Luca

@CrypticTrades_

Living in The Roaring 20's.

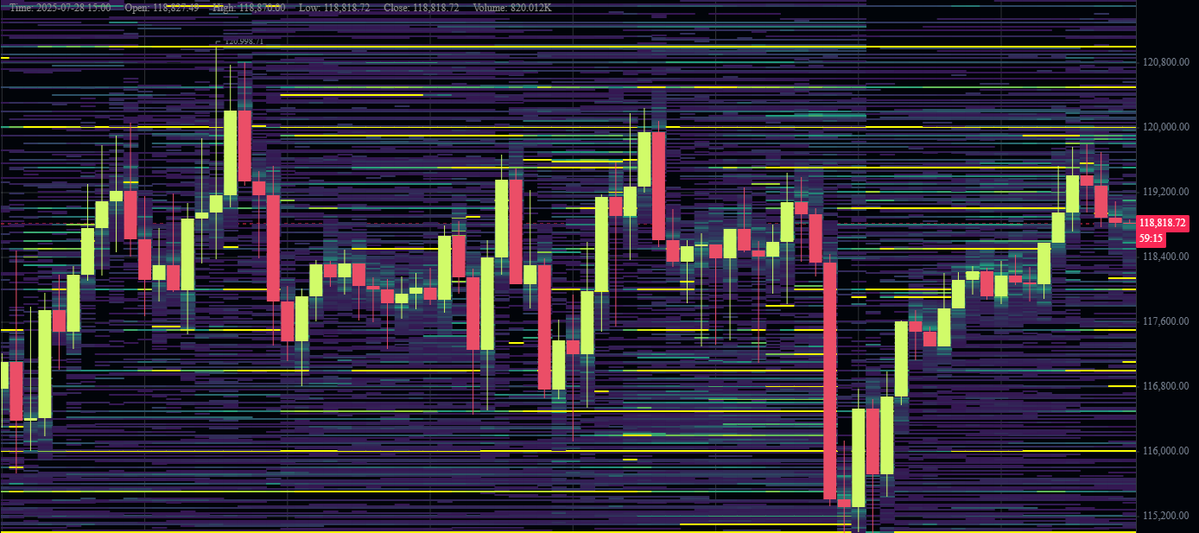

$BTC - There's a big sell wall on Binance at $120,000. You can see each time the price testing the liquidity pockets, and stopping into the sell wall. This is how market makers keep protecting the range highs, so build up liquidity for the next big breakout higher.

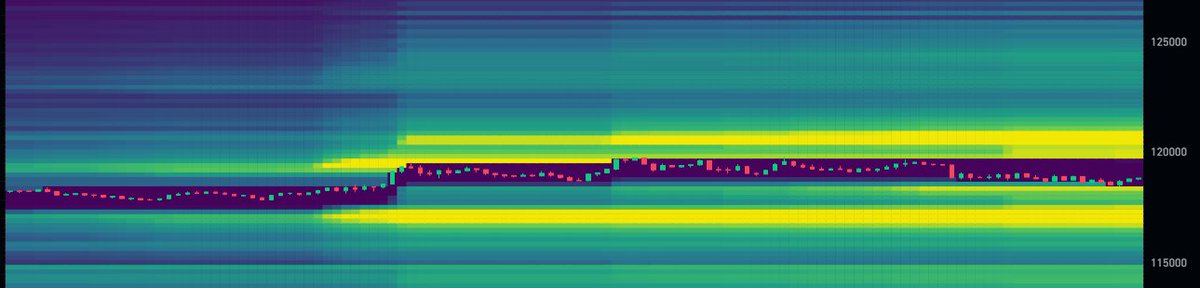

Liquidation Heatmap on $BTC: Looks like range highs got protected once again. This is BULLISH for the high-timeframes, even if degen longs suffer for a bit, it marks the perfect setup for the next breakout higher.

$BTC - Market makers are protecting the range highs to lure in bears, trap late longs, and build up liquidity for the next leg up, just like they did before the short squeeze to $123,000. This compression phase is meant to create complacency for bears before a bigger move.…

The first time I introduced the Emotional Gap thesis was back in September 2024, when most were screaming recession. That preceded the massive run-up in November. The second time was in early April, again, recession, stagflation, and tariff panic dominated the headlines. And…

In this irrational fear, uncertainty, and doubt on $BTC, miners and other equities is the BEST TIME to increase total portfolio risk. Major institutional investors need to sell, and they’ll require a strong counterparty to do it. They have used both Time-Based Capitulation, as…

The cycle top volatility trap is setting up for $BTC. As we get closer, the swings are going to get bigger and bigger. Low-timeframe moves will flush out traders even when they're spot-on about the bigger picture. Perfect analysis, wrong timing, liquidated anyway. This is why…

I believe we’re just 3–4 weeks away from the decoupling phase. That’s when TRAD-FI markets will enter a distribution range, while liquidity begins rotating into risk-assets like $BTC. It’s the same thesis that led me to call the bottom back in early April.

A lot of chatter lately about $BTC showing strength against $SPX and equities. In the short-term, I don’t think this changes much, especially with key support levels still at risk. A sweep below $76.6K is still on the table if we break those. Read more here:…

$BTC - Max Fuckery will return. There will be no winners on the low-timeframes. Patience is the one that will prevail.

Emotional Gap. ✅

In this irrational fear, uncertainty, and doubt on $BTC, miners and other equities is the BEST TIME to increase total portfolio risk. Major institutional investors need to sell, and they’ll require a strong counterparty to do it. They have used both Time-Based Capitulation, as…

Was planning a new deep-dive on $BTC today, but honestly, not much has changed since the update I shared a few days ago. If you haven’t seen it yet, make sure to check it out below. 👇

$BTC - Market makers are protecting the range highs to lure in bears, trap late longs, and build up liquidity for the next leg up, just like they did before the short squeeze to $123,000. This compression phase is meant to create complacency for bears before a bigger move.…

Let me know if you would like to see more videos like this in the future.

New video just dropped: a full breakdown on $OSCR, both my technical and fundamental outlook. Took a break from $BTC updates to cover this one after seeing all your requests. Let me know in the comments if you want more like this. Watch here: youtu.be/ZMzcMmc04u8