Boston University Global Development Policy Center

@GDP_Center

The Global Development Policy Center advances policy-oriented research for financial stability, human well-being + environmental sustainability across the globe

The timing + rarity of the #FFD4 conference establishes it as an inflection point toward either progress or acquiescing to an untenable status quo, writes @SamIgoWego in a new round-up blogpost highlighting the latest research. Read more: gdpcenter.org/4kgQqF4

From increasing the scale + quality of multilateral development bank financing to expanding voice + representation for developing countries, experts outline what #FfD4 + 🇿🇦 @g20org must deliver on to achieve shared climate + development goals. Read more: gdpcenter.org/41ehmhY

In 🔟 charts, @NathalieMarins illustrates a structuralist perspective of developing economies' debt, arguing for using a balance of payments constraint lens to assess developing countries' external debt sustainability. Read the blogpost: gdpcenter.org/3U0Fvop

Stepping up financing for development is an urgent + attainable task, and 🇨🇳China can be an important actor in these efforts, writes @TimH_B in a new @ChinaGSProject column reflecting on #FFD4. Read more: gdpcenter.org/4523fxj

🚨 LAST CALL! The Global China Initiative is accepting applications for its @BU_Tweets Core Faculty Seed Grant Program for scholarship centered around China's overseas economic activities and engagement. Learn more about the program + apply by July 31: gdpcenter.org/46Zzsbe

🚨 LAST CALL! Applications for the Global Economic Governance Initiative Core Faculty Seed Grant Program are open to @BU_Tweets scholars. Benefits include a $2,500 seed grant, joining a network of researchers + more. Applications close on July 31: gdpcenter.org/4lLrPtw

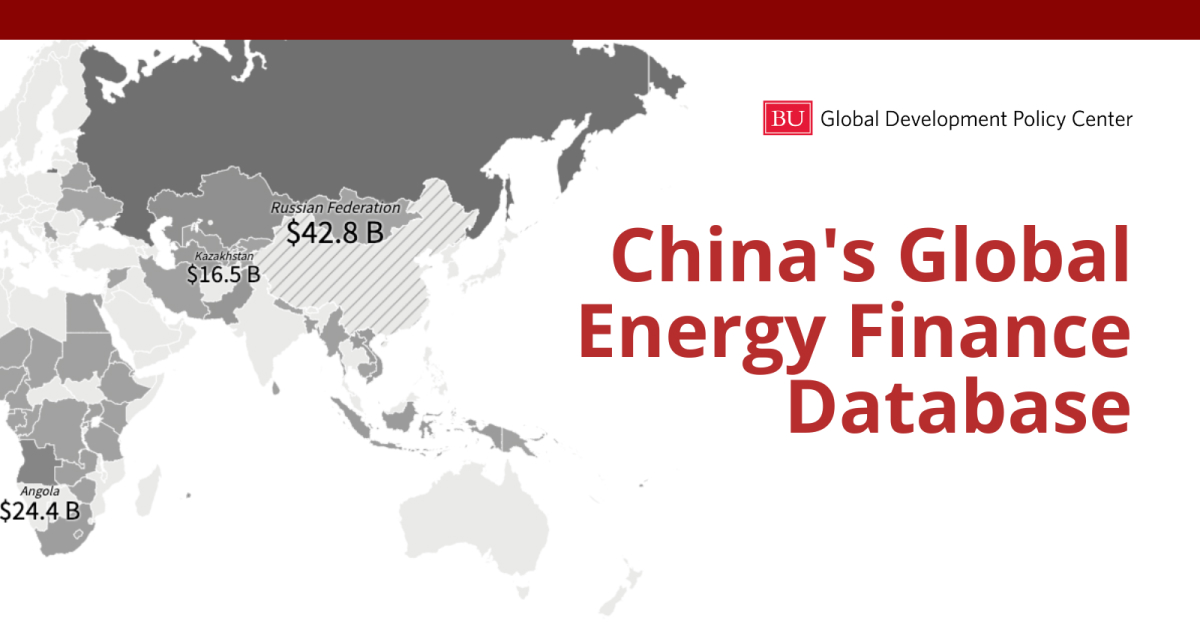

From 2000-2023, 🇨🇳China's development finance institutions provided an estimated 367 loans, totaling $209 billion to 118 public borrowers in 68 countries for energy projects around the world. Explore the data in the China's Global Energy Finance Database: gdpcenter.org/4kSxhtn

Recent policy brief by @Jackie_jlu, Diego Morro + coauthors finds 🇨🇳China's overseas energy finance is set to rebound in the coming years with a decidedly green slant, following recent commitments to support green development: gdpcenter.org/4mbh4R3

From surveillance to global policy coordination, @rishirbhandary + @KevinPGallagher assess the history of @IMFNews' engagement on climate change, with a special emphasis on its Climate Change Strategy launched in 2021, in a recent @OxUniPress book chapter: gdpcenter.org/4m8qDQF

The Bretton Woods institutions were created to prioritize global peace, prosperity + national autonomy. To meet today's challenges, @KevinPGallagher advocates for an updated set of principles around resilience, inclusivity + sustainable development: gdpcenter.org/45kxwc5

African countries pay over $74 billion per year in excess interest to international capital markets. In @dailymaverick, @dannybradlow + Kesaobaka Nancy Mopipi chart a more sustainable path for the sovereign debt architecture: gdpcenter.org/4o6z80B

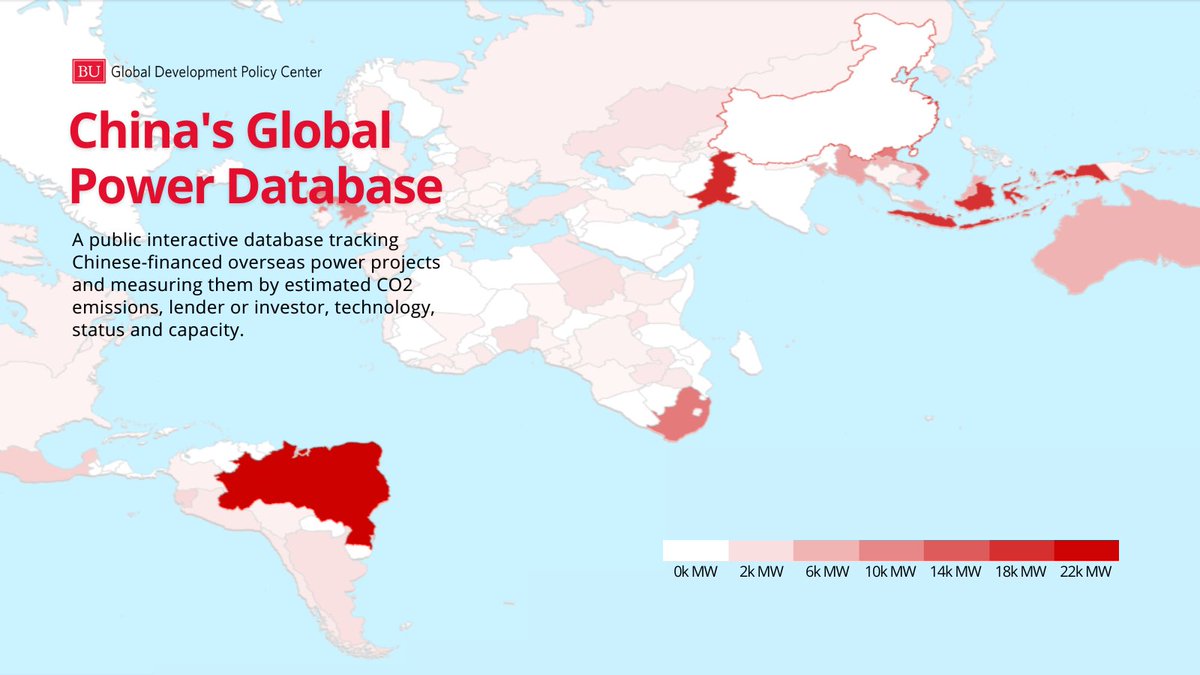

China's no-overseas-coal pledge marked an important shift in its global energy policy. New research from Diego Morro, @KevinPGallagher + others evaluates the implementation of the pledge and summarizes the trends of Chinese financed overseas power plants: gdpcenter.org/3UrXXq3

NEW Jubilee Report from the Pontifical Academy of Social Sciences + @Policy_Dialogue seeks to contribute to a comprehensive rethinking of the int'l financial system to help build a global economy that serves all people, especially the most vulnerable: gdpcenter.org/40zfCQa

Using a panel dataset covering 2012-2020 across 850 subnational regions in Africa, a new working paper from @ywang2005b + Yinyin Xu examines the effectiveness of 🇨🇳China’s bilateral support in combating energy poverty. Read more: gdpcenter.org/3Uvx0lk

The timing + rarity of the #FFD4 conference establishes it as an inflection point toward either progress or acquiescing to an untenable status quo, writes @SamIgoWego in a new round-up blogpost highlighting the latest research. Read more: gdpcenter.org/3IJcc7u

What frameworks are necessary to set the strategic direction for financing for shared climate + development goals? @abhattacharya24 Daniel Titelman + Marilou Uy discuss in a new policy brief from the Task Force on Climate, Development + the IMF: gdpcenter.org/450Q3sG

🔌 What is the status of 🇨🇳Chinese financed overseas power plants + how do they vary regionally? Explore the latest data in the China's Global Power Database: gdpcenter.org/4kWAcBu

As 🇿🇦South Africa enters the second half of its @g20org presidency, @dannybradlow + Kesaobaka Nancy Mopipi make the case for ensuring an affordable + responsible sovereign lending framework is on the agenda. Read more in @dailymaverick: gdpcenter.org/415YeTi

Almost 80 years on, are the Bretton Woods institutions - @IMFNews, @WorldBank + @WTO - fit for purpose in promoting a prosperous, just + sustainable global economy? @KevinPGallagher + Richard Kozul-Wright say it's time for a fundamental reset: gdpcenter.org/46qRlzF

The transition to a low-carbon + inclusive global economy is estimated to require about $3 trillion annually through 2050. For @INETeconomics, @KevinPGallagher explains how reforming the international financial architecture can galvanize progress: gdpcenter.org/46lWYyY

Extending the timeline for sovereign debt repayments + lowering interest rates could free up capital for climate-vulnerable nations to invest in building resilience, @rishirbhandary @MarinaZucker + @NathalieMarins find in a new policy brief with @V20Group: gdpcenter.org/4kX7eRV