Jeremy Wells

@JWellsTax

COO/Head of Tax at Steadfast Bookkeeping. Proud husband & father. PhD, EA, CPA ♈️

If you support Trump, you have to ask yourself: 15 years from now, are you really still going to be spending your time online, screaming about wokeness and immigrants and Epstein or whatever? Is that what your life is going to be, forever? Is that what America is going to be?

MAGA has no culture beyond online rage. There is no revival of Christianity or patriotism. MAGA is hurting manufacturing, canceling infrastructure, blocking energy, gutting research, and slowing the economy. This is a movement that builds NOTHING. noahpinion.blog/p/maga-doesnt-…

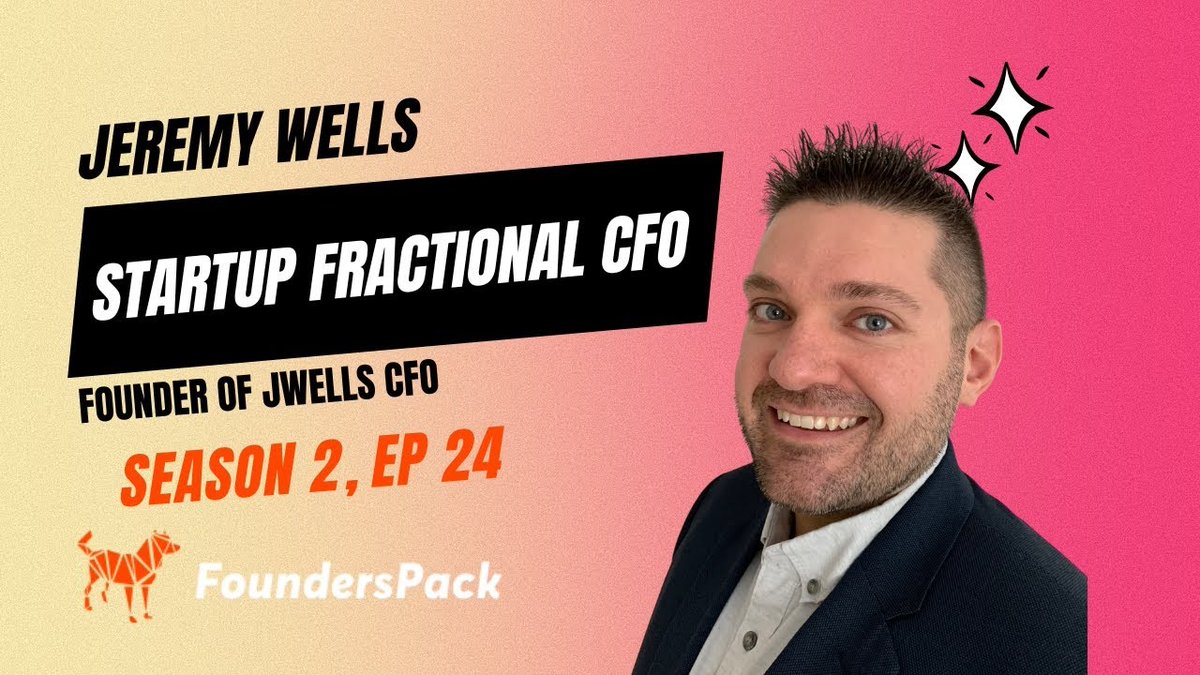

🧪 Your firm isn’t an Excel template. It’s a lab. One of the best shifts I made as a firm owner was ending the perfection mindset and embracing experimentation. In a recent interview, I explained why “experiment” is the mindset that prevents overwhelm. youtube.com/watch?v=StWoFQ…

💡 Business owner? Side hustler? Contractor? 👍 You might qualify for the Qualified Business Income Deduction (QBID). 🧮 But the calculations can get complicated with phaseouts, payroll, and fixed assets. 📰 Here’s the article where I break this down: bankrate.com/taxes/qualifie…

My intern after plugging a variance to cash and getting the balance sheet to balance

🎧 Have you listened to Tax in Action? ⁉️ If not, what are you waiting for!? 🧑💻 If yes, let me know in the comments! ✅ And the best way to support the show is to rate and review in your podcast player of choice. Thanks! 🎧 Start listening here: tax.show

Most married couples file jointly without a second thought. But in this episode of Tax in Action, I break down ✅ Why “joint by default” is a myth ✅ Steps for comparing joint vs. separate ✅ When filing separately actually makes sense 🎧 Listen here: tax.show/5

🚩 R&D Credit Myth: “Service businesses never qualify.” Not always. 🧪 Thinking about the R&D credit for your business? Drop a comment or question below. I’ll help clarify if it’s worth exploring for your situation. 🎧 Listen to the full episode here: tax.show/2

TCJA (not the recent OB3 Act) changed the deductibility of employer-provided, on-premise meals starting in 2026. Does this change torpedo deductions for free employee snacks and coffee? Find out in this Tom Talks Taxes edition: loom.ly/I88L9Vk

I don’t know who started this rumor about OBBBA and office snacks, but it needs to stop.

🚩 Tracking your P&L isn’t enough. 🚧 You can’t build a stable business on a shaky foundation. ⚠️ You can’t make strategic decisions with unclear numbers. 🥱 And you can’t outsource all financial responsibility just because it’s “not fun.” 📽️ Watch here: youtube.com/watch?v=StWoFQ…

🧪 Your firm isn’t an Excel template. It’s a lab. One of the best shifts I made as a firm owner was ending perfection mindset and embracing experimentation. In this interview, I dug into the “experiment” mindset that prevents overwhelm. 📽️ Watch here: youtube.com/watch?v=StWoFQ…

College is essentially a walkable city with good infrastructure, full of civilians working toward self-betterment. There's still a respect for expertise and facts, as well as community and forgiveness. Leaving that is tough.

I think college ruined my perception of community in real adult world because the way i yearn for something that kind of only exist when you live on campus..

I have a forthcoming article on Tom Talks Taxes that explains the TCJA employer eating facility provision, which will take effect next year, along with the minor OB3 change. The information being widely disseminated is not accurate. We will dial in the correct treatment with…

📈 What Every Tax Pro Needs to Know About §1031 Exchanges In this Tax in Action episode, I break down the basics, including ⚖️ What qualifies as “like-kind” 🗓️ The 45/180-day rules 📋 Form 8824 reporting 🏛️ Key Tax Court cases 🎥 Watch here: youtube.com/watch?v=K8xubW…

🧪 Your firm isn’t an Excel template. It’s a lab. One of the best shifts I made as a firm owner was ending the perfection mindset and embracing experimentation. In a recent interview, I explained why “experiment” is the mindset that prevents overwhelm. youtube.com/watch?v=StWoFQ…

Not sure who needs this info, but here it is. This is not unusual after a large new bill passes; there will be a lot of people trying to sort out the details.

This is incorrect. OBBBA §70305 changes IRC §274(o), which disallows a deduction for meals described in §119 and "certain eating facilities" described in §132(e)(2) (such as a cafeteria). Office meals, snacks, and coffee are not affected by the change.

🚩 R&D Credit Myth: “Service businesses never qualify.” Not always. 🧪 Thinking about the R&D credit for your business? Drop a comment or question below. I’ll help clarify if it’s worth exploring for your situation. 🎧 Listen to the full episode here: tax.show/2