High Yield Hustle

@HighYieldHustle

My Journey to 5k in Monthly Dividends. Dividends ➡️ Option Selling ➡️ Bitcoin ➡️ Repeat. Not Financial Advice.

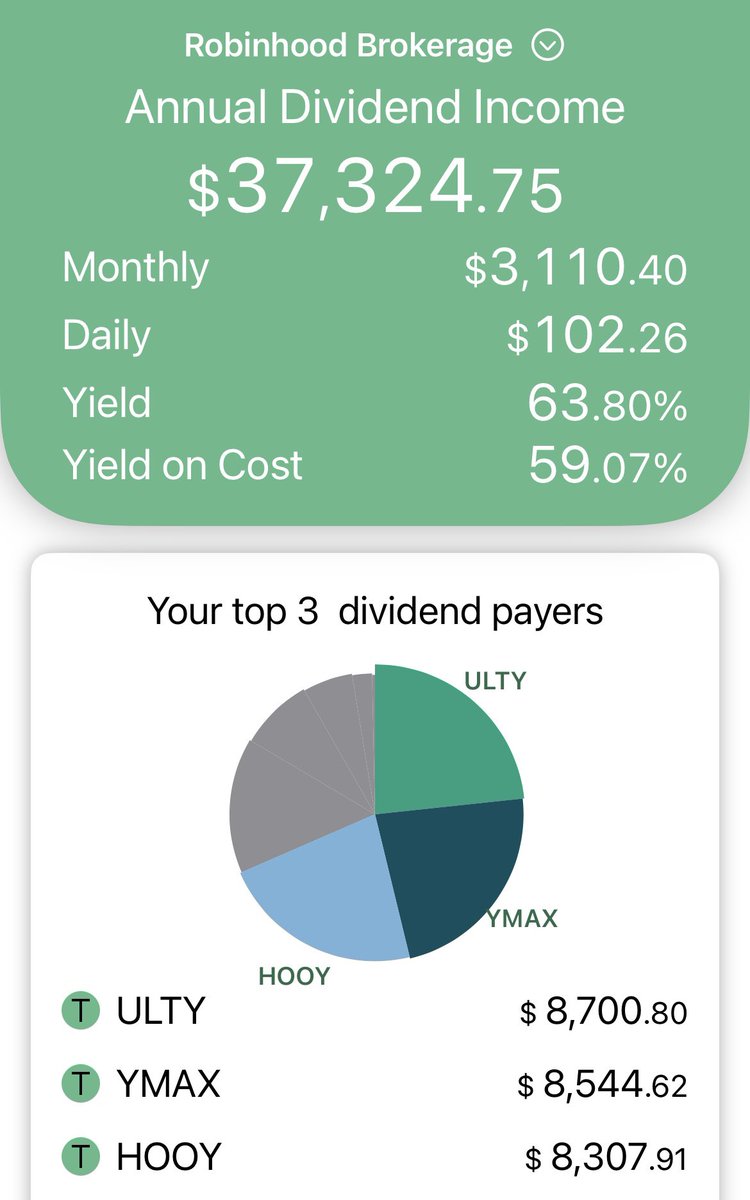

“1 million is not enough to retire!” False you just don’t know how to cash flow: 100k $BTCI 28k per year 100k $ULTY 85k per year 100k $YMAX 45k per year 100k $BLOX 32k per year 100k $GPIX 8.5k per year 100k $GPIQ 10k per year 100k $OMAH 15k per…

He’s been saying this everyday for 20 years…

⚡️ NEW: Entrepreneur Robert Kiyosaki warns that we may be on the brink of another 1929 crash and says he's sitting tight with gold, silver & Bitcoin.

It’s easier to hate something off a surface level point when due diligence takes effort. The people that do the research come around on high yield products for a reason. This space has blown up for a reason. People are making money. Why would we be buying these products if…

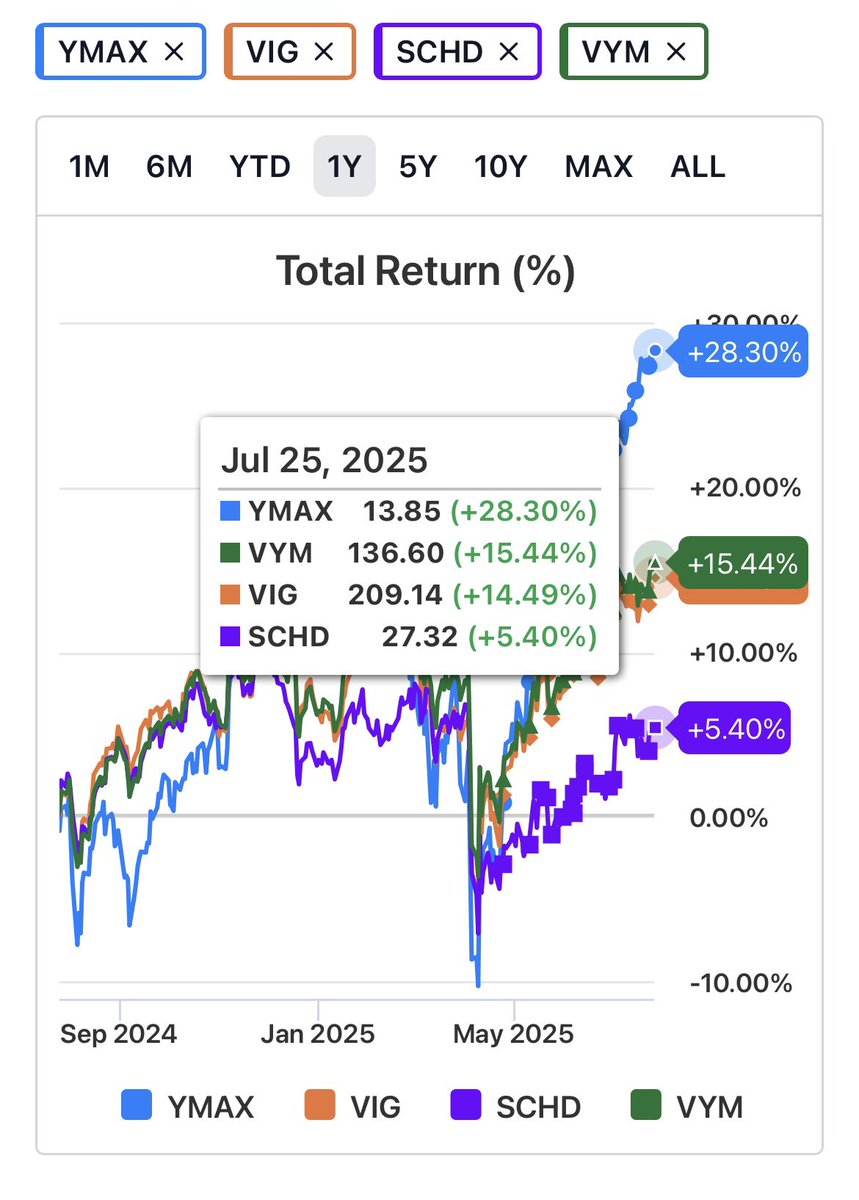

$YMAX compared to standard dividend growth ETFs. With Dividends reinvested it’s looking like a growth vehicle itself.

Proper Portfolio Management: A high yield portfolio must be run like a business. The higher the yield the more management is required for not only higher returns but portfolio stability as well. If you want to be passive a 10-15% yield correlated to the S&P or QQQ can be very…

Capital Needed for 100k in Annual Dividends at Current Rate: $HOOY $81,000 $SCHD $2,500,000

The people who hate my ambition…. Chose 100k in student loan debt Chose the $600 a month car payment Chose the vacations they can’t afford Chose the 4k a month apartment Chose to run up the credit card They consume consume consume. I stack stack stack. But in 5 years…

I’m not reading all that I clap SPY’s cheeks

Your beta is higher than SPY’s. In other words, you’re taking on more risk than a SPY investor does. When you hold MSTR, PLTR, etc, then you’re being adequately compensated for that risk. Since you hold the underlying stock, you gain all of the value when the stock rises. For…

Me after another day of battling the NAV Police, the ROC Rangers, and the Underlying Umpires.

Your so right I would never want to mislead people into crushing the S&P

Imagine all you do is invest in high yield bullshit like $ULTY with zero understanding of the risk and then tweet about it all day long for people who don’t understand and then they start buying it? Pretty sad

200k Portfolio Designed for Max Income: Capital: Dividends Per Year: $ULTY 50k = $40,000 $YMAX 50k = $30,000 $HOOY 25k = $30,000 $NVDY 25k = $20,000 $PLTY 25k = $14,000 $MSTY 25k = $25,000 Margin: $BTCI 50k = $ 14,000 Total income:…

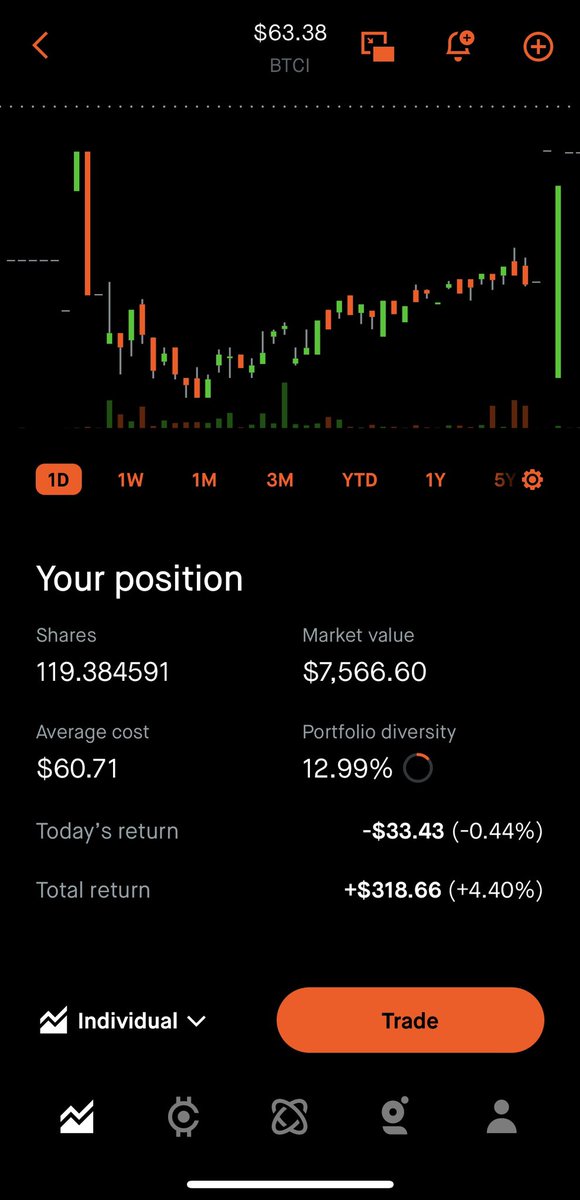

Two months holding $BTCI: Capital Return: $318.66 +4.4% ✅ Dividends: $338.73 ✅ My favorite example to point out to people who don’t like the high yield space. I would bet my net worth that $BTCI absolutely crushes $SPY over the next 5 years

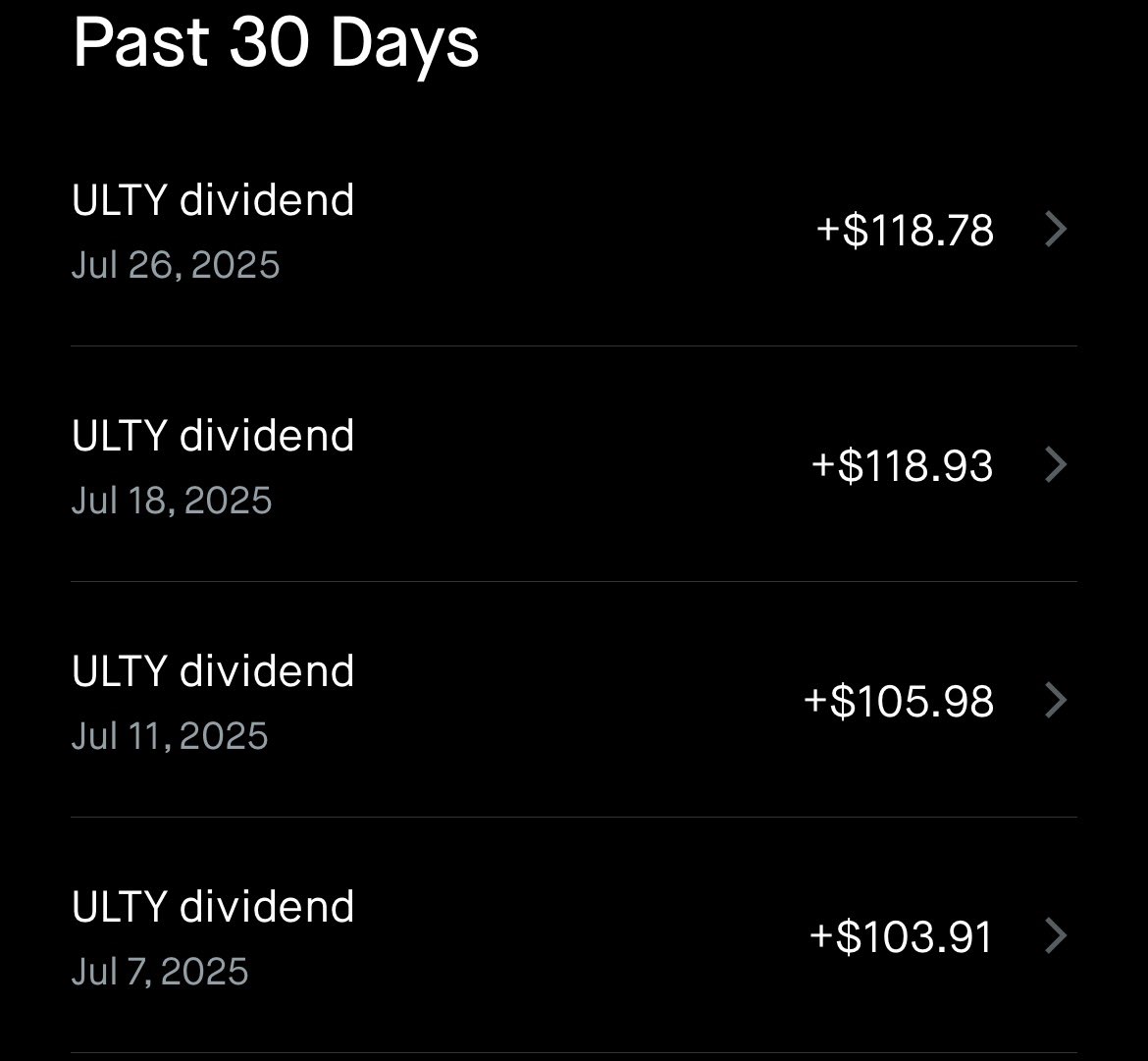

I added $ULTY about a month ago since then: Capital +0.87% ✅ Dividends received: $447.60 ✅