ISABELNET

@ISABELNET_SA

Advanced Stock Market Forecast for Professionals & Individuals available on https://www.isabelnet.com • 95% Correlation since 1970 • R² = 0.90 • Tweets ≠ Advice

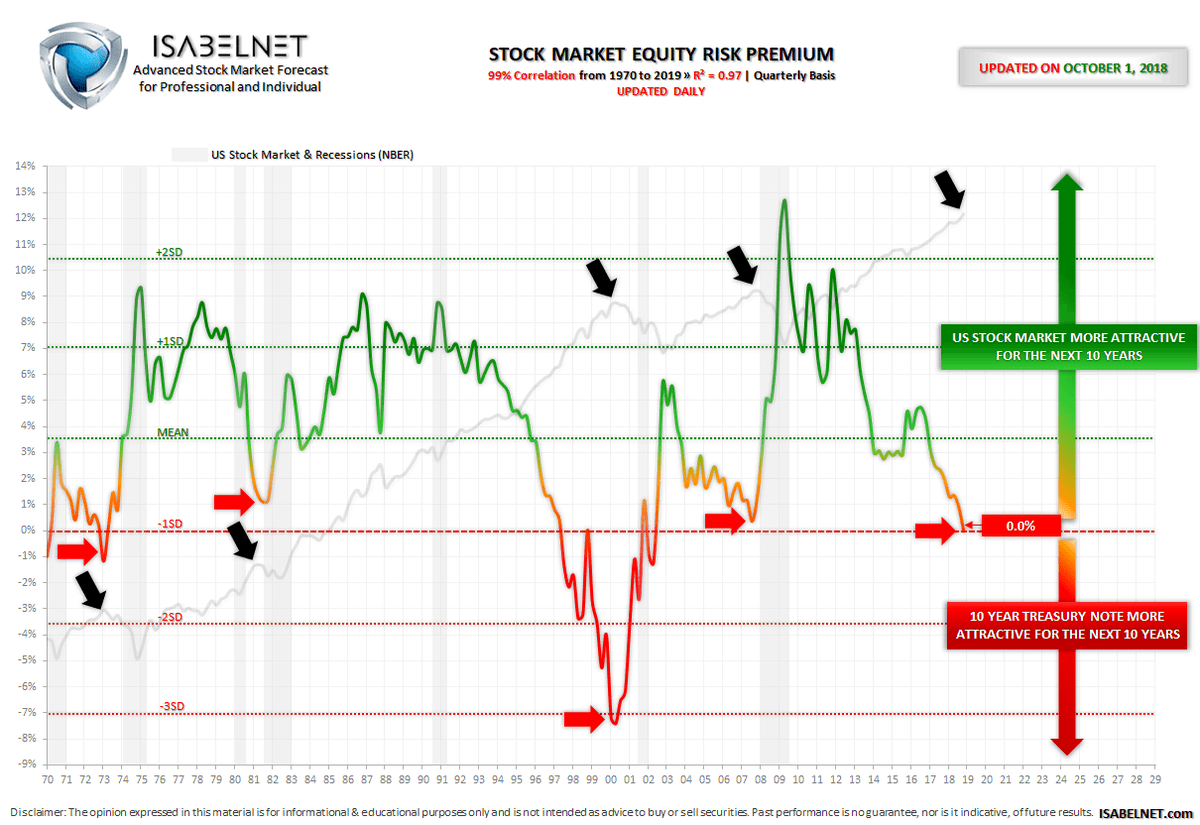

This chart shows how quickly the equity risk premium decreased since the Great Recession and how the stock market went up. On October 1, 2018, the Equity Risk Premium = 0.0% just before the market crash. It wasn't a coincidence at all. Learn more isabelnet.com

🇺🇸🇪🇺 M2 US money supply growth has robustly returned to near its long-term trend. In contrast, the euro area has experienced a slight slowdown in money supply growth recently, although growth rates remain positive 👉 isabelnet.com/blog/ h/t @DeutscheBank #M2 #moneysupply

🇺🇸 Earnings The Mag 7 companies are currently the dominant force behind S&P 500 earnings growth, with an expected 14% year-over-year growth in Q2 2025, far exceeding the remainder of the S&P 500 index 👉 isabelnet.com/?s=earnings @jpmorgan $spx #spx #earnings #stocks #equities

🇺🇸 NAAIM A reading of 81.07 indicates that active managers remain confident in the US stock market, maintaining substantial equity allocations that reflect positive market sentiment—though not necessarily extreme exuberance 👉isabelnet.com/?s=sentiment #NAAIM $spx #spx #equities

🇺🇸 Fed Nomura anticipates a measured easing cycle from the Fed beginning in December 2025 with a total of three 25 bps cuts through early 2026, driving the terminal policy rate down to 3.50-3.75% 👉 isabelnet.com/?s=Fed h/t @Nomura #Fed #fedfunds #rates

🇺🇸 S&P 500 Stocks added to the S&P 500 index typically experience their strongest outperformance before the official announcement, as market participants anticipate and position for the change 👉 isabelnet.com/?s=S%26P+500 h/t @GoldmanSachs $spx #spx #sp500 #stocks #equities

🇺🇸 Tech Since April lows, tech stocks rebounded strongly on AI growth and solid earnings, but high valuations and margin pressures from ongoing AI infrastructure investments could lead to volatility in coming quarters 👉 isabelnet.com/blog/ h/t @YahooFinance $spx #spx #tech

🇺🇸 S&P 500 While short interest in the S&P 500 has sharply risen in recent months—suggesting more caution among investors—it does not currently signal broad bearishness or panic 👉 isabelnet.com/?s=S%26P+500 h/t @GoldmanSachs $spx #spx @sp500 #equities #stocks

🇺🇸 Margin Debt The current high—but not extreme—levels of margin debt, compared to past blow-off tops, suggest frothy market conditions with some room for additional leverage 👉 isabelnet.com/blog/ h/t @DeutscheBank $spx #spx #sp500 #equities #stocks

🇺🇸 S&P 500 A slowdown in liquidity growth—particularly if combined with soft economic data—poses a short-term risk to the US equity market, increasing volatility and the likelihood of price declines 👉 isabelnet.com/?s=S%26P+500 h/t @dailychartbook @TS_Lombard $spx #spx

🇺🇸 Real Retail Sales Real retail sales in the US have been weak in recent years, indicating ongoing sluggishness in consumer spending—a pattern that has historically been associated with an increased risk of recession 👉 isabelnet.com/blog/ h/t @LanceRoberts #retailsales

📌Subscriber Access The #stockmarket bull and bear indicator, the short- & long-term forecasts, the #valuation & ERP charts have been updated on 👉isabelnet.com #valuations #markets #investing #assetallocation #sp500 #nasdaq #dow #dowjones $djia $spx #spx $spy #stocks

📌 Stocks Global equities currently show complacency, with prices surging despite a worsening earnings outlook—fueled more by speculative momentum and FOMO than by broad fundamental strength 👉 isabelnet.com/blog/ h/t @markets #markets #MSCI #stocks $spx #spx #equities

📌 Risk Appetite The GS Risk Appetite Indicator's current risk-on signal points to a constructive market environment, where investors are willing to take on risk in anticipation of sustained positive returns and economic stability 👉 isabelnet.com/blog/ @GoldmanSachs $spx

🇺🇸Earnings This quarter's earnings season demonstrates continued resilience in corporate profitability. Currently, 60% of S&P 500 companies have beaten Q1 earnings estimates by at least 1 stdev., while 11% have missed by at least 1 stdev. 👉isabelnet.com/?s=earnings @GoldmanSachs

🇺🇸 Earnings While tariff policies under the current administration create some uncertainties, the consensus among analysts and research firms points to a strong rebound and significant rise in S&P 500 earnings in 2026 👉 isabelnet.com/?s=earnings h/t @LanceRoberts $spx #spx #EPS

📌 Materials Positioning in materials stocks is low at the 21st percentile, reflecting restrained confidence or caution in the sector 👉 isabelnet.com/blog/ h/t @DeutscheBank #materials $spx #spx #equities #stocks

🇺🇸 S&P 500 Structural changes in the market—such as the rise of high-margin sectors like technology, economies of scale, and favorable financial conditions for large-cap firms—have driven elevated profit margins in the S&P 500 👉 isabelnet.com/?s=S%26P+500 ht @JPMorganAM $spx #spx

🇺🇸 S&P 500 Investor preference for the cap-weighted S&P 500, with its emphasis on large, high-growth companies, leads to a higher earnings multiple compared to the equal-weighted index, where growth is less concentrated 👉 isabelnet.com/?s=S%26P+500 h/t @GoldmanSachs $spx #spx