Didi

@DidiTrading

Syndrome down, money up @unidentifieddao

Today marks the start of my daily journal 📝 Inspired by @onchainsorcerer, I’ll be sharing my actions and thoughts each day. My goal is to create structure and consistency, reflect, stay disciplined, and work toward my goals—hoping to inspire others along the way!

Day 263: Quiet weekend on my end. Flew back to my home country to catch up with family & friends. Feels good to take a step back sometimes. Most charts are shaping up nicely, so I’m feeling optimistic about the near future. I picked up a few coins with decent size. Grind…

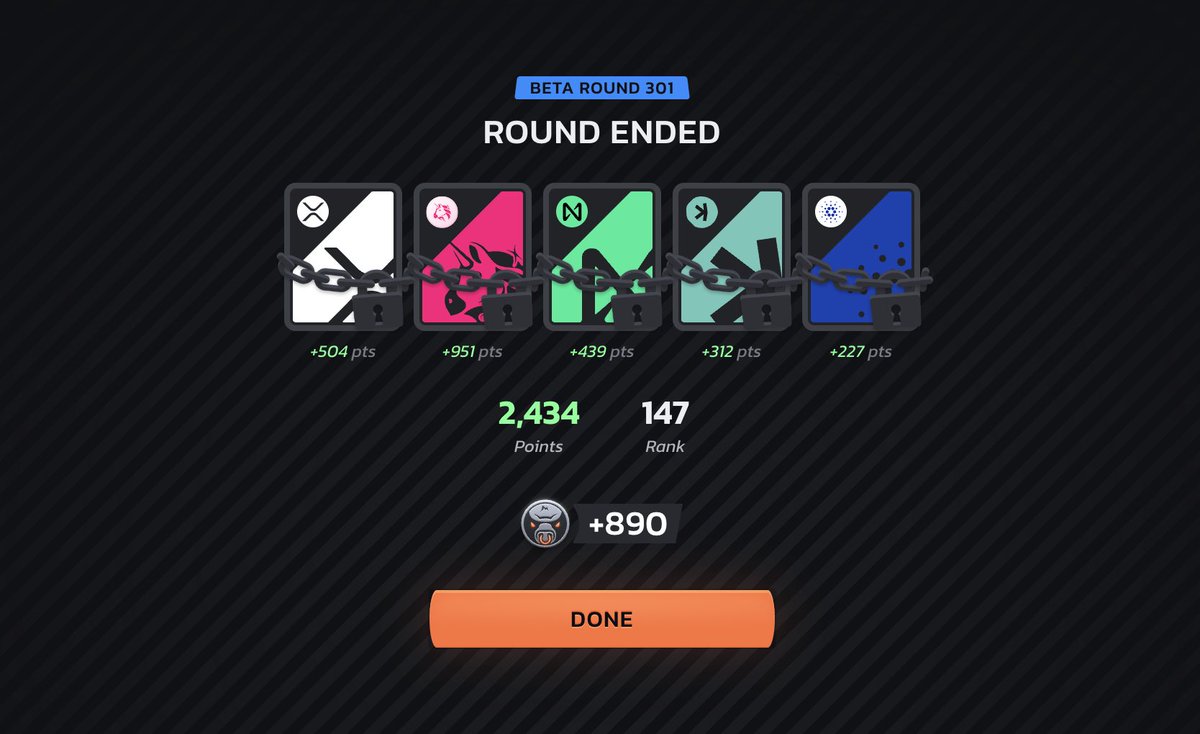

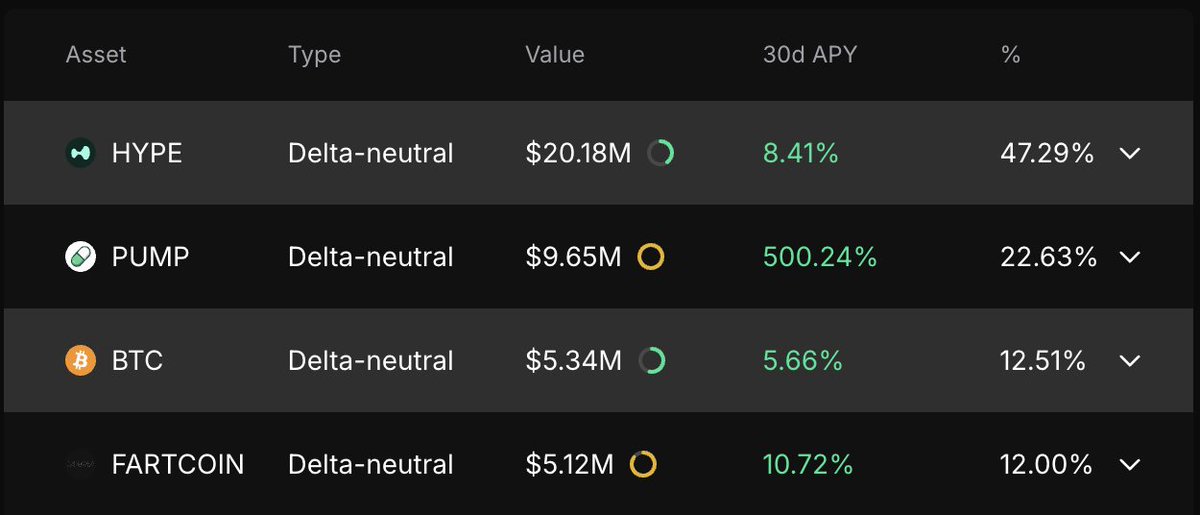

Day 261: @Hyperunit is one of the most underrated airdrop farms right now. It allows you to deposit native spot tokens directly into Hyperliquid. (supports: BTC, ETH, SOL, FART, PUMP & SPX) If you’re already holding any of these, it’s a no-brainer to park a portion on…

Day 260: It’s easy to blame others when you’re down bad but truth is, you’re the one who clicked buy or sell. Nobody forced you. You made the decision, and you’ve got to own it. Whether it’s a call you followed or some narrative you believed in. If you didn’t manage your risk…

Day 258: Deposited some USDT0 to earn 18% APY on Hyperlend. >Farming the Hyperlend airdrop >Farming $HYPE #2 airdrop >Earning 18.53% APY on stables Hyperlend is an Aave fork, so it should be safe to park capital in. I also used thehyperliquidbridge[.]xyz to bridge, just to…

![DidiTrading's tweet image. Day 258: Deposited some USDT0 to earn 18% APY on Hyperlend.

>Farming the Hyperlend airdrop

>Farming $HYPE #2 airdrop

>Earning 18.53% APY on stables

Hyperlend is an Aave fork, so it should be safe to park capital in.

I also used thehyperliquidbridge[.]xyz to bridge, just to…](https://pbs.twimg.com/media/GwZQnNJWgAAdltF.jpg)

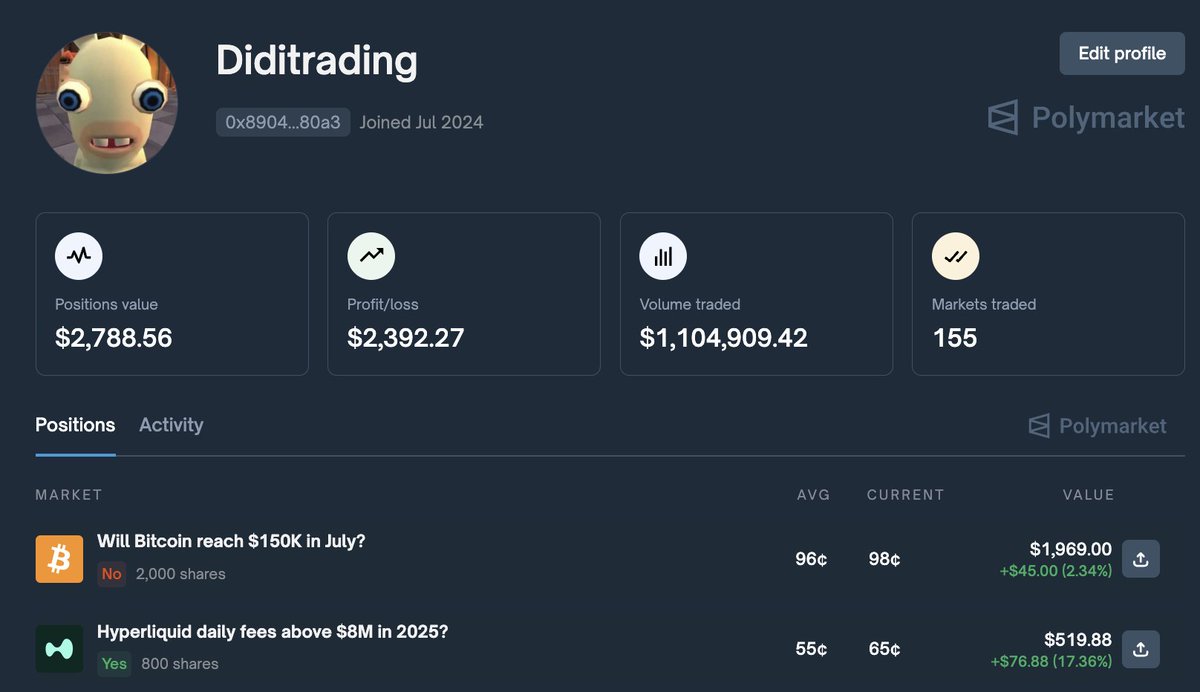

Day 257: Polymarket is still my highest conviction airdrop farm. Feels like most people will end up completely sidelined if they ever decide to tokenize. And in hindsight, it'll look painfully obvious. There’s been a lot of noise lately about them going the IPO route, all…

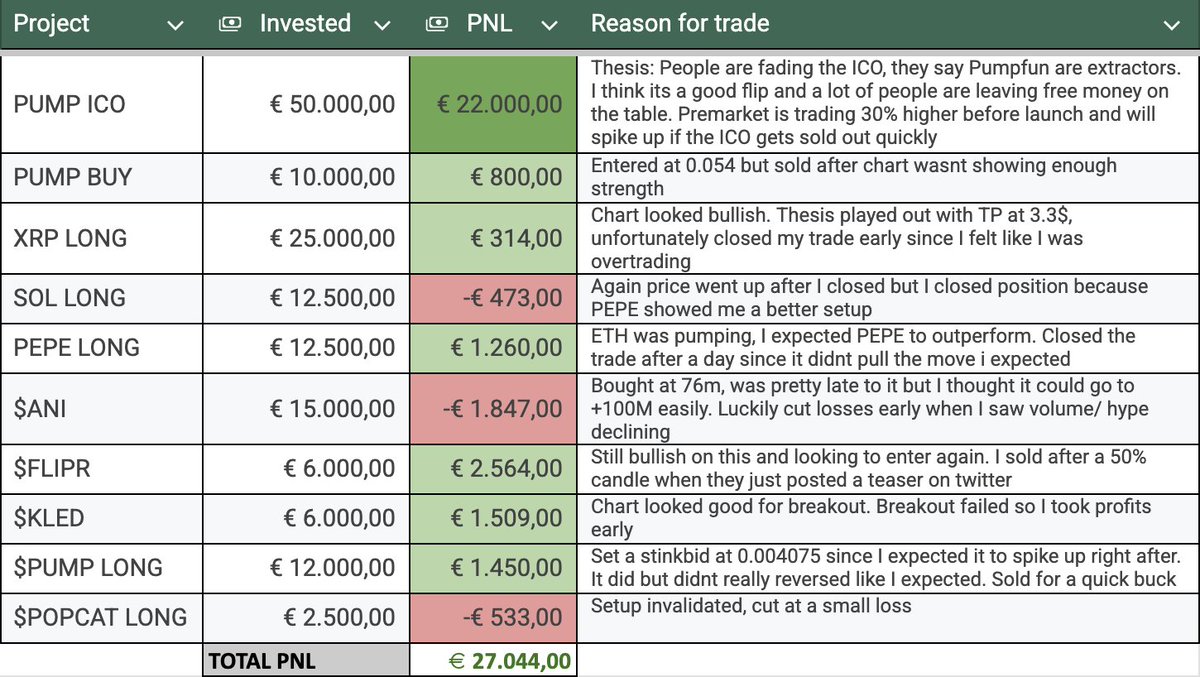

Day 256: These are all trades I took this week (14-20 July). I don’t like showing PNL, but this is how I usually log trades in my physical notebook. I typically take between 3–10 trades a week. Once you start writing things down on paper or in Excel, you’ll begin to spot…

Day 255: Stop taking financial advice from random people on the internet. Anyone telling you a specific asset is “definitely” going up or down is either lying or trying to sell you something. No one knows where the price of any asset is headed. If Bitcoin was guaranteed to go…

Day 253: Kaito just announced their new capital launchpad. If you’ve built mindshare around a project, chances are you’ll get early investment access or a chance to boost your airdrop allocation by providing capital before launch. I think it’s a great idea which could filter…

Day 252: 10 things every crypto trader should have: - Hardware wallet (Trezor > Ledger) - Steel case for your seed phrase (fire/waterproof) - Browser extension that flags malicious txs - Physical notebook to journal trades - Monthly PnL + net worth tracker (Excel) - CoinList…

Day 251: Locked in a 45% ROI on the $PUMP ICO (+22.5k) Might still go way higher in the coming weeks, but I’m fine locking in profits here. What made this play even better is that I hedged 50% of my $PUMP stack at 0.0062 on Hyperliquid, farming a solid amount of perp volume in…

Day 250: Managed to ape 50k into the $PUMP ICO. Kinda crazy how you got 12 minutes to ape in size and be able to sell 60% higher one day later If you play your cards right, you can make an unjustified amount of money in crypto to the point where it doesn’t even feel fair for…