The Fraser Institute

@FraserInstitute

#1 rated think tank in 🇨🇦! Improving the lives of Canadians with high-quality timely research and innovative outreach.

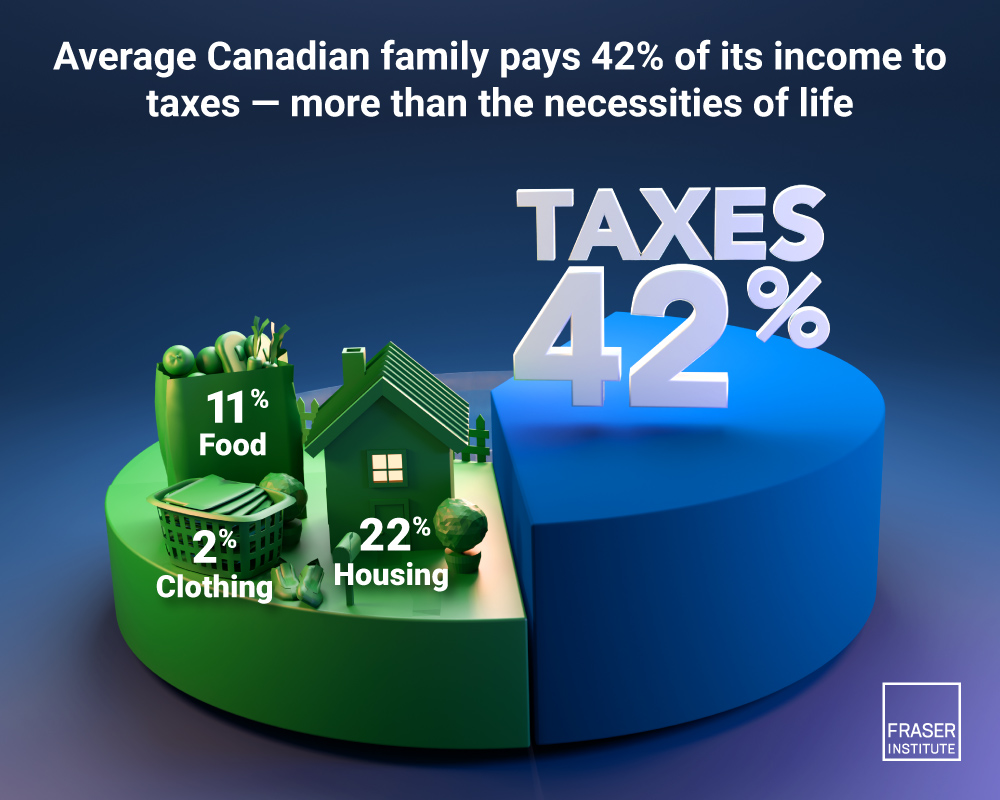

While Canadians can decide for themselves whether or not they get good value for their tax dollars, they should understand how much they pay in taxes each year. Read the full study: fraserinstitute.org/studies/taxes-…

The average Canadian family spent 42.3% of its income on taxes in 2024 – more than on housing, food and clothing combined. fraserinstitute.org/studies/taxes-…

How can the Moe government help reduce health-care wait times in Saskatchewan? fraserinstitute.org/commentary/moe…

The Fraser Institute played a significant role in getting this important book published – from inception through to editing and review, and ultimately to its final format. Get your copy today – and save 20% by using the code FRASERDAY20 – here: sutherlandhousebooks.com/product/my-fig…

Will carbon-capture reduce the risks of predicted climate change? fraserinstitute.org/commentary/car…

The B.C. government’s per-person debt burden increased by 44 per cent from 2022 to 2024. fraserinstitute.org/commentary/dav…

Like a neutral referee ensuring fair play, a wise government impartially safeguards everyone’s right to own, use and exchange property. fraserinstitute.org/commentary/ame…

If the Alberta government withdraws from the CPP, what will it mean for you? fraserinstitute.org/commentary/alb…

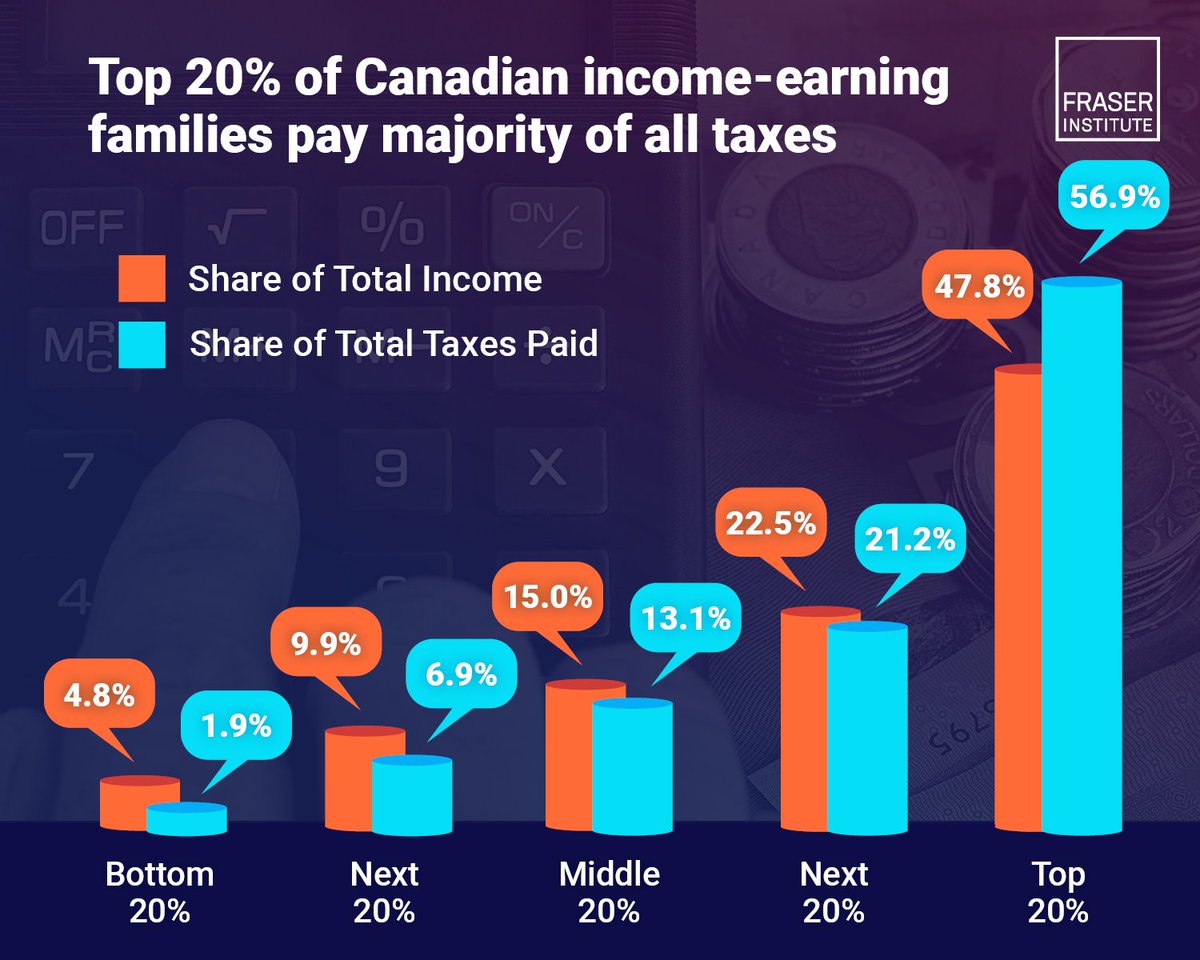

The top 20% of income-earning families pay more than half (56.9%) of total taxes including personal income, sales and property taxes Learn more: fraserinstitute.org/studies/measur… #cdnpoli

Why is domestic air travel in Canada so expensive? fraserinstitute.org/commentary/com… #cdnpoli

Should Premier Smith introduce a single 8% income tax in Alberta? fraserinstitute.org/commentary/alb… #abpoli

Will legacy media outlets, now financially dependent on government support, maintain objectivity when covering the Carney government ? fraserinstitute.org/commentary/dem… #cdnpoli

Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP. Keep reading:…

Switching from the CPP to a provincial pension plan would generate savings for Albertans through lower contribution rates — allowing them to boost private retirement savings while still receiving the same pension benefits as under the CPP. Learn more: fraserinstitute.org/studies/illust……

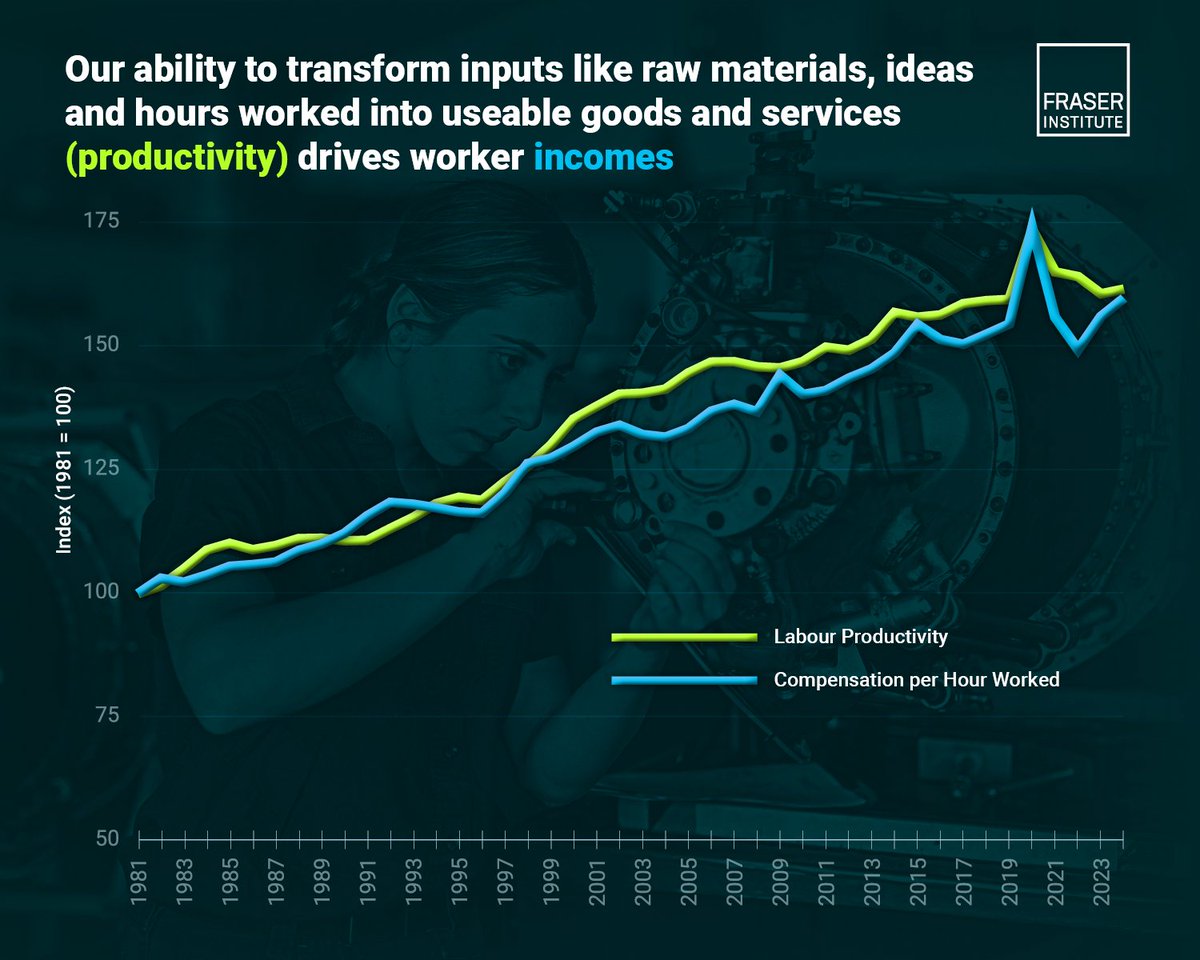

If people aren’t producing more output, they can’t be paid higher incomes. fraserinstitute.org/commentary/pro…

The Carney government’s spending review is missing these two critical aspects. fraserinstitute.org/commentary/car… #cdnpoli

How can policymakers help make B.C. more attractive to oil and gas investment? fraserinstitute.org/commentary/bc-… #bcpoli

Trade negotiations with Trump—Canadian producers and taxpayers must understand there will be some pain for any gain. fraserinstitute.org/commentary/car… #cdnpoli

If governments in Canada want to help increase incomes and improve living standards, they must focus on policies to improve productivity. Keep reading: fraserinstitute.org/studies/higher… #cdnpoli

If Canada wants to increase worker compensation, then increases in labour productivity growth must be the policy focus for all governments. Learn more: fraserinstitute.org/studies/higher… #cdnpoli