Justin Wolfers

@JustinWolfers

Professor @UMichEcon & @FordSchool | Senior Fellow @BrookingsInst & @PIIE | Intro Econ textbook author | Think Like an Economist podcast.

What happens when a populist strong man with a deep belief in his own unconventional views– and a commitment to low interest rates– takes over what had previously been an independent central bank? History tells us. A continuing Econ 101 continuing education series.…

About to get inside your teevee with the wonderful @SRuhle and here's what you won't see: Macguyvering my hotel room to serve as an on-the-road studio. That's a laptop perched on an ice bucket, with an ipad on a trash can balancing my portable light.

Inflation expectations play a central in determining inflation, so you can get a virtuous cycle where low inflation expectations create low inflation, just as you can get a vicious cycle. Central bank independence can help lock in the virtuous cycle, so it's all gain, no pain.

What is central bank independence, and why does it matter? A bit of econ 101 to help you follow the implications of Trump's ongoing threats to fire the Fed Chair. #TheProfessorIsIn #TeachEcon

When rumors hit that Trump planned to fire Powell, stocks tanked. Half an hour later, he walked it back, and they rose. And this continued an almost unbroken streak of markets falling when they believe that Trump will follow his instincts, recovering only when he reverses course.

Managing the Epstein scandal appears to have left the White House with enough bandwidth to rename privately-held football teams, but not to resolve any of the global trade uncertainty it has caused.

Steve Jobs reimagined the future. Tim Cook has to reimagine supply chains based on presidential whims. This isn't the story of Apple, but rather a metaphor for the ways crony capitalism is distorting the priorities of American business.

The public-facing thing I'm most proud of is this segment "The Professor Is In" in which @AnaCabrera and I step back from the news cycle to teach the economics you need to know. This week: Central Bank Independence. What is it and why does it matter? youtube.com/watch?v=fBVutd…

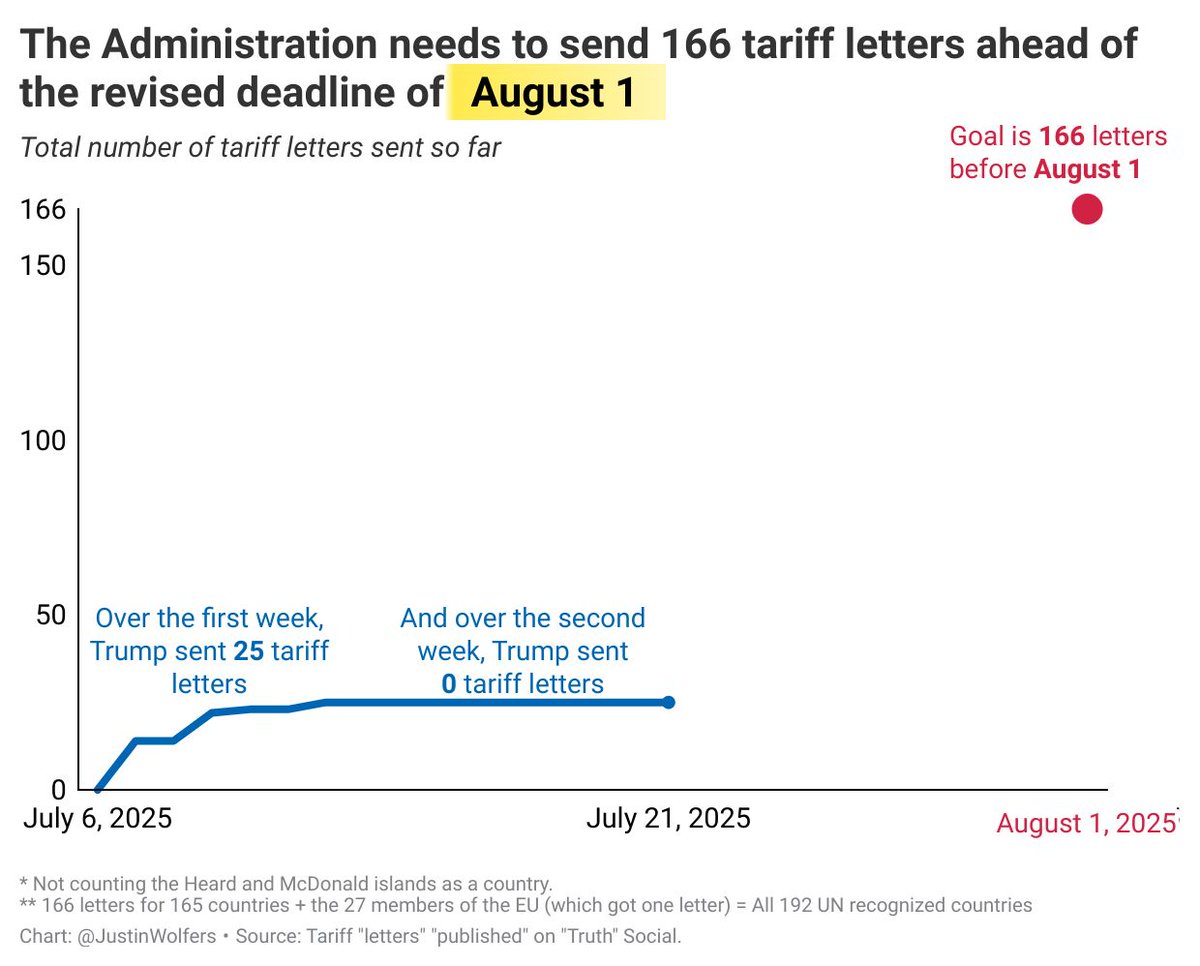

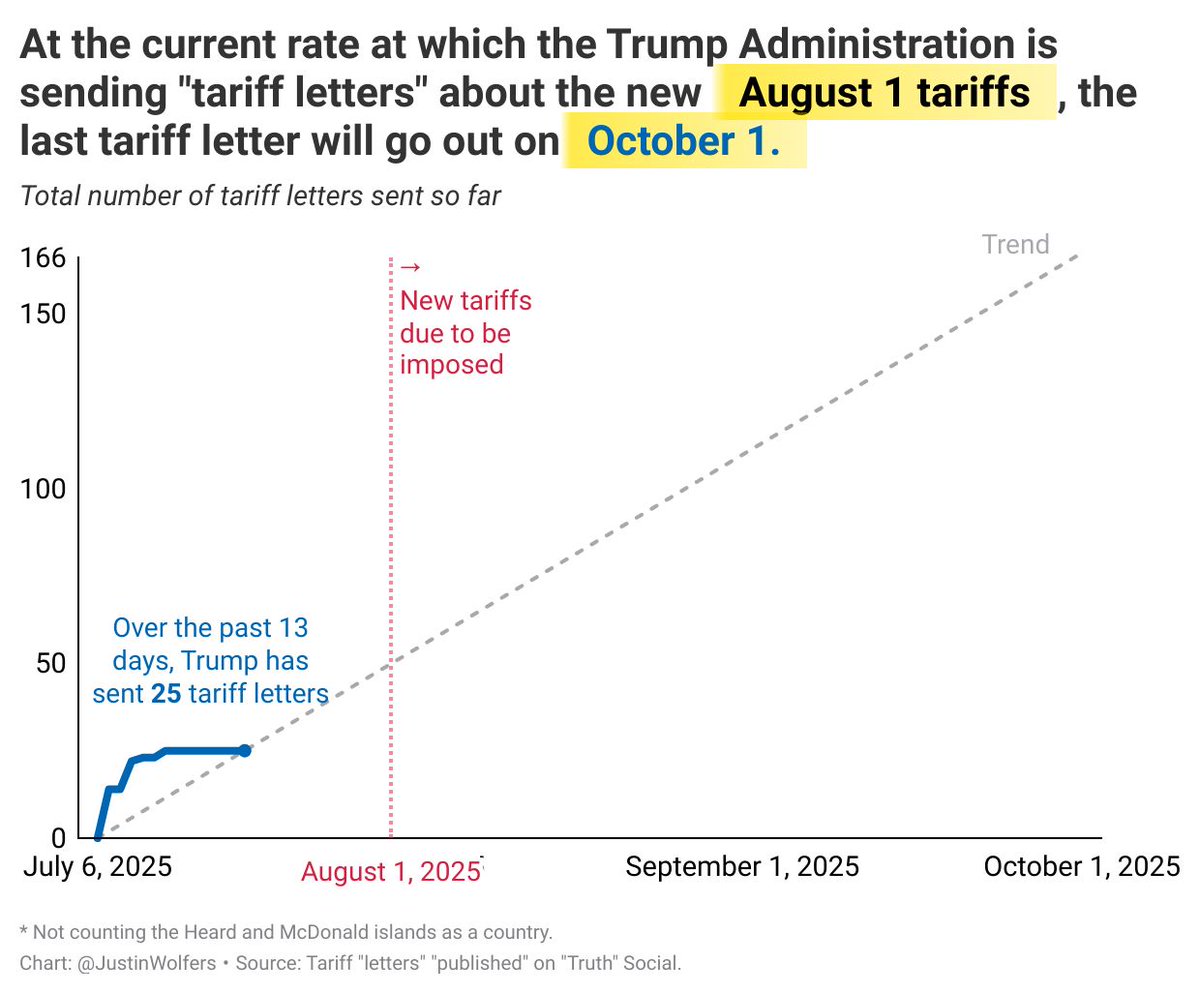

Anyone notice that the White House seems to have given up on sending out "tariff letters"? They've got three-and-a-bit- weeks to send 166 letters, and they just took this week off.

"If you look at page 1 of the tariff handbook, it says: Don't tariff inputs. It's the simplest way to make it harder for Americans to do business. Any factory around the world can get the steel, copper & aluminum it needs without paying a 50% upcharge, except an American factory"

People are miserable. The data isn't. And this disconnect may vanish once the tariffs actually arrive.

Tariffs aren’t instant inflation. Goods take a month at sea, another in customs, and more time in storage. Then you work through the storerooms that businesses filled ahead of time. Only then do new costs hit shelves. So yes, tariffs raise prices—just not right away.

Hahahahahahahahaha… everything is so stupid. The latest reason to fire Jay Powell is the Fed's use of “premium marble” as part of an "ostentatious overhaul" of its offices. But the Fed wanted glass. Trump appointees insisted on marble. apnews.com/article/powell…

You can tell two Trump stories: In one, he blusters; In the other, he acts on instincts. Which will it be on trade and economic policy?

"this is the precise opposite of 'America First.' This is what I'm gonna do: Impose a tax -- a very high tax -- on Americans who buy goods from Brazil in an attempt to influence Brazil's internal politics... why do we want to tax ourselves in order to get a former insurrectionist…

As an econ prof I like to use current events as a way to teach a bit of economics. I'm not sure there's much of a teaching moment here, beyond noting up is not down.

Navarro: Tariffs are not tax hikes, they are tax cuts.

Let me tell you the story of Steve Jobs, Donald Trump, Tim Cook, and what might be our most important economic problem.

Who wants to tell him that the import price index measures the pre-tariff price? If foreigners were eating the cost of (roughly) 10% tariffs, pre-tariff import prices would be down 10%. They're not. Therefore Americans are paying basically all of the tariffs.

Import prices just came in WAAAY below expectations: June was up just 0.1% M/M, -0.2% Y/Y, while May saw a huge downward revision from flat to -0.4% M/M; still waiting for tariffs to be passed on by foreign producers...