Hebbia

@HebbiaAI

The AI agent platform for investors, bankers, and lawyers. Save hours of your life and get better work done. Book a demo 👉

Your MD pinged you at 2 am staffing you on tariff research... you staffed Hebbia

Hebbia Pulse: stock futures are relatively flat as investors anticipate reports from Coca‑Cola, RTX, and Lockheed Martin. Global indexes hover near record highs, but ongoing trade tensions and U.S. tariff negotiations are keeping sentiment cautious. Early signs of tariff impacts…

JUST IN: Investment banking is bouncing back. Goldman crushed estimates with 26% fee growth, driven by a 71% surge in M&A. JPMorgan beat too—deal fees up 7%, trading +15%. Citi and Wells Fargo followed. M&A is snapping back, IPOs are returning, and equity desks are thriving on…

Two signs you will survive a recession: (i) your CFO dresses like this (ii) your company pays for your Hebbia seat to 10x your productivity

JUST IN: Trump is signaling he could fire Powell and push rates below 1%. Inflation just hit 2.7% (highest since February). Bear case: lower rates could crush the dollar and drive speculative bubbles in equities, crypto, and real estate, without fixing core inflation. Bull…

Excited to launch our @flybladenow partnership. We know where the best Dealmakers fly. From data room to boardrooms, Hebbia gets you there faster. (Yes, even by seaplane.)

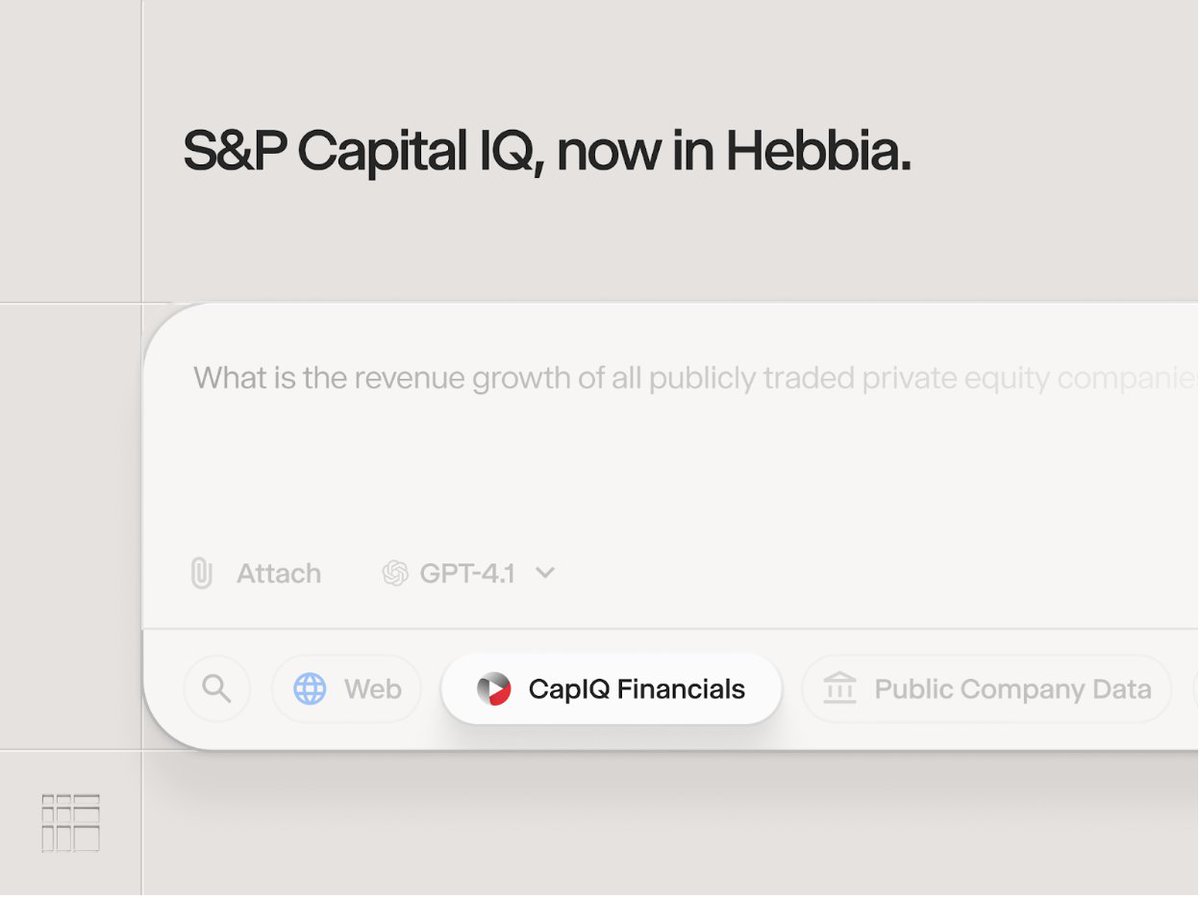

We now offer S&P Capital IQ Financials from @SPGMarketIntel, providing data coverage for over 180,000 public companies.

JUST IN: U.S. CPI rose 2.7% year-over-year in June, up from 2.4%, while monthly inflation hit +0.3%—the biggest jump since January. Hebbia uncovers that the July CPI increase is likely influenced by tariffs, particularly in sectors like food and transportation, where impacts…

Hebbia analyzed thousands of filings to find hidden Bitcoin exposure in public companies, not just MicroStrategy. • 135 companies now hold ~657k BTC (~3.3% of all Bitcoin) • MicroStrategy leads with ~423k BTC • Many lesser-known firms hold BTC through treasuries, ETFs, or…

JUST IN: Kraft Heinz plans to split into two companies: grocery (Kraft Mac & Cheese, Lunchables) and condiments (ketchup, mayo). Grocery could be worth $20B, condiments $10B. KHC trades at $31B today, which is just 5.8x EBITDA vs. food peers at 9–11x. A breakup could unlock…

JUST IN: Ferrero eyes WK Kellogg acquisition at ~10x EBITDA. The stock trades at $18, with a rumored offer of $23—implying 30% upside. Ferrero gains U.S. scale and $500M in margin levers. Classic PE-style trade by Ferrero: buy unloved asset, squeeze margins, go global.

Copper jumped 12% after Trump suggested 50% tariffs on Chinese metals. Rising copper costs will squeeze profits for semis, autos, and solar just as supply chains were starting to recover. If copper is the signal, margin pressure is back.

Banking used to be about who could grind the longest. Now it’s about who has access to the right AI tools (Hebbia) —and knows how to actually use them. The edge is shifting from endurance → leverage.

JUST IN: House just passed the final Big Beautiful Bill—here’s what changed since the Senate version: – AI moratorium is out (states can regulate AI) – $40k SALT cap locked for 5 years – Child Tax Credit cut to $2,200 – Medicaid work rules tightened – Debt ceiling raised $5T…

JUST IN: U.S. unemployment falls to 4.1%, but private sector job growth posts its 2nd-weakest print in 8 months. Headlines tout +147K jobs, but nearly half came from government hiring. Strip out the public sector and the story shifts: the labor market is quietly slowing — and…