Lucid

@LucidLabsFi

The Unified Liquidity Layer | Now live!

We’ve teamed up with @peaq to help manage liquidity for their growing Machine Economy ecosystem. Now live: Get discounted $PEAQ tokens by providing targeted liquidity for Machine DeFi on peaq through Lucid. 👇🧵

Our founder @Tony_LucidFi is now live with @AlvaraProtocol to discuss BSKTs, Liquidity, and Multi-Chain DeFi. Tune in 👇 x.com/i/spaces/1vOxw…

Excited to announce Sydney Sweeny as our newest CMO with a 400k base salary and 1% allocation.

Tune in tomorrow for a conversation between @Tony_LucidFi and @Crypdjo on all things Web3 Don’t miss out🎙️

🗓️ Set your reminders! @Crypdjo will be joining @Tony_LucidFi from @LucidLabsFi this Friday chatting all about Unified Liquidity and everything BSKTs 🧺 🕚 11AM UTC → x.com/i/spaces/1vOxw…

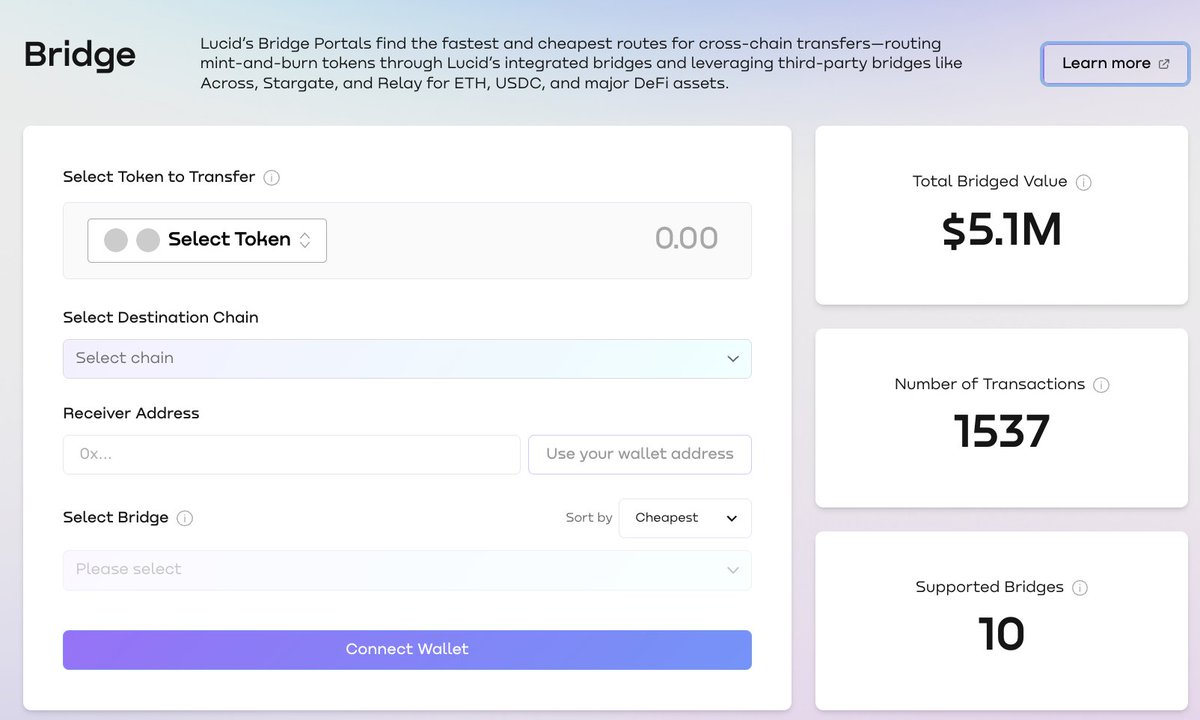

Welcome @RedbellyNetwork to the Lucid ecosystem 🤝 USDC, USDT, and wETH can now move to and from Redbelly using our bridging infrastructure via @Polymer_Labs, with transfers costing just $0.06 and confirming in under 10 seconds. Industry-leading performance, now live.

Redbelly Network is now live on @LucidLabsFi! Users can now transfer digital assets to and from @RedbellyNetwork using Lucid Lab's bridging interface, powered by @Polymer_Labs secure interoperability layer. Start bridging: app.lucidlabs.fi/bridge

Bridges still rely on single providers. Lucid’s Multi-Bridge solves this with 2-of-3 consensus across multiple bridges. One message. Multiple routes. Fault tolerance by default.

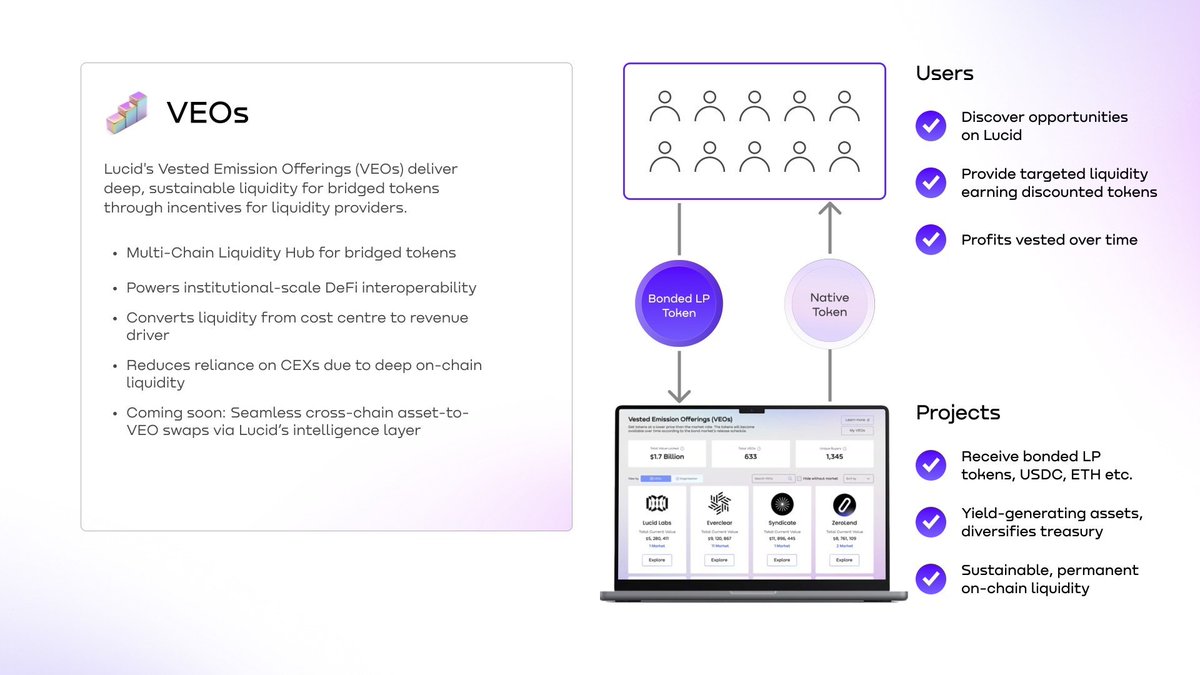

Hey bro, ever heard of VEOs? They're a sustainable and treasury-aligned way to build liquidity.

Liquidity mining is costly, short-term, and inefficient. Lucid's VEOs maintain over 90% liquidity, with net returns often surpassing 100% in ten months, boosting liquidity and treasury growth.