Erik A. Otto

@ErikOtto2

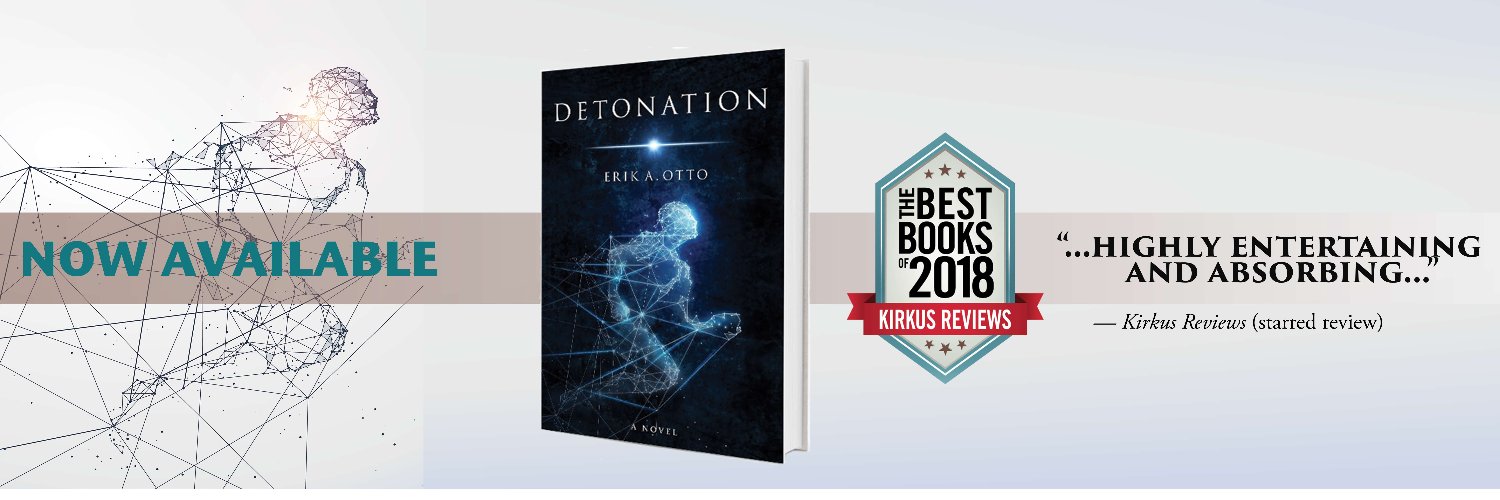

#Scifi author. Biotech Investing. #AI Safety. Looking for collaborators to co-produce Detonation screenplay adaptation. Tweets not advice.

We are at an inflection point with #AI development and need to take action as a society to mitigate our risks. Here I propose a step forward that could move us toward a safety engineering mindset. Why not this, and why not now? #AGI #AIsafety medium.com/@ottoerik/guar…

I can’t believe it’s already the 2-yr anniversary of OpenAI announcing it would solve the alignment problem in 4 years. Such a relief that Ilya, Jan, Leopold, and the rest must now be ~50% done with the breakthroughs needed to steer/control superhuman AI systems

We need new technical breakthroughs to steer and control AI systems much smarter than us. Our new Superalignment team aims to solve this problem within 4 years, and we’re dedicating 20% of the compute we've secured to date towards this problem. Join us! openai.com/blog/introduci…

Civilizations used to dream. Even communists wanted to go to the stars. At some point, the future died; we all silently decided that the purpose of a civilization is not to dream, but to just scrape by, to cut corners, to be as close to bare minimum functionality as possible

Really impressed with $CDTX data. One question I have is what the regulatory scrutiny will be on a "non-vaccine" that acts very much like a vaccine.

$INSM raises $750 m at 2% discount to share price when most biotechs are lucky to raise money at zero EV with full warrant coverage. Talk about the haves and have nots…

This is going to sound crazy but $NKTR holders be careful if you see the bid flooded with 1 share buys in the next few days - this is what happened to $GLTO. Just before the reverse split there was orchestrated buying of about 150k 1 share buys which added 13% dilution on the…

Random musing about $PTGX. Takeda has to be nervous about oral rusfertide (still owned by PTGX - coming soon) eating into most profitable years of their deal on the subQ. Takeda will build the market, possibly only to have an oral come in and cannibalize it in 6 - 8 years.…

$atyr strong lately. Here is my article from early 2024 on the company. I still think it's cheap fundamentally and the thesis and fair value estimate still stands for the most part. Recent developments have been incremental positives (claims analysis, expanded translational…

I get why people look at $ATYR's 1b/2a study sideways, it's a very useful biotech survival trait to think that way. One of the things that makes me take this small trial more seriously than I normally would is Anti-Jo-1 synthetase syndrome.

During biotech’s retrenchment, the shift toward validated and/or “hot” targets has been palpable Two recent reports nicely visualize this trend of increasing competitive intensity, as well as its influence across the full life cycle of asset development $XBI $BBC

Been thinking $INZY was a target for a while, but I am barely above my cost basis at this price. Highway robbery IMO, but INZY was in a hard place - only other alternative is toxic financing. Sense of relief for me rather than elation. Hope it helps the sector.…

Piper $ATYR Pulmonary sarcoidosis represents a blockbuster opportunity with ~>200K US, ~150K EU, ~20K Japanese patients.if priced at ~$120K/patient with only half of patient population targeted initially (~100K),would represent a robust ~$12B market opportunity.

I would say $atyr if I only had to choose one with a good chance of going 5-10x because the market is not assigning it the right POS or market size, but … it could also go to zero. Basket of $atyr, $alec, $ocul, $cmmb and $rzlt should do well in next 9 months to a year.