Save Invest Repeat 📈

@InvestRepeat

My Mission: Spread Financial Freedom / Stock Market / Mutual Funds / Gold / Crypto / Inner Circle → http://SaveInvestRepeat.com/community

Best part about SIR Community is how people help each other out. 💵 From beginners to crorepatis, all are helping & learning from each other. I am myself learning a lot from so many group members. Group link in the replies below 👇

As I mentioned many times before, India's over-reliance on IT for exports & jobs, when these human resource companies have spent near to nothing on R&D for building products; is surely coming back to bite us.

Indian IT services companies or as I call them Human Resource companies are suddenly realising that years of only focusing on services & distributing 1000s of crore in dividends instead of deploying that in R&D to build our own products is coming back to bite them. These…

Won't be surprised if other Indian IT companies do layoffs too. 1) In Big Tech companies as well, if one announces layoffs - others join in as they can remain under the hood of "layoff season" & not be singled out. #TCS layoffs is a big green light to other IT companies. 2)…

If you have a hectic salaried job or lack passion for stock analysis then you don't need to do direct stocks. But you can still generate wealth. Either buy Nifty 500 / LargeMidcap 250. Or buy 2 flexi cap funds. And keep doing SIP with top-up for 20 years to see the magic.

PPFAS DAAF Mutual Fund's June Portfolio is out. • Holding same 8 stocks - Power Grid, Petronet LNG, ITC, Coal India, Swaraj Engines, Nesco, Nirlon, VST Industries • Equity + Arbitrage exposure goes down. Currently at 35.73%. • Pure equity allocation goes up. Note: Parag…

If your country has “Misinformation” or “Hate Speech” laws, it means your country don’t have free speech.

🚨 The ‘Online Safety Act’ makes it an offence to say something that is false which causes “non-trivial psychological harm”. Platforms would also be forced to proactively censor the speech. The Tories deserve their extinction and Reform will restore free speech.

Data on average volatility of different hybrid fund category. Average return is based on annualised last 3 years data. Many use hybrid mutual funds in their retirement bucketing strategy so pulled this data for them.

Mutual Funds platform Kuvera released last week's platform data. As usual, PPFAS and Nifty 50 index fund continue to receive new inflows. Motilal Midcap's trend continues as well. Bandhan Smallcap is the new trending fund in town now. Arbitrage funds got dumped last week.

quant Small Cap Mutual Fund's June Portfolio is out. NAV is down -0.99% YoY and MoM AUM is up by ₹1424 Cr+ • Top 3 holding: Reliance, Jio Fin & Aegis Logistics. • Additional 0.73% futures LONG positions: RBL Bank, NCC, Chambal Fertilizers • Cash holding goes down. From…

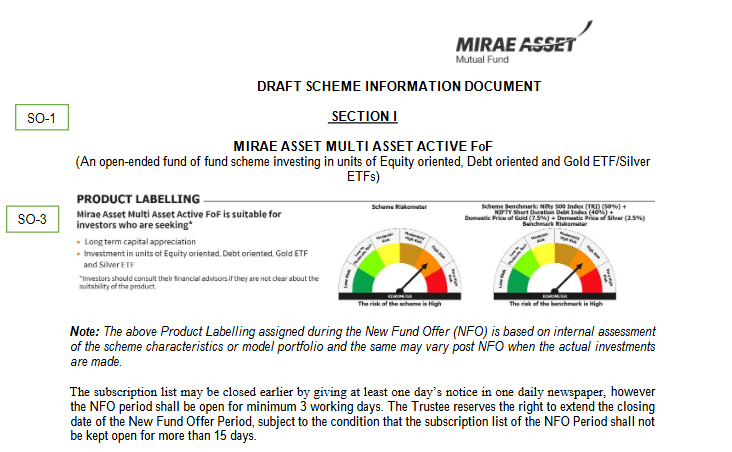

Mirae Asset Mutual Fund has filed papers with SEBI for Multi Asset Active FoF. Benchmark is 50% Nifty 500 Index TRI 40% Nifty Short Duration Debt Index 7.5% Gold 2.5% Silver

⚡️ Embassy REIT becomes India's 1st REIT to raise ₹2,000 Crores through 10-Year NCD issuance

Always pay your Credit Card bill in full & on time. 💳 If you pay only 'minimum amount due', then remaining amount will be charged interest at 25-45% yearly from the day you spent the money.

Accumulated 4192.27 Mutual Fund units this month. My first 'personal' goal is to hit 1,00,000 units of this particular portfolio. (And no, goal isn't to buy any random funds with lower NAV just to reach 1L units.) Small small steps 🏃 → Financial Freedom 💸

Kenneth Andrade Sir's Old Bridge Focused Equity Mutual Fund's June Portfolio is out. • Top 5 holding: Redington, Airtel, Prestige Estates, UPL, Maruti. • Only buying, no stocks sold or decreased. • Cash holding decreased from 3.38% in Apr to 11.81% in May to 7.86% in June.

⚡️ Zerodha Fund House has filed papers with SEBI for Nifty 8-13 Yr G-Sec ETF Nifty Smallcap 100 ETF

You can buy 'future income' with your 'present income'. ⤷ REITs ⤷ Dividend Stocks ⤷ Mutual Fund Units etc. Most haven't even realised this yet.

Motilal Oswal Midcap Fund's June Portfolio is out. • Top 3 holding - Coforge, Persistent, Trent • 0.55% of the Paytm position is hedged (SHORT) • Cash holding (including arbitrage) drastically goes down from 39.66% in Apr to 37.17% in May to 17.72% in June.