Hedge Fund Alpha

@Hedgefundalpha

Everything hedge funds and value investing. Premier hedge fund intelligence platform with a focus on emerging managers. (Formerly known as Valuewalk Premium)

ValueAct "Rocket is our biggest new investment of 25. Our thesis is simple idea: this is not just a mortgage firm it is a tech platform in one of the most consumer-hostile, fragmented, and bureaucratic categories of American finance." Q2 letter $RKT hedgefundalpha.com/letters/

3/ What did Carlson get wrong about short selling? Why does Anderson say Milton’s story falls apart on facts alone? Full breakdown of the fallout here: ⬇️ hedgefundalpha.com/news/hindenbur…

2/ Milton says Hindenburg made up its report. The DOJ, SEC, and Nikola itself all disagreed. Anderson breaks down the real timeline, the evidence, and why Tucker’s “Wow!” moments don’t hold up.

1/ Trevor Milton, convicted ex-CEO of Nikola, just went on Tucker Carlson’s show claiming it was all a conspiracy. Hindenburg’s Nate Anderson isn’t having it. He called out the false claims, the missing facts, and Carlson’s lack of basic pushback. 👇

3/ What sectors does Hohn love? What red flags make him walk away? We’ve got the full breakdown of his talk and how TCI keeps winning:⬇️ hedgefundalpha.com/conferences/20…

2/ Hohn avoids tech hype and bets on assets that last. Airports. Toll roads. Aerospace engines. He sizes positions up to 25%, demands cash flow, and exits when moats fade. His edge isn’t secrets. It’s patience and discipline.

1/ “Growth alone won’t save you.” Chris Hohn has delivered 9% annual alpha for 21 years. His formula: find rare businesses, size the bet, hold long, and act like an owner. At Oslo, he laid out the 4 rules behind TCI’s edge. 👇

Active ETFs outnumber passive ETFs @MorningstarInc

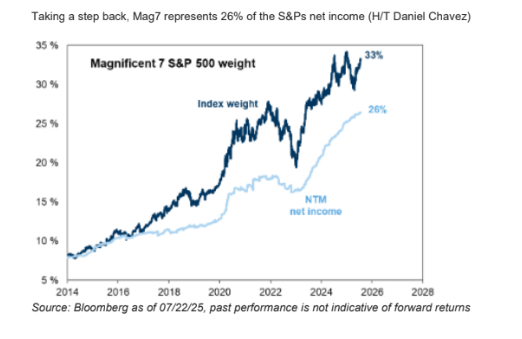

Over 25% of S&P net income is from Mag 7 - Goldman Sachs

UBS on $BRK nixes potential acquisition of $CSX "Given where public market valuations are, still well above historical averages, we do not anticipate BRK would be deploying much of its cash to purchase public equities."

1/ Some fund track records look too good to be true. validityBase gives allocators a way to verify them. It’s a low-cost, blockchain-backed system that proves whether a model or signal actually worked, without revealing IP. 👇

3/ How does Baupost stay calm while the market panics? What are Klarman’s filters for buying in today’s climate? We break down the full Goldman Sachs conversation here: Full story⬇️ hedgefundalpha.com/news/seth-klar…