Donald Schneider

@DonFSchneider

Deputy Head of US Policy at Piper Sandler. Tweets on public policy and the economy. Formerly Chief Economist @waysandmeansgop. Personal views only.

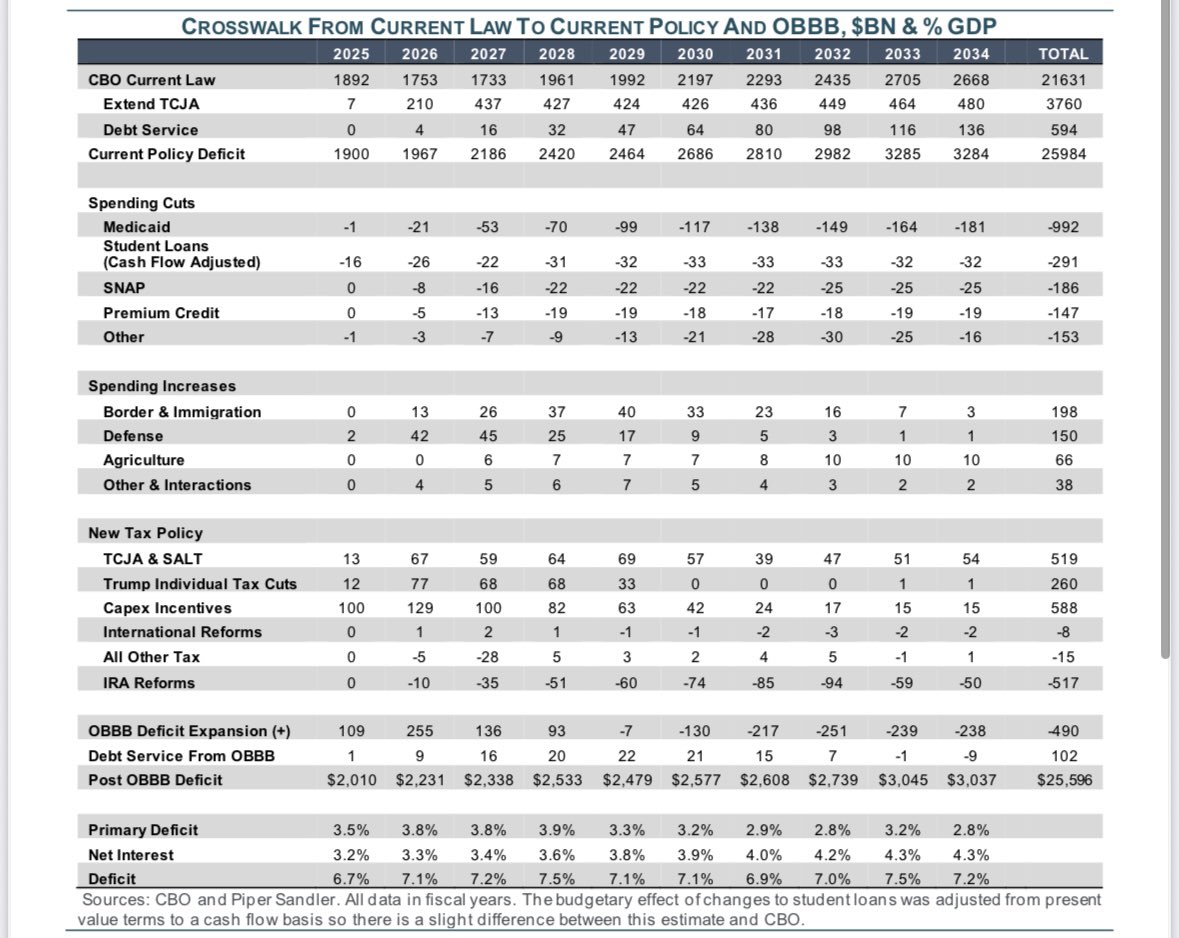

I’ve made a table to help people understand current law, current policy, OBBB and the all in impact on the primary deficit, interest costs, and the deficit. Posted here as public service.

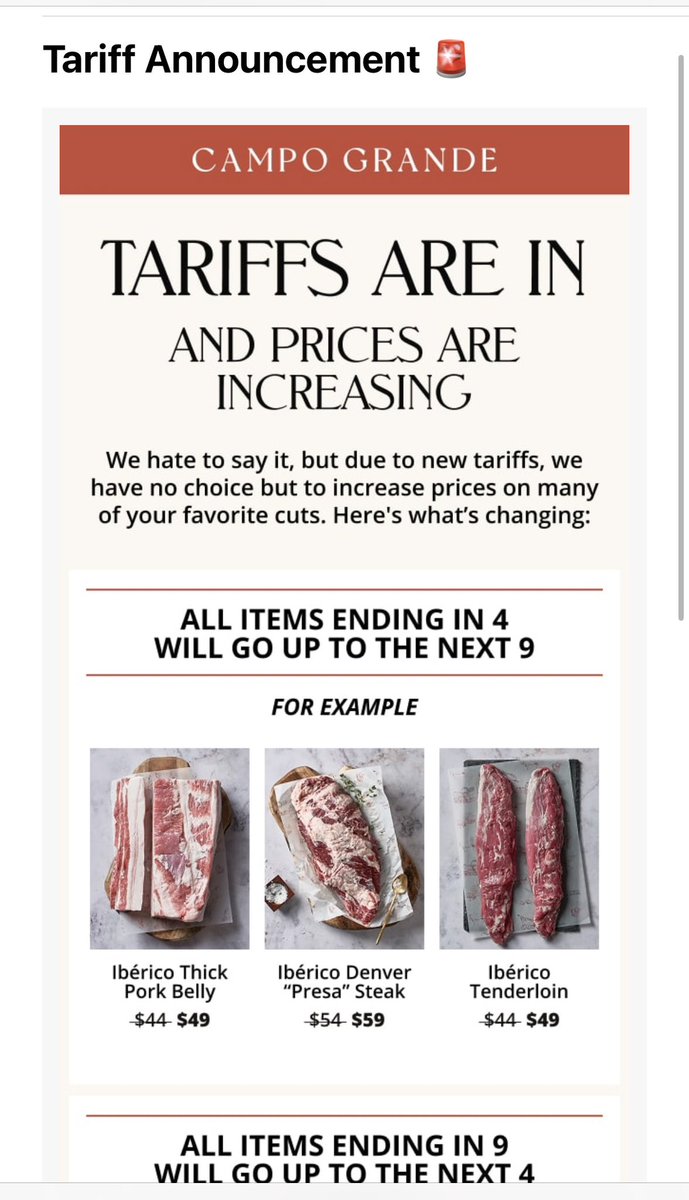

Not a huge mystery here. Tariffs are a tax increase. Expected to raise about 0.8% of GDP. Thats a bit smaller than the tax cut from say original TCJA. Fiscal multipliers around 1. Should produce meaningful growth slowdown of similar size. But OBBB also serves as offset.

Having broken most of the rules of politics, has Trump really smashed one of the supposedly iron laws of economics too? asks @gerardtbaker on.wsj.com/4fgfHhQ

It’s also quite soon. Business have anticipated the tax and built up inventories + only been faced with ~$60bn or so tax hit so far. That will grow as effective tariff rate reaches policy set rate. But we have $30tn economy. It’s quite large.

Not a huge mystery here. Tariffs are a tax increase. Expected to raise about 0.8% of GDP. Thats a bit smaller than the tax cut from say original TCJA. Fiscal multipliers around 1. Should produce meaningful growth slowdown of similar size. But OBBB also serves as offset.

This is not Golden Age economic growth GOLDMAN SACHS: "Our tracking estimate suggests that GDP growth in 2025H1 will be a bit over 1%, and we expect it to be a bit under 1% in H2."

The president says that if the Fed lowered short term rates, interest expenses for the U.S. would fall by $1 trillion per year. The U.S. spent $1.1 trillion on interest expenses in 2024, and so there's almost no way this claim is remotely true.

Who wants to tell him that the import price index measures the pre-tariff price? If foreigners were eating the cost of (roughly) 10% tariffs, pre-tariff import prices would be down 10%. They're not. Therefore Americans are paying basically all of the tariffs.

Import prices just came in WAAAY below expectations: June was up just 0.1% M/M, -0.2% Y/Y, while May saw a huge downward revision from flat to -0.4% M/M; still waiting for tariffs to be passed on by foreign producers...

BLS's import price indices explicitly do not include tariffs. So this chart is actually making the exact opposite point: foreign producers have likely eaten very little if any of the cost of US tariffs in the form of lower prices. 1/2

Meanwhile, the CPI data we got yesterday show clear evidence that tariffs are affecting the prices of import-exposed goods. x.com/ernietedeschi/…

Headline CPI at 0.29% MM, Core CPI at 0.23% MM, roughly in line with expectations. The impact of tariffs is becoming more salient. Apparel, which had seen cool inflation the last 2 months, grew 0.4% in June. Household furnishings grew 1%. Video & audio electronics grew 1.1%.

Imploring people to only tweet confidently about things you understand. Second, as matter of good staffing if you want to own this stat on the way up be prepared to own it on the way down. So be careful latching onto any one data point.

Unlike the Consumer Price Index (CPI), the Producer Price Index (PPI) doesn't include imports. Tariffs only indirectly affect PPI through later stages of the production process.

Zooming in and averaging capex expectation series. Tariffs will dampen the capex tailwind from OBBB. x.com/DonFSchneider/…

Challenge for the capex outlook. Here's capex expectations 6 months ahead. As was the case in 2018, after the boom in capex expectations tariffs & uncertainty around them dampened capex. Same is happening now.

Challenge for the capex outlook. Here's capex expectations 6 months ahead. As was the case in 2018, after the boom in capex expectations tariffs & uncertainty around them dampened capex. Same is happening now.

Why is Manufacturing Productivity Growth So Slow? Self recommending. enghinatalay.github.io/manufacturing.…

Let me highlight in particular our Tuesday 3:30-5pm panel discussion on tax policy and innovation with Glenn Hubbard @DonFSchneider Tim Simcoe @S_Stantcheva, moderated by @bfjo

I don't understand the new 50% copper tariffs. They're not going to jumpstart US production, aren't targeted to countries in which we're in a trade war, and will drive up prices on a wide range of essential goods. A couple mines in the US are world-class and economic without the…

For those who don’t know. Never had his Pulitzer pulled en.m.wikipedia.org/wiki/Walter_Du…

Duranty's spirit is still very much alive at the NYT!

The (more or less) flat-lining of the red line in recent years is a success story in my view. I imagine Brad wants the red line to drop, but a rough leveling off is meaningful on its own.

And you would think that the Trump administration would be focused like laser on reclaiming the 1 pp of US GDP corporate tax base now located in the world's low tax jurisdictions (it has chosen instead to defend the right of US firms not to pay US tax :) ... ) 4/

I have been waiting to write this piece for a long time. I think people are misinterpreting the lessons from the China Shock open.substack.com/pub/agglomerat…