Leverage Shares ETFs

@LeverageETFs

The Leverage Shares™ by Themes ETFs provide leveraged exposure to popular stocks. Investing involves substantial risk, not suitable for all investors

Meet UNHG – our 2x Long @UnitedHealthGrp (UNH) Daily ETF - trading now on @Nasdaq! Fund does not invest directly in the underlying stock. Investment involves significant risk. Learn more and access important full risk disclosures and prospectus at: leverageshares.com/us/etfs/levera…

.@UnitedHealthGrp faces a major reset: CEO change, 2025 outlook pulled, DOJ probe into billing. Yet reforms like easing Rx access show promise. With Q2 earnings due July 29, UNH must prove it can cut costs, rebuild trust, and lead in care.

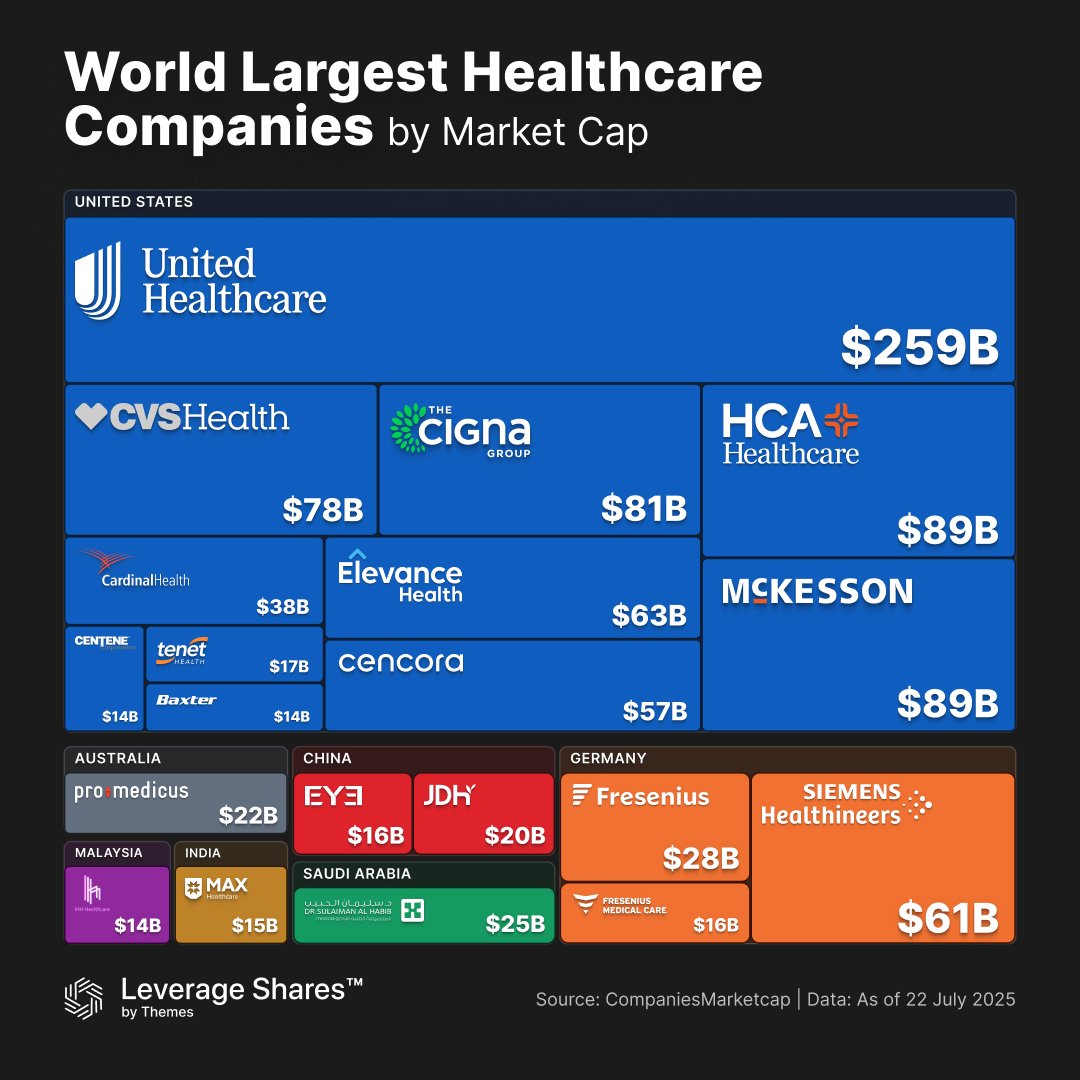

UnitedHealth (UNH) leads the global healthcare market with a $259B market cap - bigger than the next 3 U.S. firms combined. Global players are rising, but U.S. dominance in healthcare remains strong.

What is your current stance on UnitedHealth Group (UNH) given recent news and the upcoming earnings report on July 29?

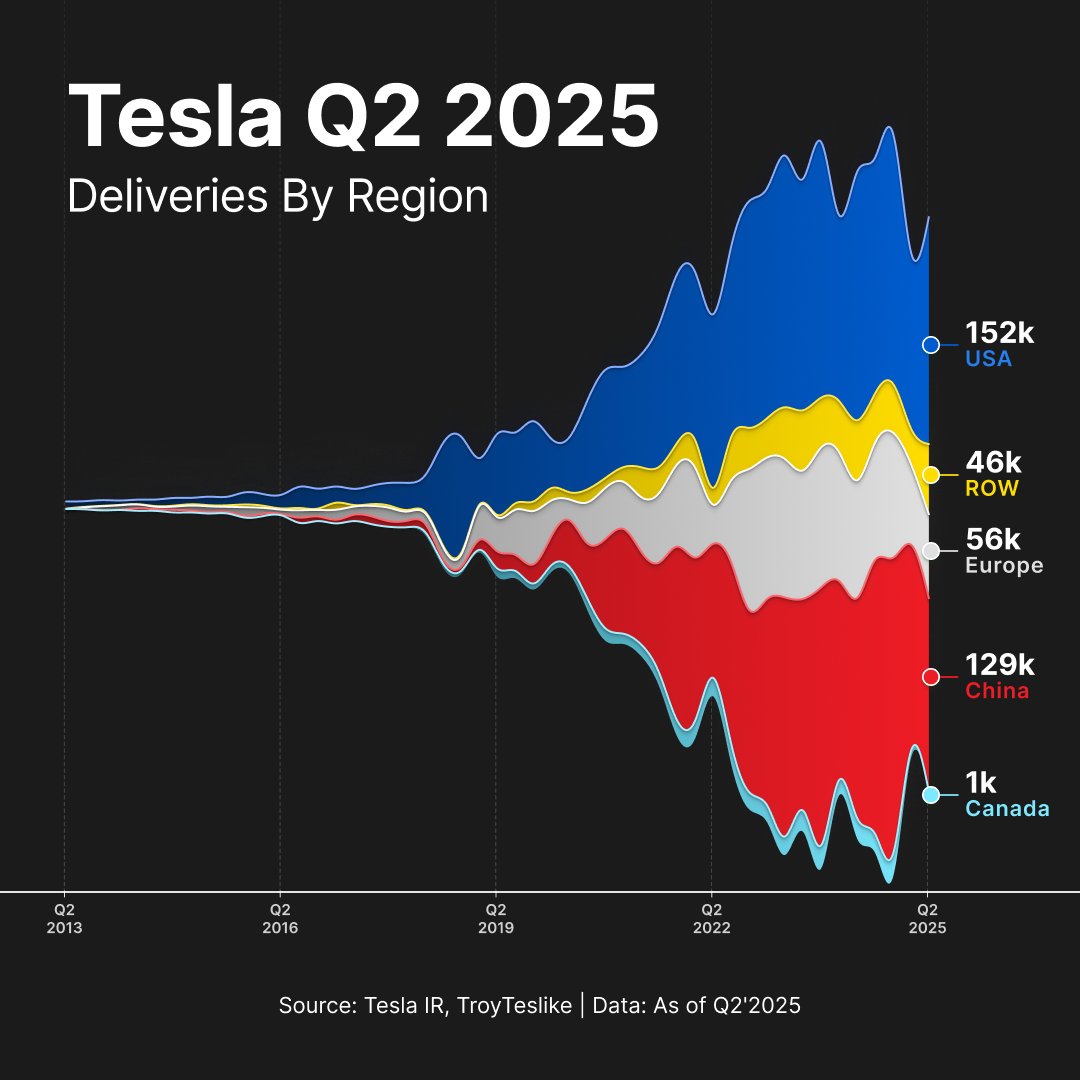

Tesla delivered over 380K vehicles globally in Q2 2025 - and the regional breakdown tells a deeper story. The U.S. and China together made up the majority of global deliveries, underscoring Tesla’s continued dominance in its two core markets despite intensifying competition and…

🚀Introducing the Leverage Shares 2x Long UnitedHealth (UNH) Daily ETF - Ticker: UNHG! Now trading on @Nasdaq and targeting 200% of UNH’s daily move. Investment involves significant risk including potential loss of principal. See prospectus for details leverageshares.com/us/

Meet AALG – the Leverage Shares 2x Long AAL Daily ETF! Trading now on @Nasdaq ! Fund does not invest directly in the underlying stock. Investment involves significant risk. Learn more and access important full risk disclosures and prospectus at leverageshares.com/us/all-etfs/

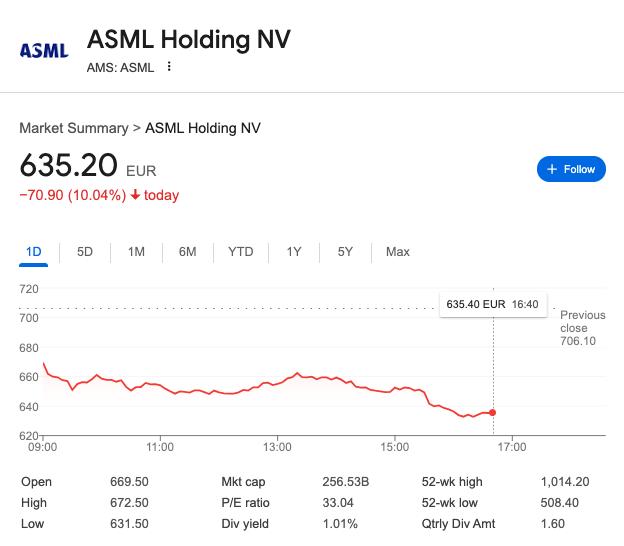

$ASML is down ~10% today. Fast Company reports ASML warned that it “may not see growth in 2026” as U.S. chipmakers wait for clarity on potential tariffs and macro‑geopolitical risk. Despite beating Q2 forecasts, the 2026 guidance freeze is sparking concern.

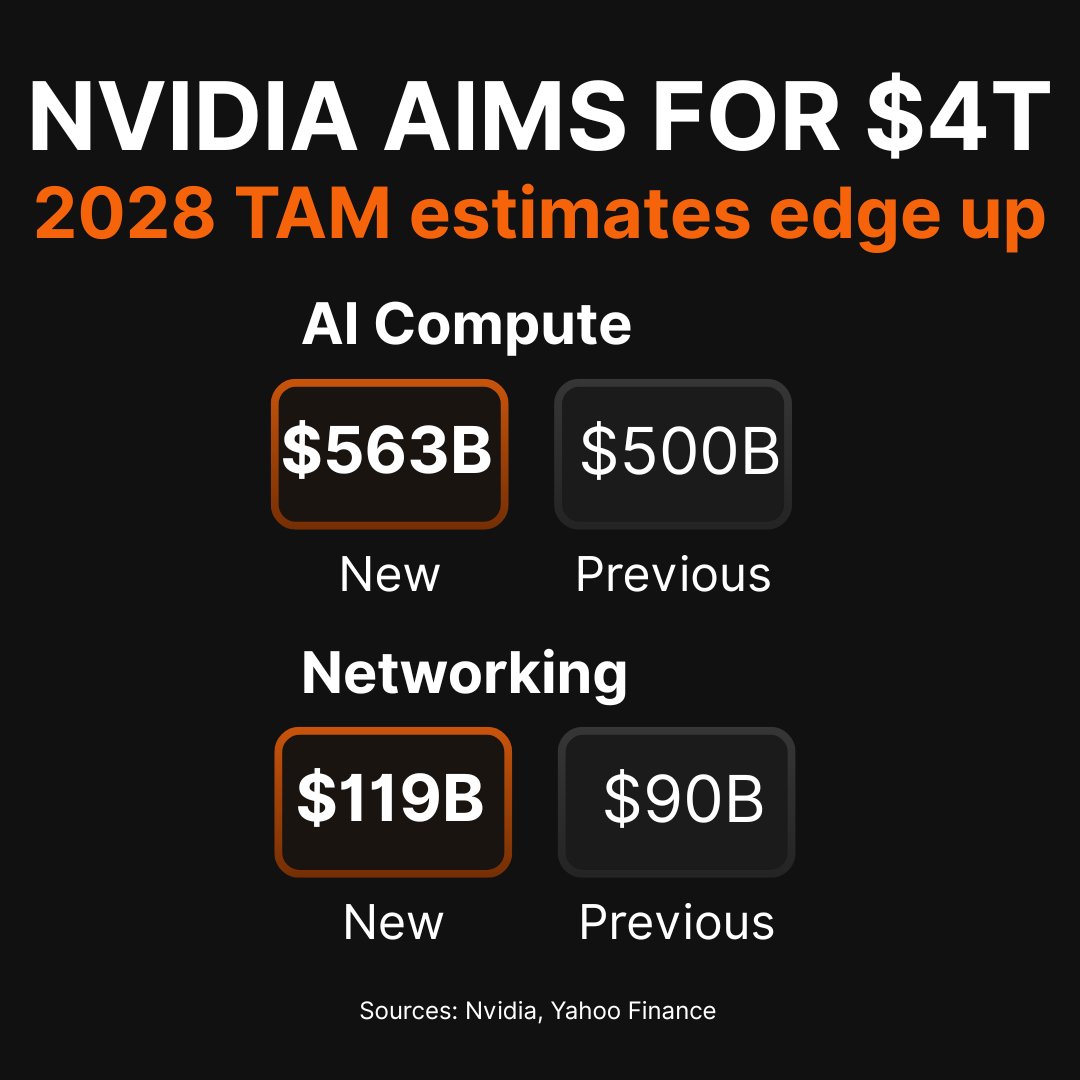

NVIDIA hit a $4 TRILLION market cap! From gaming GPUs to powering the AI revolution, NVIDIA is now the second most valuable company on the planet - only trailing Apple. The age of AI isn’t coming. It’s here - and NVIDIA is leading the charge.

Robinhood benefits from a rising Bitcoin (BTC) price by leveraging its commission-free trading platform and expanding crypto offerings to capitalize on market enthusiasm. As Bitcoin surges to new highs, increased trading volume can drive higher revenues.

🚀 Introducing our newest leveraged single stock ETF - say hello to: ➡️ 2x Long AAL Daily ETF (Ticker: AALG), listed at @Nasdaq! Investment involves significant risk including potential loss of principal. See prospectus for details leverageshares.com/us/

🤯Bitcoin breaks $118K while $COIN hits record highs Both assets surge ahead of Congress's Crypto Week as institutional adoption accelerates. $BTC +20% YTD performance signals a fundamental shift: crypto isn't just an alternative anymore, it's becoming core infrastructure.

📅Tesla sets November 6 shareholder meeting, per the 8-K filing with the Fed posted this morning. Headwinds, legal pressure and mounting challenges set the tone for the annual shareholder meeting of $TSLA.

💥 $TSM Q2 revenue JUST IN: - $31.9B (+38.6% YoY) vs $28.4-29.2B guidance. - TSMC also gets boost from enhanced US tax breaks (25%→35%) for Arizona expansion. - Having $AAPL and $NVDA as main customers seems to help. Full earnings next week Thursday (7/17)

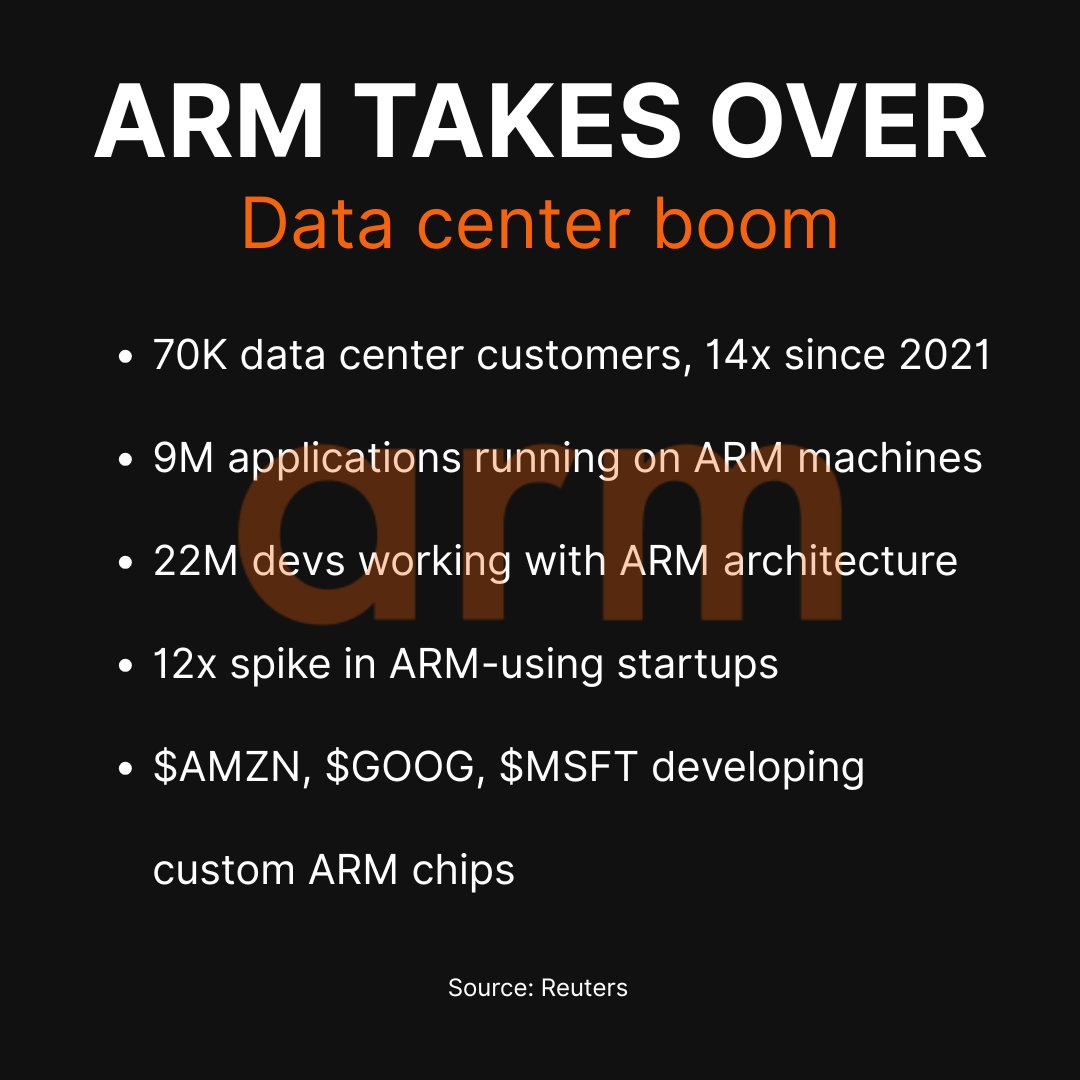

🔥 JUST IN: $ARM's stealth takeover of data centers accelerates AI boom drives tech giants such as $AMZN, $GOOG or $MSFT toward energy-efficient chips.

🚀 Citi DOUBLES DOWN on $NVDA as it approaches $4T market cap - New $190 target - Key catalyst: SOVEREIGN demand for AI - New math: total addressable market (TAM) up $C notes Nvidia´s AI benchmark vision: "1 supercomputer/ 10K GPUs per 100K employees" as enterprise standard.

🔥 $TSLA shares are down almost 7% in premarket Elon's "America Party" announcement triggers investor selloff. Tesla bulls seem exhausted by Musk's return to politics after vowing to focus on business.