Liquity

@LiquityProtocol

Be $BOLD • The best way to borrow with (staked) ETH Join us: https://discord.gg/HFKpCdgQm6

Strong start for @NeriteOrg just days after launch. Mint $USND, Arbitrum’s native stablecoin, using: - ETH, wstETH and rETH - weETH by @EtherFi - rsETH by @KelpDAO - ARB & COMP - tBTC by @tBTC_project Then boost your rewards by LPing on @CamelotDEX - earn incentives +…

Whales don’t want you to know this trick… You can currently borrow at 0% on Liquity V2. Why? ETH loans are currently exempt from redemptions. But why? Redemptions are based on outside debt per collateral type, and the ETH Stability Pool holds $7M more than the total ETH debt.…

USDaf arrives in < 12 days! Immutability. Battle-tested thoroughly. Done right. Borrow against your BTC/Stables with custom FIXED interest rates from 0.5%. USDaf is a stablecoin like never before.

The extra $BOLD rewards are still in play - we're exactly at the half way mark of this campaign! As a reminder, these are the eligible actions: - Creating a new leveraged Liquity V2 Trove - Moving an existing position to Liquity V2 Check the quoted post for rules and details.👇

10k in $BOLD up for grabs on the Liquity V2 @DeFiSaver campaign ❕ Looking to: • Fix your borrowing costs? • Earn attractive yields? • Have full control over your loan? Use @DeFiSaver to: - Migrate your loan to Liquity V2 using Loan Shifter - Open a leveraged Trove 👇

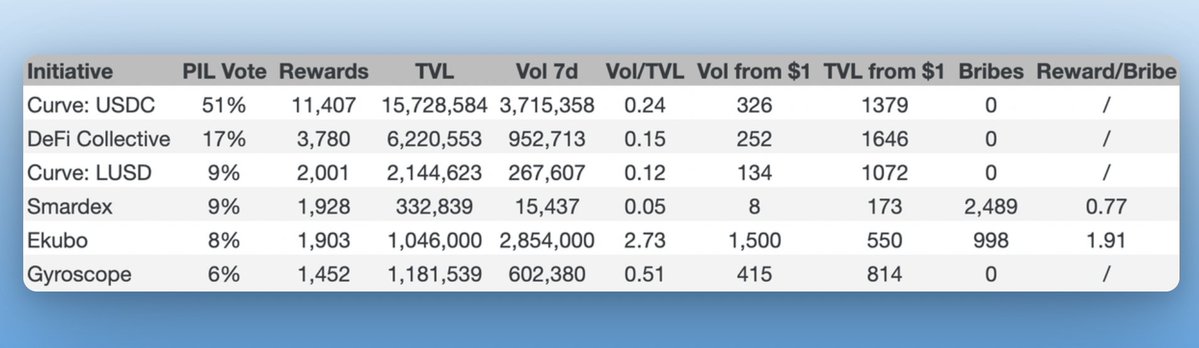

Record weekly rewards for @EkuboProtocol and @GyroStable 100% of the $BOLD will flow to LPs in their pools. Be like Ekubo and Gyroscope. Study PIL.

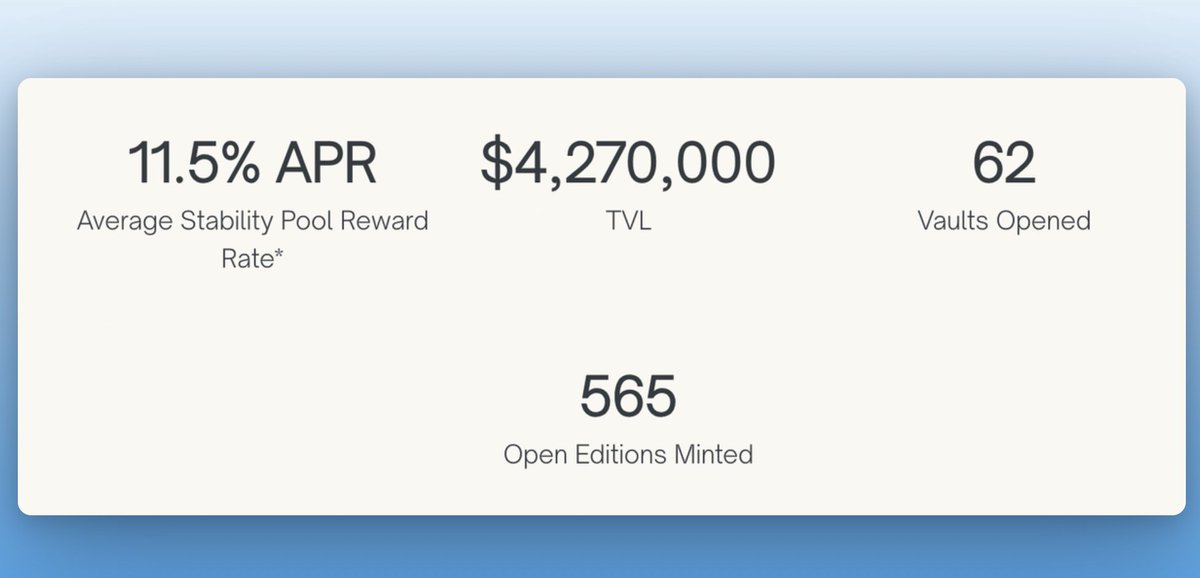

Not all Yield is created equal The $BOLD Dashboard is your go-to hub for organic, sustainable yield on mainnet and beyond. All BOLD yield venues, always up to date. 🔹 Top LP yield: 12% 🔹 Top single-sided: 11% Check it out👇 dune.com/liquity/liquit…

The cheapest $wstETH borrow rates, by far. Get paid to migrate on @DeFiSaver

The @LiquityProtocol is offering 10,000 $BOLD in incentives for users that: - Create new leveraged positions in V2 - Migrate from other protocols to Liquity V2 (including V1) You know how they say: better BOLD than never, right? Read on below for full details.

All the latest V2 alpha with Sam and Bojan who were guests at the DeFi Dojo.

I had the pleasure of talking all things $BOLD and @LiquityProtocol with @bjnpck and @SamExotic3. We're now seeing friendly forks publicizing their airdrop commitments to BOLD LPs and SP. Well worth the watch if you like actual decentralization and good yields.

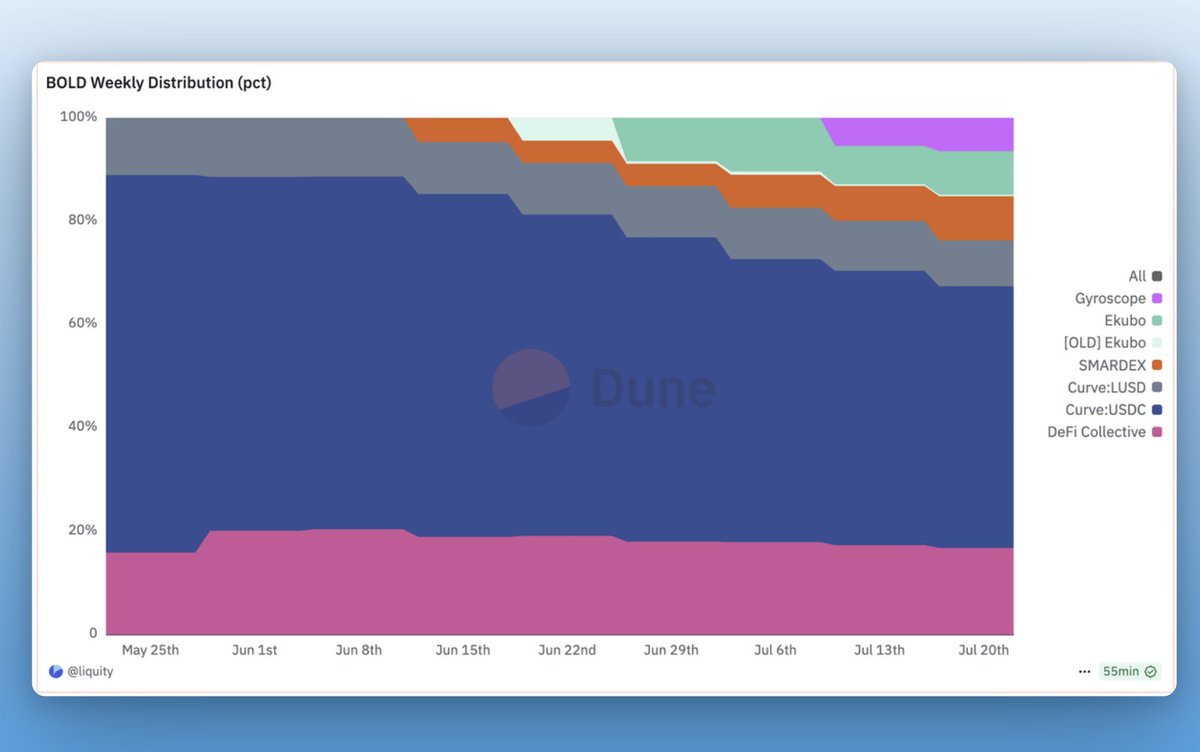

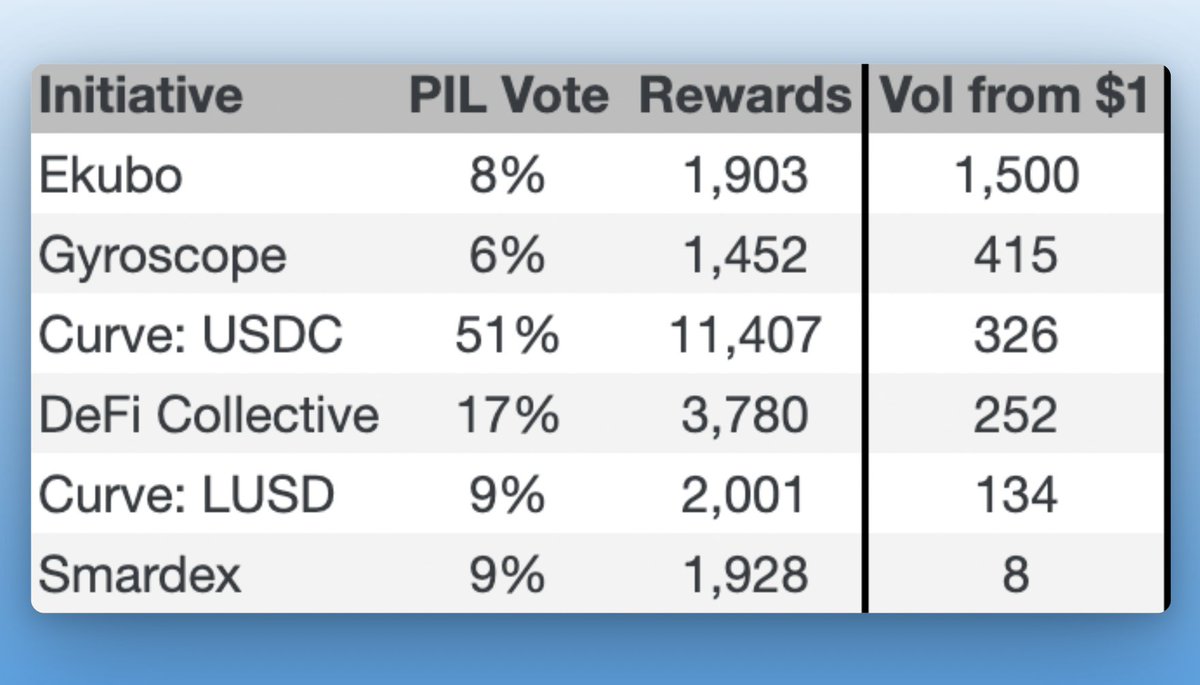

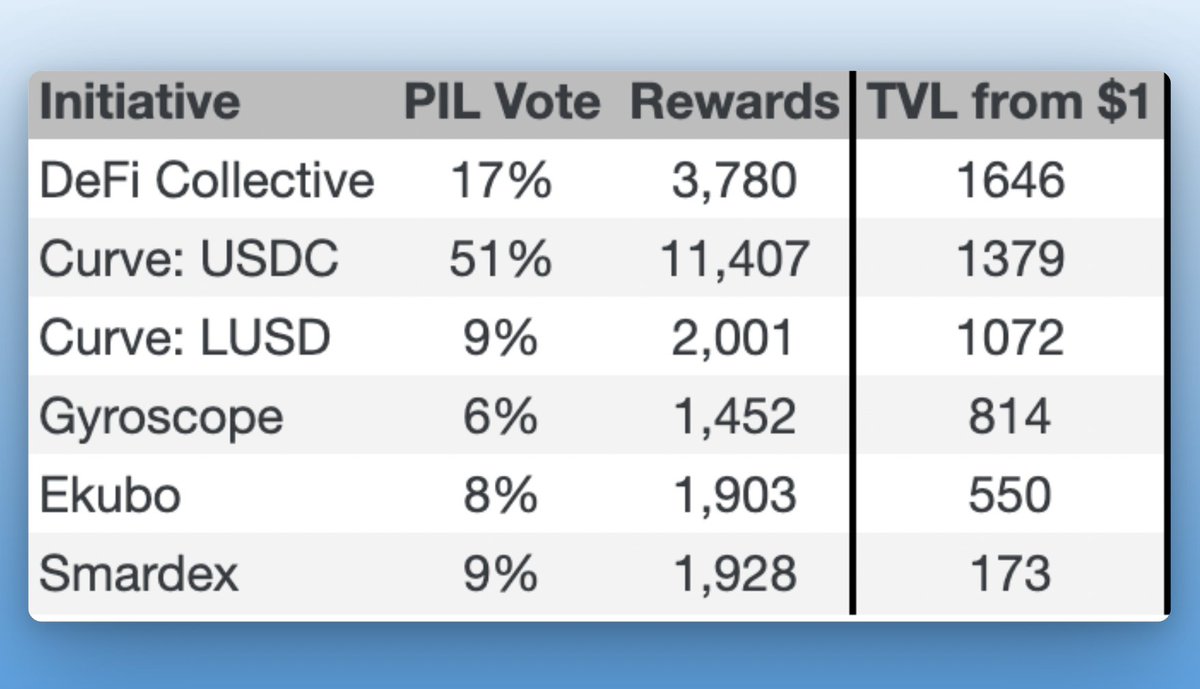

PIL Overview - Epoch 10 $LQTY stakers decide where PIL funds flow. At Liquity V2’s launch, the default options were @CurveFinance and @DeFiCollective_. Since then, three new entrants have joined: @SmarDex, @EkuboProtocol, and @GyroStable. Let’s take a look at the numbers.…

Banks RWA's KYC/AML US T-bills Blacklists Custodians Black boxes Asset dilution Locking of assets Stablecoin depegs Unsustainable yield Volatile borrow rates Limited redeemability Withdrawal limits/fees Centralized exchanges Centralized stablecoins Rehypothecation of assets…

x.com/i/article/1945…

10,000 $BOLD for loan migration and leverage. You have until August 9th.

10k in $BOLD up for grabs on the Liquity V2 @DeFiSaver campaign ❕ Looking to: • Fix your borrowing costs? • Earn attractive yields? • Have full control over your loan? Use @DeFiSaver to: - Migrate your loan to Liquity V2 using Loan Shifter - Open a leveraged Trove 👇

Pls help me with this question. Do you perceive Liquity as the safest system in DeFi? The one where the value of your assets is preserved with the highest certainty? Yes mean better than Aave, Maker, Euler etc. No means equal or worse. Would be very helpful if you could…