Dynamo DeFi

@DynamoDeFi

DeFi news, trends, tutorials, and analytics. YouTube: https://www.youtube.com/dynamodefi Newsletter: https://newsletter.dynamodefi.com//

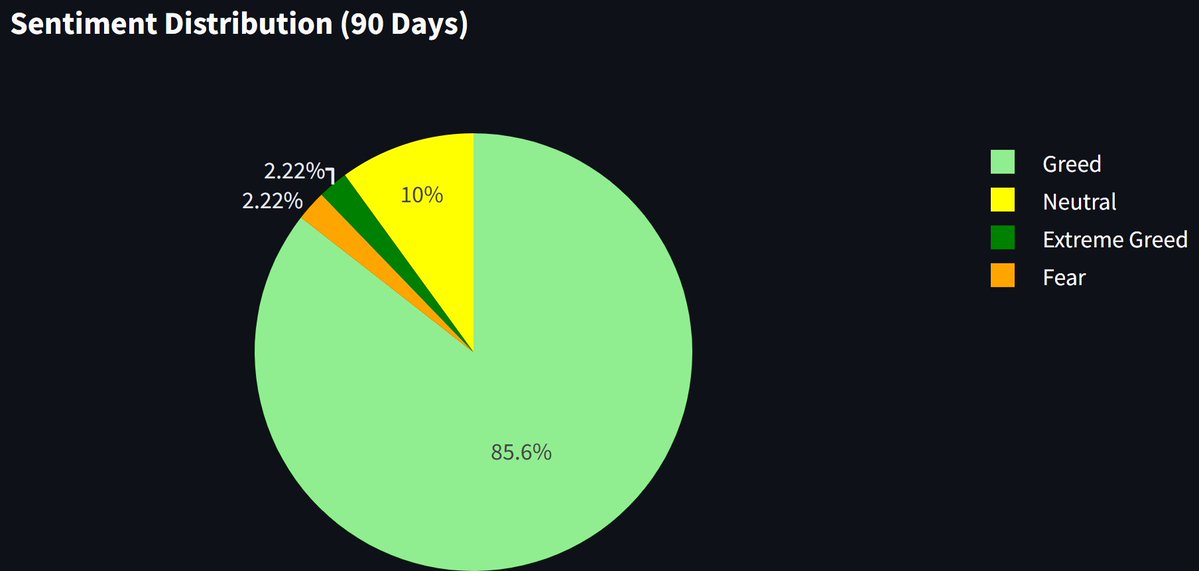

The market has only experience Fear twice in the last 90 days. 77 of those days were marked by Greed. Is sentiment running ahead of fundamentals, or is the optimism justified?

The world is moving onchain. Stablecoin users will simply see digital dollars while blockchains power global payments & transactions. More and more assets will be tokenized. They'll be more transparent, easier to access and cheaper to transfer.

JUST IN: JPMorgan says crypto stablecoins will be "integrated with the traditional financial system, as well as more tokenization of real world assets."

Couldn't agree more. This is the healthiest the industry has looked in years.

Crypto's new narrative cycle is very healthy: Revenue, Buybacks. Transparency around market makers. Healthy tokenomics. ICOs. Distribution out of CT. Institutional adoption. Real yield. We have a long ways to go, but it feels like we are in alignment with a strong value prop.

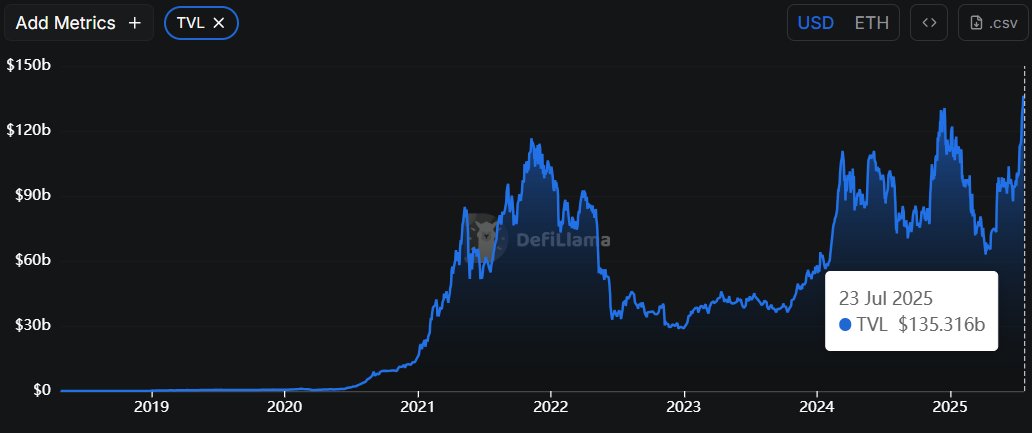

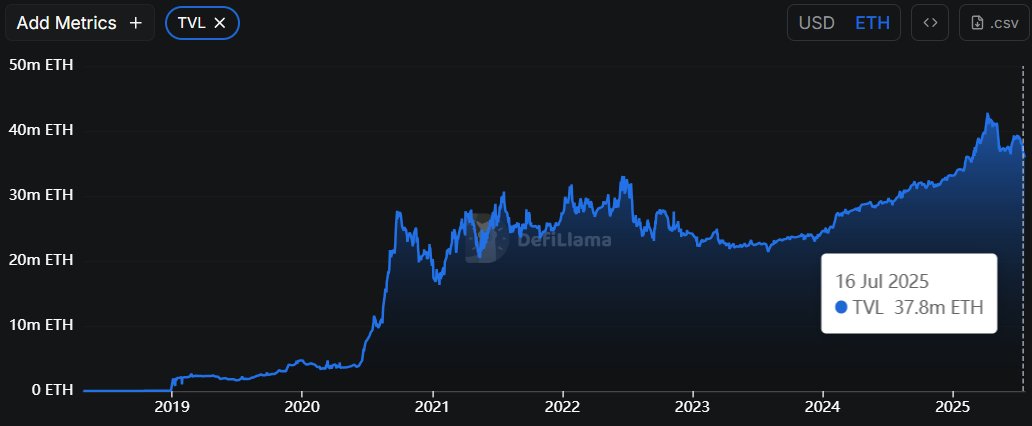

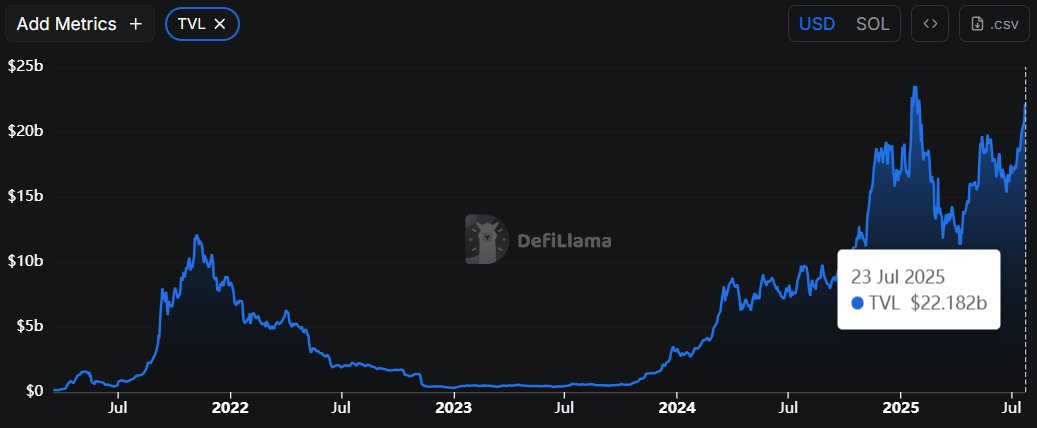

Lots of major chains are seeing ATHs in TVL, but is that a real signal? Simply denominating in USD means TVL is largely affected by the price of the chain's native token. Denominating TVL in the chain's native token tells you if more tokens have entered the ecosystem. It takes…

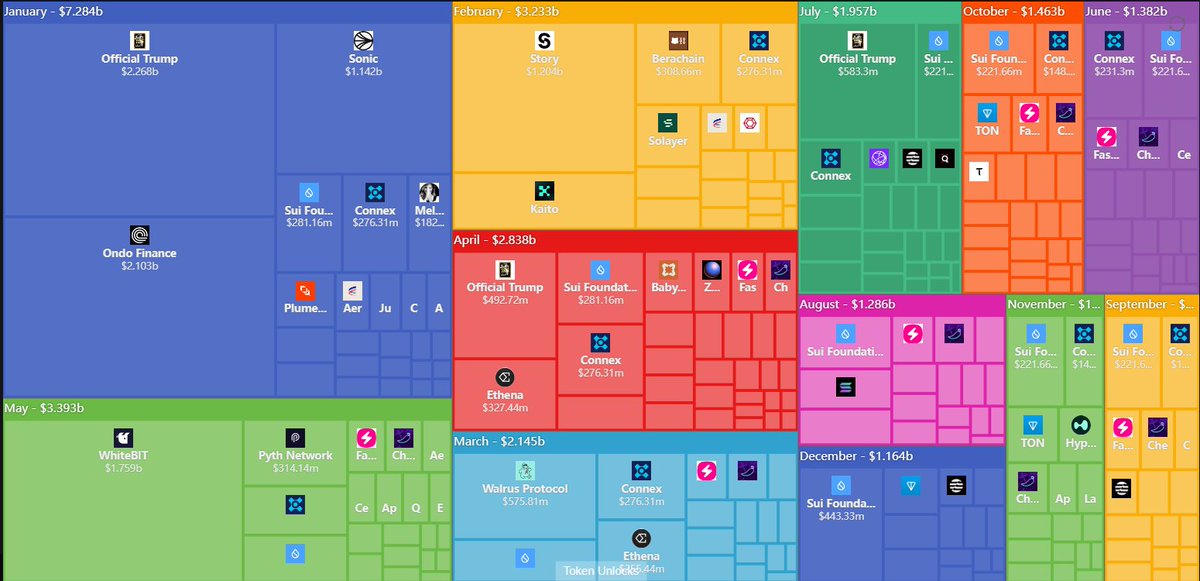

Many of the biggest months of token unlocks are behind us. Out of the $28b in tokens unlocking this year, $20b have already unlocked. After July, each month for the rest of the year has less than $1.5b in unlocks.

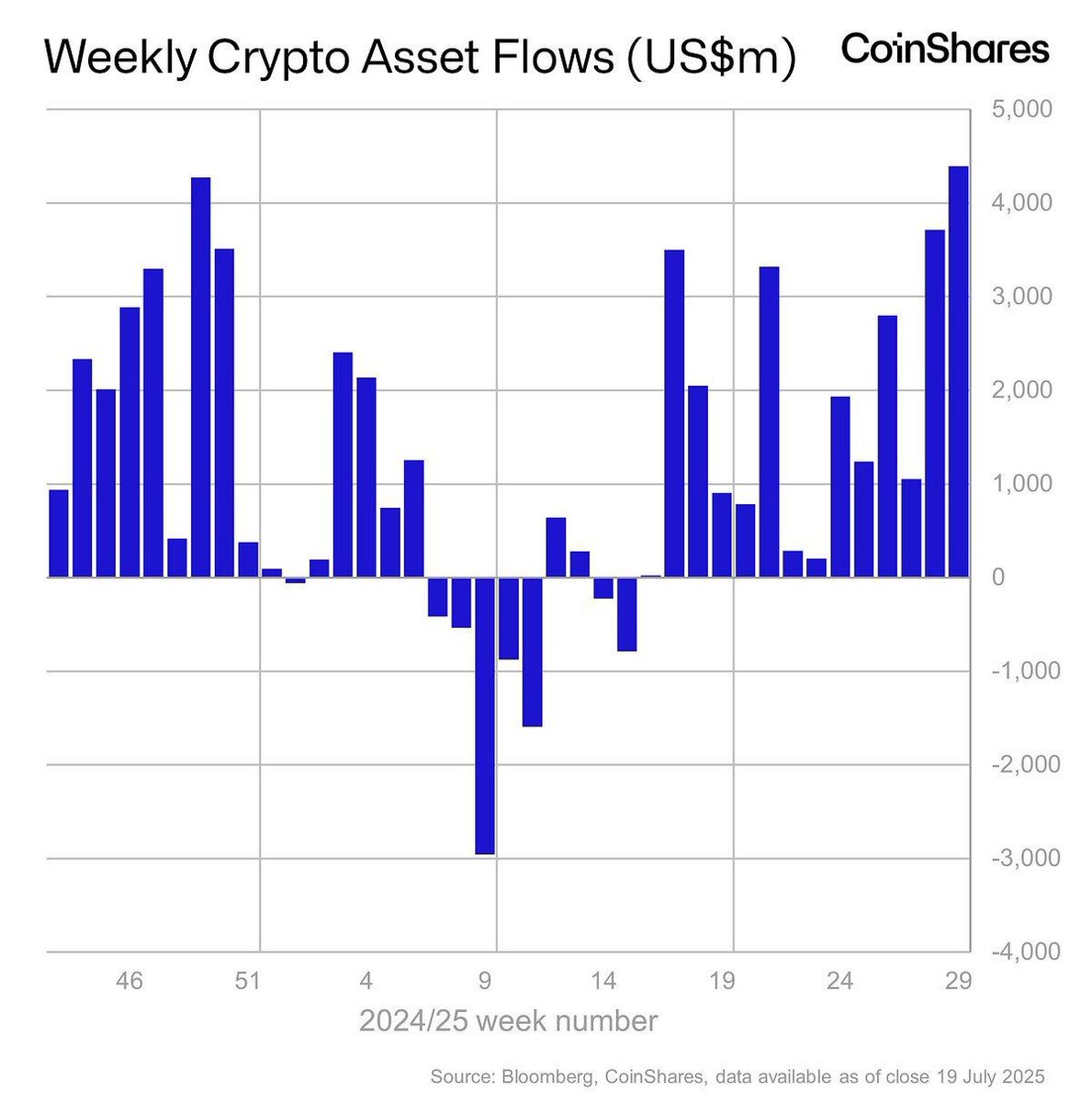

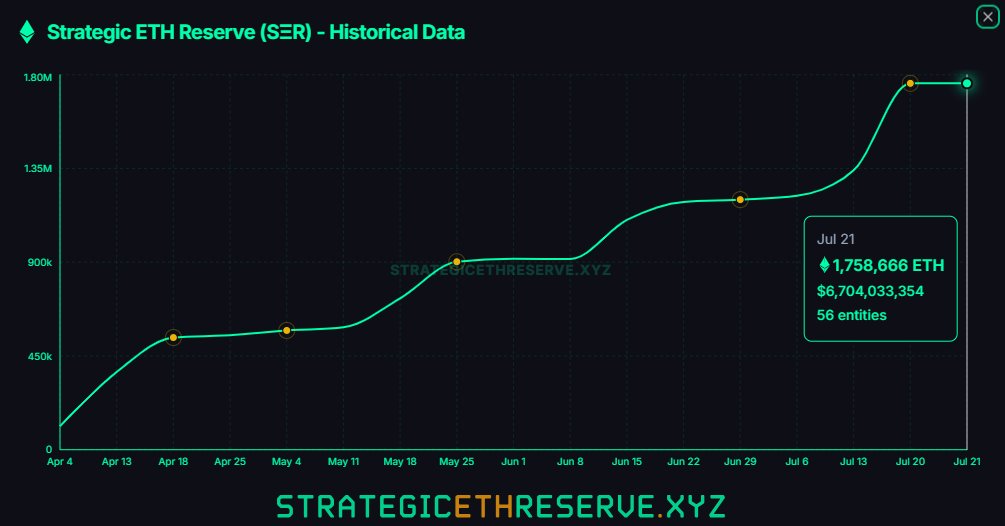

Last week's inflows for digital asset products were the highest ever at $4.39b. A large portion of these flows can be attributed to ETH-related products. 400,000 ETH were added to Ethereum treasuries last week. 56 entities now hold ETH reserves, up from 12 in April.

Key Onchain Metrics Surge to New Heights [Dynamo DeFi Pro Report] newsletter.dynamodefi.com/p/key-onchain-…

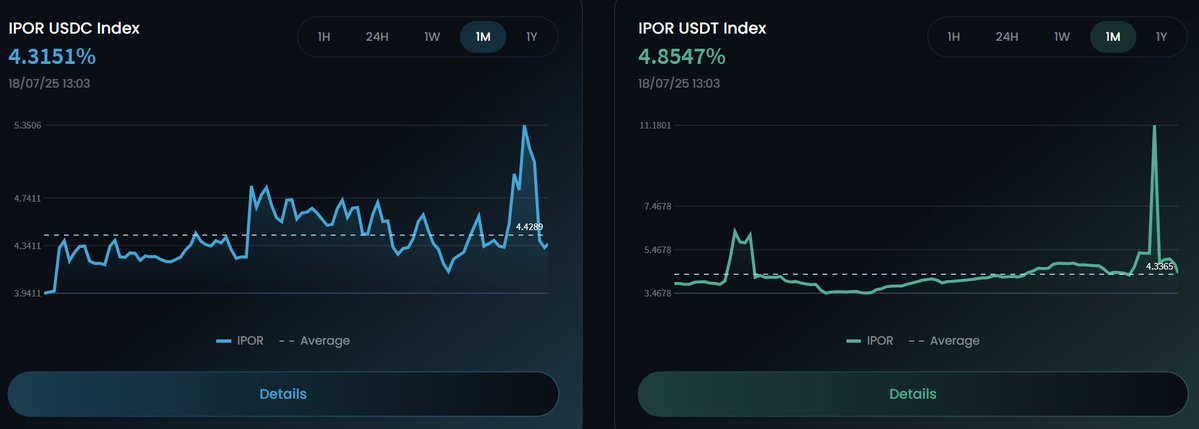

Onchain lending rates have been trending up all month, and briefly spiked yesterday. Rates returned to baseline for now. More money is being borrowed onchain.

The Dynamo DeFi Injective validator is ranked #2 in uptime. Injective is powering the future of onchain finance, and we're thrilled to support the mission.

Another massive week for Injective. Canary Capital filed for the first staked INJ ETF, bridging the gap between traditional finance and the decentralized future Injective is building. Investors will gain exposure to staked INJ. Instead of an ETF that simply holds tokens, the…

Another massive week for Injective. Canary Capital filed for the first staked INJ ETF, bridging the gap between traditional finance and the decentralized future Injective is building. Investors will gain exposure to staked INJ. Instead of an ETF that simply holds tokens, the…

1/ History is being made today! Canary Capital just filed the first US Staked $INJ ETF with the SEC, giving institutions and everyday investors a regulated path to access the native Injective token through traditional brokerages and banking rails. Here's why it's a big deal 🧵