Jamie Halse (Senjin Capital) 🇳🇿🇦🇺🇯🇵

@JamieHalse

Senjin Capital founder. Engagement investor. Contributing to the corporate reform process in Japan.

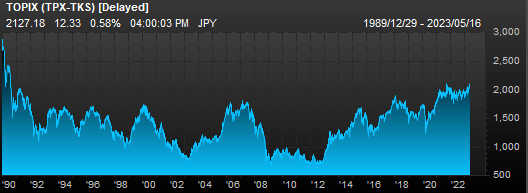

Japanese stocks are rallying to heights not seen since the 1990s. Back then it was the aftermath of bubble valuations. Now, there is a solid foundation of earnings growth, corporate governance improvements, and increasing cash returns to shareholders! 1/n

I received some interesting advice today from a fellow fund manager who has been on a similar journey building his business. He has found that when communicating with potential investors, it is key to spend as much or more time talking about what your strategy / philosophy /…

The opportunity is large.

Nice work from @verdadcap quantifying the ongoing opportunity in deep value in SMID Japanese cos. Per the below there are still ~450 cos trading in Japan sub 0.5x P/B (on reported book mind you, often this is v understated), most all of which is sub $300mm mkt cap... happy…

Interesting views. Reading this as a long time member, but someone who has never been involved in the administration or from memory, ever voted a proxy, this year I think I will vote.

The CFA Institute is no longer the outstanding organization it was when I joined upon earning my charter 31 years ago. If you are a CFA charterholder and have not yet voted your proxy (deadline this Monday the 21st at noon Eastern) or may consider changing your vote, or are…

💡 I made the mistake—so you don’t have to. One key lesson from my time investing in Japanese equities: never underestimate the value a private equity buyer might see in a Japanese public company. The combination of solid fundamentals, activist involvement, and a PE exit can…