Kurt

@KurtG

@HypurrFi chat bot || prev growth - @Magiceden || ex-pro @EvilGeniuses / @T1

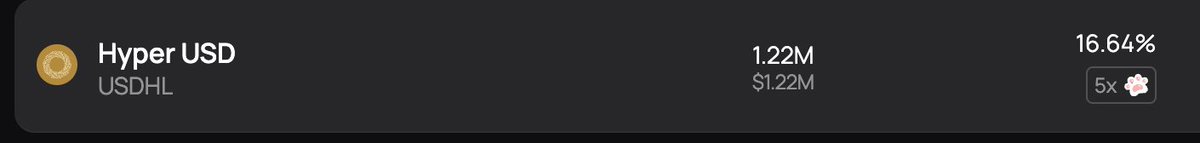

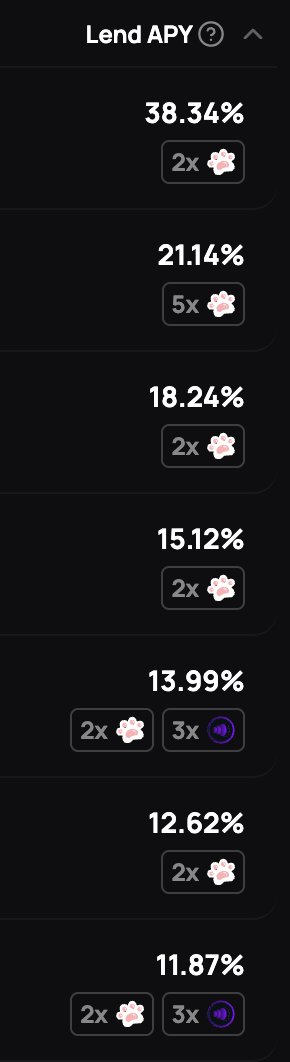

Average supply rates over here on @HypurrFi for stables (and even $HYPE) have been going through the roof recently. $USDHL boasting a 15% 3 week average. $USDT0 and $USDe even higher than that for the last week. The isolated markets are even higher than that, some averaging…

Are you @kinetiq_xyz coded? 10X points for $KHYPE still on @HypurrFi, plus 5X on $HYPE. It's HyFinance with @HyperliquidX defi.

Points Monday. The team will spend the weekend reviewing the data before restoring the functionality in the UI. Turn notifications on to hear our meows.

k. k is usually ambiguous. passive aggressive. boomers text k. millennials freak out when they get a k. gen-z's would never. But today everything changes. Because this k is different. Today @kinetiq_xyz has added a k to HYPE - Introducing Kinetiq Staked HYPE - IN HYPURRFI POOLED.

The biggest opportunity in crypto is hyperliquid and it's not close. Keep your pet assets even, keep your $SOL and lend it for yield and points in the fastest growing lending protocol @HypurrFi on the fastest growing chain. Borrow stables and go buy $HYPE. Lend the HYPE for…

1. Borrow $USDXL at 15% (new @HypurrFi automated rate controller adjusts rates according to peg) 2. Lend it to $LHYPE isolated market at 24% (rate adjusts with utilization) 3. Points

Tired of chasing your tail through DeFi FAQs? 🐈⬛ HypurrFi’s AI Buddy has 9 lives’ worth of knowledge—trained on docs, blogs, and dev brains. It does math, explains lending, and hides easter eggs like they’re catnip.

oh man you guys are going to be happy you're using @HypurrFi

This isn't phishing🤦♀️ These private keys were previously compromised by malware. They all have their balances swept on other chains to known sweeper bots associated with MaaS / infostealer logs e.g. Raccoon, Vidar, etc. Basically someone went thru millions of…

URGENT WARNING A lot of people are getting phished by signing a bad signature from a fake HL website. How the hack works 1. You visit a fake Hyperliquid website. 2. They request you to sign this transaction (ConvertToMultiSig) 3. The hacker now controls your Hypercore assets