Bruce Booth

@LifeSciVC

Early stage biotech VC. Recovering scientist. Opinions expressed are solely my own and do not express the views or opinions of Atlas Venture.

$MRK will acquire Verona Pharma $VRNA for $10B. Fun bit of biotech history: 20 years ago, it was founded as a university spinout in the UK to make respiratory drugs. In 2006, before even raising money privately, it went public via a listing on London's AIM stock exchange,…

Excited to partner with @Novartis on a novel I&I program borne out of our targeted covalency engine at @matchpointtx Novartis inks deal with covalent medicines biotech Matchpoint for $60M upfront - endpoints.news/novartis-inks-…

Big late stage win for Takeda! Oveporexton (TAK-861) hits on all endpoints in narcolepsy for the first-in-class orexin receptor 2 selective agonist. Congrats to Andy Plump and the team at $TAK - perseverance and conviction on the MoA paid off takeda.com/newsroom/newsr…

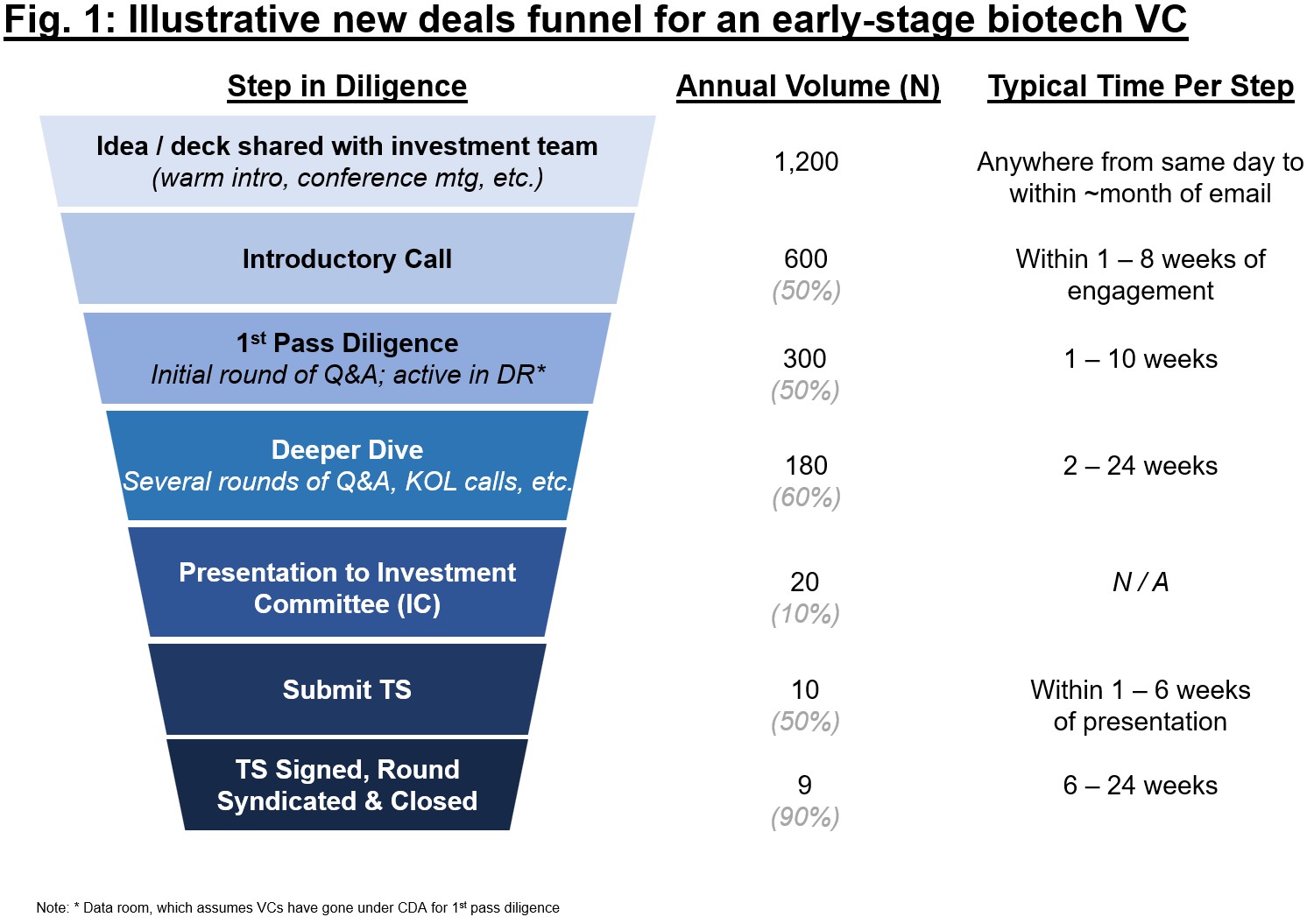

A great post for raising money from VCs.... "Best Practices for Pitching, Geared Towards First-Time Founders" - from @AtlasVenture's @AimeeRaleigh13 ... lifescivc.com/2025/07/best-p…

Some military leadership perspectives applied to biotech, from the always thoughtful Jason Campagna. @jcampagna98: "Leadership in the Age of Stacks" lifescivc.com/2025/07/leader…

Building Korro Bio: A CEO’s Perspective on Innovation and Risk Management @KorroBio $KRRO lifescivc.com/2025/06/buildi…

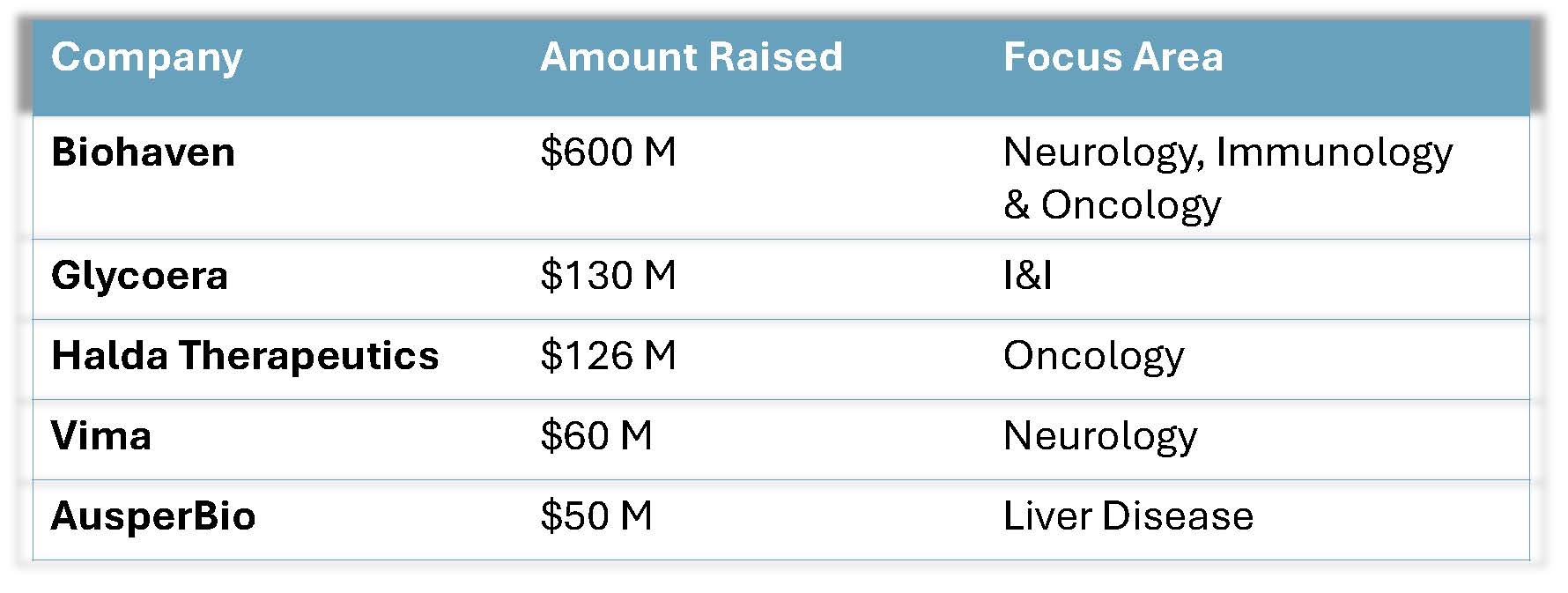

Impressive early stage deal activity by Novo... planting a wide range of innovative bets with smaller biotechs... Nice to see them investing some of that current GLP1 cash flow into long term external R&D rather than the short term toolkit of buybacks or dividends...…

The corrosive effects of dilution - via the compounding impact of multiple +/- 15% follow on financings and 5% annual evergreen option pool expansions….

Today is a great day for $RNA but it's also a good example for a common feature in successful public biotechs: the frustrating decoupling of share price and valuation. The company IPO'd in 2020 at $18 representing a ~675M market cap (37.5M shares outstanding). Today the stock…

Time to get more positive about biotech? @ArthurTzianabos makes the case in a new blog... “We Got This”: Don’t Let Negativity Become a Self-fulfilling Prophecy lifescivc.com/2025/06/we-got…

Biotech Wisdom Of The Crowds: Competition And Capitalism In a sector defined by science, R&D, and risk capital, crowding isn’t necessarily a bug – it’s more of a feature. Winners will emerge from the crowd and bring differentiated drugs fwd to patients lifescivc.com/2025/05/biotec…

Atlas EIR Cody Tranbarger opens up the aperture in a blog that's out of this world: "Boosters and Biologics: Is Space-Based Biomanufacturing Real?" lifescivc.com/2025/05/booste…

Great to see the early clinical data progress with "DNA caretaker” WRN helicase in MSI-H cancers... #AACR25: Roche's first results for Werner drug that uses synthetic lethality endpts.com/aacr25-roches-…

As @adamfeuerstein writes "the three recent examples cited as harbingers of doom — Daré Bioscience, Vanda Pharmaceuticals, and Stealth BioTherapeutics — all have problems or issues of their own that complicate the narrative". 💯 Those three are not the "canaries in the coal…

M&A is back, but nothing in biotech is neat or simple Plus: Drugmakers shouldn’t be too worried about FDA delays — yet trib.al/R2JORgf

There's lots of noise about how the changes at the FDA are having a negative impact on biotech as a sector. FDA departures must be bad for business. Drug delays make sensational headlines. But I don't think the sky is falling at the FDA, or at least not yet. I do expect that…