FibSixOne8

@FibSixOne8

Mining employee, husband, father. Loves charting and good entry on jr mining stocks. Not part of any pump schemes. https://ko-fi.com/dollarcostaverage

$usl.ax:

Say hello to hole JDD017-25. This core comes from ~36 m down. Here’s why $USL is pleased: 90 m @ 144 g/t AgEq ( 1.3 g/t Au, 40 g/t Ag ) starting just 10 m below surface ✨ 4 m @ 718 g/t AgEq ( 8.7 g/t Au, 20 g/t Ag ) from 23 m ✨ 6 m @ 559 g/t AgEq ( 6.5 g/t Au, 35 g/t…

Zinc up, Copper up, $teck down. I think those sellers have it wrong. Just my 2c. $teckb.to

Gap filled 🎯 Did anyone have an order there? $ti.to

$ti.to bullish gap fill incoming?

What is that, like 2500 calories?

また福袋ハズレた・・・。 ベビーボディーバーガー食べよっと。 #バーガーキング

No one wants to live an hour drive from downtown just to be in a new house. That's a lot of wasted life.

New homes cost more than existing homes. But not now: not only is the median existing home price higher than a new home, it's never been higher than it is today

Here's what that looks like in relation to some fairly simple supports and resists. Maybe it does. Gold likes to do fake outs and sometimes bounce on square numbers. Definitely wouldn't try to trade that, however.

Not going to happen. Gold heading back to $3050-$3100 before a big move to $4000

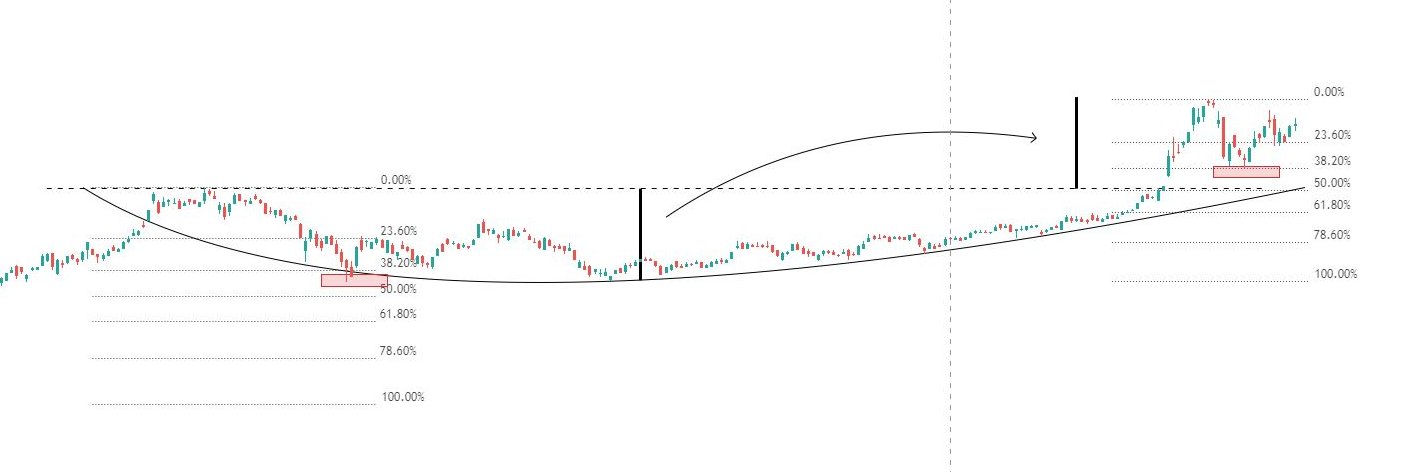

Watching. It would seem that this particular decision might unfold with next weeks FOMC. #dxy

#dxy major decision event very soon.

Bounce at the expected spot. Huge.

Clean reversal, but there's a confluence of support just below now, as opposed to the the last 3 rejections since April. A retest of dotted line would be really bullish IMO.

Not one summary mentioned USD weakness driving up all commodity prices, which they are all priced in. Maybe that's why the rise in platinum and silver price was a mystery, and why they'll likely be wrong on copper (because it follows gold and is also priced in a weakening USD).

GS note on majors and commodity views $GLEN $ANTO $AAL.L $RIO $BHP

Here comes the backseat construction worker. He probably knows the best way to remove asbestos while preserving historical architecture. This should be good.

Trump to Visit Federal Reserve 4pm ET Thursday: White House

Not sure what old timers say. But it sure does well once it starts outperforming stocks. 1971-1980 was a good run. Or what about 2000-2011? Is 9 or 11 years bull a "tail-end"? Silver leading gold simply means new folks are front running what's to come IMO.

When silver runs, doesn’t it also mean we’re in the tail end of the bull? At least that’s what I’ve heard from interviews of the old timers

The total market cap of all mining companies across tsx/tsxv/cse is around 1.3T. That's roughly just 25% of shitcoins total market cap. People who buy digital nothing will feel delighted to rotate into mining companies. They'll feel like they are de-risking, because they are…

Front-running the collapse? You decide.

Ethereum mooning has typically indicated that a bearish or sideways cycle for Bitcoin has begun. And where bitcoin goes, all the shitcoins follow, because it's all the same.

Clean reversal, but there's a confluence of support just below now, as opposed to the the last 3 rejections since April. A retest of dotted line would be really bullish IMO.

Gold closed right at the daily close high that has been touched 3 other times in the last 3 months. Easily visible with the line chart. Is this week going to deliver the breach?

Market is slow to react/believe what's going on.

Silver leading is a sign of a bull market for precious metals.