IIF

@IIF

The global association of the financial industry

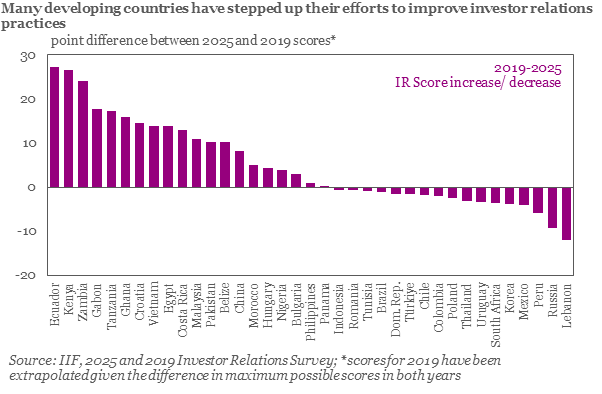

🌐 We are seeing an increase in the number of emerging markets #EM and developing countries that are embracing investor relations. 39 countries participated in the IIF Investor Relations Survey this year, up from 25 in 2019 🤝 See More: ow.ly/xYsA50WrUrv

❓ Did You Know ❓ The IIF offers an independent source of global economic & financial research 🔍 assessing regional & macro outlook with a focus on #EmergingEconomies and #InternationalMarkets, #Risk & #Policy challenges Visit our Research page: iif.com/Research

Register Now: IIF-@CdnBankers Canada Forum 🇨🇦 Join us for our upcoming event in-person in Toronto, Sep. 25, to hear from experts on Canada's position in the evolving global economic & geopolitical landscape Check out our agenda and register here: ow.ly/kg4N50WubsE

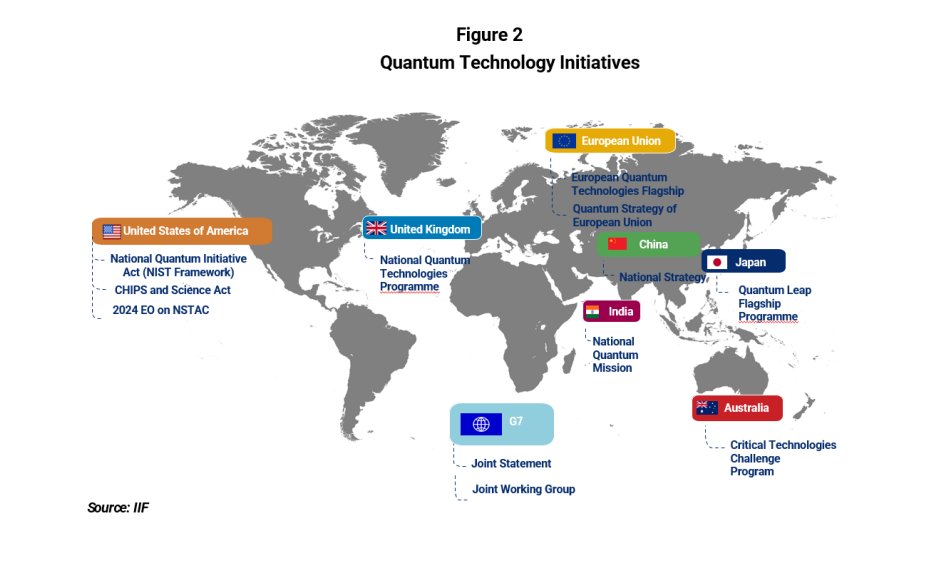

Curious about #QUANTUM? 💻 What is #QuantumComputing, and how is it impacting the global financial sector? 🏛️ Check out our recent research, and find more from our experts: 🔗 ow.ly/ANZH50WtliB 🔗 ow.ly/Oa6k50Wtlkf

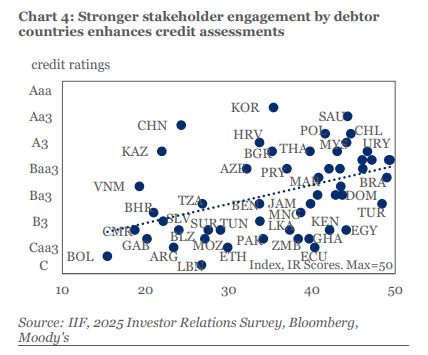

Stronger dialogue among debtor countries and other stakeholders boosts sovereign credit assessments, as seen in Ghana's recent success in recording one of the largest increases in its investor relations #IR score since enhancing practices 🇬🇭 Full Report: ow.ly/gkRh50Wtvko

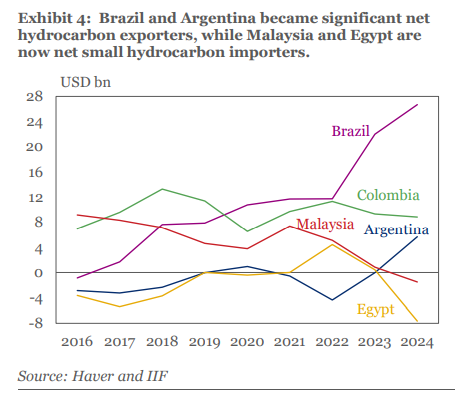

🇧🇷 Brazil & Argentina have become major net #hydrocarbon exporters in recent years, while Malaysia and Egypt have shifted to small net importers 📊 This, combined with other factors, could widen Brazil & Argentina's #CurrentAccount deficits 🇦🇷 See More: ow.ly/jRnS50Wtvm0

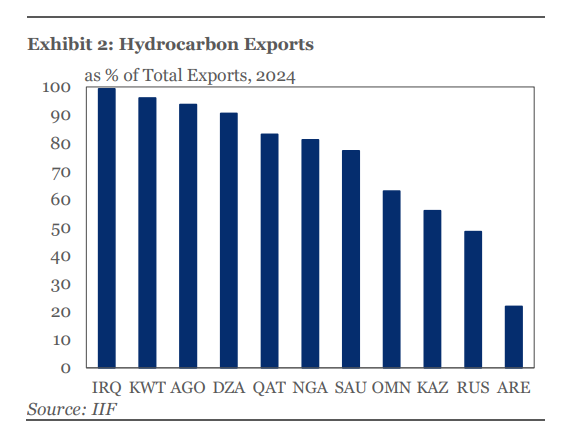

Lower oil & natural gas 🛢️ #hydrocarbon 💲 prices result in a shift in purchasing power from producers to consumers. The impact is clear, notably in #EMDEs; Net hydrocarbon exporters with large terms of #trade loss will take the biggest hit 📉 Read now: ow.ly/IhRW50WsVMx

🆕 Current Account with Clay Lowery 🎙️ Ep. 114 - The Dollar: It Really is All About the Benjamins 💵 @sobel_mark of @CSIS & @joshualipsky of @ACGeoEcon @AtlanticCouncil sit down with Clay to talk all things #DollarPolicy under #Trump Tune in Here: ow.ly/uw7r50WsQJp

Catch last week's Current Account #podcast episode? Host Clay Lowery provides updates on #Trump #Tariffs & #Trade in his most recent episode, "Six Months Down, 42 To Go - Updating the Trump Economic Agenda" 🗓️💵 Listen Now! ow.ly/zVvc50WrUME ▶️ Find us on Spotify & Apple

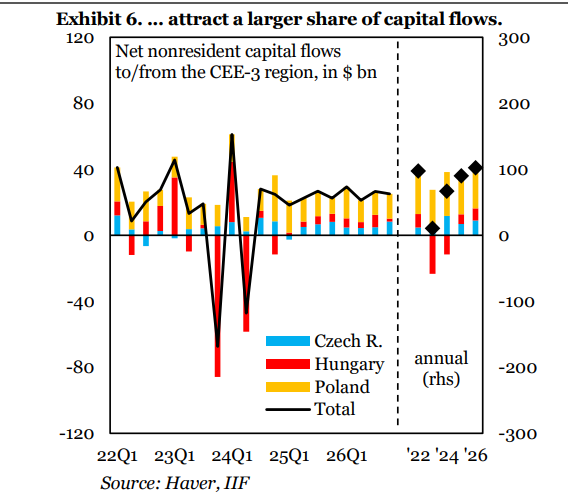

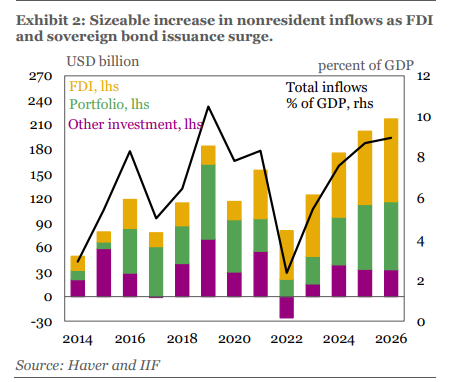

From @UgrasUlkuIIF: we expect the CEE-3's regional growth momentum will be accompanied by a steady increase in nonresident #capitalinflows from $67 billion in 2024 to $90 billion in 2025 - and further to $102 billion in 2026 📈 Read More: ow.ly/J4AT50WrU3y

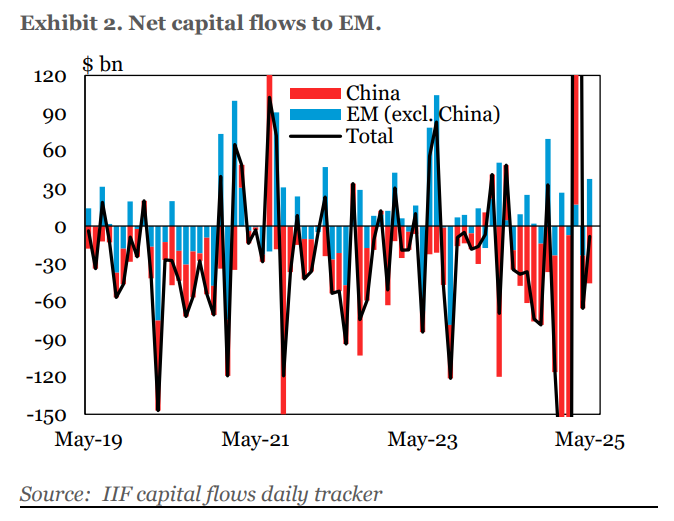

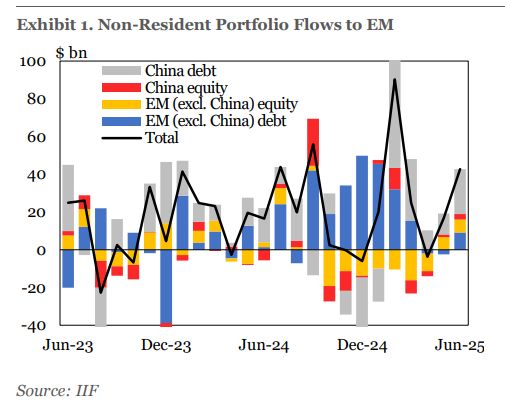

From @econchart 🗣️ June saw #debt flows total $32.9 billion - a major jump from May's $8.7 billion - with China remaining the primary driver, attracting $23.8 billion 💸 Read the Capital Flows Tracker: ow.ly/lM7h50WqKem

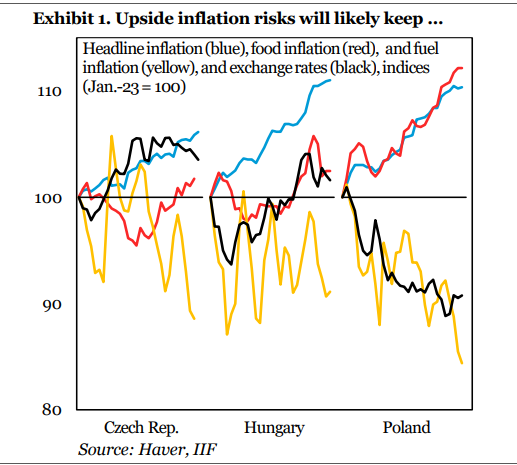

CEE-3 central banks are expected to remain cautious amid heightened #geopolitical tensions and persistent #inflation risks - food inflation & unstable #oilmarkets could trigger a spike in fuel inflation 📊 Read More: ow.ly/Q4NS50WqKjv

On the #GCC from @garbis_iradian 🗣️ We expect nonresident capital flows to the GCC region to increase to $202 billion in 2025, and further to $217 billion in 2026 🌍 Read the report: ow.ly/v7nl50Wq6PK

⏩ IIF Capital Flows Tracker - Goldilocks for Now, but Global Risks Loom Portfolio flows to #EmergingMarkets reached $42.8 billion in June, furthering the strong momentum we've seen over recent months 📈 See More: ow.ly/g8Th50Wq6Bc

🗣️ Rather than pulling back, investors are reallocating capital toward #EMs with credible policies, low #FX mismatches and solid #fiscal anchors, reaffirming the implication that while uncertainty is high, investor selectivity only heightens 📈 Read More: ow.ly/TiwQ50WpsbA

NEW EPISODE: Current Account with Clay Lowery ⏳ Six Months Down, 42 To Go - Updating the Trump Economic Agenda Tune in for our most recent updates on #Trump, #trade & #tariffs 🔊 Listen Now! ow.ly/vQWc50WphIx

ICYMI: In recent years, China has seen the issuance of numerous green & #sustainable #bonds. The outstanding stock of green, sustainable, social bonds & loans reached $341 billion & $53 billion as of January 2025 🌏📈 See More: ow.ly/moqu50WoxQI

In Europe there is significant friction among services, labor and capital markets. Intra-#EU services exports as a share of #GDP continue to trail far behind intra-EU goods exports 🇪🇺 Read More: ow.ly/ohpE50Wn7r7

🇦🇷 In Argentina, the real economy is showing signs of healing, especially among tradables like agriculture, energy & mining, which are gaining momentum through #deregulation and stable macroeconomic conditions See More: ow.ly/VTcS50WokM5

🇪🇬 Egypt has remained resilient in the face of external shocks - we see this in relative stability in portfolio flows. Recent outflows have been orderly and limited, showing greater investor confidence 📈 See More: ow.ly/Wnw750WnRNx