Jon Steinsson

@JonSteinsson

Economics Professor at UC Berkeley

Very timely and thoughtful article on the value of our money by @jasonfurman Happy Birthday, Money nytimes.com/2025/06/22/opi…

Even IF there is SOME truth to this cloudy concern in the very long run, we are so far from that concern being first order in most places at the moment that we can go all out on solar and batteries for quite a while.

Too many people are still sleeping on the solar + storage revolution. The most common objection you hear is "Well, we would still need to build an entire parallel energy system for the random week when it's cloudy." But this ignores two critical points: 1. While solar +…

The 'China shock' at the turn of this century wreaked havoc on US manufacturing. Is a second shock coming? I talked with @davidautor — one of the economists who identified the first 'China shock.'

When I studied Alesina-Drazen 91 in grad school, I associated it with Latin America. But now it feels like home. (If you don't know the paper, it is a gem. Worth reading!)

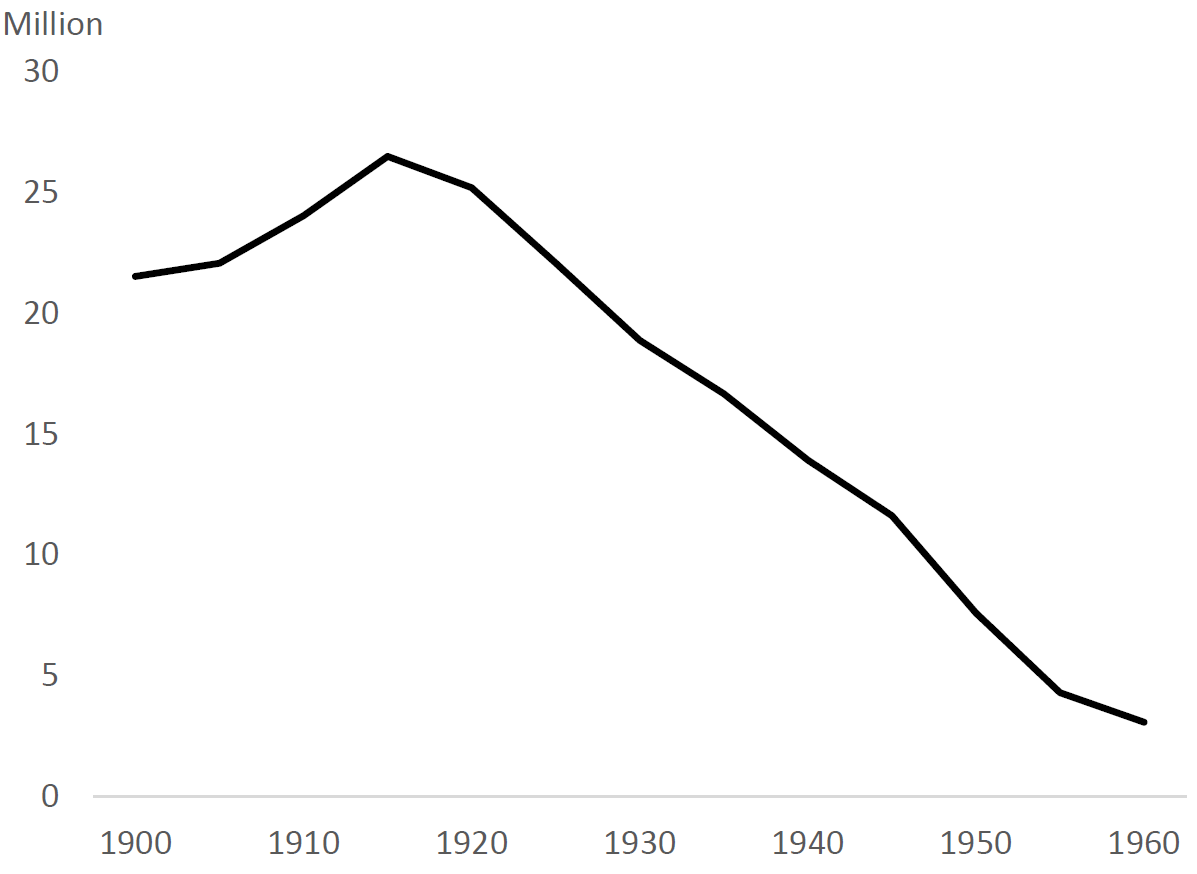

Horses didn't do so well in competition with the internal combustion engine.

It is remarkable how utterly we economists have failed to convince others that rent control is a bad policy. Our rhetoric has traditionally relied heavily on the logic of theory. I think we need to rely more on evidence.

Abundance is a very good book. Worth reading as opposed to just reading about.

The main story this time is the growing divide between the no-cuts and 2-cuts camps. A good illustration of how the dot plot helps highlight uncertainty (technically disagreement, but whatever). So much for "too much focus on the median." Win for dot plot in my book.

"Most of the time, I really regret having to fill out the SEP," says the Minneapolis Fed's Neel Kashkari. "You can't communicate just how uncertain you really are, because you have to put these handful of dots down." wsj.com/economy/centra…

A more sensible policy (if you want to tax banks) is to put in place a reserve requirement and only pay interest on excess reserves. Interest on (excess) reserves allows the Fed to separate monetary policy from liquidity provision, which is important.

Ted Cruz thinks interest on reserves costs the tax payer $1 trillion. He is quite mistaken. Mostly the Fed buys bonds in exchange for reserves. Both pay interest. So, to a first order, this is a wash. On average though the Fed makes money on this due to term premia, etc.

Ted Cruz thinks interest on reserves costs the tax payer $1 trillion. He is quite mistaken. Mostly the Fed buys bonds in exchange for reserves. Both pay interest. So, to a first order, this is a wash. On average though the Fed makes money on this due to term premia, etc.

CNBC: You think that's gonna go through -- telling the Federal Reserve that can't pay interest to banks anymore? TED CRUZ: For nearly 100 years, until the financial crisis, the Fed paid no interest on reserves CNBC: It was put in place to ensure the stability of the financial…

My very hot take: CBO is basically the most functional component of the legislative branch. The staff are super smart, non-partisan (their analysis annoys both Ds and Rs), and prolific--putting out incredibly helpful public materials and backup data. It's Congress's jewel.