The Analyst

@MMatters22596

Two passionate stock & finance analysts 🤝 Technical & Fundamental 📊 Stockmarket, Indices, Cryptos 📈 Not financial advice

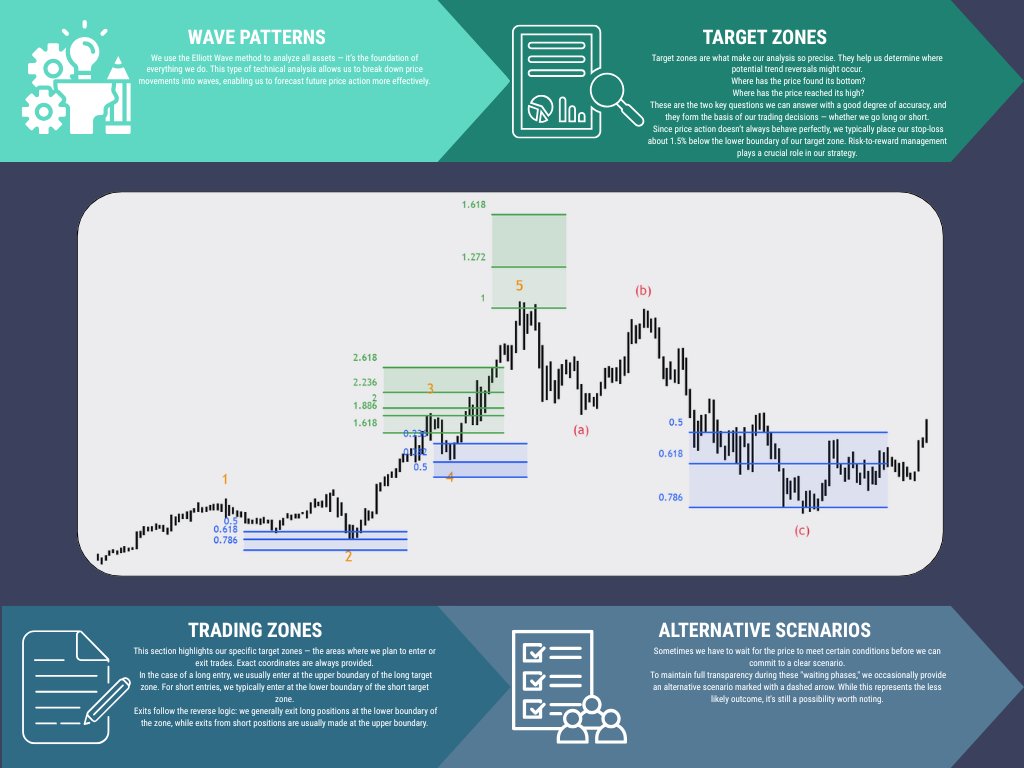

📊 This Is How We Analyze & Trade Here’s a condensed summary of our method for you. ❓ Got questions or feedback? Feel free to drop them in the comments! 👇

$JD showing signs of a trendreversion right now. I'm already long with a small position, but hoping for another drawdown to DCA lower. The target for wave 3 is set at $70

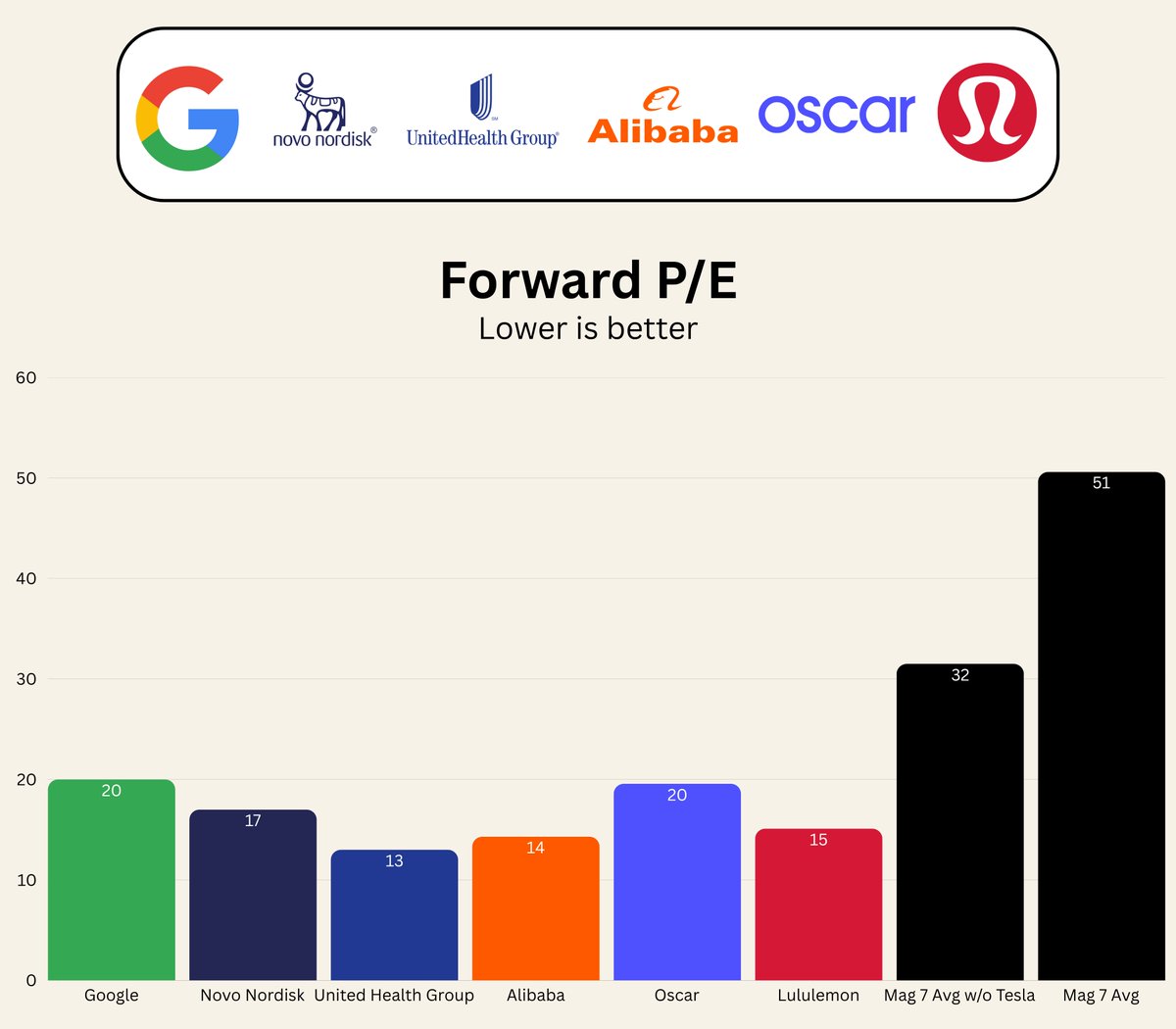

Stocks I would buy, hold or sell right now: BUY $BABA $UNH $NVO $GOOG $OSCR $LULU HOLD $SOFI $NVDA $PYPL $HIMS $LMND $NBIS SELL $PLTR $HOOD $COIN $SPOT $CRWD Would you change anything?

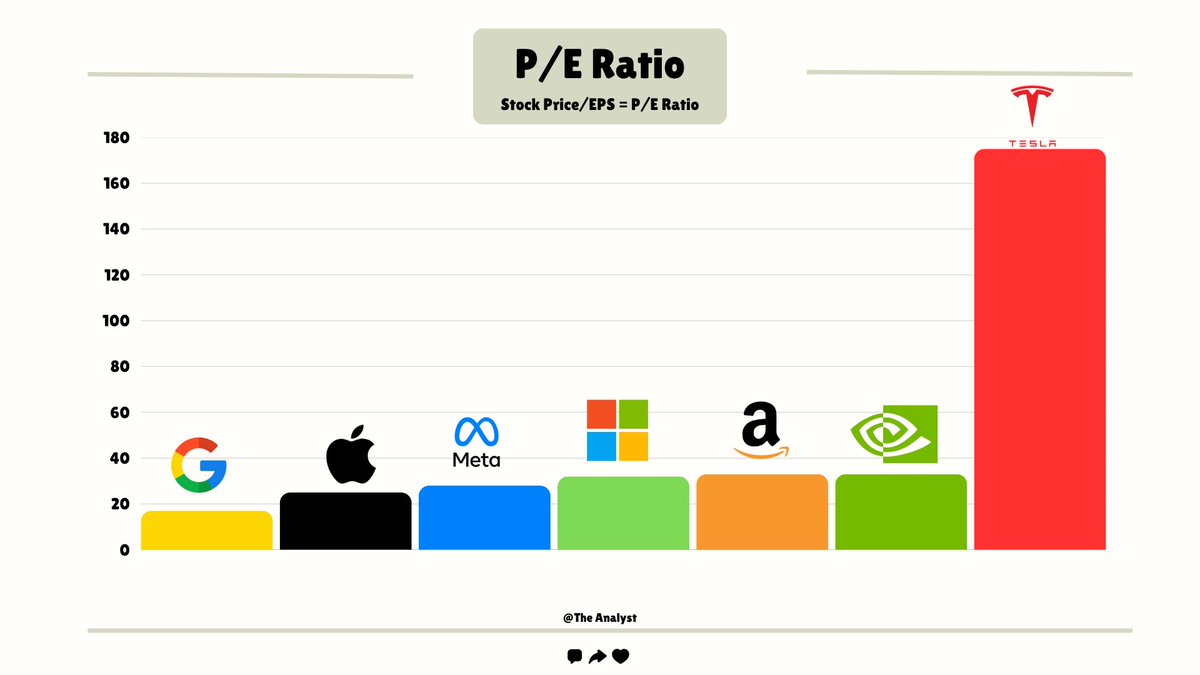

The truth behind the Mag 7 valuations 👀 $GOOGL: 17x 📉 $AAPL: 25x $META: 28x $MSFT: 32x $AMZN: 33x $NVDA: 33x $TSLA: 175x 😳 Tech avg: 22–25x → Only $GOOGL looks cheap. $TSLA? Absolute fantasy. Time to rethink your portfolio?

$XYZ Called the bottom in april, already up 62% since my entry at $50. I won't take profits any time soon, as this is just a long-term position. First target is $110 - we're already halfway there.

$XYZ perfect reversion at the 78.6 level. My bags are heavily loaded. One of my top picks for this year.

$PLTR just reached my long-term target. Sold all my shares. It'll probably extend a bit higher up, but I think the cyclical top is close now.

These are the most obvious picks to buy right now. Extremely undervalued and cheap. $GOOGL $NVO $UNH $BABA $OSCR $LULU Compared to the mag 7 with and without $TSLA

$OSCR The last few days might have just completed the expected dead cat bounce. Could theoretically still go a bit higher before the last drawdown starts. Just set my second Limit order at $12.

$OSCR down 11% in premarket. This eliminates the bullish count, which a lot of people shared on X. This will give a great opportunity to load up cheap one last time around $12

#Tesla's Q2 earnings confirm our bearish call 📣 from yesterday! 📉Revenue (-12%), FCF (-89%), & auto sales (-16%) drive the drop. Earnings as catalyst align with our Elliott Wave analysis. Expect deeper lows, min ~$160. $TSLA #Earnings

This company will present its #Earnings today. What can we expect form $TSLA? We expect falling prices 📉 We'll update you tomorrow...

The expected reversal! $RBLX bounced exactly at one of our retracement levels. Whether this move is sustainable will unfold in the coming sessions. 📉 Mid-term outlook remains bearish.

⚠️ $RBLX on the verge of a trend reversal! ALL our indicators are flashing RED! 📉 When’s the tank running dry? Chart analysis gives the stock room to climb between $112.36–$126.97. Theoretically, $150 is possible, but we’re skeptical. Check the indicator charts below! 👇

As expected... $LMND is losing momentum. We anticipate a deeper drop in the coming weeks. 🎯 Our entry point: $23.58 per share.

$LMND might just be the key to our financial freedom 🍋 We expect a final downward move soon, likely revisiting the zone between $30 and $20 🎯 Our most probable target for an entry? The 78.6% retracement at $23.58 Over the coming months, we’re aiming high 📈 $85+ is in sight

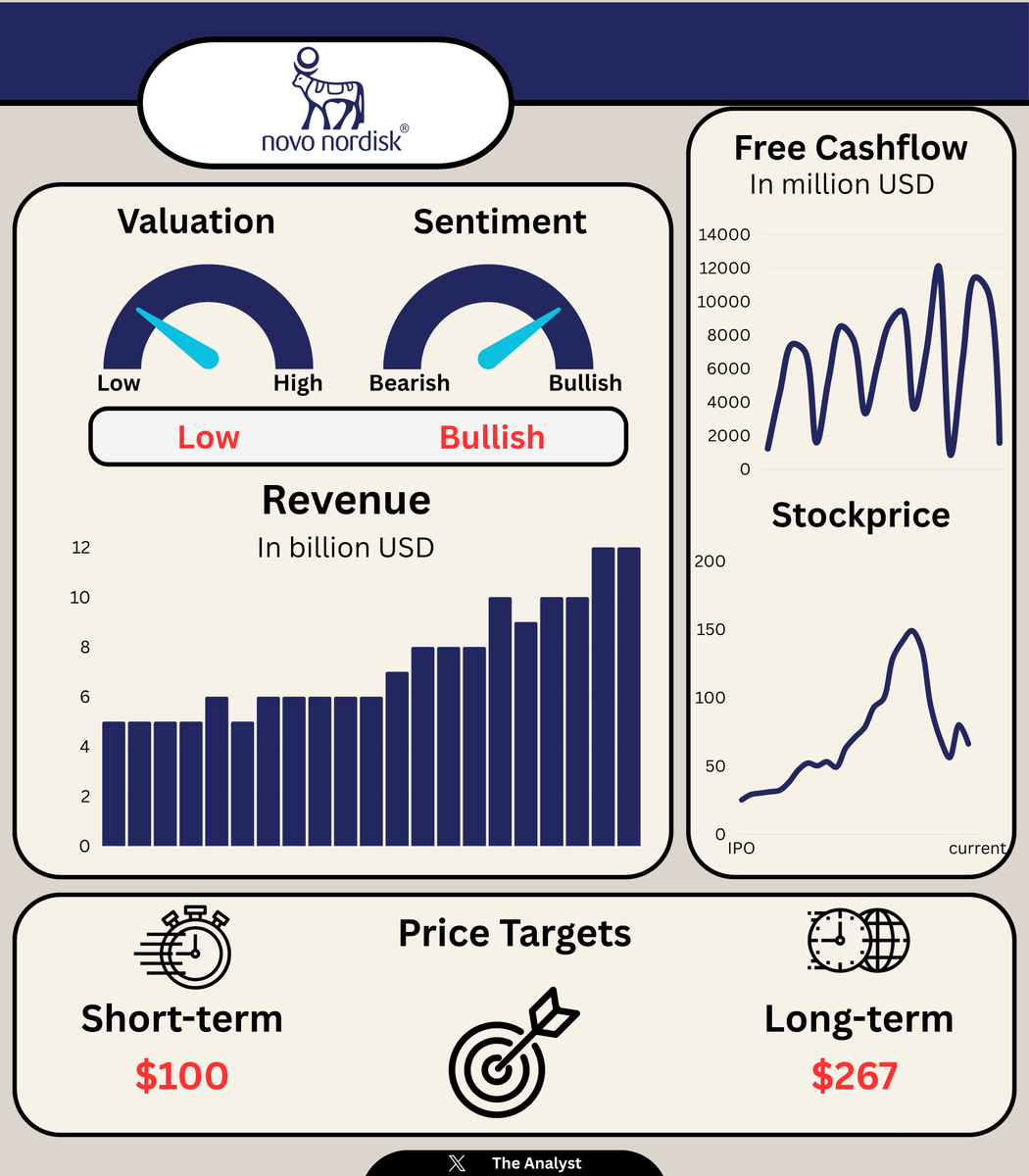

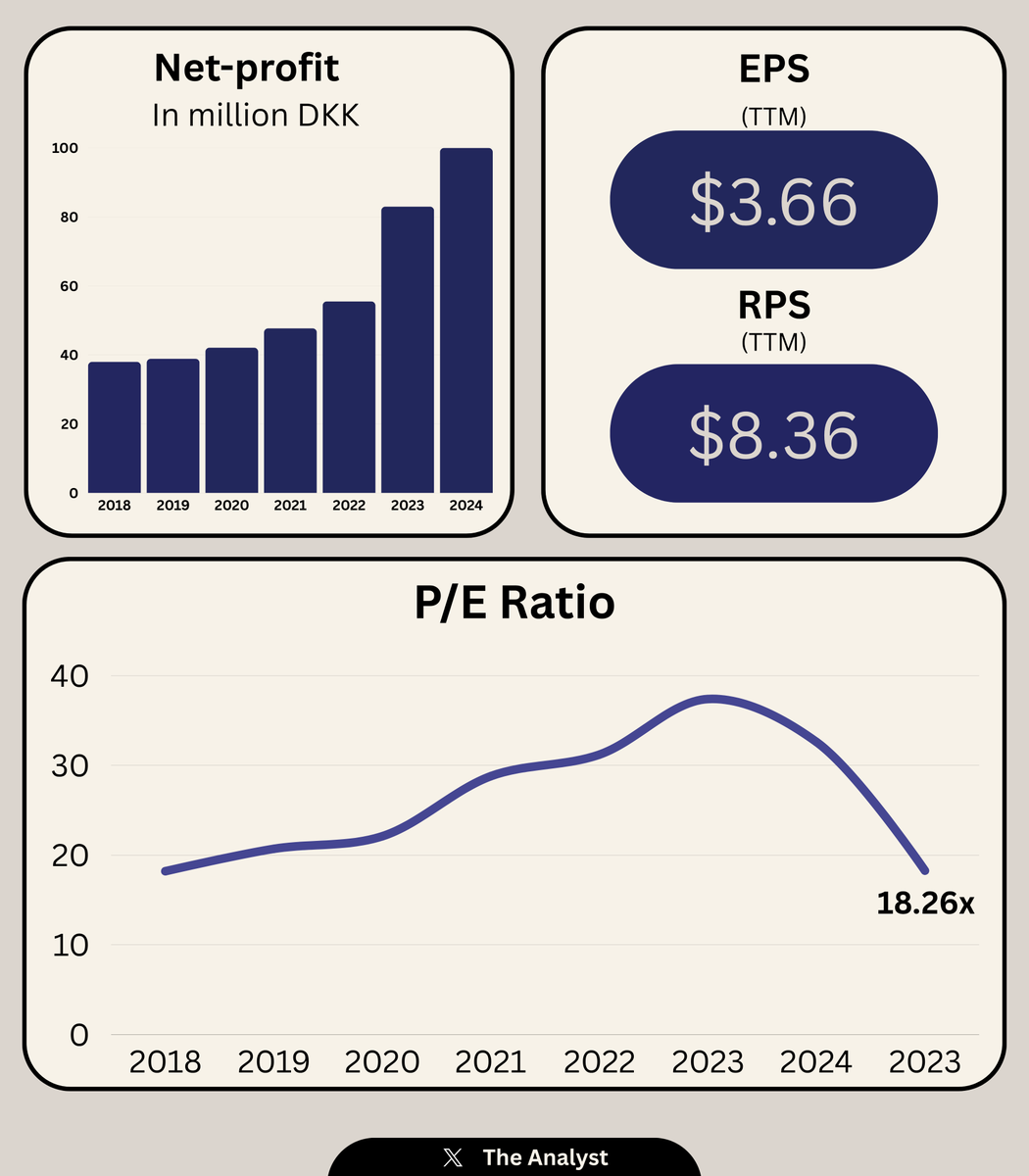

Fundamental overview on $NVO's keymetrics. The share is still extremely cheap, based on how well the company is growing lately. The P/E ratio of 18.2x signals a low valuation compared to fundamental statistics. Is this a better opportunity then $UNH?

💡 Interesting fact: $NIO still has OVER 2000% to go to hit its long-term target. We’re aiming for ~$110 minimum. Wait or load up? Who wants a deep dive? What’s your move? 👀

This company will present its #Earnings today. What can we expect form $TSLA? We expect falling prices 📉 We'll update you tomorrow...

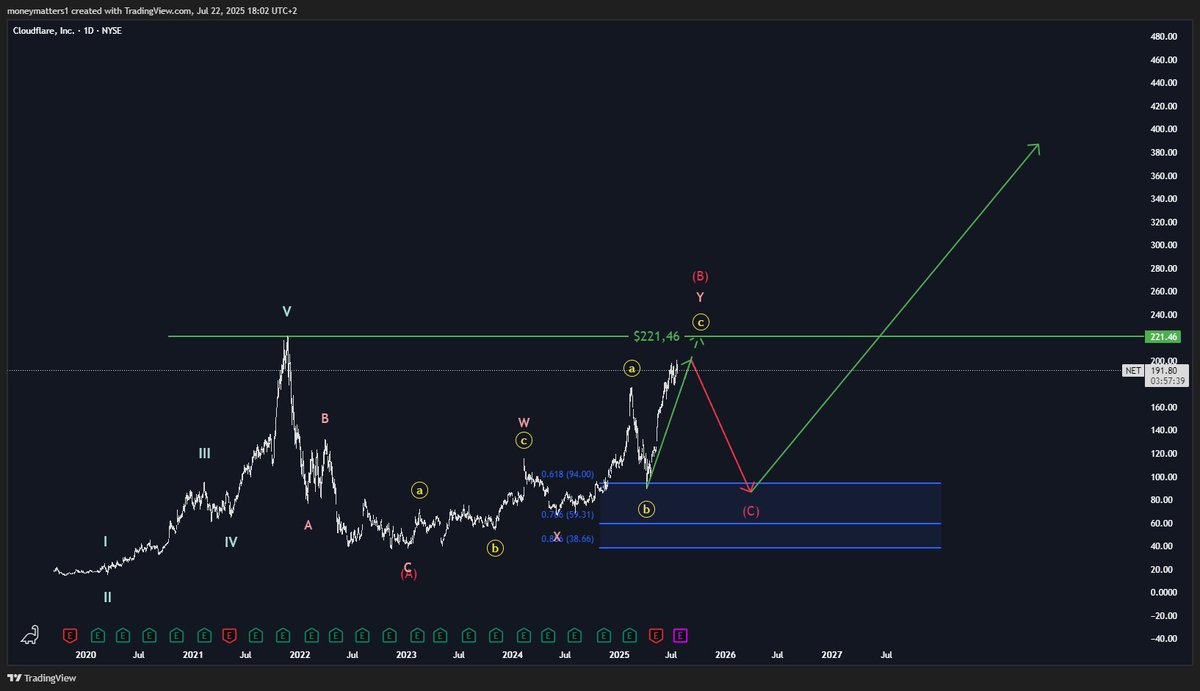

SHORT on $NET 📉 We’ve just opened a short position on Cloudflare. Technicals point to significant downside in the coming weeks. Target: at least $94. Let’s see how this plays out...

$SNOW isn't just another stock — it's a hidden gem. Top-tier partners like $AMZN & $MSFT, strong revenue growth, and oversold. We're not buying yet... But we're watching VERY closely.⏳

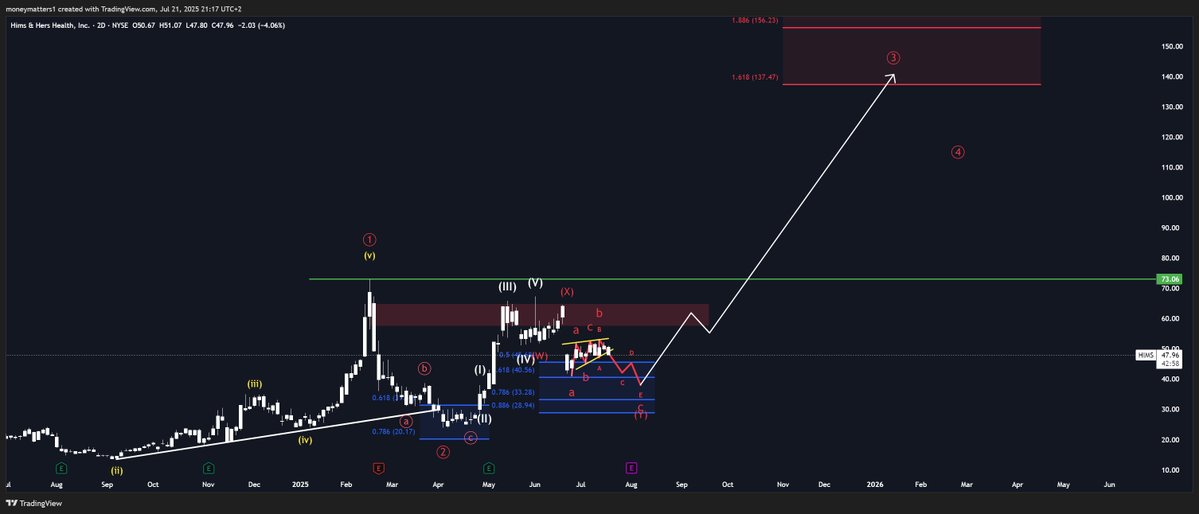

$HIMS is close to finishing off it's correction, and starting the next bullish impulse. Minimum target for this wave 3 is $137. I currently only hold a smaller position here, waiting to load up on the dip. I will share my entry.

SHORT on $AVGO SL is 1% above the upper line of our trend reversal zone at $318.17. We're expecting something big during the coming weeks.

🤔 Is $MANA finally ready for a bullish trend? #Decentraland has shown solid strength lately — great news for us holders. But for confirmation, we need a breakout above ~$0.40 and ~$0.85. Next move decides it all.

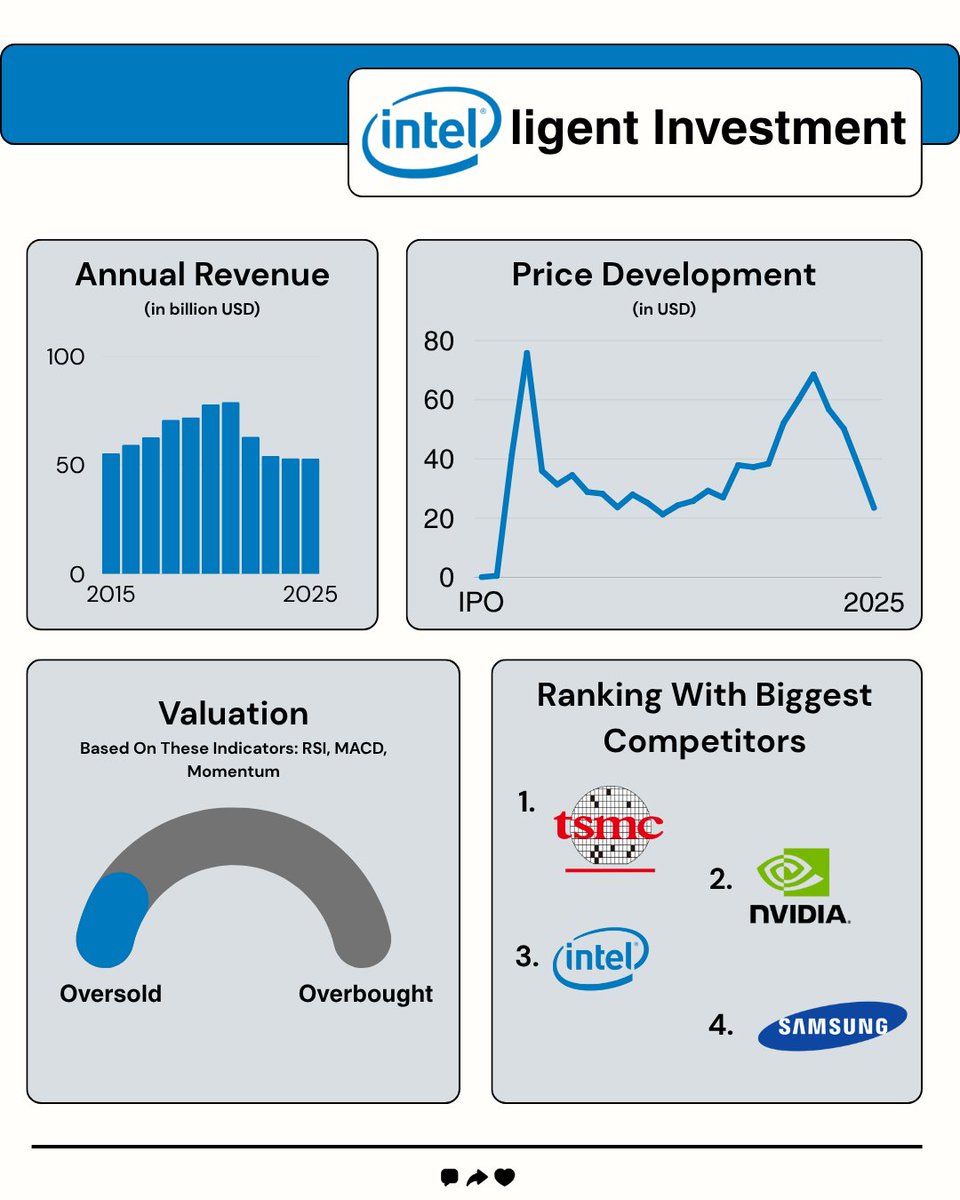

I’ve been analyzing $INTC for a while now — and from both a technical and fundamental perspective, one thing is clear: This is an INTELligent Investment. 📉 Short-term: still cautious 📈 Long-term: going LONG

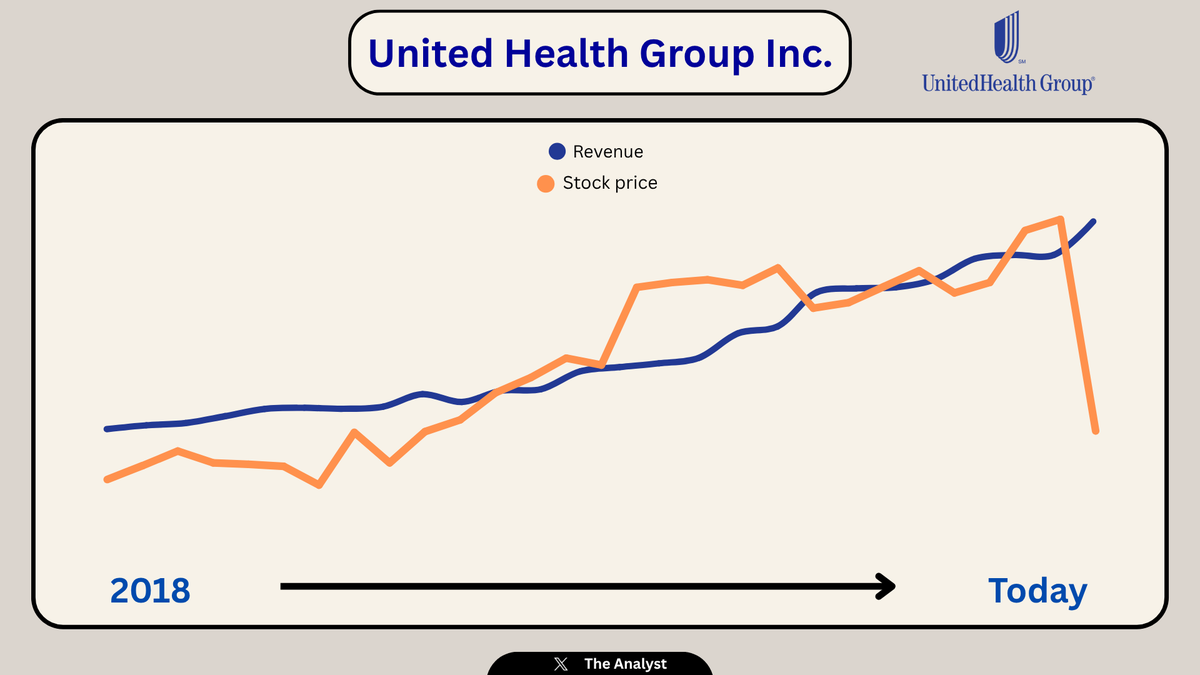

$UNH is trading at the same price as in 2021, while revenue has nearly doubled. Is this a broken stock, or a broken business?