Illiquid Insights

@IlliquidInsight

Private Markets & Macro | Data & Analysis | PE, Credit, Illiquidity

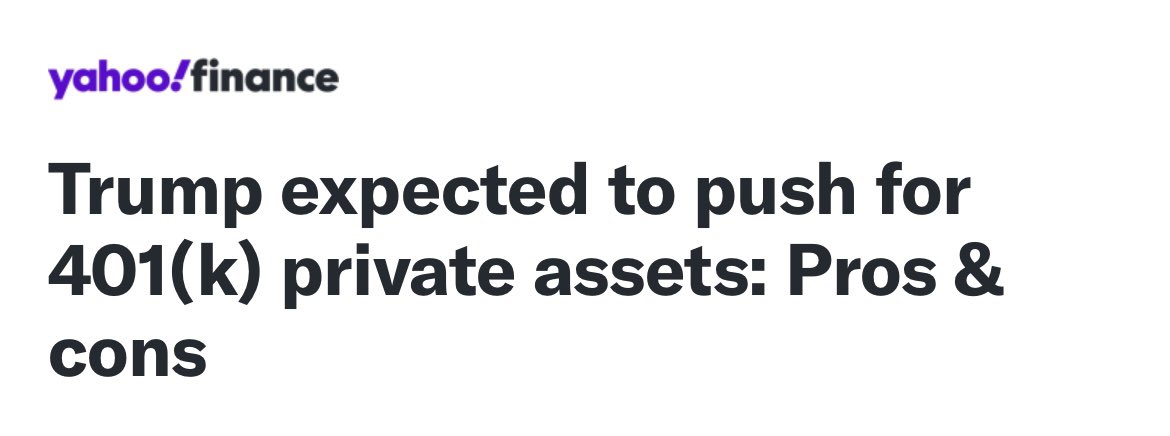

Private equity is getting killed in the new world of higher rates, less M&A and volatility. LP’s are adjusting. More plan to allocate to Private Credit and Secondaries, and less in Private Equity and Real Estate.

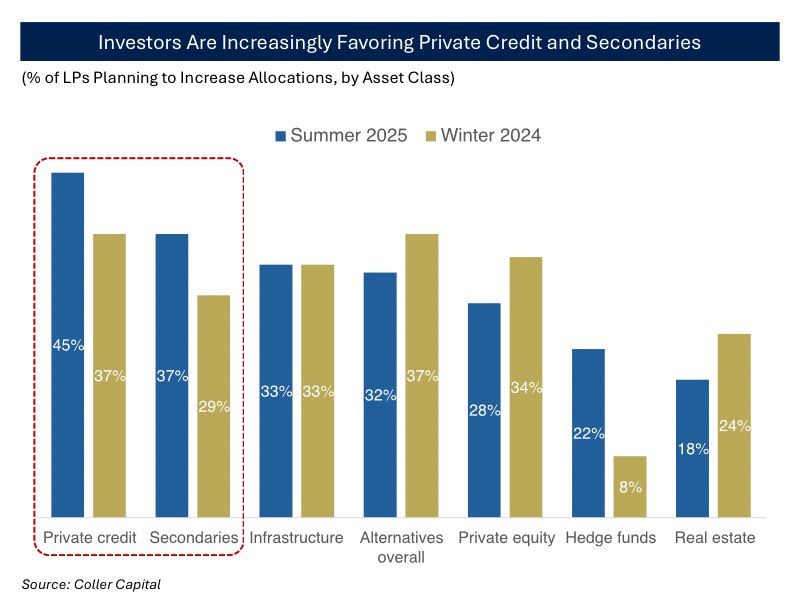

Loose credit docs and pressure to deploy capital have given distressed borrowers a lifeline through LMEs. These transactions allow borrowers to raise new capital and to avoid impending defaults and bankruptcy. Loan defaults are actually near the 2020 peak if counting LMEs.

Housing is already too expensive, and investors are making it worse 💀:

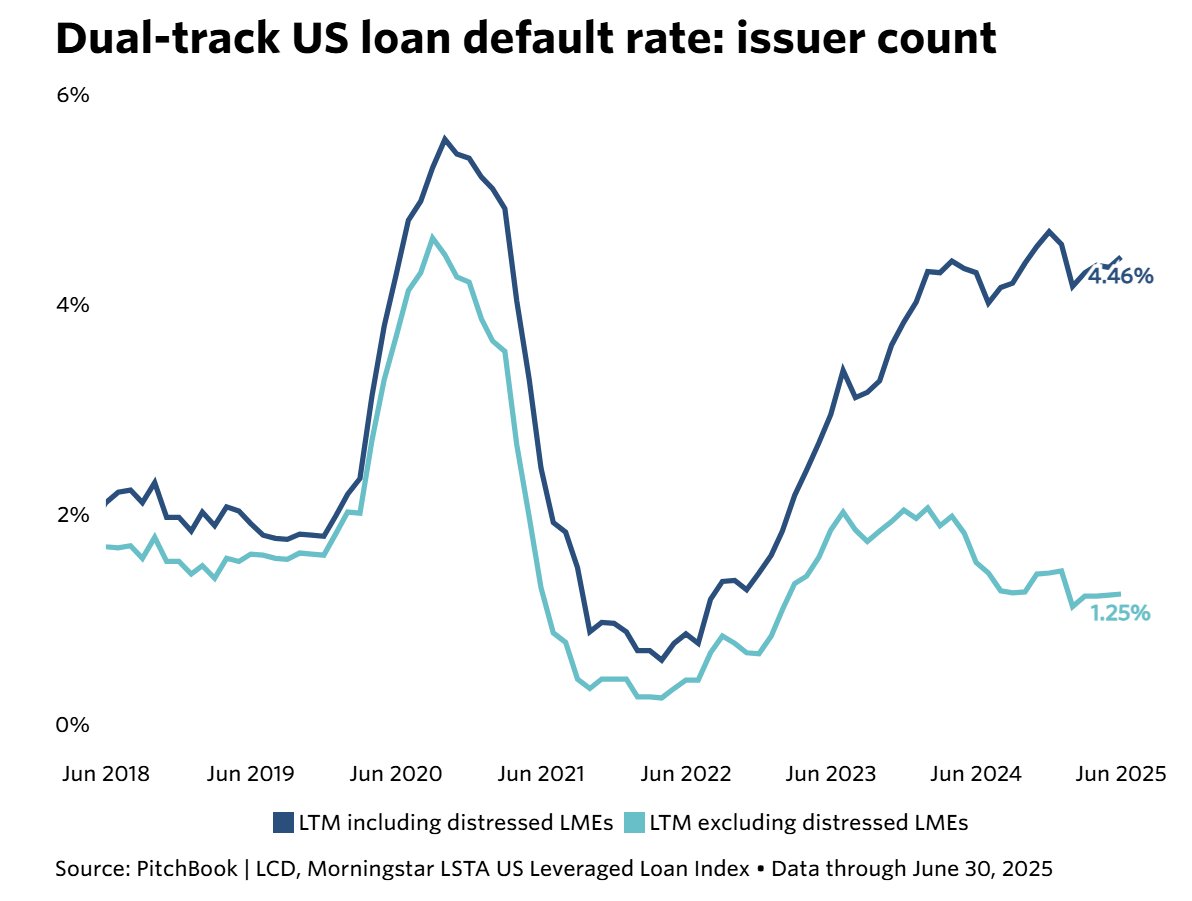

Private equity returns have declined over time as entry multiples have increased. Its the natural cycle of finance: Profitable investment strategy attracts investors. More investors increases prices. Higher prices cause lower returns.

The worst part of investment banking is the unpredictability. Working 60-80 hours a week is already brutal. But never knowing what time you'll leave the office, if a new deal or pitch will pop up, or if your boss will call you on a Saturday wears on you. Ironically, weekends…

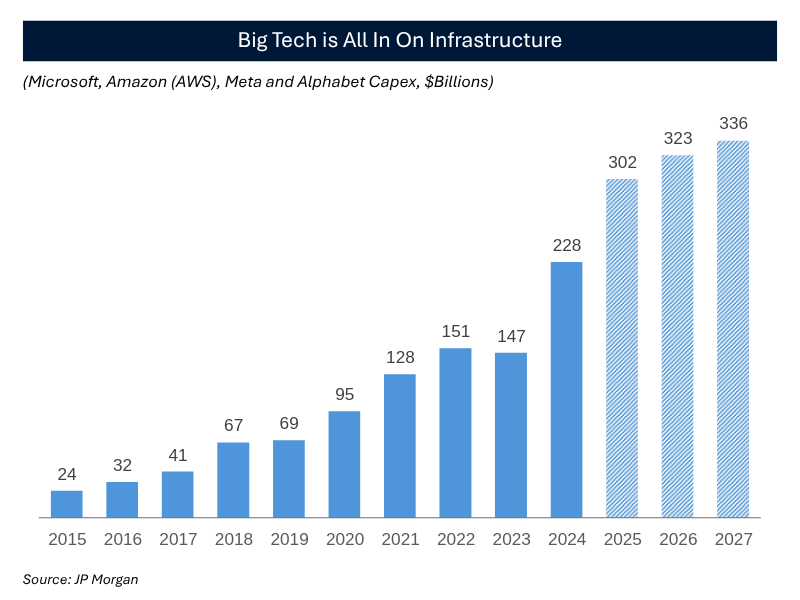

The AI boom is driving a data center arms race. Capex has doubled since 2023. Big Tech is buying up GPUs, land and generation assets to stay ahead. If firms don’t lock in infrastructure now, their competitors will.

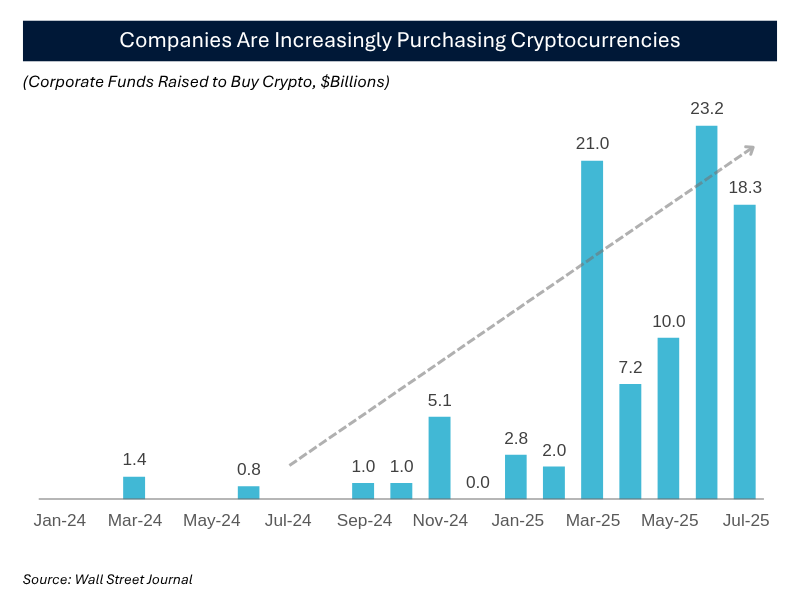

1999: "Add dotcom to our name" 2025: "Buy $2 billion in Bitcoin"

"Did you see Saylor's interview... Bitcoin is going to $1,000,000"

Finastra's new deal reflects the evolving debt market. The company executed a private debt deal in 2023, and is looking to return to the broadly syndicated market. BSL market is leaning on lower cost to claw back market share.

Private credit lenders checking the “protections” in their credit agreement

EBITDA pronunciation is heavily debated, but what about MOIC? Is it “moy-k” or “mow-ik”?

The last thing you see before your LBO financing deal gets shot down by risk management:

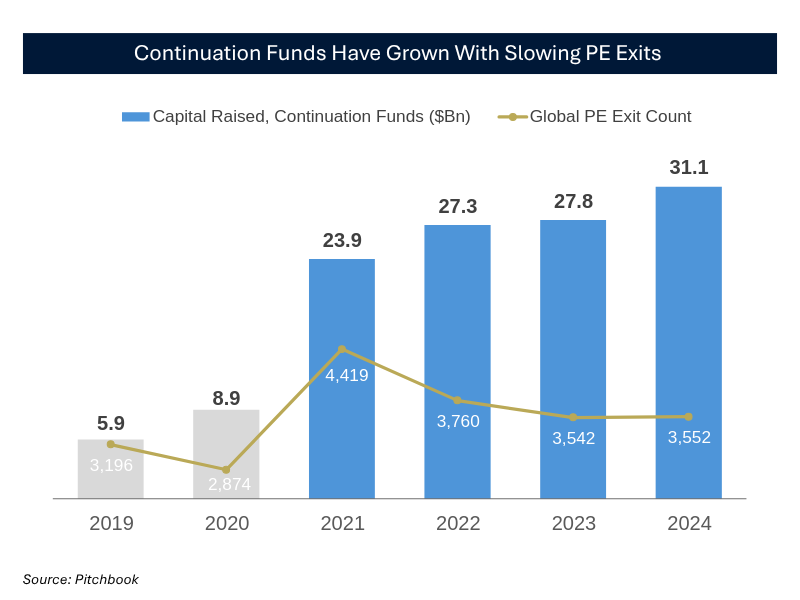

Continuation funds are the newest bandaid for the PE liquidity crisis. Next stop, boomer 401k's...

It's insane how warped the housing market has become. Housing is now an investment asset for boomers and asset managers, at the expense of new generations. There will be big long-term costs for making it even more expensive to have families.

U.S. Housing Market has reached its most unaffordable level in history 🚨🚨

Poverty won’t exist once we can load our 401(k)s with PE, private credit and bitcoin funds (all at peak valuations)