Dave

@EventuallyWLTHY

Portfolio 2X'd in 2023, 2024, & 2025 YTD thanks to $HIMS $FUBO & other growth stocks 🔑 Highly concentrated in strong businesses w/broken stocks

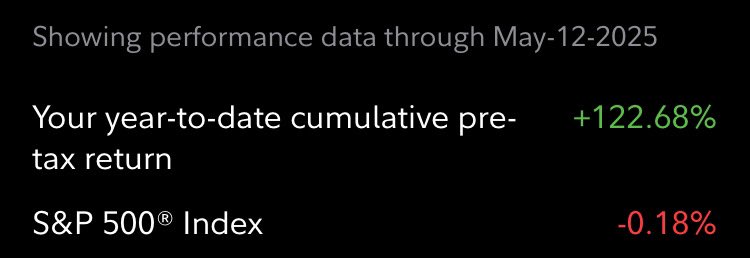

My YTD gains Might have to get this framed or something The S&P500 still hasn’t made money this year — so you know Wall St def hasn’t — yet I’ve already doubled my money Grateful to be a part of this genius community 💪🏽 learned a lot on FinX

Fair $HIMS could just float in this range for 6mo until launches contribute to significant growth again Either way, folks hoping for $100 anytime soon may be in for a surprise I've seen the damage shorts can do during acceleration, imagine slowing growth I hope I'm wrong

The market is pricing in 60% revenue growth for 2025 and much less for 2026. Unless they do worse than these expectation, it won't impact much. Most of the impact will be from the weekly hit pieces and low price target reiterations

Good Life is selling compounded versions of $LLY Tirzepatide $LLY made it very clear that they didn't want telehealth companies selling compounded version of their drugs anymore Compounders are ramping back up Other players are now following $HIMS

$HIMS $LLY $NVO 🚨 BREAKING: GOOD LIFE MEDS IS SELLING TIRZEPATIDE FROM 503B PHARMACIES FOR THE FIRST TIME SINCE THE SHORTAGE ENDED - Confirms our report that major 503Bs are ramping production again - Reddit chatter points to Olympia as the supplier - Still unclear what…

Seems like the $TSLA cult is losing a looot of members lately

I'm a huge fan of Elon & firmly believe that he's one of the most impactful humans in modern society. But dude.. we're half a decade into 2020's & $TSLA has released Cybertruck, FSD, Supercharger licensing, & did some model revamping. In that same time Elon's: -Hosted SNL…

This is how $HIMS rips to new ATHs I still think revenue growth slipping in the coming qtrs may still make $100 a bit harder to reach tho This def makes things interesting tho

🚨 IMPORTANT 🚨 $HIMS has been compounding via the 503A personalized exemption This would be different And bigger The four facilities rumored to be restarting GLP-1 production are 503Bs 503Bs are *mass compounding* facilities

I'm not a $HIMS bear I'm just being transparent Growth is gonna flatten at some point & we know how that affects growth stocks I'm bullish on the long term

Don’t you go bearish on me Dave. You know the team is cooking. Narrative will shift soon. GLP noise will fade.

Let em come man.. I've been screaming buy $HIMS on FinX since 2023 Now I say anything unattractive & weak hands want to act like I called the company garbage I'm sure these FOMO'ers are pretty flat on their cost basis & can't stomach not touching $100 for months

I feel the bulls coming for your throat with this lol

Idc if this hurts your feelings – sht, it hurts mine But $HIMS WILL get halved within 12mo, prepare yourself I'm not a bear/short/BofA/Citi saying this – I’m a bull Good thing is this company has so many growth levers in the pipeline that it'll likely be a V shape recovery

Sitting back in the office thinking about how I really believed that $HIMS x $NVO deal was going to be long term Didn't last the summer

$HIMS went up like $2 every time they mentioned “long-term” this morning Imagine another 5x during their earnings call on Monday

In other words, testosterone is stick & tricky to treat If $HIMS can pull this off it could be another big money maker that others can't easily dupe

TRT is a huge opportunity for $HIMS but it can only be prescribed after a blood test and those patients will need a blood test every 6 months at a miminum so the dosage can be adjusted as needed. Will be very important for $HIMS to also monitor their blood pressure and other…

No $HIMS bull is talking about this Chat, we gotta stay balanced

My thing with $HIMS rn is we're only going to be able to put up 110% rev growth quarters a couple of times next earnings we may already be looking at the 70s-80s the market might not respond well to that if test/peri/meno was already launched it could've maintained the…

Earnings I'm looking forward to in about 2 weeks: $MVST 8/7 or 8 Est $FUBO 8/5 BH Est $HIMS 8/4 AH $SRTS 8/7 AH $PGY 8/7 BH $ELF 8/6 AH

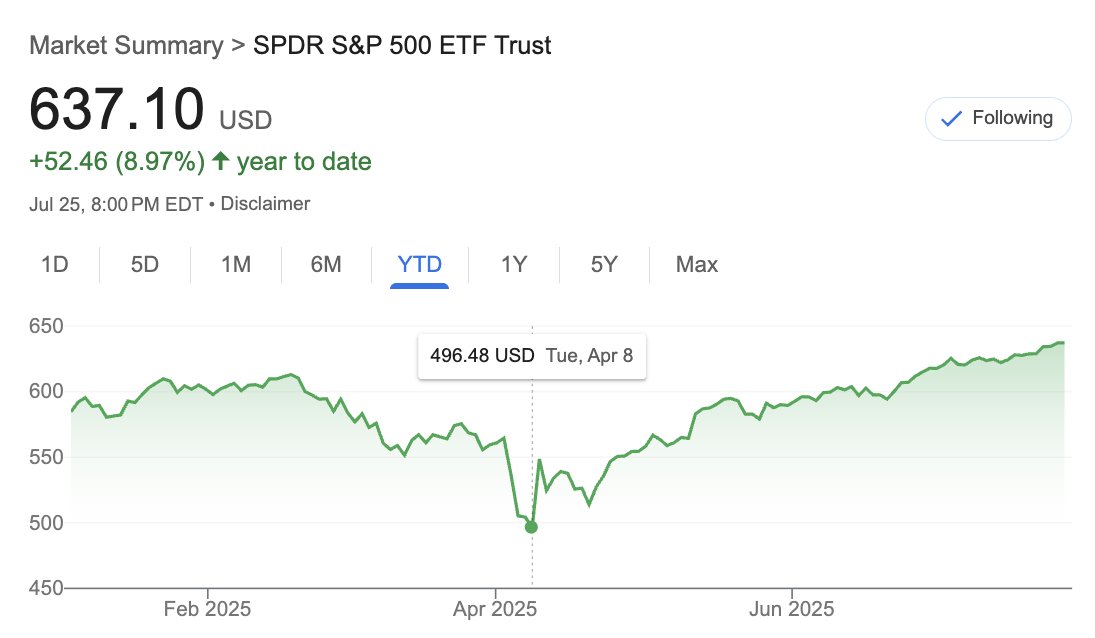

Everyone in the market should be making money right about now The S&P 500 $SPY has already recovered from the tariff crash & has hit new all time highs If you’re red YTD, you might want to take another look at your investment strategy

A lot of threads OTW, changed up the port Which do you prefer? a) Super long | 10mins+ read | all details b) Mid length | 5min read | condensed into highlights c) Very short | 2min read | nearly bulleted format d) Keep the threads | Just flood valuable tweets

My $SRTS 2026 Price Target: $21 +271% upside from today Under $11 is a buy for me

Risk management is sooo not talked about enough Buying a winner is only half the battle, you also have to master the selling Balancing that exposure will make or break your EOY returns

Why is $SRTS up 20% today? $SRTS is a medical device company whose entire business is pretty much up of their Superficial Radiation Therapy (SRT) systems Those systems just received their MDSAP cert The Medical Device Single Audit Program cert allows a single regulatory audit…

$SRTS in a nutshell B2B Global Niched Profitable Micro cap Disruptive 3Xer in 2yrs Founder Led Many growth levers Cash > Ttl Liabilities Accessible to masses One time & recurring rev Needs-based/cosmetic services Biggest competitor SELLS $SRTS product

$SRTS has some catching up to do this year, but we'll get there +20% today

If you know nothing about $SRTS read this I just bought this stock at $5 I’m pretty sure we’ll climb to at least $15 in 2026 Here’s what I’ve learned over the last few weeks (deep dive thread)