Margin of Safety🇮🇳

@InvestorOfJAMMU

NISM Certified RESEARCH ANALYST💼 Value Investor from Jammu with focus on Margin of Safety. Stock market investor since 2016🏆 Financially Independent💸

📢📢If I compare the profits and valuations of Kotak Life, Kotak AMC and Kotak securities with the listed peers, the Valuations of the subsidiaries of Kotak bank is alone 2.2 lakh Crores. The full #KotakBank is available with its subsidiaries at 3.4 lakh crores and standalone…

Indian Macros are slowing down🔻 - Kotak Management Is this the reason for 2% inflation? Muted demand🔻 Can this trigger market correction if market sense in advance that GDP will be slowing down??

One thing is clear in IDFC Bank results, if you see their last year base PAT, the high base is over. Now from hereon, you will see above 30% YoY PAT growth going forward as the base is very low. Problem - Too much liquidity dilution is pulling the book value down. As of now,…

CDSL is a shallow cyclical business. The drop in PAT was happened in 2022 too when there was a fall in stock market. The growth will recover again once Bull run resumes. Evergreen business but very high PE, P/S, PEG and P/B 🚨 #cdsl

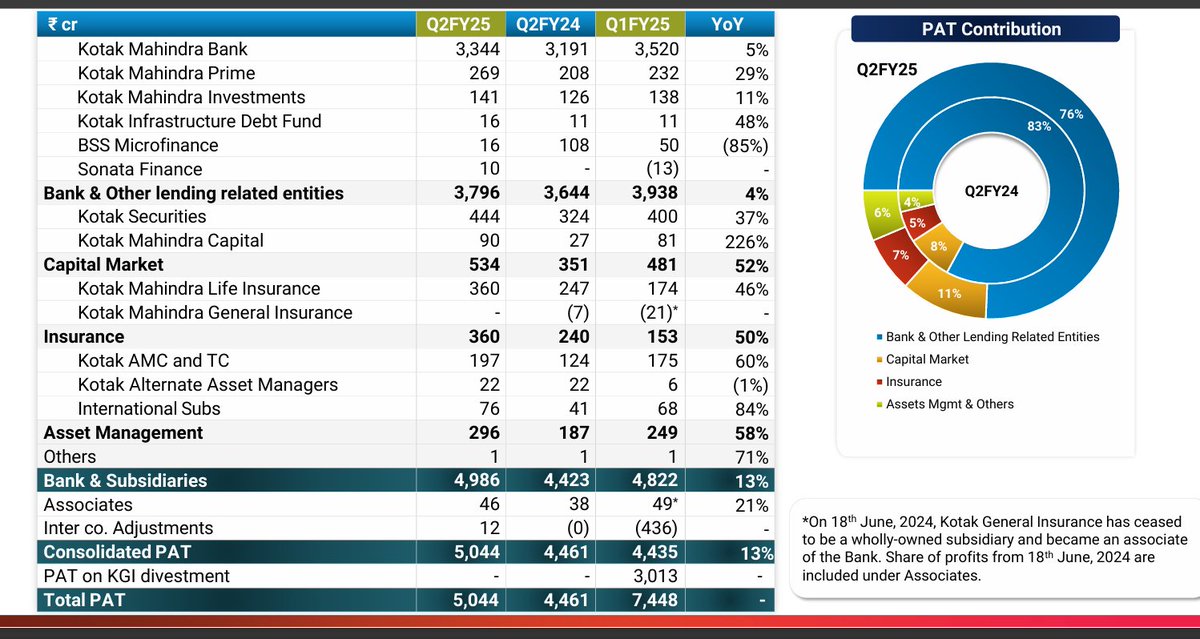

Poor set of numbers from Kotak Bank. Much below my conservative estimate. Consolidated PAT up 1% (excluding one time gain in Q1FY25) Standalone PAT down 7%🔻 NIM down by 32bps QoQ🤦 NPAs almost flat Provisions up more than 2x YoY Only positive is Book Value up 17% YoY Bank at…

Kotak Bank Q1FY26 Expecting PAT of 5,000 Cr Vs 7,448 Cr of Q1FY25. Last time it was a one time gain of 3013 Cr from selling KGI subsidary. YoY comparison will not be right Headlines may show you Consolidated PAT down🔻 30% YoY NIM may see 10 bps down. Eye on NPA & provisions

Citi actually wants to say that Bitcoin has 1. No real value 2. Cannot be use as Barter 3. No financial parameters, quarterly results or dividends 4. No authority to regulate/grievances and avoid hacking People buy crazily, it goes up and vice-versa. Enjoy the Ponzi scheme till…

Bitcoin will go up if more people buy bitcoin and won’t if they don’t: Citi on.ft.com/3TVk4Fl

Listen to everyone carefully. Analyse in your mind. Decide what is good for you✅️ Never follow anyone blindly. Start taking responsibilty for your own actions.

Ptoject a willingness to listen and learn from your peers and you will attract quality people who you can learn and benefit from.

If you project an overall negative outlook on the world, it is more likely that you will receive negative in kind. But if you act and react positively and project kindness & intelligence, this will come back to you.

It is better to hang out with people better than you. Pick out associates whose behaviour is better than yours and you will drift in that direction.

Mentor👇 For the investor, business owner, or even to the construction worker or waitress, a mentor can simply be someone whose ideas you identify with on a personal or professional level through articles, books, and television programs. Sometimes inspiration drawn from these…

Banking is not only the business of lending, it is the business of risk management while public deposits are at stake. Banking is the most regulated sector of India and banks need to follow hundreds of rules.

Why do we need banks now if only maintaining the ledger is the necessity. Any tech company can do. For financing, we already have lending company. Most Banks should be closed in 15 years.

Who is sad after ULLU and ALT BALAJI are banned by Indian Government ??

Take my Tweets seriously. This is just the start of fall🔻🔻

Those who are invested in midcap IT companies at 50-80 PE, they will cry after few years.