Arbor Data Science

@DataArbor

The team at Arbor Data Science provides daily commentary and data-driven analysis for institutional clients of Arbor Research & Trading.

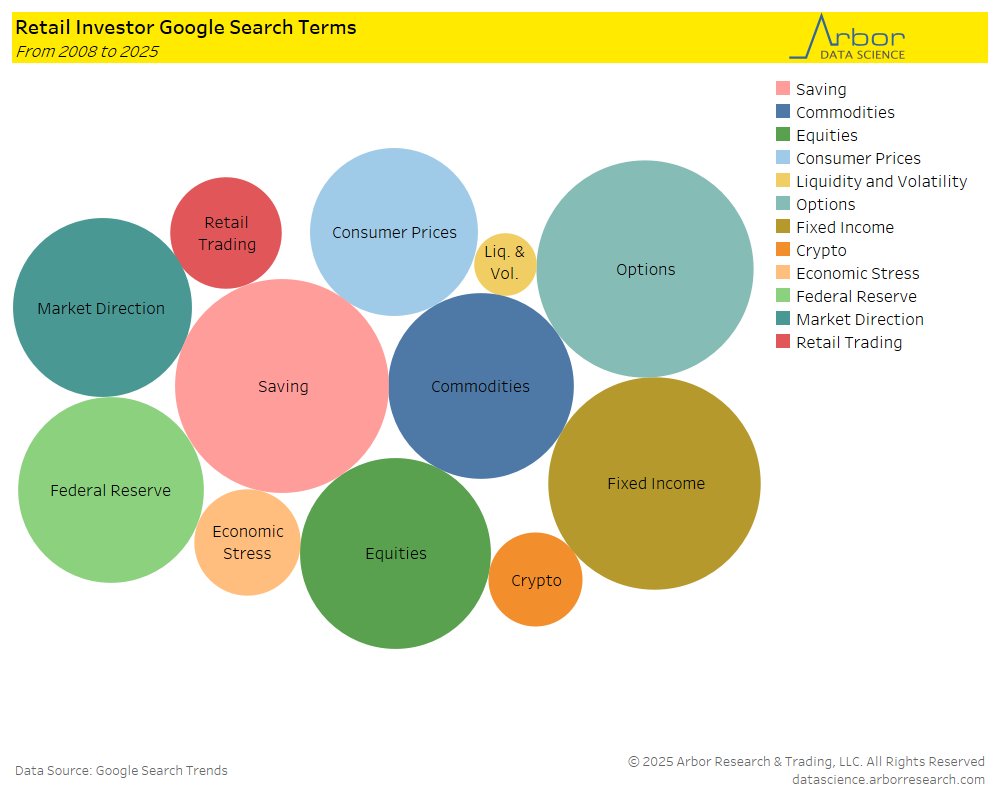

What topics are Retail Investors searching for? Utilizing Google Search Trends, ‘Options’ currently tops the list, followed by ‘Savings.’

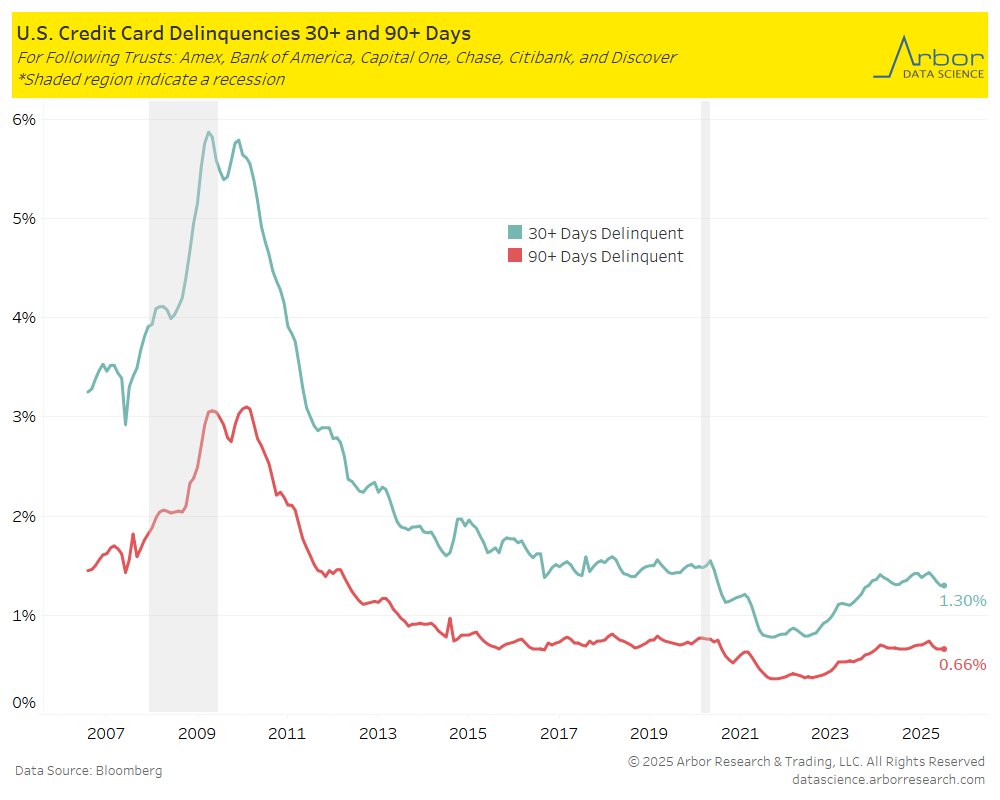

Delinquency rates on credit cards declined in June 2025 to 1.30% (30+ Days Delinquent) and 0.66% (90+ Days Delinquent).

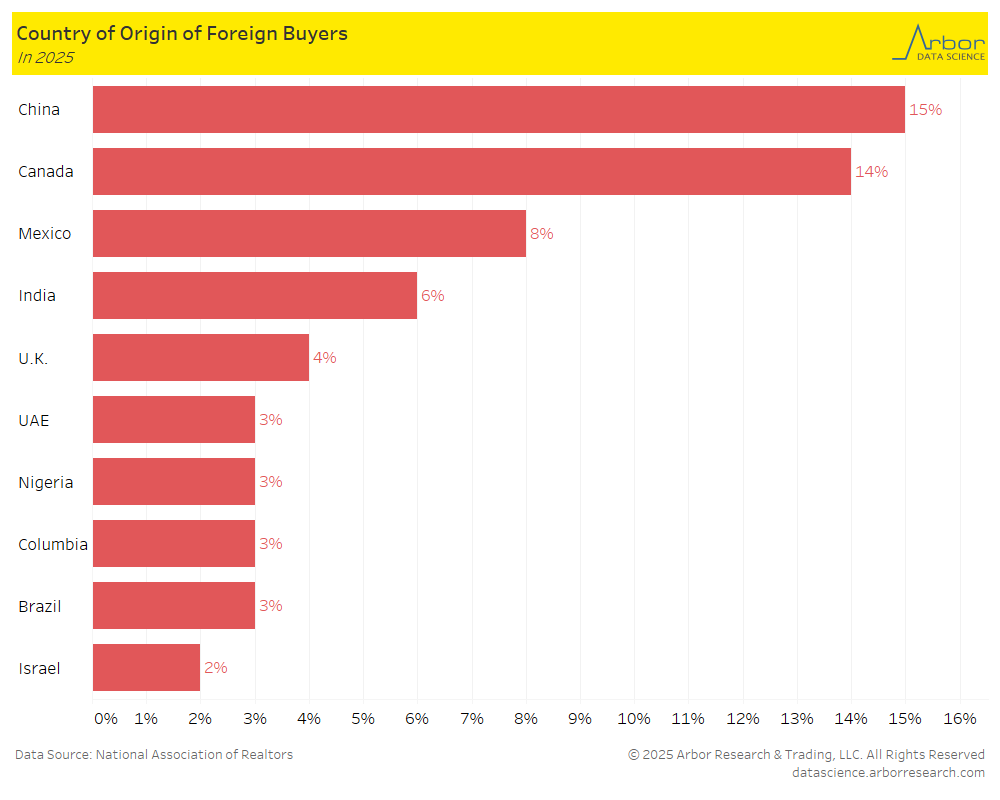

Buyers from China were the largest group of foreign purchasers of U.S. homes at 15% in 2025.

In 2025, Young Boomers (ages 60 to 69) account for the highest share of homebuyers at 26% and the highest share of sellers at 31%.

Jim Bianco @biancoresearch explains that “he’s thinking about it like a real-estate guy,” pointing to Trump’s career as a developer. bloomberg.com/news/newslette…

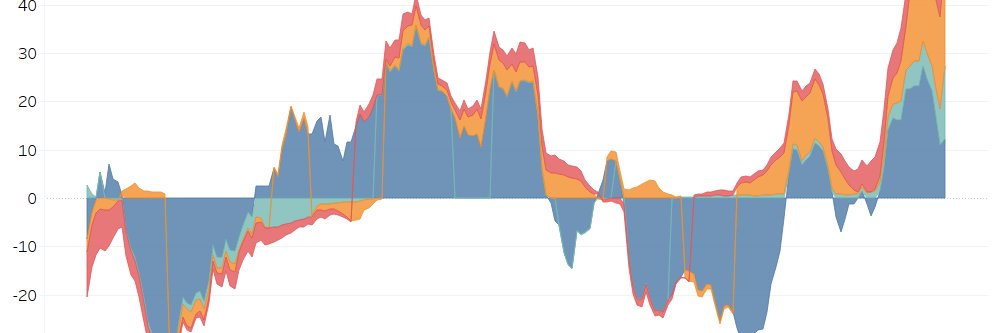

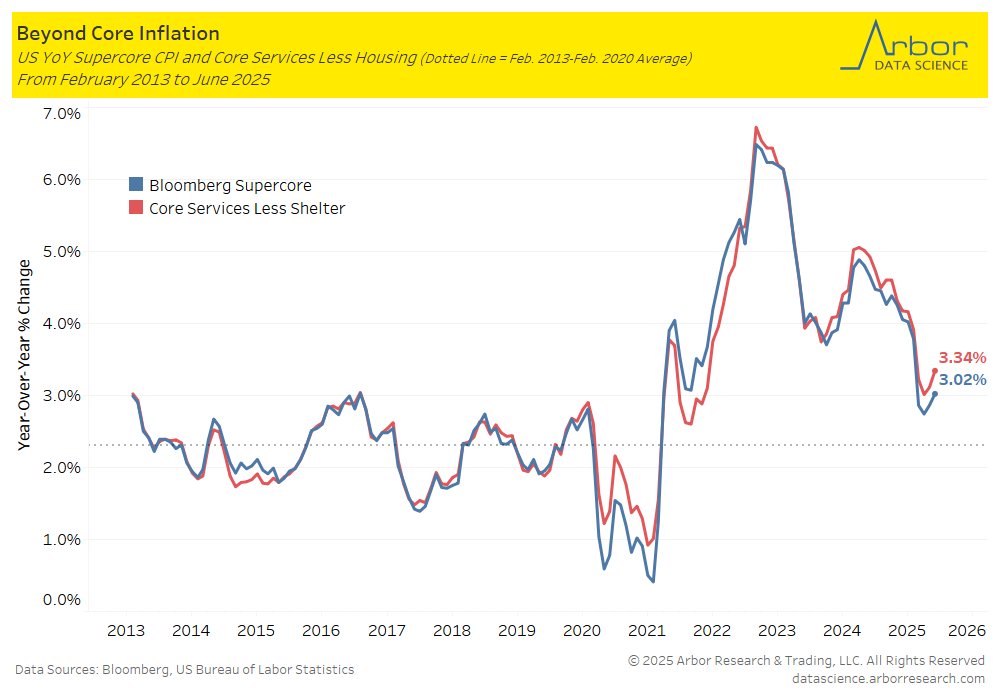

Core services is beginning to become a issue. It is far from out of control, but it is no longer deflating like it did for much of 2024 and early 2025. @SamuelRines :Macro Strategist at WisdomTree and frequent contributor to Arbor Data Science

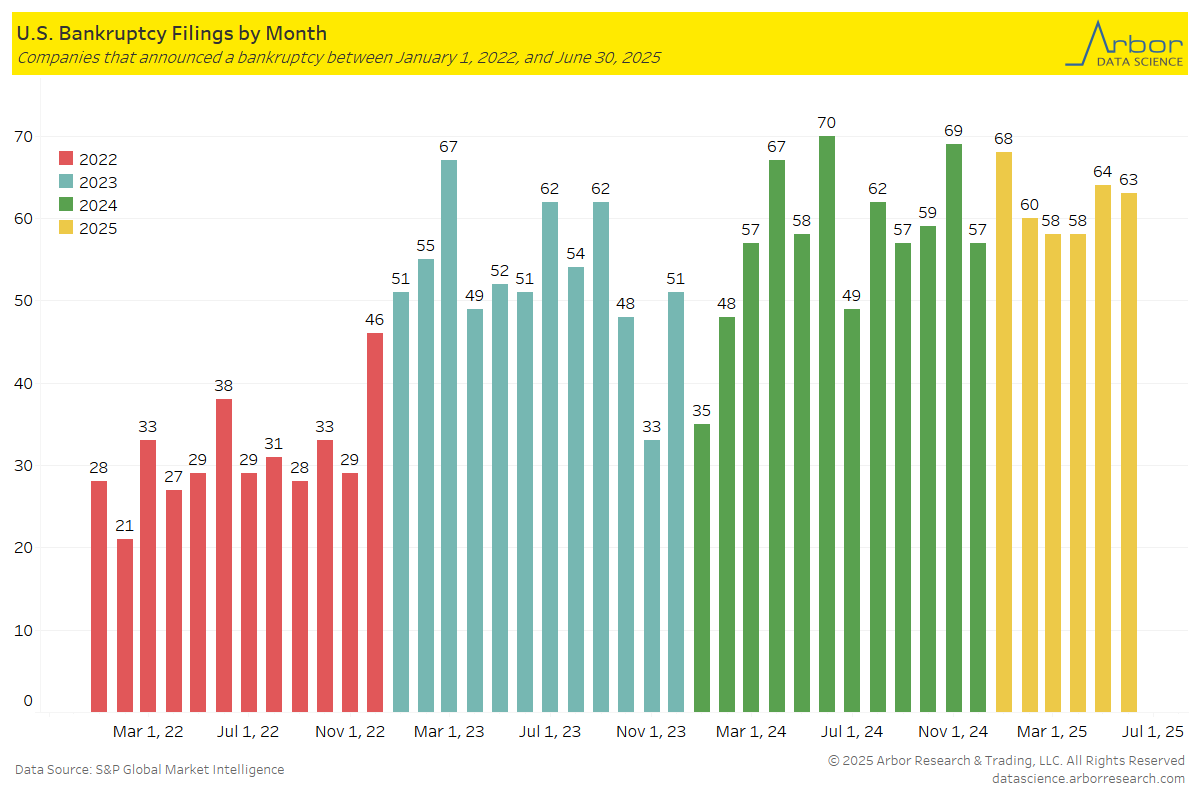

There were 63 corporate bankruptcy filings in June 2025, a decrease from 70 filings in June 2024.

There were 371 U.S. corporate bankruptcies through the first half of 2025.

In 2024, 27% of student loan borrowers with an annual household income of <$25,000 and $25,000-$49,999 were behind on their payments.

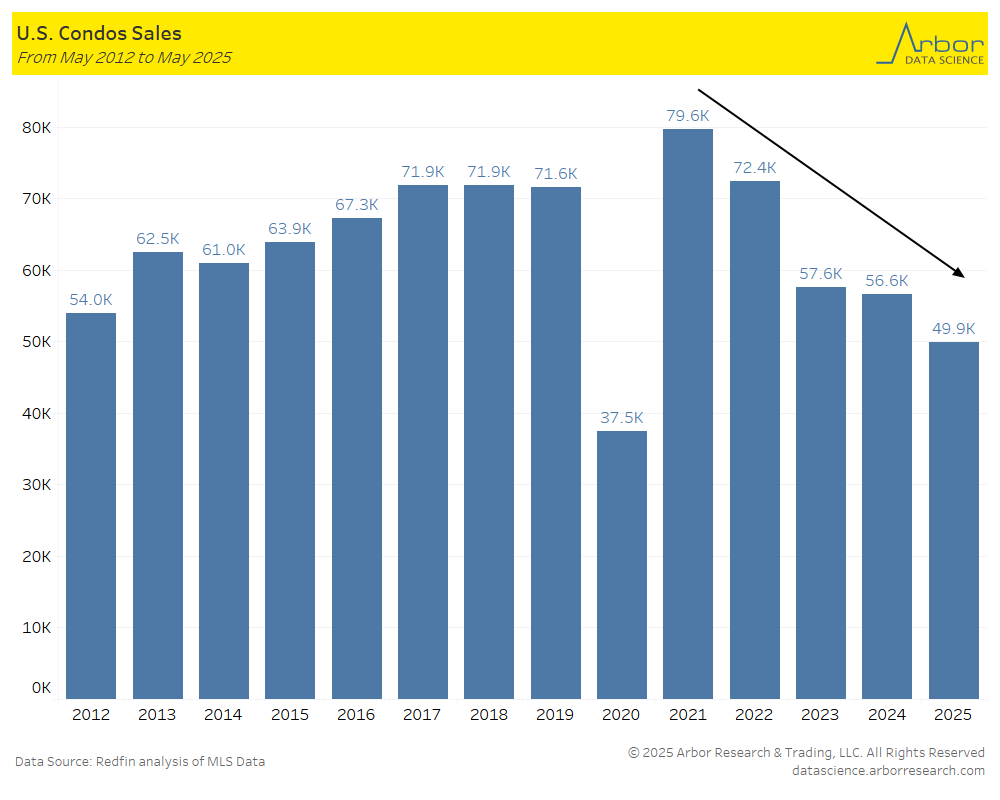

In May 2025, there were approximately 50K closed condo sales in the U.S., the second-lowest level since 37.5K sales in May 2020.

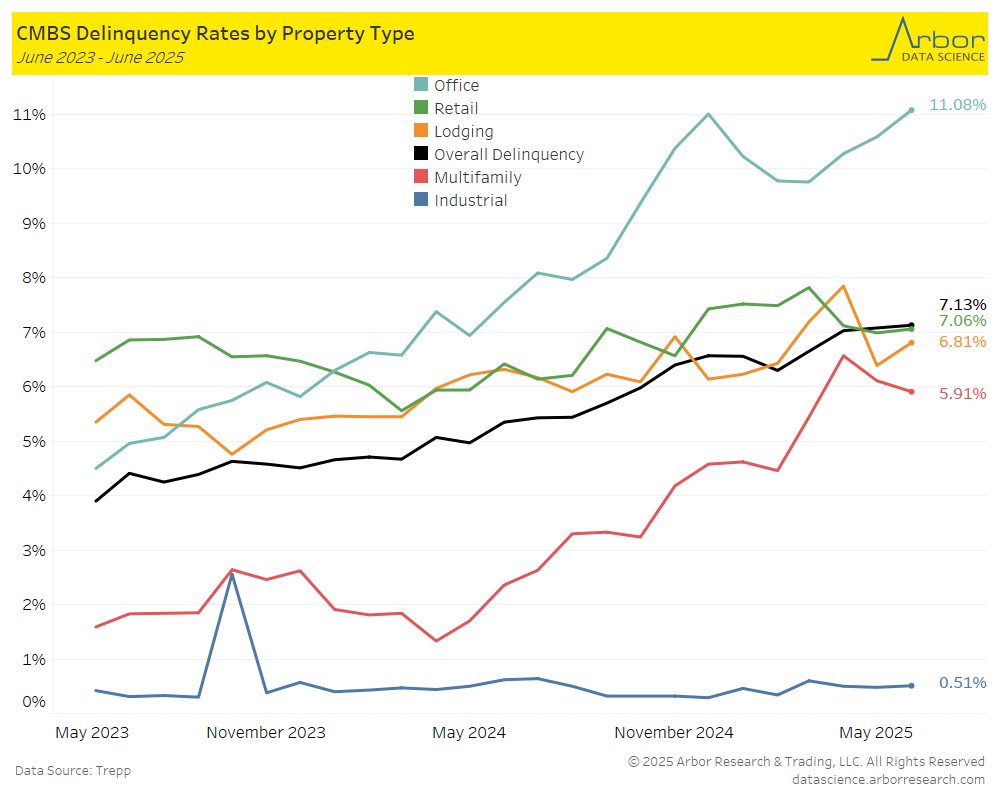

Covid did not kill the office market. Work from home has waned but not reversed. It remains prevalent across significant swathes of the economy, and it will continue to as well. @SamuelRines :Macro Strategist at WisdomTree and frequent contributor to Arbor Data Science

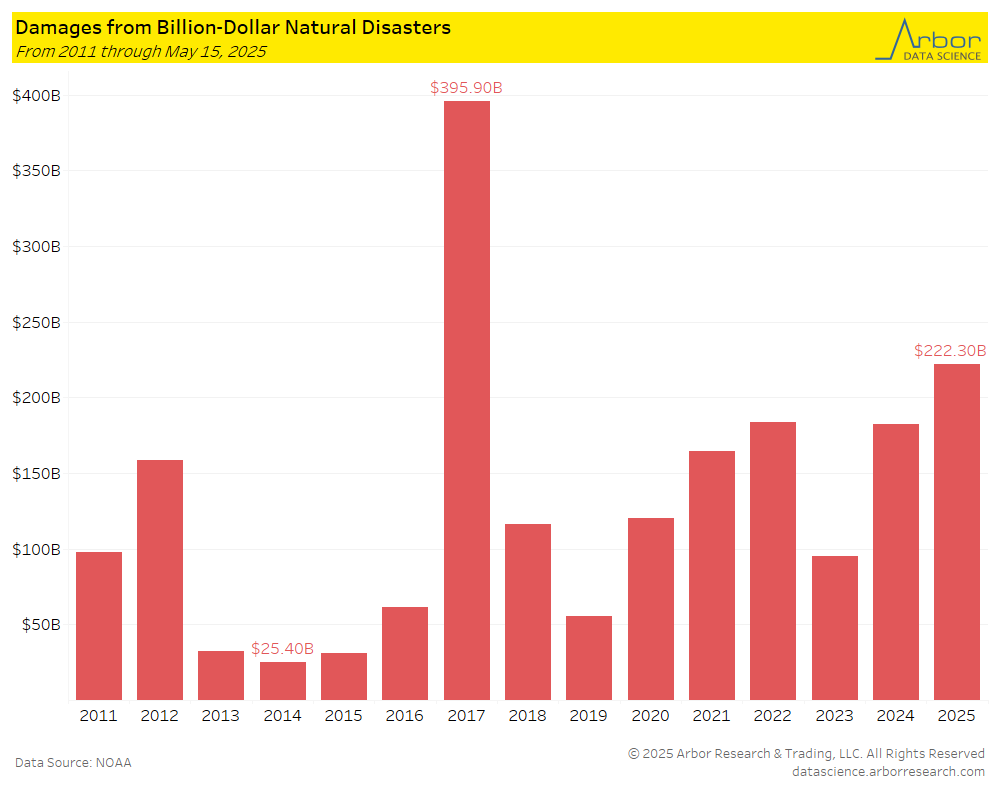

Prior to the flooding in Texas, total damages from natural disasters were $222.3 billion in the U.S. in 2025 (though 5/15/25).

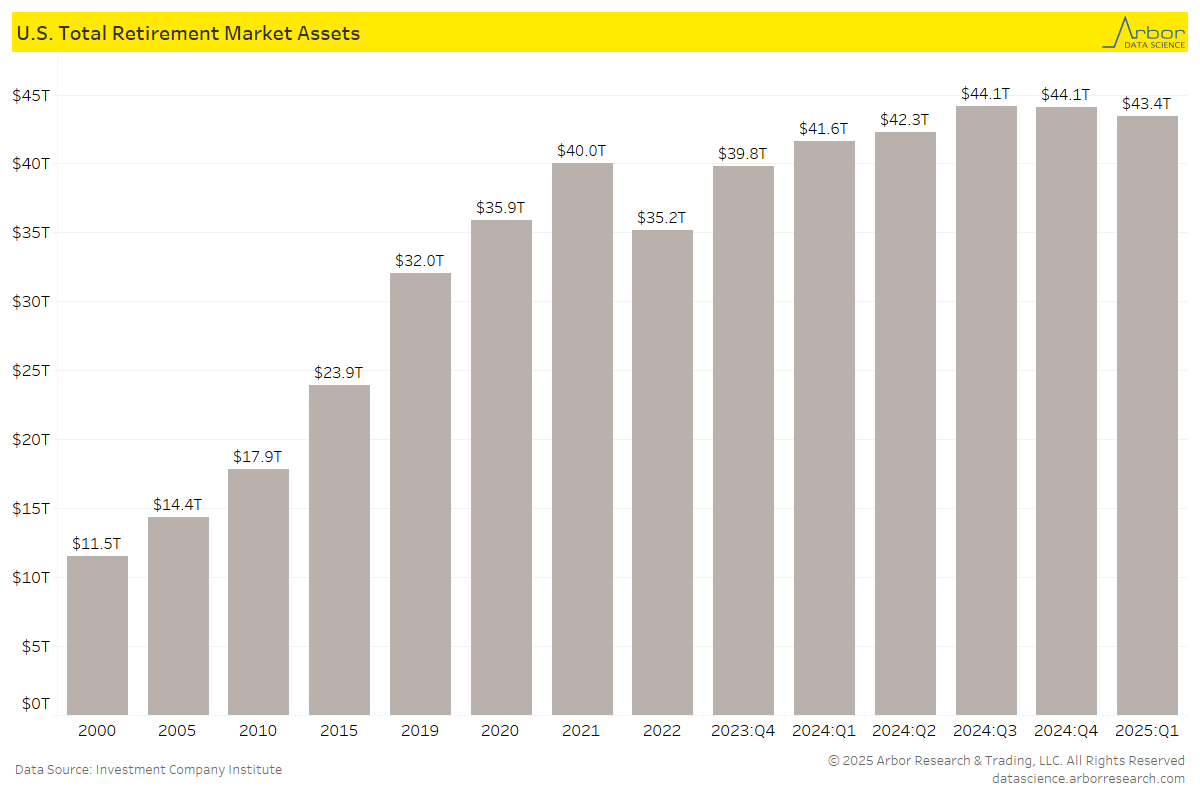

Total retirement market assets declined in Q1 2025 to $43.4 trillion, from $44.1 trillion in Q4 2024.

Total food spending in the U.S. was $2.63 trillion in 2024, up from $2.57 trillion in 2023.

The Education and Health Services sector had the most job openings in May 2025 with 1,763,000 jobs.

The U.S. homeownership rate declined in Q1 2025 to 65.1%, down from 65.7% in Q4 2024.

According to SmartAsset, the state where you need the highest income to live comfortably was Hawaii at $124,467 in 2025.

We use Google Search Trends to illustrate changes in search activity relating to the process of filing for Unemployment from 1/1/2025 to 6/22/2025.

That is one of the more important employment segments that could keep the labor market buoyed through tariff and trade uncertainty. The vacations of 2025 may be the labor market’s savior. @SamuelRines :Macro Strategist at WisdomTree and frequent contributor to Arbor Data Science

The median price for U.S. Existing Home Sales trended higher in May 2025 to $423,000.