Liz Ann Sonders

@LizAnnSonders

Chief Investment Strategist, Charles Schwab & Co., Inc. Disclosures: http://aboutschwab.com/social-media

I hate that I keep having to post (and pin) this, but anything you think you see (or hear) via AI-generated fake videos from “me” on this platform, Instagram, Facebook, WhatsApp and/or Bluesky claiming I have a stock (or crypto) picking club for a fee are all IMPOSTERS … I am…

Signing off for a 2-week vacation. If you’re not already doing so, give a follow to @KevRGordon for his always-invaluable posts. I’ll be back on this site on August 11.

Our latest #OnInvesting podcast episode has dropped, in which @KathyJones and I riff on markets, inflation, Fed policy, etc., and Kathy sits down with our brilliant colleague Collin Martin to chat all things credit markets schwab.com/learn/story/tr…

June core cap goods orders (blue) -0.7% vs. +0.1% est. & +2% prior (rev up from +1.7%) … core shipments (orange) +0.4% vs. +0.2% est. & +0.5% prior (rev up from +0.4%)

June durable goods orders -9.3% m/m vs. -10.7% est. & +16.5% prior (rev up from +16.4%) … goods ex-transportation +0.2% vs. +0.1% est. & +0.6% prior (rev up from +0.5%)

Per @SPGlobal Market Intelligence, S&P 500’s robust recovery since early April, coupled with subsiding volatility, breathed life into previously moribund U.S. IPO market in Q2: number of U.S. IPOs was highest in 13 quarters, and amount raised was most in 14 quarters – although…

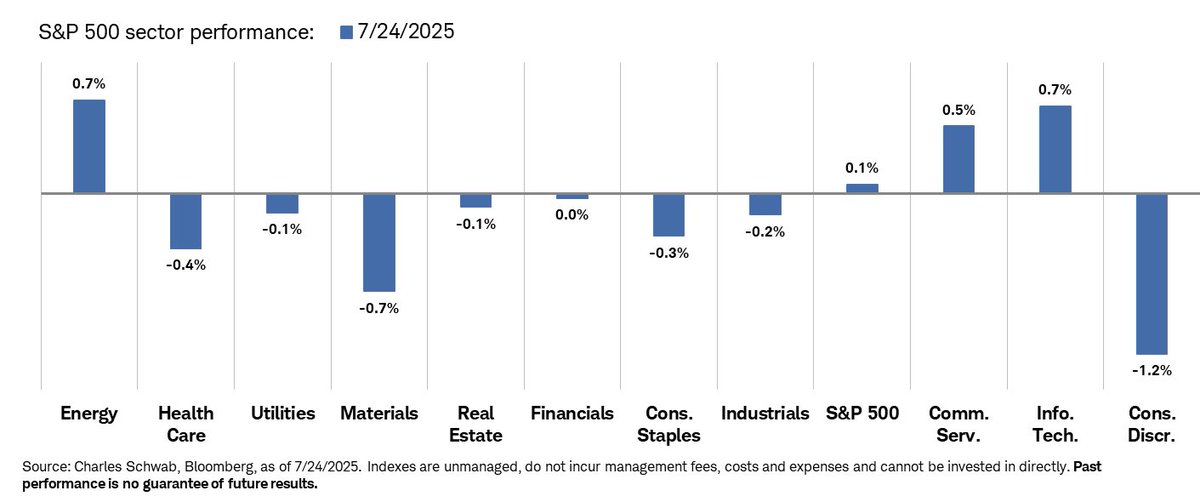

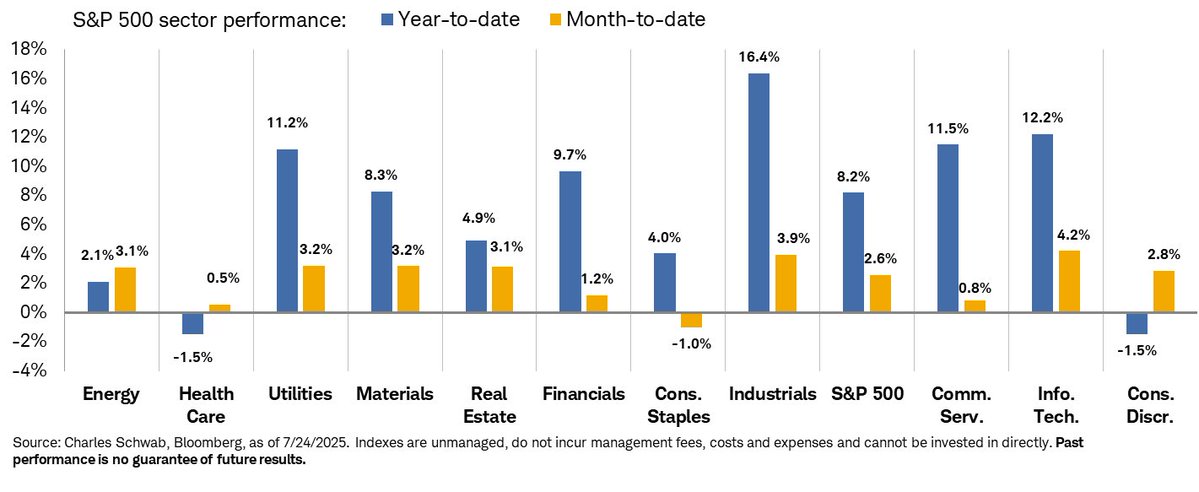

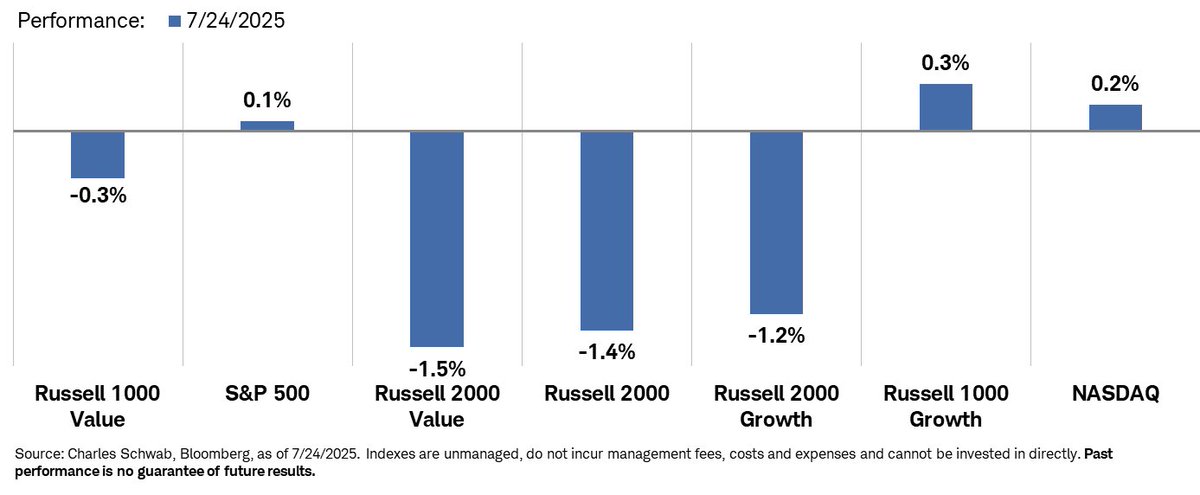

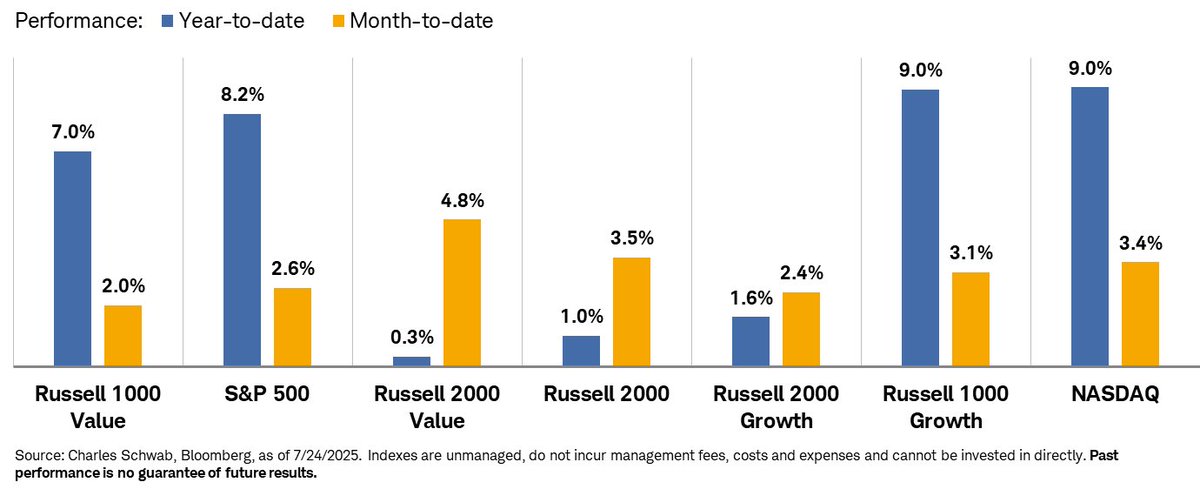

Performance: index tables and Mag7 chart/table updated thru yesterday’s close

Path for median home price has been very different over past few years when looking at existing (blue) vs. new (orange) markets … former has continued to rise while latter has trended lower since 2022

Input and output price components in July U.S. @SPGlobalPMI were all mixed relative to prior month … generally, they’re still elevated relative to past couple years

Capex expectations continued to deteriorate in July per @KansasCityFed Manufacturing Index

Prices paid (blue) component in @KansasCityFed Manufacturing Index eased a bit in July, but 6-month outlook was still stretched and remained unchanged

Monthly supply of new homes continued to creep higher in June … now up to 9.8 (getting closer to peak seen right after pandemic erupted)

Sharp upward move in prices component in U.S. Composite @SPGlobalPMI suggests further upside for CPI

Huge gap in July between employment (blue) and new orders (orange) components in @KansasCityFed Manufacturing Index, with former sinking further into contraction and latter moving into expansion

Adjusted using ISM methodology, @KansasCityFed Manufacturing Index moved up to 50.3 in July … highest since September 2022

AAII bull-bear spread still positive but just barely … no major conviction shown over past few weeks @AAIISentiment

New home sales continue to slide in year/year terms … down to -6.6% in June, deepening decline