GST Reckoner®_CA (Adv) Gaurav Agrawal

@GSTReckoner

GST Reckoner is a Registered Trademark owned and managed CA (Adv) Gaurav Agrawal. Follow us for GST updates and practice based research.

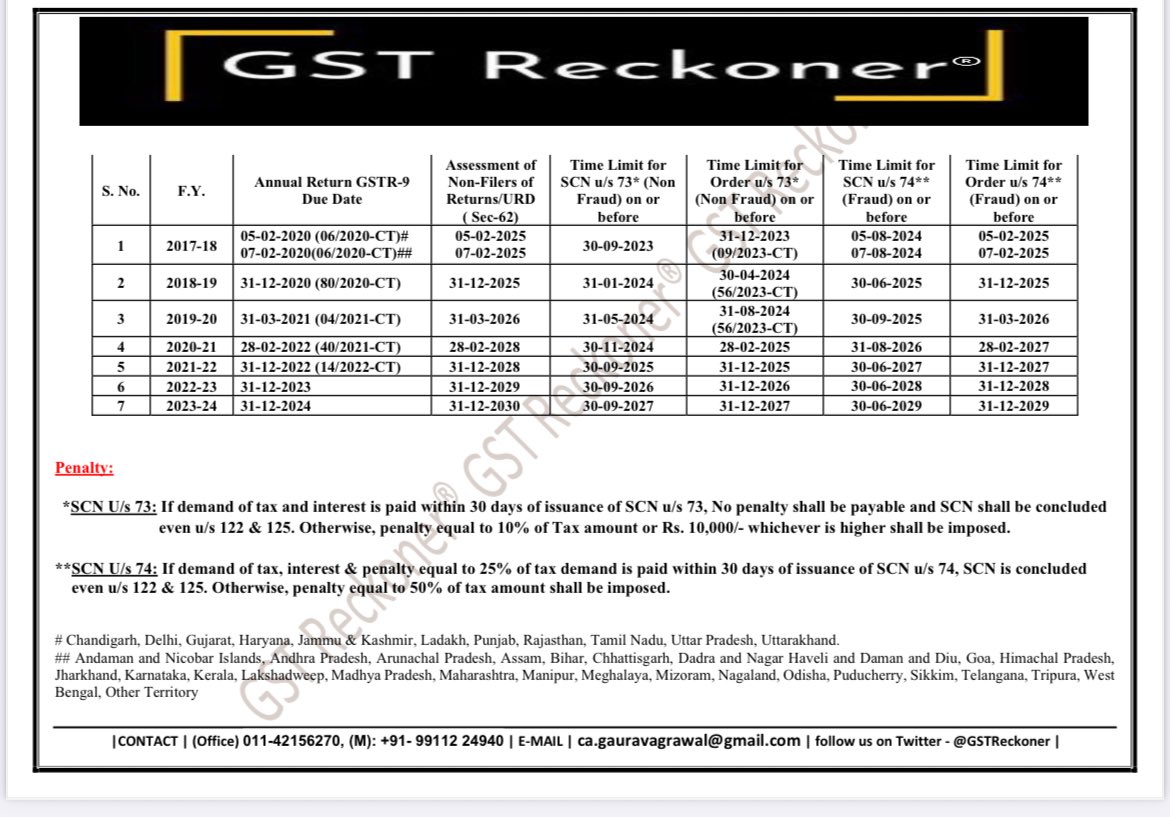

We have compiled year wise updated date chart showing cut off dates for issuance of SCN/Assessment Order u/s 62, 63, 73 & 74 For more updates follow us: ➡️Join WhatsApp Group: chat.whatsapp.com/KuFysUlOWV4IXf… ➡️Join on Twitter: x.com/gstreckoner

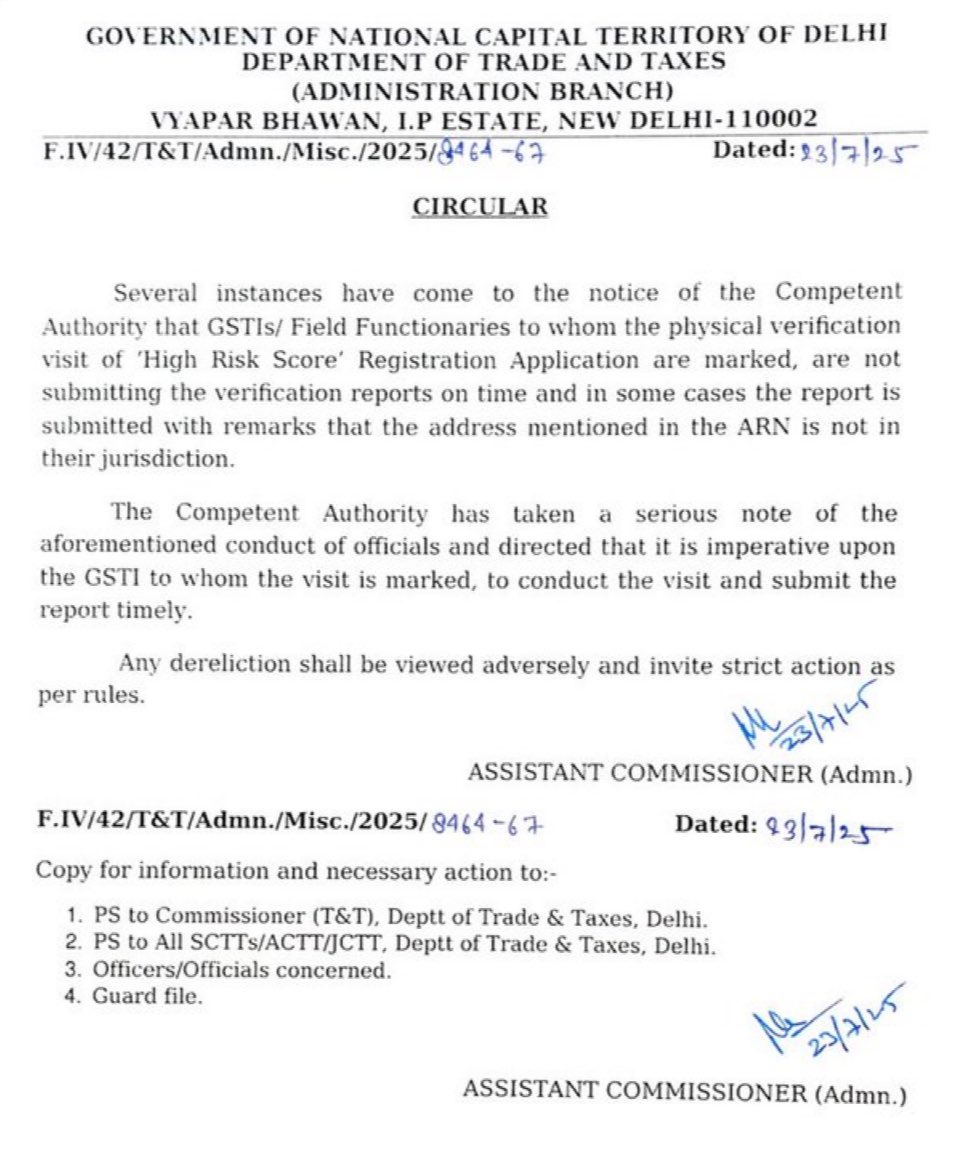

Update Delhi State GST has issued circular on physical verification report and it’s timely submission in case of new #GST registration

Beware of fake GST Notices!: @cbic_india

Beware of fake GST Notices!

GSTR 3A Notices issued for non-filing of form GSTR 4 to Composition Taxpayers; who have either duly filed the relevant return or whose registrations were cancelled prior to FY 2024–25 are advised to ignore these notices, as no further action is required on their part in such…

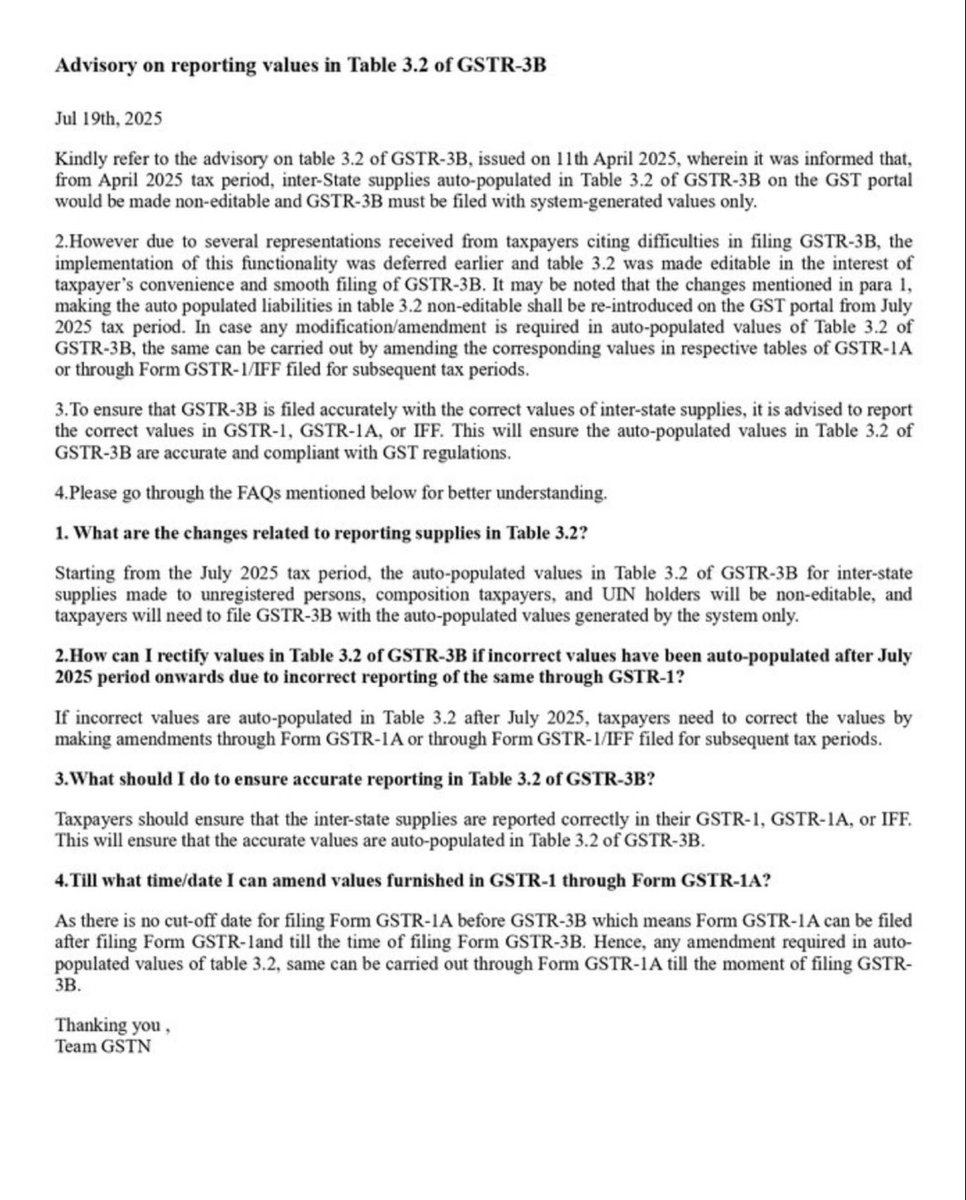

GSTN Advisory: Starting July 2025, Table 3.2 in GSTR-3B for inter-state supplies will be auto-populated & non-editable. Ensure accurate reporting in GSTR-1/GSTR-1A/IFF to avoid discrepancies. Amendments via GSTR-1A allowed till GSTR-3B filing. #GST #GSTR3B #TaxUpdate

#GST Revamp on table: From reducing Tax slab to procedural revamp, Relief etc

#CNBCTV18Exclusive | #FinMin holds inter-min talks on GST rate rationalisation ahead of #GST council meet. Fin Min seeks inputs on rate rationalisation from Comm Min, Home Min & Health Mins, sources to @TimsyJaipuria

GST due date on a Sunday? 😓 Asking the team to work weekends is tough, especially when clients delay R-1 details till evening. Need better planning for holiday deadlines! #GST #TaxSeason #WorkLifeBalance What do you feel?

Advisory 𝐫𝐞𝐠𝐚𝐫𝐝𝐢𝐧𝐠 𝐁𝟐𝐂 𝐭𝐚𝐛𝐥𝐞 𝐨𝐟 𝐓𝐚𝐛𝐥𝐞 -𝟏𝟐 (𝐇𝐒𝐍 ) 𝐨𝐟 𝐆𝐒𝐓𝐑-𝟏:

𝐓𝐡𝐢𝐬 𝐢𝐬 𝐫𝐞𝐠𝐚𝐫𝐝𝐢𝐧𝐠 𝐁𝟐𝐂 𝐭𝐚𝐛𝐥𝐞 𝐨𝐟 𝐓𝐚𝐛𝐥𝐞 -𝟏𝟐 (𝐇𝐒𝐍 ) 𝐨𝐟 𝐆𝐒𝐓𝐑-𝟏: • 𝐓𝐚𝐛𝐥𝐞 𝟏𝟐𝐁 𝐢𝐬 𝐧𝐨𝐭 𝐦𝐚𝐧𝐝𝐚𝐭𝐨𝐫𝐲 — 𝖨𝗍 𝖼𝖺𝗇 𝖻𝖾 𝗅𝖾𝖿𝗍 𝖻𝗅𝖺𝗇𝗄 𝗈𝗋 𝖿𝗂𝗅𝗅𝖾𝖽 𝗐𝗂𝗍𝗁 𝖺𝗇𝗒 𝗏𝖺𝗅𝗎𝖾. 𝐈𝐬𝐬𝐮𝐞: 𝖧𝗈𝗐𝖾𝗏𝖾𝗋, 𝗌𝗈𝗆𝖾…

We have compiled year wise updated date chart showing cut off dates for issuance of SCN/Assessment Order u/s 62, 63, 73 & 74 For more updates follow us: ➡️Join WhatsApp Group: chat.whatsapp.com/KuFysUlOWV4IXf… ➡️Join on Twitter: x.com/gstreckoner

GST Knowledge Series: Section 76 of the CGST Act empowers authorities to issue recovery notices for GST collected from any person, even beyond the extended time limit for issuing notices. Notice can be issued for tax collected against both taxable and exempt supplies. #GST

Finance Ministry collects Goods and Services Tax (GST) Rs 1,84,597 crore, registering an increase of 6.2% as compared to Rs 1,73,813 crore collected in June 2024, says the ministry.

There is saying: 'सैयां भये कोतवाल, अब डर काहे का'

DIN को ही Non-Mandatory कर दिया!! हे प्रभु रक्षा करो