Andrew Freedman, CFA 🦅

@HedgeyeComm

Comms + Software Sector Head @Hedgeye (Internet, Media & Cable/Telco) For research, click the website link below!

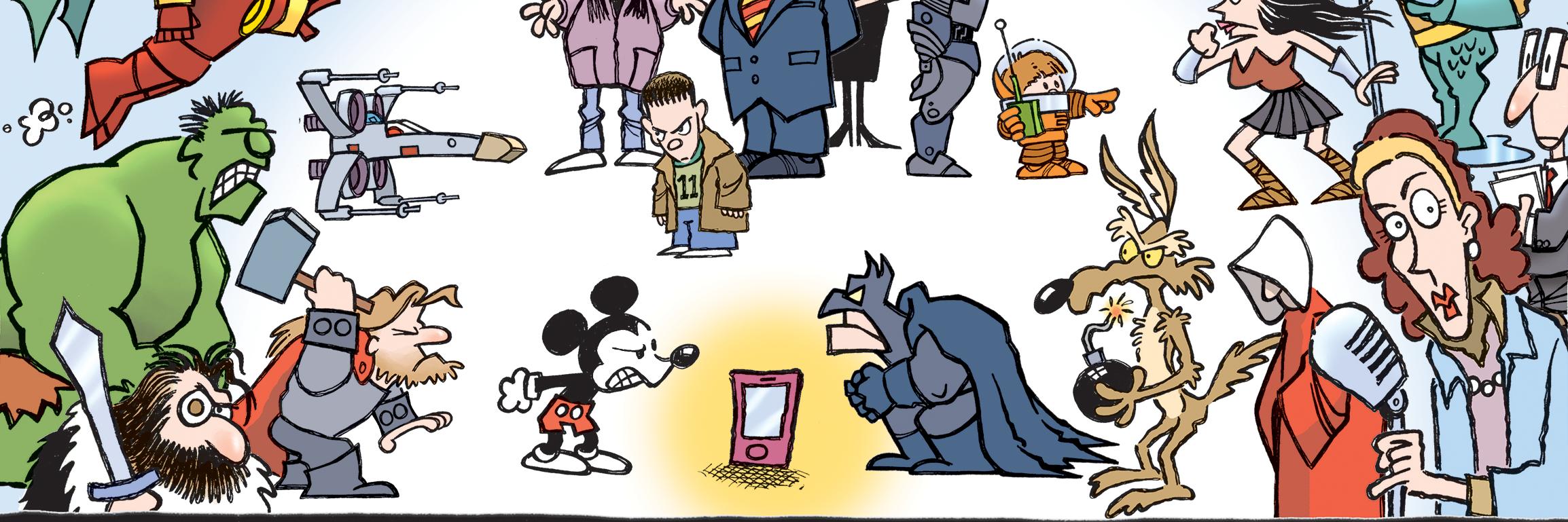

i know a guy in his 30s, billionaire, owns half of Gotham, peak physical shape, genius-level intellect, insane cars, has a butler, huge house, no kids. yet he spends his nights alone in a cave, wondering why he can’t find true love. is modern dating really this broken..?

Powell probably just ends up resigning because he feels he can no longer maintain his independence because of the chronic gaslighting.

$CHTR needs to stop calling it cell phone internet...

From Part II of our Themes Call Monday: $CHTR Cost Structure Reversion Expected Outlook: Expecting "biggest downshift in momentum on the key metric that matters" among covered names. Recent Performance: Running business "hot" with price increases and cost cuts Political…

Oh wow.. so ACP impact isn't a one and done impact to $CHTR? Hmmmm who would of that?!

Just published our Black Book invite for upcoming IPO, $FIG, which we will host on Tuesday, 7/29, @ 2PM ET

Why doesn't ESPN just get absorbed by NFL long term and effectively become NFL's DTC service?

The bears are just so wrong about $GOOGL long term…

Factset consensus for $GOOGL capex 2025 was $72.9B... which they just increased to $85B and said 2026 was going to be higher. Before the print, consensus didn't even have $GOOGL capex north of $80B until 2027....

$GOOGL On 2H25 and beyond... "We now expect to invest $85B in capex in 2025 up from previous estimates of $75B" "We expect a further increase in capex in 2026" "Expect growth rate in depreciation expense to accelerate in Q3" "...at current spot rates could see revenue…

$GOOGL love the point about sacrificing clicks for better monetization

$GOOGL On 2H25 and beyond... "We now expect to invest $85B in capex in 2025 up from previous estimates of $75B" "We expect a further increase in capex in 2026" "Expect growth rate in depreciation expense to accelerate in Q3" "...at current spot rates could see revenue…

$GOOGL services and ads business was good but nothing spectacular... about ~100bps accel in Q2 versus Q1 when adjusting for leap year headwind in Q1. The ~32% YoY in 2Q25 is pretty impressive... and the $1.36B net new or +76% versus 2Q24. Will see what $AMZN $MSFT do but I…

$GOOGL number of new GCP customers increased nearly 28% QoQ.... the AI advantage with 2.5 pro and Vertex is starting to show up. Should really be a step function...