HTS Commodities

@HTSCommodities

We provide commercial risk management services & advanced quantitative analytics for commodity hedgers inside of a leading investment bank (Hilltop Securities).

If you know who this majestic woman is, live in Chicagoland, have an active agricultural brokerage book and are looking for a broker that gives IBs access to the latest in AI/machine learning price prediction techniques and real-time yield products then DM us. DM us if your…

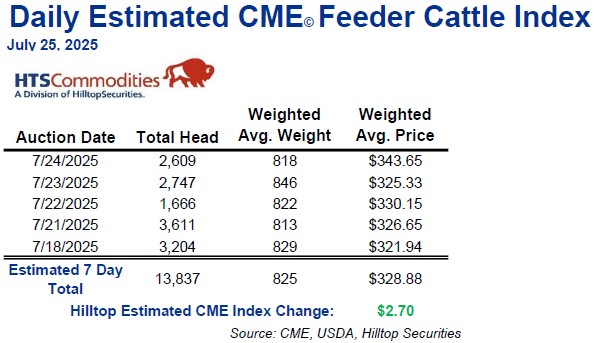

Estimated CME Feeder #cattle index for 7/28 $+1.10 at $329.93/cwt. $330. All. Most. There.

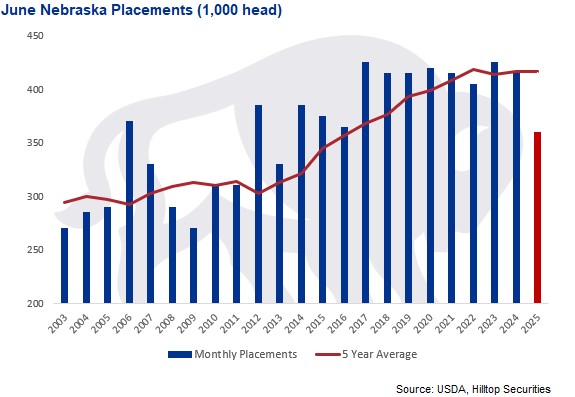

Nebraska #cattle placements during June were the smallest for the month since 2013. Tightening supplies in the northern can help keep cash market prices running hot.

US #rice is making the news lately. #Tariffs talks led Japan increasing US exports by 75%, (no time frame), and now S. Korea is willing to increase US export volumes. No details but strong news.

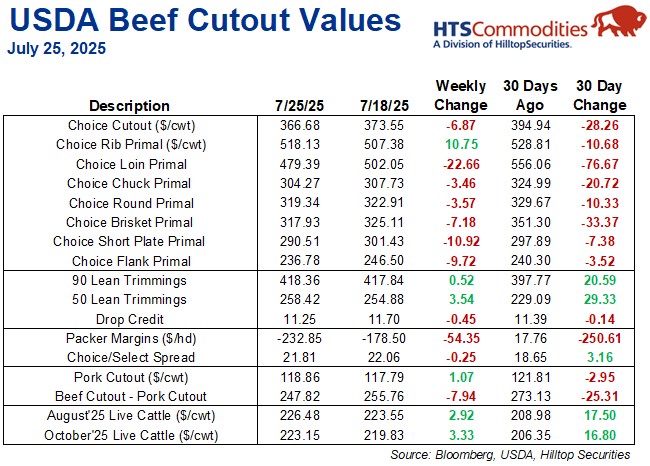

Choice beef prices for week ending 7/25. Despite the White House's threat of a 50% tariff on Brazilian imports effective on 8/1 there has not been an increase in demand for chucks or rounds. 90's and 50's have been trending but this is due to lack of cow slaughter. #cattle

Indonesia plans to give precedence to US #wheat and #soybeans imports as part of a decision to ease import tariffs on Indonesian products. #corn is not a priority. INDO Ag Minister Sulaiman announced the policy on July 25, after a senior-level meeting on food coordination.

Big moves in Argentina. Tariffs on soy meal and soy oil, Argentina is the top exporter, will fall to 24.5% from 31%. For #soybeans, the rate drops to 26% from 33%, and for corn to 9.5% from 12%. Several beef cuts will now be taxed 5% instead of 6.75%.#cattle

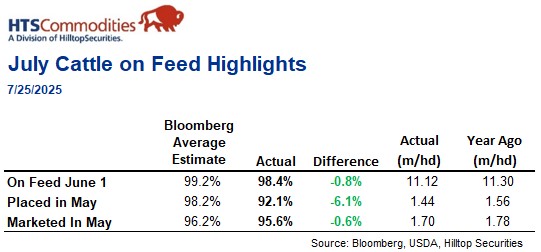

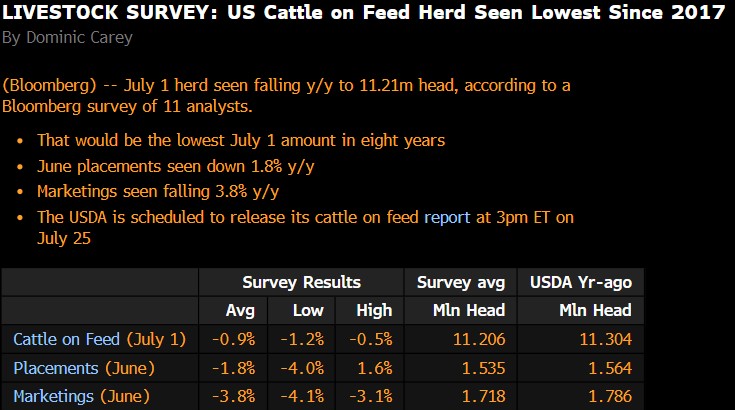

USDA's July Cattle On Feed highlights....pretty big miss on the placement number. The structural supply deficit narrative continues. #cattle

REMINDER: July Cattle On Feed report is today at 2:00 CST. Bloomberg's COF estimates are below. Good luck!!

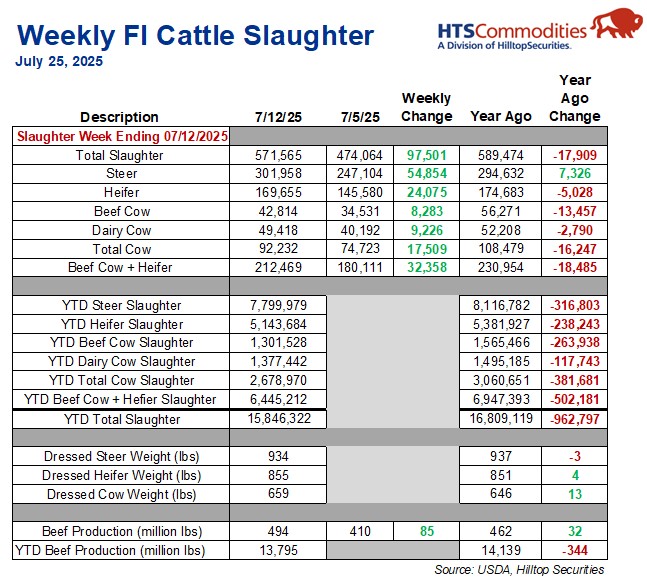

Weekly #cattle slaughter for week ending 7/12. Largest dairy cow slaughter since late March.

Estimated CME feeder #cattle index for 7/25 +$2.70/cwt at $328.88/cwt. $330 is insight but $350 is the prize.

HTS's Lead Commodity Strategist Walter Kunisch discusses the fundamental drivers that are driving US #cattle and beef prices to record levels on MarketWatch. A strong read about the supply challenges that are driving food prices and #inflation higher marketwatch.com/story/inflatio…

About that 50% #tariffs on Brazilian imports. Brazil has options. None are good for US consumers and domestic inflation. Goods such as grains, cocoa, citrus, coffee or sugar — which accounted to nearly 7% of exports to the US in 2024 — or energy commodities — which totaled…

Some fine looking #corn with obviously no problems in western Minnesota. Both are from the same field that we've been posting pictures from this crop year. Beyond a great yield potential in this field/area we don't read much into it. Lots of time and lots of acres in the US.

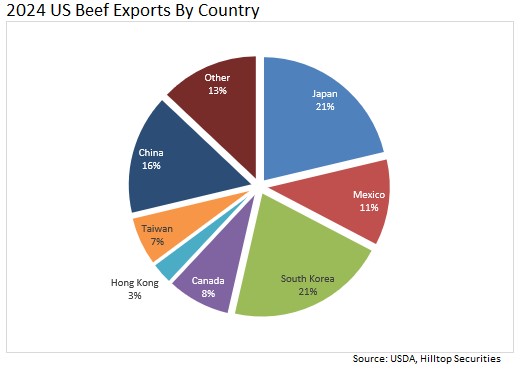

Recent headline data from #Tariffs talks with Japan and Korea are positives for US ag exports. Both countries are key export clients for US row crop & protein and are the first and second largest export destinations for beef. Will trade talks increase volumes? #cattle

More #tariffs news, this time from Korea. Unsure what "drawing the red line" means for US beef and rice. Korea is a top 5 US export market for beef. The country needs US #corn for the expanding renewable program. More details when the representatives meet on 7/25. #cattle

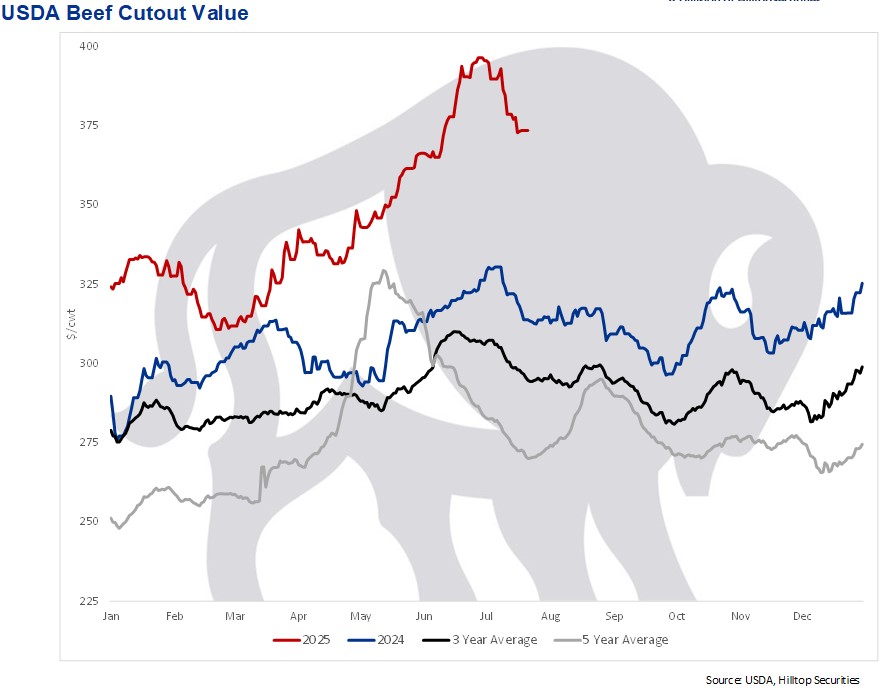

Choice beef cutout...for all you market technicians out there, classic head and shoulders, pretty funny. If #cattle supplies are historically tight how much of a seasonal break will occur?