Jeffrey P. Snider

@JeffSnider_EDU

Host Eurodollar University channel. Monetary science reborn. Putting central banks where they belong.

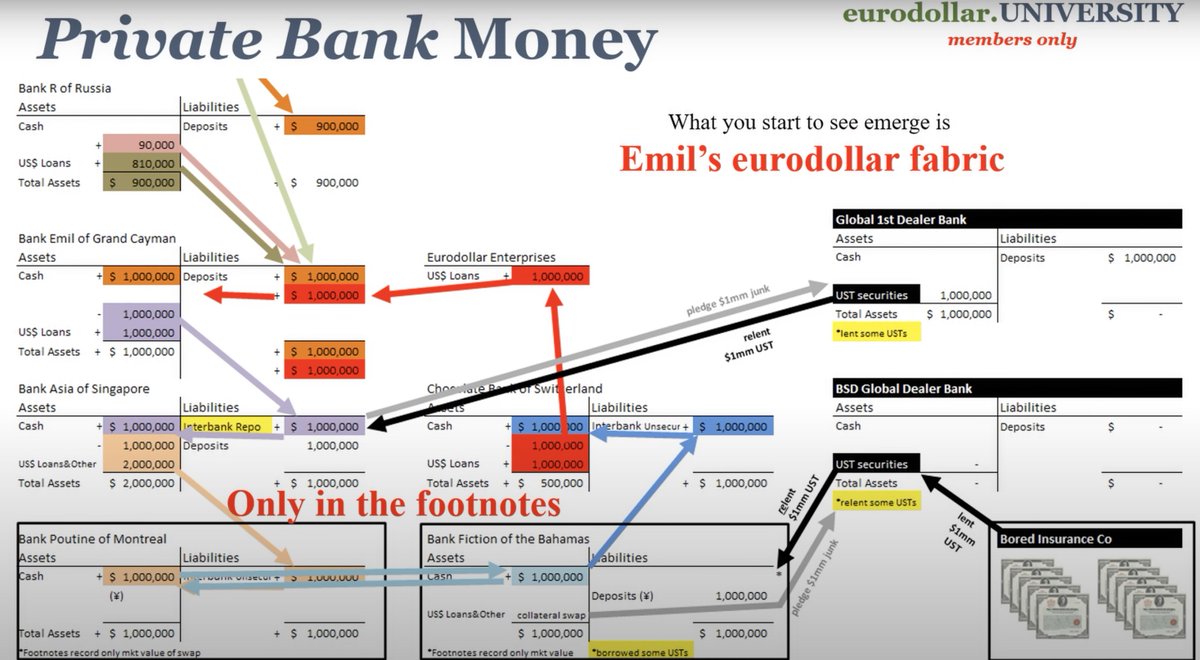

🚨 What is a eurodollar? - (Must Read)🚨 THREAD: 1: The Mystery Begins The Euro$ is NOT what you think it is. It's our hidden monetary system, lurking in the shadows. Think of Euro$s as a black hole, hidden yet profoundly affecting everything around it. The Government…

Sweden just reported a negative GDP print, officially slipping back into recession. It’s not an isolated case. Across the globe, we’re seeing the same signs: Japan, South Korea, China, Australia, all reporting weak or negative growth Germany and France facing rising…

The market is making a HUGE bet on interest rates… and no one’s talking about it. I’m breaking it all down in today’s live webinar. Join me here event.webinarjam.com/channel/swaps

Yesterday, something shocking happened. The New York Fed published a blog post quietly titled: “The Zero Lower Bound Remains a Medium-Term Risk.” In plain English? The Fed is admitting they might have to take rates all the way back to 0%. For years, this was unthinkable.…

The market is making a HUGE bet on interest rates. Swap spreads have anticipated every major move, including banking stress, policy pivots, and more. Now they’re flashing another major warning. I'm breaking it all down live in 2 days in this webinar You can sign up here…

This Is The Setup for a Historic Currency Crash Everyone’s acting like the dollar is dying, the euro is rising from the ashes, and it’s time to “Sell America.” Problem? That entire narrative is built on bias, speculation, and complete ignorance of how the system actually…

The Banks Are Preparing for Something Big How? They’re quietly doing the same thing they did before every major deflationary shock of the last 2 years. Here’s what they’re not telling you, and why it matters now more than ever: In the last month, primary dealers (the banks…

Microsoft just announced 9,000 job cuts. ADP reported –33,000 jobs in June. Hiring has collapsed across small and mid-sized businesses. And yet the stock market marches up, blindly. This is the exact disconnect we’ve been warning about for months. Markets are signaling…

Imagine waking up Thursday morning, knowing it’s the last day of your workweek. Not because of a union. Not because of a new law. But because AI quietly rewrote the rules of the economy. Let’s talk about what that really means, and what’s coming. 👇 Everyone’s screaming about…

You didn't imagine the collapse. Your income didn’t recover. Your rent is high, but your job still sucks. You’re not crazy. The experts are. If you want to Learn what really broke the global economy and what happens next in my webinar, Link: event.webinarjam.com/channel/swaps

When FedEx refuses to give guidance for the rest of the year, you should be asking: What do they see coming that they’re too afraid to say out loud? Here’s what we know: Consumer incomes are falling at a rate we haven’t seen since 2020 Real spending is already negative in…

Something’s happening again in the bond market that most people will either ignore or misinterpret entirely. Just a few weeks ago, the 4-week Treasury bill started seeing its yield drift lower. Now, it’s done more than drift. At the most recent auction, the 4-week came in with…

Nine months ago, China fired its biggest economic bazooka in over a decade a massive stimulus plan the world expected to “fix” everything. It didn’t. Loan growth just hit another record low. Bank lending is vanishing. And the so-called “recovery”? Built on zombie companies…

When did the U.S. dollar stop being the dollar? Most people (including 99% of finance “experts”) would say: August 15th, 1971. That’s the day Nixon cut gold convertibility and “ended the Bretton Woods system.” But here’s the truth you’ve never been told: The dollar most…

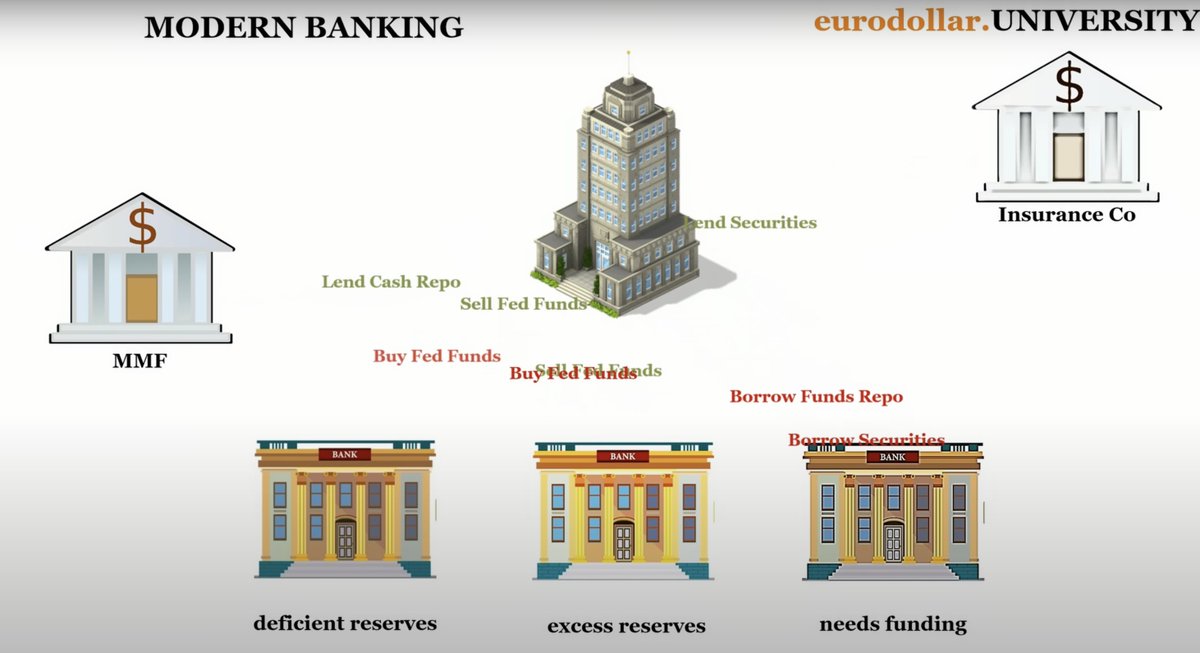

Something strange is happening between U.S. banks and shadow banks. In Q1 2025, American banks quietly lent $333.6 billion to offshore investment funds. That’s a third of a trillion. In three months. Why now? Because here's the part no one’s talking about: This isn’t…

Oil builds again – EIA data showed crude stockpiles rose by 3.5 million barrels this week, despite elevated refinery activity. Gasoline and distillate inventories, meanwhile, continued to drain. Crude curve? Still steepening - the market sees short-term tightness, long-term…

In China, the PBoC cut LPRs - first time since Oct. Stimulus is "happening"… but real demand isn't biting. Banks are swimming in bad real estate loans. Monetary transmission? Still clogged. In Europe, Germany’s PPI came in soft again - "disinflation" entrenched. But construction…

Everyone’s freaking out because Moody’s just downgraded U.S. government debt. But what if I told you… That’s not even close to the real crisis? Because here’s what no one’s talking about: The government is already broke — It’s been broke. And yet… the market just keeps…

Everyone’s focused on rate cuts. But beneath the surface, signals are shifting. In China, all eyes were on April’s data drop. Fixed Asset Investment? Slowing. Retail Sales? Below expectations. Real estate? Plummeted 10%. Industrial Output? Decelerating. The message:…

Everyone remembers October 1929. The stock market crashed. The world spiraled into the Great Depression. At least… that’s the story we’ve all been told. But if that crash was the cause, why didn’t the same thing happen after 1987? Or the dot-com bust? Or even 2008?…