Jim Osman

@EdgeCGroup

I find alpha in spinoffs, corporate company change, and what everyone else ignores.

Ever wondered what shapes a successful investment strategy? In my book, I share the insights and experiences that have guided my decisions over the years. If you’re curious about the ‘why’ behind profitable investing, take a look. 📘📊” linktr.ee/jim_osman

A great spinoff. I should have held on. $GEV

GE Vernova $GEV with a moonshot after blowout earnings 📈📈 Up a whopping 380% since its IPO last year, it's showing no signs of slowing down even at new all-time highs 💪 Check out the Tradr 2X Long GEV Daily ETF $GEVX from @TradrETFs if you're looking for leverage. #Sponsored

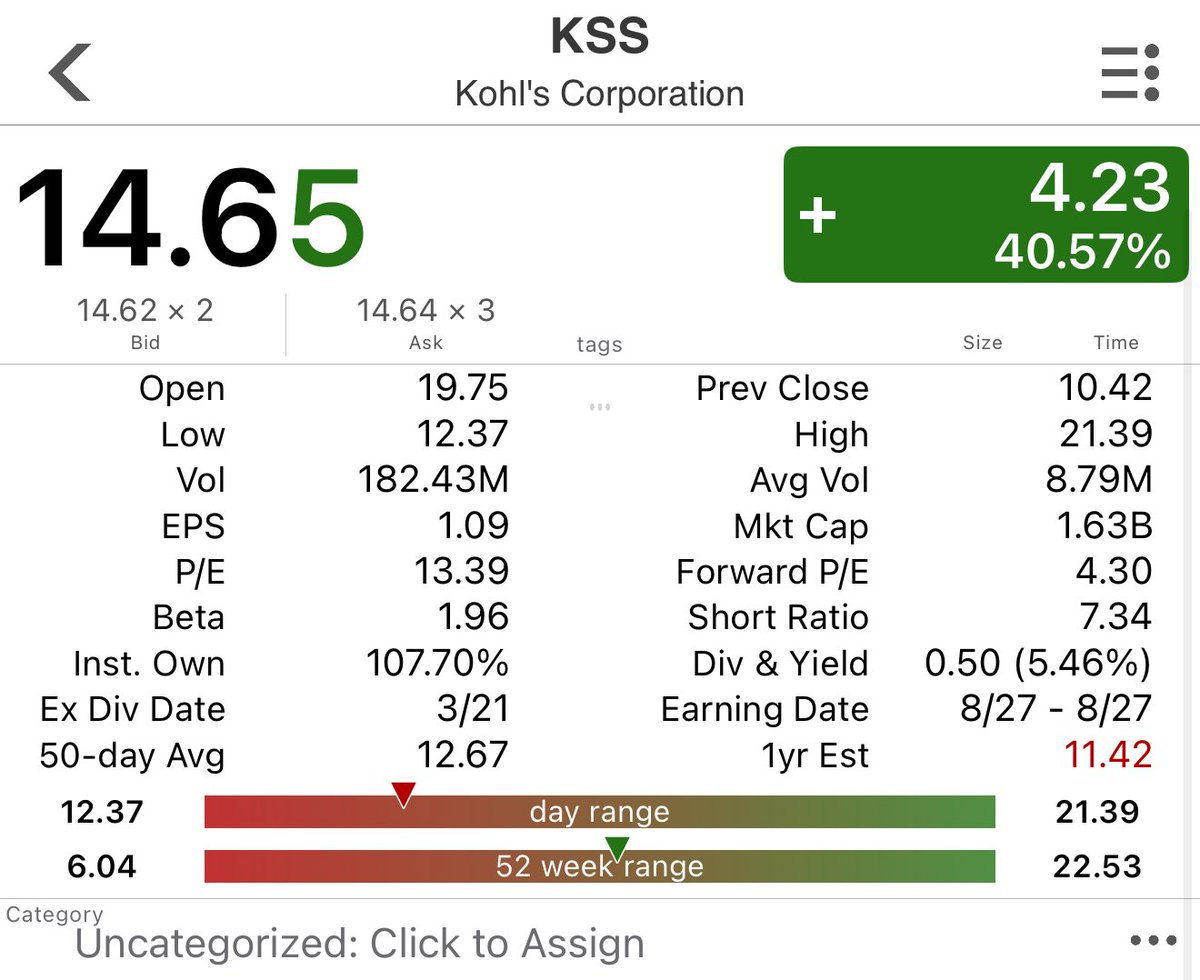

Meme stocks. SPACs. Crypto. All ripping. I’ve seen this playbook before - right before it caught fire and burned retail $KSS $OPEN

Some are saying this is AI. Others are saying my neighbor’s dog didn’t actually pick up a copy of my book and start reading about special situations. Both are wrong. She’s already outperforming most fund managers.

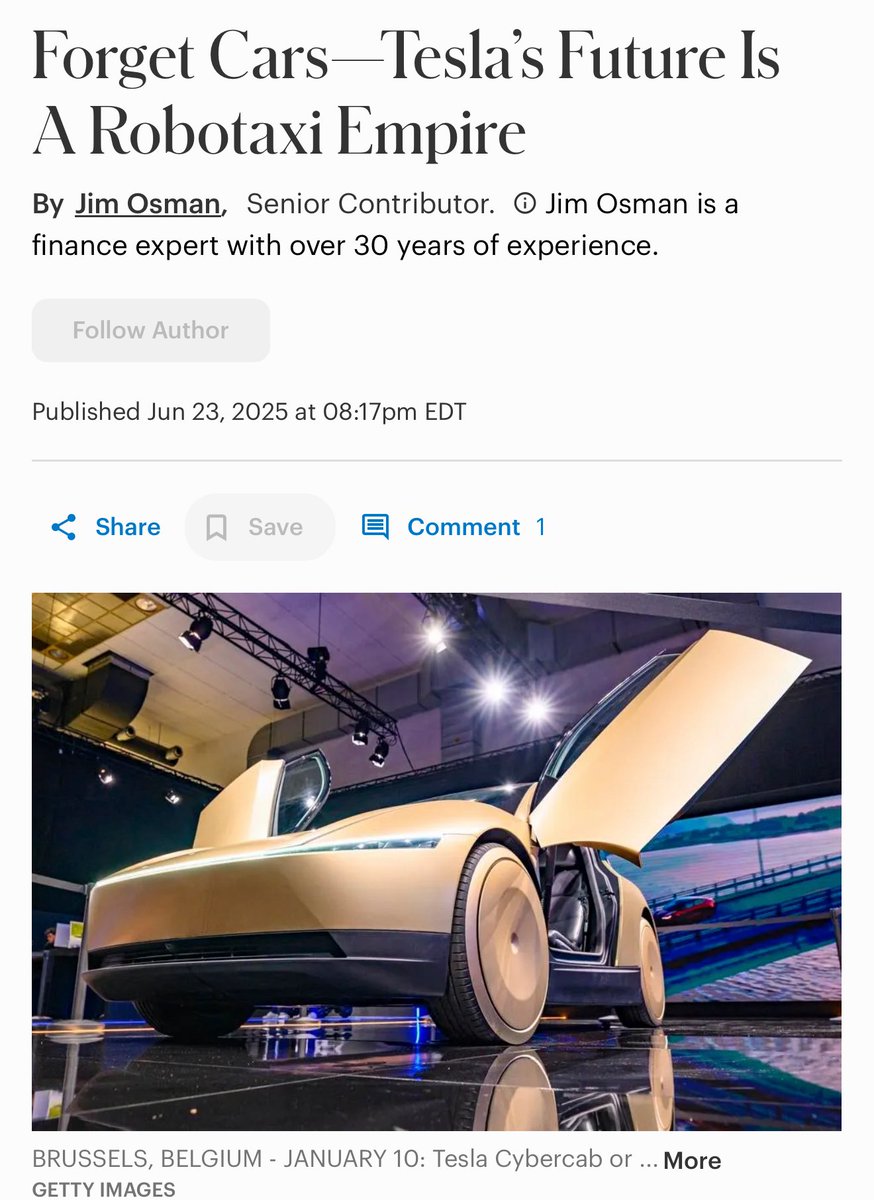

Tesla beat earnings, but operating profit keeps sliding. The real headline? The EV story is fading. Burgers, movies, and robots are the new pitch. Robo-taxis in Nevada, not cars in driveways. Feels less like leading the EV market more like quietly leaving it. $TSLA

Inside scoop: Chipotle’s losing ground with the younger crowd. Smaller portions, same price. Meanwhile, Qdoba’s serving more for less. Source? My daughter and her friends, aka the most honest focus group on Earth. $CMG

A few things I miss about the UK: 1.Sarcasm as a second language 2.Real crisps, not “chips” 3.Pub gardens with bad weather 4.And yes… the mighty Belgian Bun.

If you missed it. Meme stocks are back in play. What’s next? forbes.com/sites/jimosman…

Nothing to worry about. Just SPACs partying like it’s 2021, meme stocks defying gravity, and the market quietly whispering, “This is fine” while the ceiling caves in.

Good morning to everyone except the unprofitable zombie stocks with 30% short float, negative equity, and a fan club on Reddit, enjoy your 40% pop.

The last meme stock/short squeeze insanity took place in January 2021. The market did not top out until December of that year.

Meme stocks are back. Not the businesses, just the hype. Kohl’s up 40% on nothing. Sound familiar? This isn’t investing. It’s déjà vu with worse odds. Don’t get burned twice. Read before you trade: $KSS $OPEN Chart @Barchart CC' @Spencerjakab forbes.com/sites/jimosman…

What are the chances $GME, $AMC, and $CVNA pull off a sequel tomorrow? Short interest is loaded. Retail is circling. Feels like 2021 with worse fundamentals. 😳📉📈

Love how the “seems easy” crowd always shows up after the trade. No skin, no insight, just hindsight and hot air. I take the heat. You take notes.

So you promoted them when they were $333 as a monster buy ,they retrace to $300 ...nada ...now they are $330 your banging the drum again ...No delta position myself but I must take up this Stock Guru game ...seems easy ??

I warned you about SPACs on my @Barchart blog the other day. Now it’s meme stocks all over again. Markets don’t learn. They just recycle stupidity with a new ticker. $KSS