Machiavelli Capital

@MachiavelliCap

The interest of each is the good of all

$SLNO Could be another potential candidate? Betaville cited takeover interest from a US biotech firm on June 24, exactly the date $LLY flew to California at an unusual airport. How's the takeover rationale/fit? x.com/WallStSai/stat…

Weird flying patterns by $LLY in California. Landed in San Diego a few days ago (never did in the last year, SF is usual spot). Now they are in Monterey (no LLY facility there): quiet location for some dealmaking? Maybe $CYTK, or $BBIO (if for sale)?

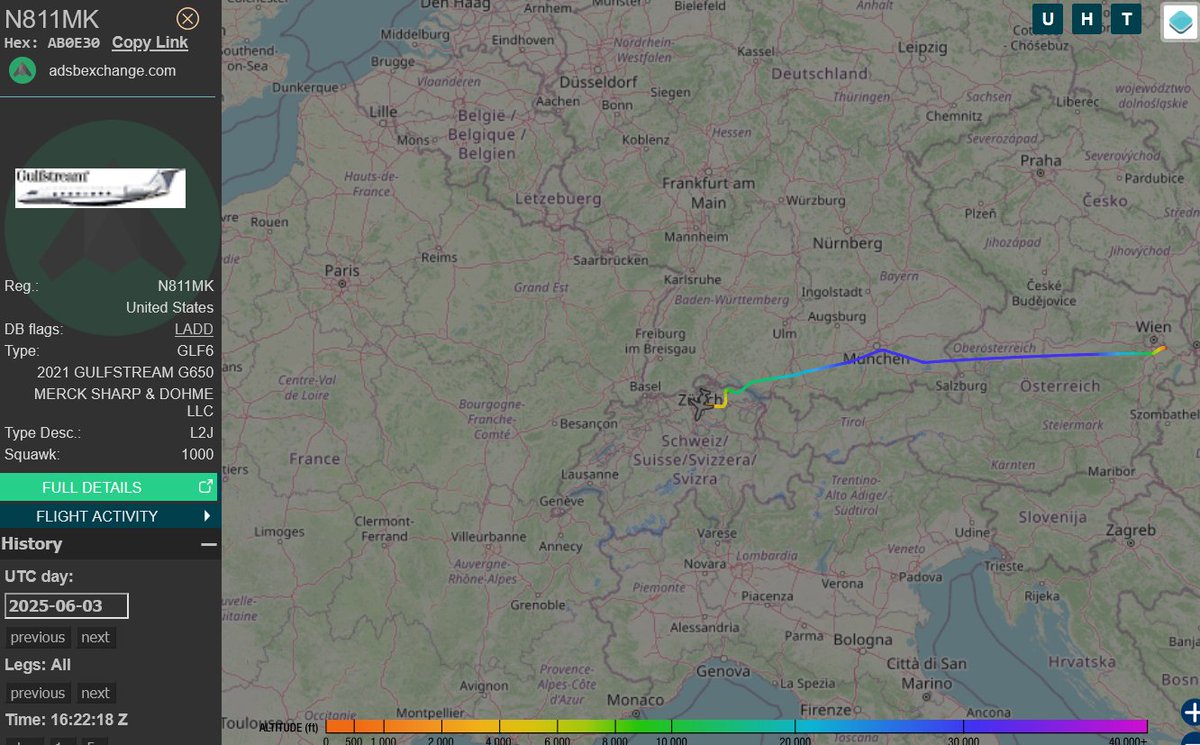

$MRK In Zurich today, where Moonlake $MLTX is headquartered (Zug)... It's been the third time over the last 30 days, plus the leak today, maybe to push Merck for a final offer? @PersimmonTI

Exclusivity for Tyvaso PH expired in March 31, 2024 so why cannot they market for that indication only? And the non-DPI version of the drug? globenewswire.com/news-release/2…

$UTHR - Great short set up with the looking set to approve $LQDA's Yutrepia. This launch poses serious risks to Tyvaso, accounting for 50% of $UTHR revenues, a real cash cow. I expect the district court to rule this morning as was strictly communicated during a March hearing.

$LQDA: So fun that the market is likely overreacting to some news that came out 2 weeks ago

@LionelHutz_Esq Any views on the SCOTUS acceptance of the United vs Liquidia case? The court demanded an answer from Liquidia due on August and case set to be heard on September. United claims the federal circuit should have established a de-Novo IPR and not defer to PTAB.

Best pair trade out there remains long $LQDA and short $UTHR as their dispute continues. United is very exposed to single-drug risk with around 50% of their revenues coming from Tyvaso and their nebulizer failing to perform well.

$LQDA We fly. Next stop FDA approval, now straightforward. This was deeply mispriced over the past few days as the legal risk was virtually zero.

$LTH Playbook 101: engage in self-dealing transactions to mask that there is no demand for your shitty properties.

$LTH - When in trouble.. 2x

Bought $LQDA at $12.15 and sold front month $17.5 call for $0.80. That's a nice 6.5% monthly yield while I await FDA approval and/or (another) patent win against United on the 327 patent. Remember that patent is a copycat of the one that was found invalid 3 months ago.

I think one way or another a deal for $PARA will be signed. Shari might not be the one calling the shots after all. NAI creditors (a group of hedge funds) are. Either she sells or they will repossess the Class A shares posted as collateral. wsj.com/business/media…

"Paramount’s directors opted to move forward with Skydance as it wasn’t clear how Apollo would finance its bid" $PARA Sure it's notoriously hard for Apollo to find financing lol