Dave | Passive Income Pro

@Dave_CashFlow

29yo | 7+ years in finance 📈 MBA | Cash flow investor with $30k+ annual passive income 💵 High yield dividends, Options selling & Real Estate 🏡 NFA ❌

Net Worth Tracker updated for the month of June 2025 Achieved a 5.6%+ increase MoM to reach $283k 💰 This marks 3 consecutive months of increases and I am now back to having cash coming in instead of mostly going out 😅 👉 Brokerage & Retirement accounts increased 6.9% & 7.2%…

Net Worth Tracker updated for the month of May 2025 Achieved a 7.7%+ increase MoM to reach $268k 💰 Marking 2 consecutive months of increases, on the back of 15 months of "mini retirement" 😉 👉 Brokerage & Retirement accounts increased 7.9% & 10% MoM, respectively 👉 Home…

As someone who was a fervent $ULTY denier for many many months I am here to admit I was WRONG Just turned on daily recurring buys Another lesson in being willing to admit when you’re wrong & change your opinion in light of gathering more information 🤷🏼♂️

Solid week of options selling 👍 $406.28 in total realized profits while collecting an additional $307 in premiums for the week Was working with $HIMS $OSCR $NEM $TSLL $IBIT $CMG & $SOXL

Just paid $2.54 for an iced coffee from Cumberland Farms Since when did this garbage coffee go above 99 cents?!? What a world we are living in 😅

Good morning & happy Sunday to all those who celebrate ☀️☕️

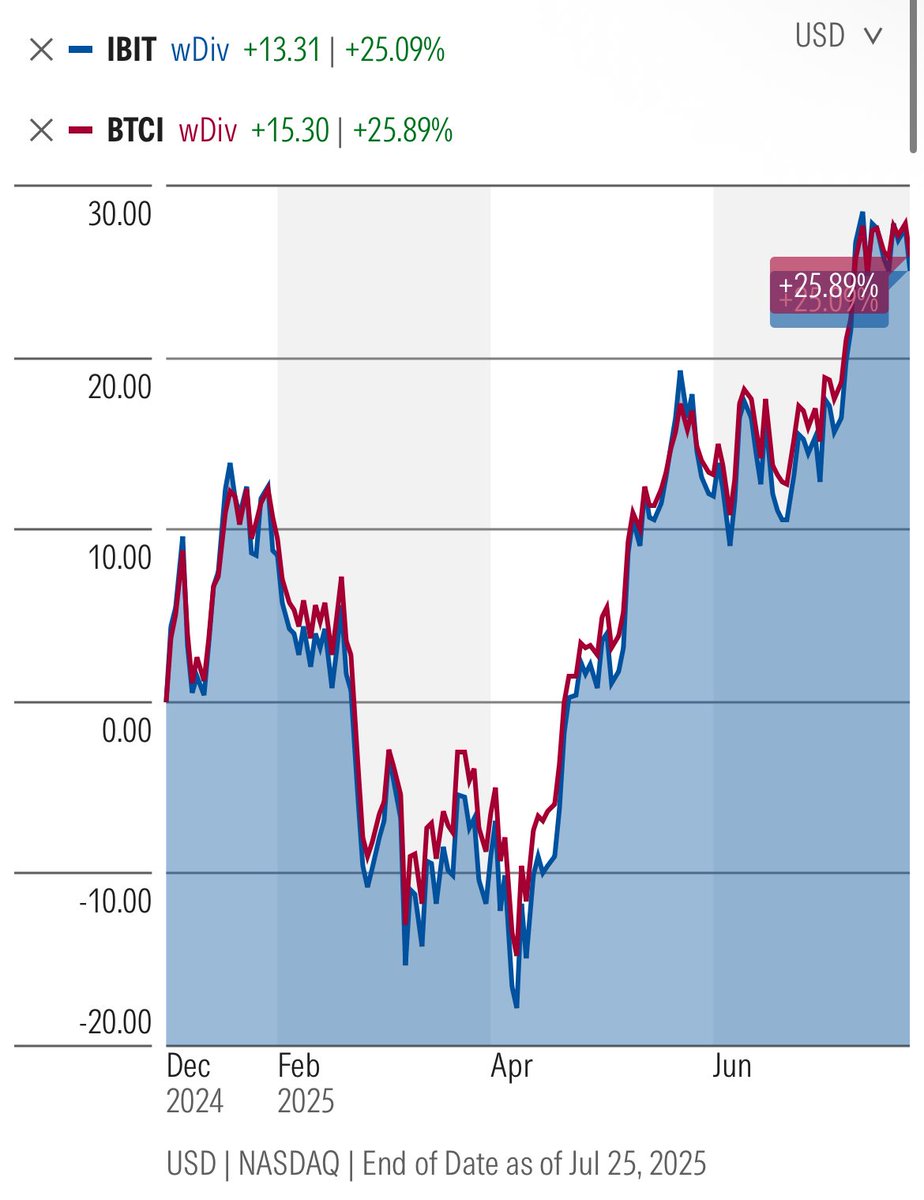

CRAZY BUT TRUE… $BTCI has outperformed $IBIT $BTC in 2025 YTD 👀

🚨 BREAKING: LAWMAKERS PRESS FDA TO TARGET COMPOUNDED, FAKE WEIGHT-LOSS DRUGS $HIMS $NVO $LLY

$HIMS oh my goodness 😳

More profit taking on $HIMS cash secured puts ~90% realized profits on each trade $HIMS continues to be a money printer and I definitely don’t have enough shares

Active morning ☀️ Sold 2x $IBIT CSP’s $63 & $62 strike expiring 8/1 1x $OSCR Covered Call $17 expiring 8/1 4x $SOXL CSP’s $19 strike expiring 8/1 Rolled the premiums collected into $ENPH & $SMH shares Still have the $ULTY $YMAX $CHPY & $GPTY auto buys set up for this afternoon

2 days in to my $ULTY adventures and I’m already doubling up on my daily recurring buy because the dip was irresistible 👀 Up to $75 worth of shares! 😂

More profit taking on $HIMS cash secured puts ~90% realized profits on each trade $HIMS continues to be a money printer and I definitely don’t have enough shares

The near term top is in 😳 My father-in-law has never bought a tech stock and has only stuck with blue chips & large value companies Two days ago he sold his Kraft Heinz & General Mills positions to buy Nvidia $NVDA Be careful folks… 😬

European countries do Pilsners & Lagers way better than North American countries And it’s not even close in my mind

Little pre-lunch 10k & time to celebrate properly with some 🍻 Managed to nail 4x runs this week! 1 easy, 2 speed sessions & this was the long run for the week Starting to build some consistency back into this sport!

If you were a student and a teacher said your work read like it was generated by AI, but you did in fact do it yourself… Are you taking that as a compliment or an insult? 🤔

Friday dividends are hitting 🤝🏻 $106.21 from sitting on my hands and owning $QDTE $XDTE $RDTE $YMAG $YMAX $LFGY $GPTY & $PBDC

And for you derivative income investors This is why you might want a product like $IAUI or $IGLD as opposed to $GDXY for your Gold exposure The YieldMax crew talked about how they were getting better premiums by writing options on $GDX miners as opposed to $GLD spot gold This…

$NEM CFO resignation driving the stock down over 7% while Gold is up on the day Business specific risk like this is what makes it difficult to justify owning the gold miners instead of just getting exposure to spot gold

$NEM CFO resignation driving the stock down over 7% while Gold is up on the day Business specific risk like this is what makes it difficult to justify owning the gold miners instead of just getting exposure to spot gold