Fiisible | Trendfollower

@FiisibleTrends

Trendfollower • Writing on trends, mindset, & winning strategies • Helping you master the markets • Subscribe for Free - http://fiisible.substack.com

Introducing The Master Trading Sheet This is a free resource that includes all the basic calculators that every trader and investor must have. You can create more complex calculators but the foundation will always remain this. docs.google.com/spreadsheets/d… What does it have? 1.…

I have been trading mechanically for too long. Over those months and years, too many people have claimed to know the tops, bottoms, and even mundane movements of the market. Unfortunately, they often end up changing platforms, locking their accounts, or simply disappearing. The…

When I think about it too deeply, trading is all about learning to handle disappointments. Yet, getting ready to face some more. A trader has to be ready to act. But not too impulsive. Ready to face disappointment when a trade goes against you. And yet, you have to get ready to…

There are markets where fools look like geniuses. And there are markets that make even geniuses feel like fools.

A trend always looks simple in hindsight. But it almost never is when it's beginning. Every move that translates into a meaningful trend requires a certain leap of faith from a trader. And you will have to keep taking that leap again and again. That's why cushioning the fall…

#LTF on Weekly Sometimes a trend is just a trend. There's no story around it. Even if there is, I don't care about it. A simple crossover on larger timeframe has shown me more opportunities than any complex screener would. It just throws too many stocks which is fine with me.…

Boredom is a trader’s worst enemy. It makes you do worse things with your trades. When you are bored, you get into hyper-optimising your trades in the belief that you will improve your performance. Boredom sometimes inflicts pain that is worse than a drawdown.

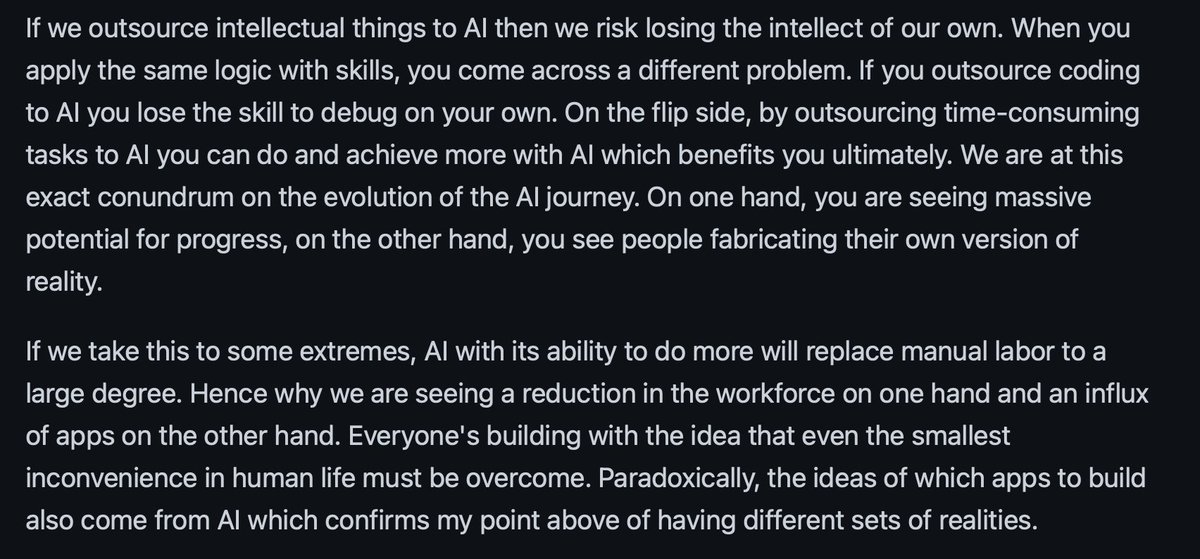

Wrote an essay on the downside of too much thinking with AI. It's already happening.

The index is trading near ATH, but the stocks are behaving as if we are at the bottom consolidating. When that happens, it usually indicates a lack of institutional participation. It's a problem.

The market seldom punishes you for being wrong. It doesn’t matter how many times you go wrong. It punishes you for staying wrong.

The beginning of the trend in this stock has been frustrating. Too many whipsaws. Representing the uncertainty of the bigger money in this stock. But the structure seems to be improving gradually over the weeks. This is how it looks on a daily basis. Very few traders managed…

Don't let the market decide your mood. For a person making money on short, the market isn't so bad. For a person holding equities in a falling market, they would blame everybody under the sun. Keep a mental distance from your trading positions because it's easy to get…