will use enhanced technologies to protect patients, decrease use of low-value care, and reduce fraud, waste, and abuse in Original Medicare: bit.ly/3TJUGSD

There were shades of this in the ACA repeal bill, where they had token funding for high-risk pools that would have come nowhere near to addressing cuts and coverage losses from changes elsewhere

Senate Republicans are eying a $15 billion rural hospital fund to ease the pain of their bill's Medicaid cuts. One problem: That wouldn't cover losses of ~$50B to rural hospitals (AHA) or ~$300B hospitals overall (Urban Inst). @news_jul @frankthorp & me nbcnews.com/politics/trump…

What could changes to the actuarial values (AVs) of ACA Marketplace plans, as finalized by CMS and passed by the House in the #OneBigBeautifulBill, mean for consumers? 🧵 @KFF

BIG attention grabber from Wakely, which says the marketplaces will shrink 47-57% if tax credits expire and reconciliation changes are made. wakely.com/blog/future-of…

Large cuts to SNAP, Medicaid, ACA subsidies, and low-income Medicare beneficiaries + Large tax cuts predominantly for the highest-income households = Large transfer from the lowest-income to the highest-income households cbo.gov/publication/61…