Alex Hsu 許家樺

@MGoFinance

Finance and Macro. Monetary policy and fiscal policy. Prof @GeorgiaTech @GATechScheller. Previously @MichiganRoss. @BrownUniversity alum. Uncertainty is here.

I'm planning a small US seminar tour in mid-November. My work covers my travel expenses, so I'm easy on your seminar budget. Invite me if you're interested in hearing about rationing in sticky price models!

I asked ChatGPT to turn my son’s goal celebration into a painting. A Monet was born. 😂

This conference 👇 is one of the most intellectual and well-organized I have been to in the last 10 years. uni.lu/fdef-en/events… I highly recommend submitting your paper. Got terrific feedback on our #GreenCoins paper and the keynote/panel speakers were AWESOME.

Thanks @nberpubs! Here's a thread breaking down our methodology and key findings - including why FCI* stayed stable after 2008 while r* crashed, and how FCI gaps captured the 2022 policy shift before rate gaps: x.com/alpsimsek_econ…

Introducing FCI* (Financial Conditions Indices), the neutral level of financial conditions that closes output gaps. FCI gaps—difference between FCI and FCI*—better reflect monetary policy stance than rate gaps, from Ricardo J. Caballero, @tomycaravello, and @alpsimsek_econ…

Call for Papers! The 26th MFS Workshop will take place on November 13–14, 2025, at the University of Chicago. Carolin Pflueger and Rohan Kekre will serve as co-organizers. More details here: bfi.uchicago.edu/events/event/c…

OpenAI CEO Sam Altman will be the keynote at the Fed board's conference next month on bank capital and regulation federalreserve.gov/conferences/in…

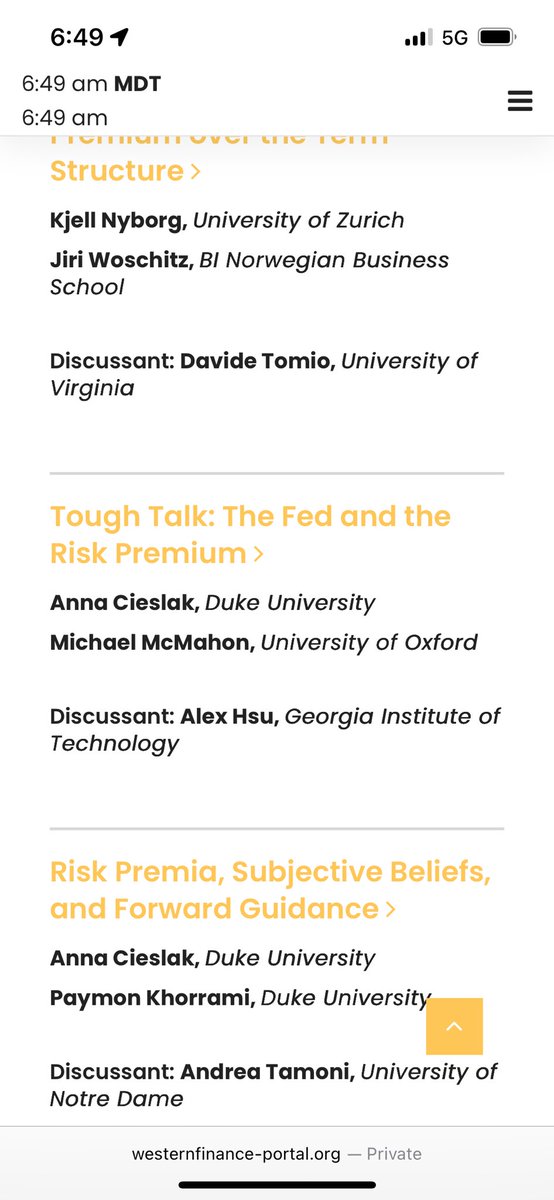

Excited to discuss this paper by Anna at the WFA this morning. Clever empirical design allows the authors to show that slow information release after FOMC announcements, via speeches and hearings, can drive risk premia in equity and bond markets. Great read!

Please repost: The submission deadline for the second NBER conference on “Compensation of Top Executives: Determinants and Consequences” is on June 23. The conference will be in Cambridge, MA, on Oct. 9-10, 2025. Please submit your best work! The link is in the first reply.

🚨 "Consumption in Asset Returns" (w. @SBryzgalova & Jiantao Huang) forthcoming @JofFinance We use asset returns to uncover the elusive dynamics of consumption. Turns out, financial markets know a lot about future consumption—and it matters for both macro & asset pricing🧵👇1/n

🚨If you are a macroeconomist using the “sequence-space” to solve your models, come share your work at this SITE conference, September 8-10! Both substantive and methodological contributions are welcome. The deadline is this Monday, June 16! with @ludwigstraub and Matt Rognlie

The video of my talk last week at Oxford, “Geoeconomics is Back!”, is now online: youtu.be/ezzVhAA-ABc?si… A version of the slide deck, including a few more references, is available here: sas.upenn.edu/~jesusfv/Lectu… An important topic I didn’t have time to discuss in detail was…

This paper started with data. We were convinced that the discrepancy between book and market values of banks was key to understanding the data. We then developed a theory where, with a simple model, only one state variable driving Tobin's Q, you can explain several data moments.

"We are thrilled to share that our latest research is now published in @RevEconStudies! 🎉Check it out here: restud.com/a-q-theory-of-… We look forward to hearing your thoughts! " @JulianeBegenau, @SakiBigio, Majerovitz, and Vieyra

A beta version of my slide deck for my upcoming lecture on Geoeconomics at Oxford this Friday is now online: sas.upenn.edu/~jesusfv/Lectu… I’m looking for feedback: What else should I include? Are there any important citations I might have missed? Please note: I don’t have room for…

Extremely happy to share that the paper “Interlocking Directorates and Competition in Banking”, joint with @GuglielmoBarone and Fabiano Schivardi, has been published in the Journal of Finance @JofFinance -doi.org/10.1111/jofi.1… (1/N)

I gave a lecture at the London School of Economics on the structural changes in the global financial system and how they shed light on recent events Some highlights:

❓ Have you booked your ticket for the 4th Annual Lecture in Honour of Charles Goodhart, which will be delivered by Hyun Song Shin (@BIS_org) and chaired by Dimitri Vayanos (@LSEFinance, FMG)? ✍️ Lecture title and pre-registration info in the comments 📅 19 May, 6pm #LSEGoodhart

Excellent papers at the Second Thomas Laubach Conference of the @federalreserve. Follow Ben Bernanke's presentation on Central Bank Communication live now, or watch the recording later. Great stuff! federalreserve.gov/conferences/se…

Our paper finds that accredited investor standards DO bind and—at the margin—constrain entrepreneurship 🎉 Newly conditionally accepted at @J_Fin_Economics 🎉 lukeste.in/angels

Me: I’d like to invest in this brewery SEC: no, dummy. You’re not an accredited investor. Me: cool, guess I’ll just teach myself some double broken wing butterfly trades by watching tik tok SEC: yea, I mean, for sure. It’s your money, do whatever.

"A Quantitative Analysis of Bank Lending Relationships" with @KyleDempsey1, is now published in the Journal of Financial Economics. We develop a model of heterogeneous banks to study how they jointly manage financial and customer capital, and directly estimate its key parameters

Our Center for Monetary Research is hosting the 2nd Annual Macro-Finance Conference at the @sffed this fall. If you have a recent paper on the linkages between financial markets, monetary policy, and the macroeconomy, please submit by May 31! frbsf.org/news-and-media…

Always remember that we live in GE...

Turmoil in Taiwan's foreign exchange market is bound to lead to questions about how shifts in Taiwan will impact the US bond market; Taiwanese investors have been fairly steady buyers of Treasuries and US corporate bonds over the last 5 years 1/