Ilya Strebulaev

@IlyaStrebulaev

Finance Professor at @Stanford. Founder & Director, Venture Capital Initiative at @StanfordGSB. Startup financing, Silicon Valley, corporate innovation

Access valuable information on the Venture Mindset now – sign up for our free newsletter at thevcmindset.com/newsletter/ Every other week you will receive, directly in your inbox, takeaways from decades of our research and hundreds of interviews with venture capitalists and unicorn…

𝐀 𝐰𝐞𝐥𝐥-𝐝𝐨𝐜𝐮𝐦𝐞𝐧𝐭𝐞𝐝 𝐫𝐞𝐜𝐨𝐫𝐝 𝐛𝐞𝐚𝐭𝐬 𝐦𝐞𝐦𝐨𝐫𝐲 𝐞𝐯𝐞𝐫𝐲 𝐭𝐢𝐦𝐞. We spend a lot of time discussing the art and science of investment memos in our Stanford Venture Capital class. In addition to their main goal of helping to make an investment decision,…

🌎 Did you know nearly HALF of all US unicorn founders were born outside the US?! Stanford Professor @IlyaStrebulaev analyzed 3,000+ unicorns and discovered this incredible statistic. Founders came from 65 countries, with India leading the way, followed by Israel and Canada.…

Are California unicorns different from their non-California counterparts? California unicorns show similar patterns in industry focus and initial valuations. However, they tend to raise more capital and achieve higher exit valuations (largely driven by top performers).

California's 35-Year Reign as the Unicorn State of America – and Its Challengers

Think you need to be in your 20s to start a unicorn company? 🦄 Think again. When you hear about legendary founders like Bill Gates, Steve Jobs, or Mark Zuckerberg, you probably picture 20-year old college dropouts building billion-dollar empires in their dorm rooms. But the…

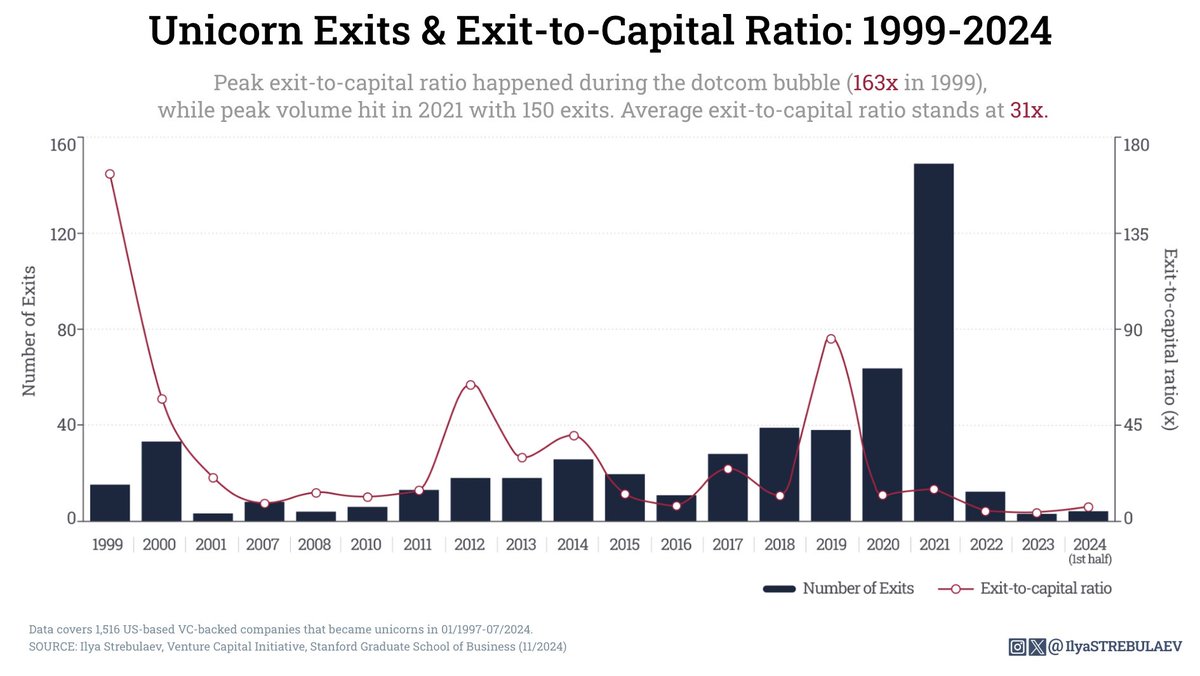

📊 Unicorn Exit Multiples. Peak exit-to-capital ratios happened during the dotcom bubble (163x in 1999). Peak volume hit in 2021 with 150 exits at 15x. More recently, ratios are down to 4-6x.

Traditional organizations have great intentions – innovation labs, idea lists, innovators inside. But then? Legal wants reviews, Finance wants models, Marketing fears brand impact. The road to hell is paved with good intentions. Too many cooks, meetings & approvals = not enough…

Honored to have contributed to the Financial Times' fascinating documentary on Sequoia Capital: youtu.be/U-FLEO0Ndrg?si…. Their remarkable 50-year track record speaks volumes – having backed Apple, Oracle, Cisco, Google, PayPal, Airbnb, YouTube, Instagram, and OpenAI.

Stanford GSB leads in the number of unicorn founders per 1,000 alumni: 5.7. The top 5 include HBS (4.2), Berkeley Haas (2.8), MIT Sloan (1.7), and Wharton (1.7).

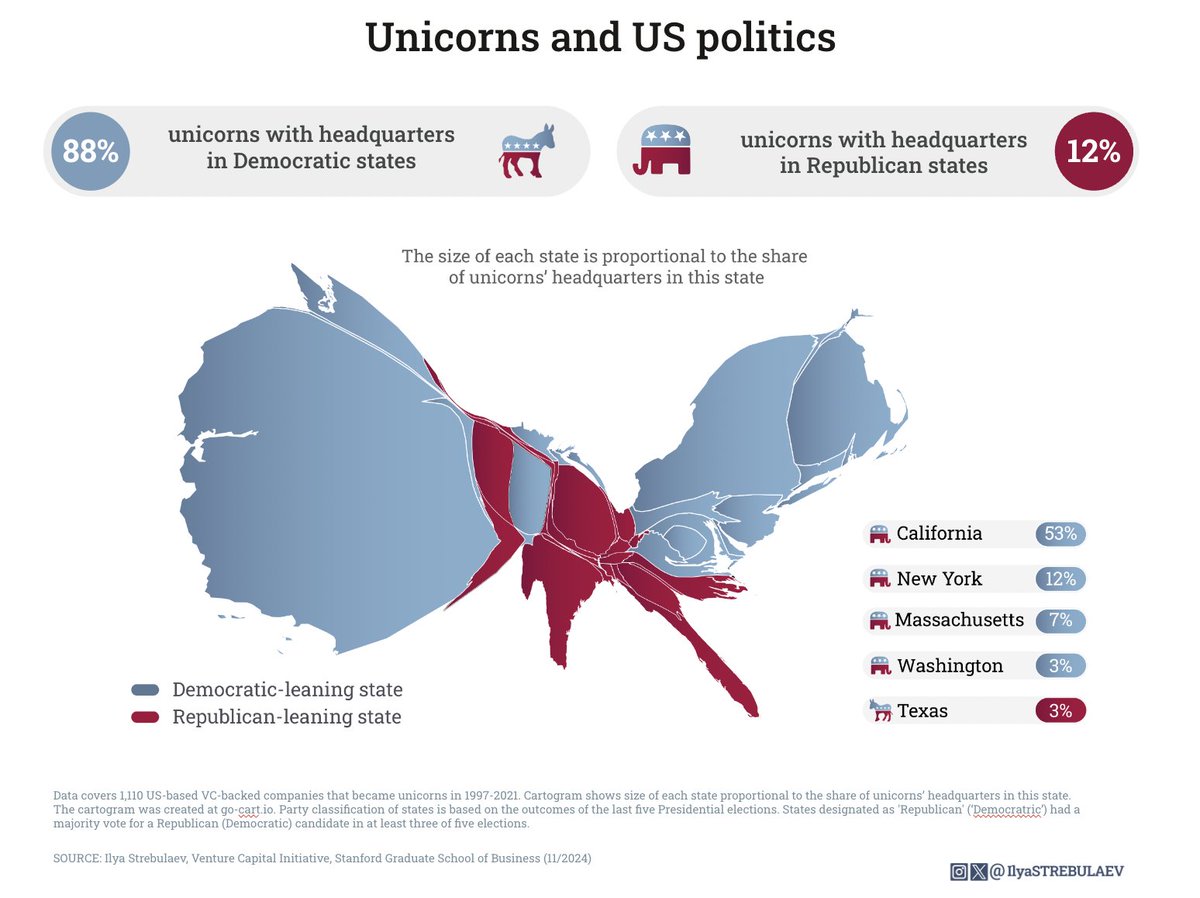

🔴 Fewer than 1 in 8 unicorns are located in “red” states that tend to vote Republican. 🟦 88% of US-based, VC-backed unicorns are in “blue” states that vote for Democrats.

Unicorn Returns: How Big Are They Really? On average, 8x the capital raised by exit. The average capital efficiency by exit type goes like this: IPOs (30x), acquisitions (33x), direct listings (34x), and SPACs (8x).

There is a 93% correlation between the exit timeline of US unicorns and the divorce timeline of US marriages! Of course, correlation ≠ causation. But remember, it may be more difficult to divorce your investors than your spouse. #DataScience #Economics #Causation #Correlation

During my 20 years at @Stanford, I've noticed a trend: many graduates stay in Silicon Valley to build #startups. An impressive 78% of #founders stay in California. Can you guess which three US states follow California? Here's a hint: their percentages are 60%, 42%, and 33%!

One-quarter of unicorn #founders worked in scientific research or technology development prior to founding a #unicorn. 22% worked as CEOs, 21% as engineers, and 17% as software engineers. Most of these jobs were in areas of leadership or technological proficiency. #startups…