Lorenzo Valente

@LorenzoARK

Crypto at @ARKinvest I Director of Research I Disclosure: http://arkinv.st/2rxmMRG

We think crypto, particularly smart contract L1 tokens, represents a distinct and transformative asset class. Ethereum stands out as foundational: it secures the on-chain economy via proof-of-stake, enables transactions, and acts as programmable collateral at the protocol layer.…

We are honored @CathieDWood and @ARKInvest embrace our vision for Bitmine @BitMNR - ARK has been at the ground floor and forefront of AI, Bitcoin, Palantir $PLTR… Glad to have her on our team for $BMNR

One of the biggest miscalculations in the criticism of L2s and Ethereum’s rollup centric roadmap is the assumption that fintechs and exchanges coming onchain would prioritize deploying where liquidity and atomic composability already exist. Prioritizing fast and high-performance…

Expert rotating from BTC to ETH now.

Ether is back near the upper end of its trading range again. If you own any, this is a great time to sell. As much as it pains me to say, selling Ether and buying Bitcoin with the proceeds is a better trade than holding Ether.

Sharplink is set to buy $5B worth of ETH through a common stock offering. At today’s prices, that’s over 1.4 million ETH. Since the Merge (2 years, 307 days ago), Ethereum supply has only increased by ~389K ETH. In other words: @SharpLinkGaming is buying 3.6x all ETH issued…

*TRUMP SET TO OPEN US RETIREMENT MARKET TO CRYPTO INVESTMENTS:FT

*TRUMP SET TO OPEN US RETIREMENT MARKET TO CRYPTO INVESTMENTS:FT

Imagine if, instead of just one @MicroStrategy, you had two, racing head-to-head to see who can accumulate the most ETH. That’s exactly what’s happening right now. Both @BitMNR and @SharpLinkGaming now hold more ETH than the Ethereum Foundation. They both have roughly 30 bips…

This is why an ETH treasury stock can outperform holding ETH 👇 $BMNR @BitMNR

Yesterday, Bitcoin spot ETFs saw $799M in inflows. Ethereum $726M. That’s 91% of BTC’s flows… from an asset that’s still only 18% of BTC’s market cap. Reflexivity continues....

Ethereum ETF Flows are booming. As a group the US spot Ether ETFs have taken in over $5.5 billion since launch. Which includes over $3.3 billion since mid April.

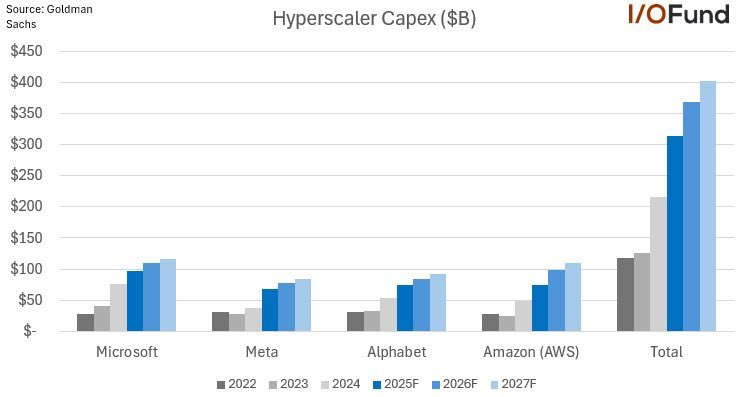

We’re living through history. Hyperscalers are projected to invest over $1 trillion in CAPEX over the next 3 years. Putting this boom among the largest capital deployments in history (2025-adjusted): 1) WWII – $5.3T 2) China’s Belt & Road (still ongoing) – $1.3T 3)…

In the two days since the ETH/BTC breakout: Bitcoin spot ETF inflows: $700M Ethereum spot ETF inflows: $451M ETH now accounts for 64% of BTC’s inflows, yet its market cap is still only 16% of BTC’s. People are underestimating the reflexivity between flows and price for the…

If you’re listening to the earnings calls of some of these huge TradFi companies and you’re still not bullish enough, you’re not paying attention. On JPMorgan’s call this morning: An analyst asked how JPM plans to keep customers from switching to more convenient payment…

JPMorgan CEO Jamie Dimon: We Are Going To Be Involved In Stablecoins And JPM Deposit Coins

Bitcoin whales moving 80k, @RobinhoodApp launching their own L2. Things have been busy on the crypto side!

x.com/i/article/1944…

We’re starting to see the first based rollups go live, and once there are 2–3 high-revenue or MEV-generative protocols built on them, I think it’s going to supercharge and reinforce the ETH narrative even more.

ReyaChain The first trading-specific based rollup built to upgrade global capital markets into Internet Capital Markets. Fast and decentralized - the end of tradeoff. A breakthrough for DeFi and traders at large. Live today: - Perp DEX embedded into the chain - Deep liquidity…

Since The Merge 1,030 days ago, only ~373k ETH net has been issued (accounting for the burn). In just the last 9 days, ETH ETFs have pulled in ~380k ETH. That’s 3 years of new supply eaten up in less than two weeks. Supply shock coming for BTC and ETH

The bitcoin network only produces 450 bitcoin per day. Yesterday alone, bitcoin ETFs bought 10,000 bitcoin. There is unrelenting demand from corporations and institutional investors and that’s colliding with severely limited supply. @dpuellARK @LorenzoARK @rhadiARK

$SBET buying 10k ETH from Ethereum Foundation to stake and re-stake

$SBET buying 10k ETH from Ethereum Foundation to stake and re-stake

For $100B, Apple could’ve bought 1 @AnthropicAI, 5 @perplexity_ai , or 20+ @MistralAI . Instead… more buybacks.

“I heard Tom Lee ( @fundstrat ) describe the @circle IPO as the ChatGPT moment. Before, we were spitting in the wind with institutional investors. Now they’re finally studying crypto hard because you cannot miss the equivalent of AI and crypto together.” @CathieDWood of…

Stoked to have @rhadiARK joining the crypto team. Expect some killer research from him in the coming months. Stay tuned and give him a follow!

After years tracking the evolution of blockchain and crypto, I’m thrilled to share that I’ve joined @ARKInvest on the Digital Assets team. It’s an incredible time for the industry, and I’m excited to help advance the financial infrastructure of the next era.

Vlad going full Internet Capital markets Everything will be tokenized

I believe tokenization is the greatest capital markets innovation since the central limit order book

Forgot to add that you can raise via equity for the Labs entity as well

Conversation with dead chain: - Raise $25M on a $250M post. Then $75M on $750M post - Over 2 years, $100M raised for 20% equity. - Team: 40–50 FTEs at ~$200K avg comp = ~$9M/yr. - Add ~$4M/yr in ops (legal, SaaS, travel, etc.) - Total burn: ~$13M/yr - Keep ~$80M in t-bills…

Pentoshi bullish ETH, wasn't on my bingo card

You can see the narrative changing around $ETH right now. And imo it will be obvious in hindsight. But most are too jaded In less than one month, public companies will have bought enough eth to offset all the eth that's been created since the merge It's 1/9th the marketcap of…