Financial Services Forum

@FSForum

The official account of the Financial Services Forum, an economic policy and advocacy organization serving consumers, businesses, investors, and communities.

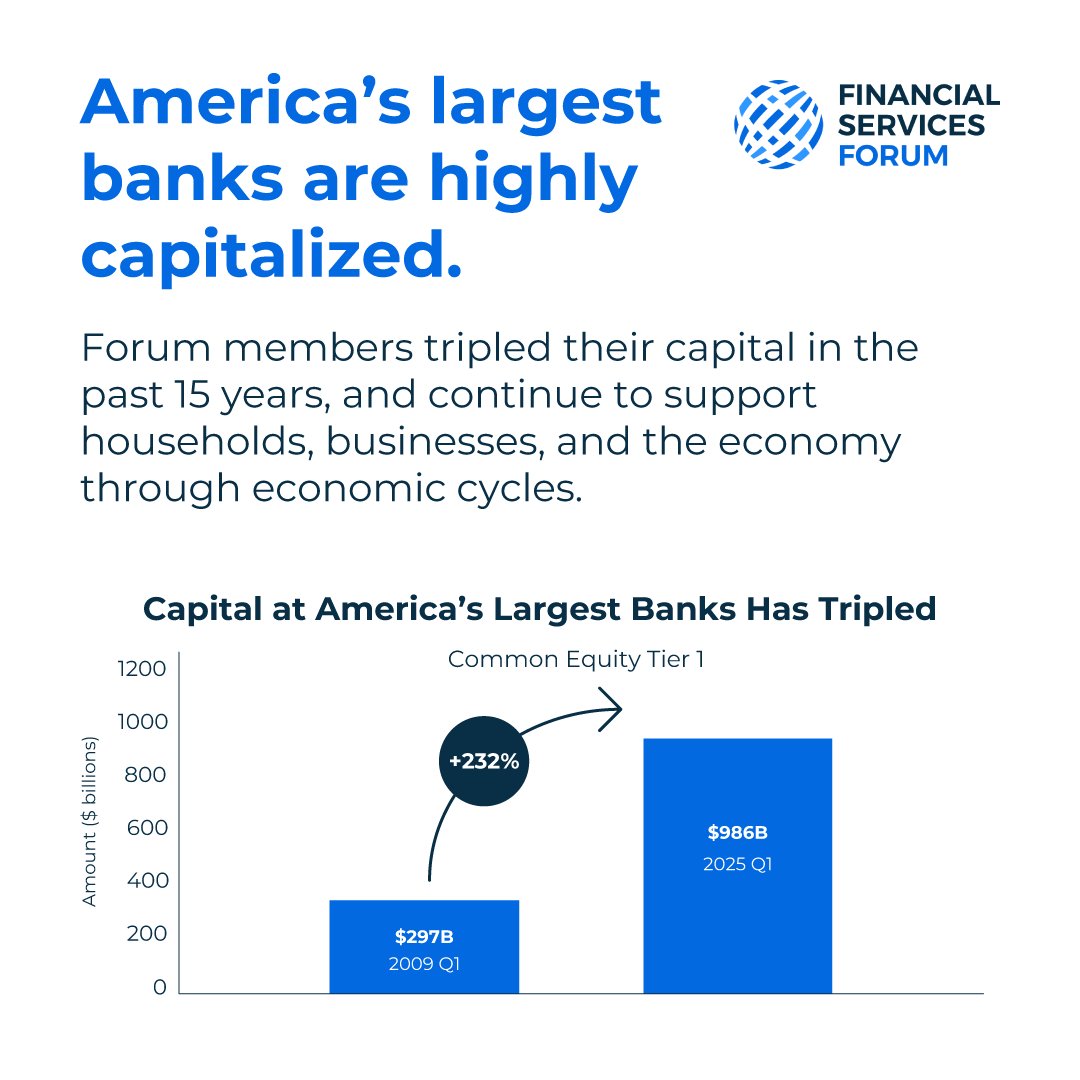

The largest U.S. banks are already highly capitalized, strong, and resilient. Since 2009, Forum members have tripled their capital levels to nearly $1 trillion. Learn more in our latest factsheet: zurl.co/qGLwo

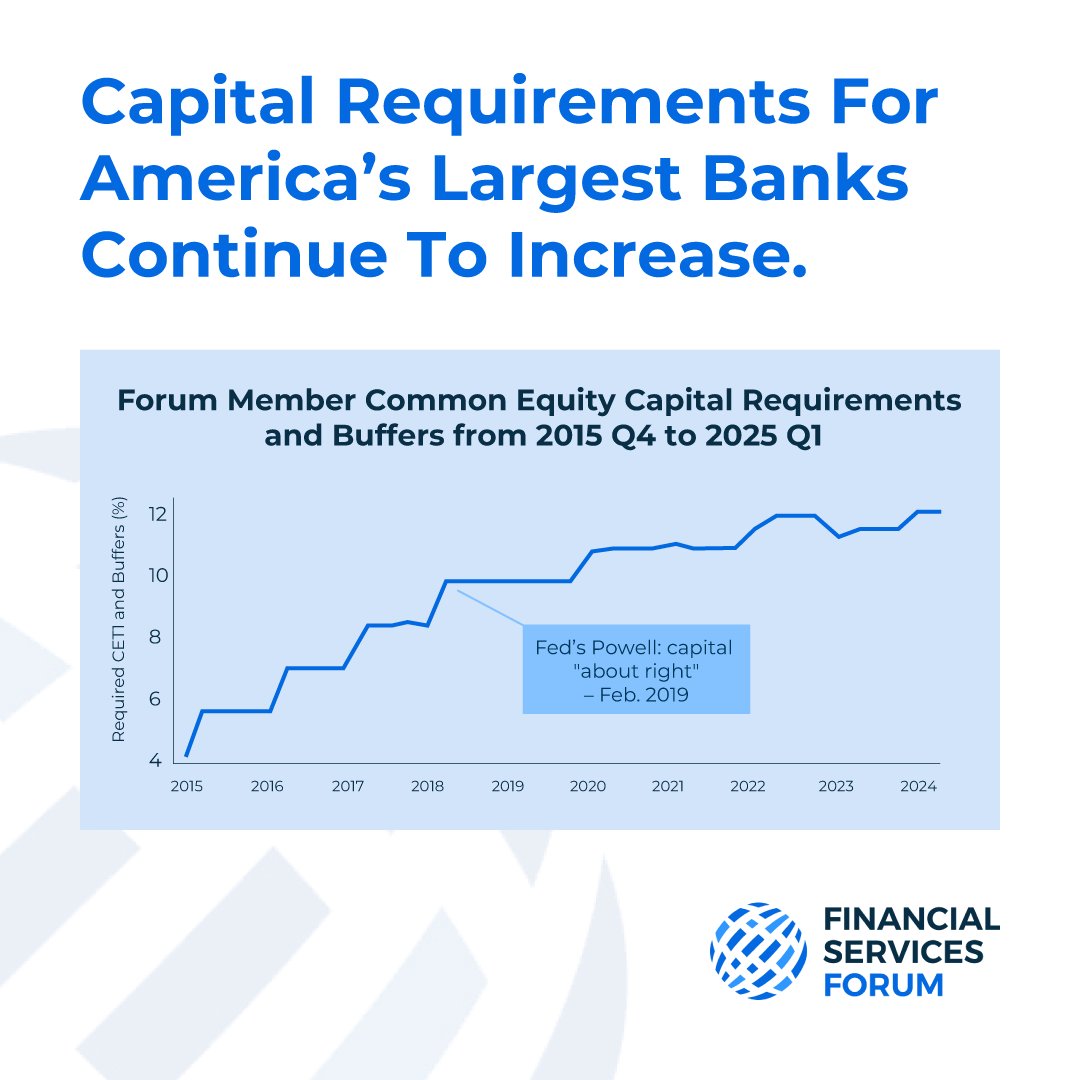

.@morganstanley CFO Sharon Yeshaya stresses the importance of evaluating U.S. capital requirements as a whole, not individually.

At today's @federalreserve capital conference, @jpmorgan's Al Moffitt discusses the importance of appropriately calibrating the U.S. GSIB surcharge: "the calibration must, and I say must, reflect the totality of all regulations to ensure it's fit for purpose."

Former @federalreserve VC Quarles - Basel 3 Endgame is not about raising capital: “It's about the incentives that the overall capital framework is creating. And they were not intended to increase the quantum of capital. That should be a first principle of implementation."

.@WellsFargo’s Mike Mayo calls for “simpler and strong” capital requirements at @federalreserve conference: “There's too many targets. It's acronym soup and too much capital volatility. It's too much of a black box. You don't know the cost of goods sold until after the fact.”

.@WellsFargo’s Mike Mayo says “pendulum has swung too far” on bank capital requirements. “The system today is too confusing, too constraining, and too costly.”

Current leverage ratio requirements can "disincentivize banks from intermediating treasuries during those periods of stress exactly when it's needed most," says @BNYglobal's Tiffany Eng, highlighting the need for reform.

The largest U.S. banks are among the world's best capitalized. Higher capital requirements could limit financial opportunity for American families, raise costs for consumers, and slow economic growth. Learn more: zurl.co/OWH5g

When the financial system works well, Americans thrive. Modernizing capital rules for the largest U.S. banks can make credit more affordable for families and businesses. Learn more: zurl.co/d6gZf

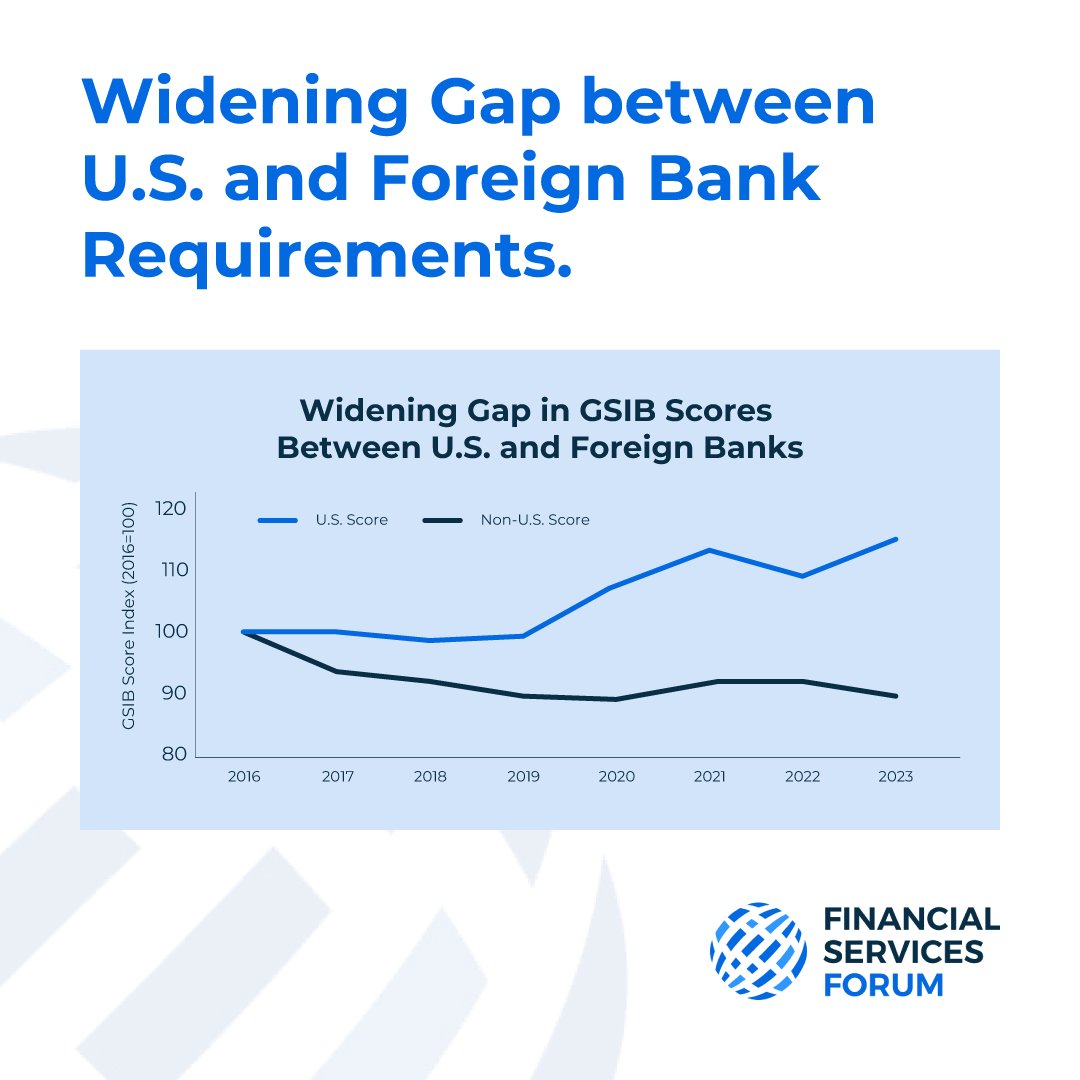

To put America first, we can’t let the largest U.S. banks fall behind. Stringent capital requirements are putting America’s largest financial institutions and their customers at a global disadvantage.

The largest U.S. banks have demonstrated resilience and the capacity to support the U.S. economy, even during periods of stress.

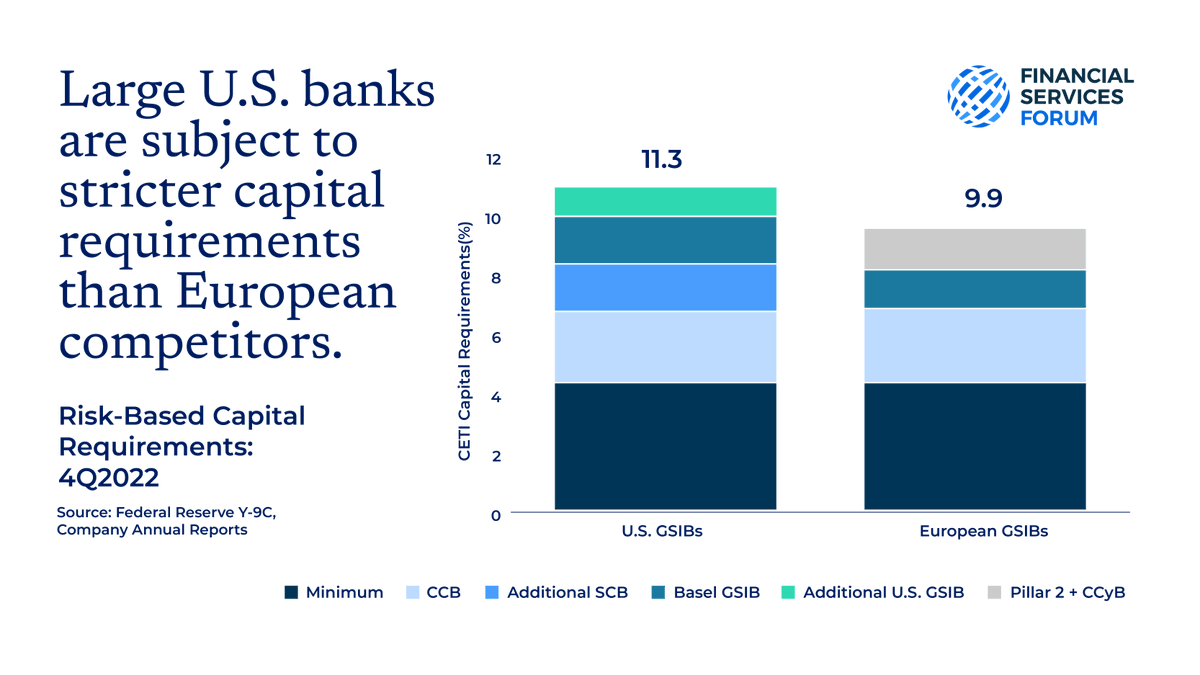

The largest U.S. banks are already held to higher capital standards than their global peers, and ever-rising regulatory requirements are making it harder to lend, invest, and support the economy at home.

America's largest banks face significantly higher capital requirements than their foreign counterparts. This disparity puts U.S. consumers and businesses at a competitive disadvantage on the global stage. zurl.co/deabk