Coinbase Asset Management

@CoinbaseAM

Premier asset manager creating strategies for institutions to engage in digital assets. Wholly-owned, independent subsidiary of Coinbase Global, Inc.

Our Q3 report, Charting Crypto: Tailwinds Take Shape, is now live. We highlight the trends that matter most, including the unstoppable growth of stablecoins, the attractiveness of building onchain, the surge in ETH ETF inflows, and more: 1. There’s no stopping stablecoins.…

Coinbase AM’s Eric Peters joined @davidlin_TV to discuss the state of the crypto market and how developing tailwinds could drive asset prices higher. Eric assesses some of these tailwinds—including regulatory clarity, fiscal policy, and market volatility—and whether widespread…

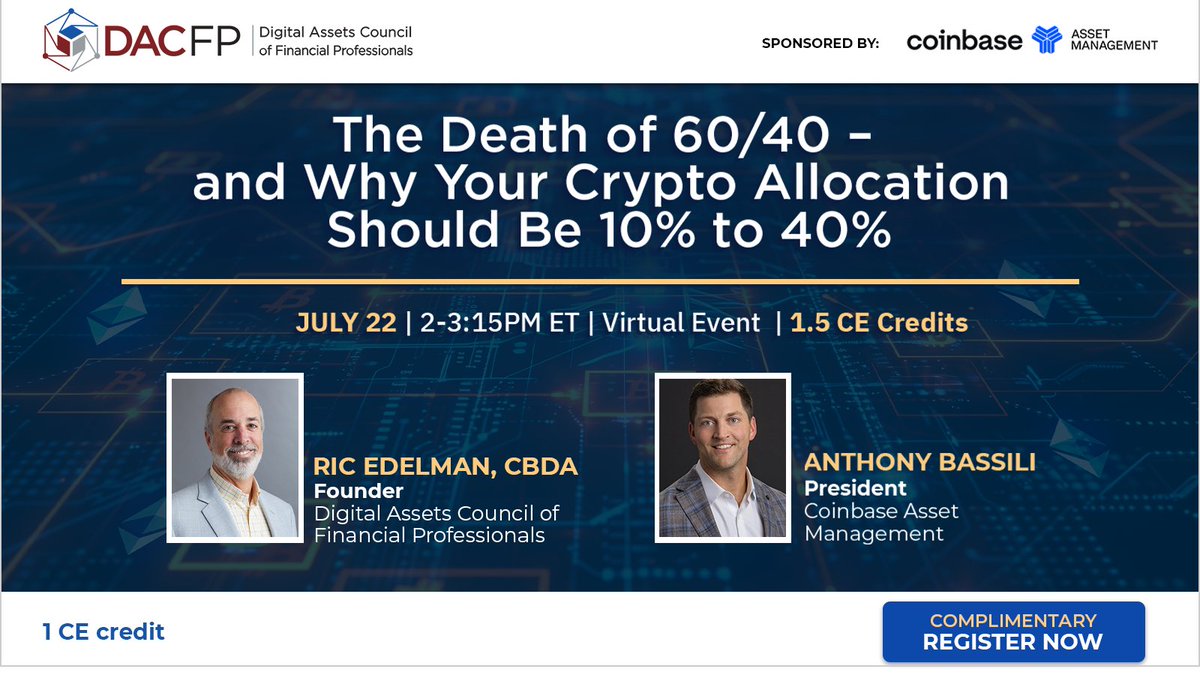

We’re joining @ricedelman and @thedacfp tomorrow to discuss digital asset allocation and strategies to help position your clients for this new era of crypto. If you’re an advisor, wealth manager or investor, tune in here: dacfp.com/events/the-dea…

On today's Crypto Mondays by @CoinbaseAM with @MarcelKasumovic and Portfolio Manager Sarah Schroeder, we discuss: 1. Macro: When assets without cash flows are leading, it signals monetary change. A monetary reset is happening, which has historically led to a Bretton Woods event.…

On today's Crypto Mondays by @CoinbaseAM with @sebastianbea and @MarcelKasumovich, we discuss: 1. Macro: Does the US debt downgrade matter? Despite market concerns around US fiscal sustainability, all eyes will be on how the ‘Big Beautiful Budget Bill’ impacts fiscal conditions.…

On today's Crypto Mondays by @CoinbaseAM with @sebastianbea and @MarcelKasumovich, we discuss: • Macro: How should we think about corrections? Historically, corrections were deflationary and inflation had a ceiling. Today, inflation has a floor—making store-of-value assets more…

How can institutional investors incorporate store-of-value assets, like gold and bitcoin, into their strategic asset allocations? In our new report, Capital Markets Assumptions: The Case for Store of Value, Coinbase Asset Management’s CIO @MarcelKasumovic outlines our framework…

On today's Crypto Mondays by @CoinbaseAM with @sebastianbea and Head of Credit Doug Wilson, we discuss: 1. Capital Market Assumptions: In “The Case for Store of Value,” we provide long-term return forecasts for gold and bitcoin to help allocators better navigate a transformative…

Is bitcoin’s “digital gold” narrative becoming a reality? @SebastianBea joined @fintechfrank on The Scoop to discuss bitcoin’s recent decoupling from traditional risk assets, how institutions are integrating BTC into portfolios, and more. Listen to the full episode:…

Gold revaluation could lead to US treasury buying Bitcoin sooner than expected - Coinbase Exec @CoinbaseAM President @sebastianbea joined @fintechfrank at our NYC office to discuss Bitcoin's continuing maturation as an asset class, and how a government move to revalue gold could…

On today's Crypto Mondays by @CoinbaseAM with President @sebastianbea and Portfolio Manager Sarah Schroeder, we discuss: • Coinbase Bitcoin Yield Fund (CBYF): This morning, we announced CBYF—an institutional solution built to invest in BTC that seeks a conservative BTC…

We’re proud to introduce the Coinbase Bitcoin Yield Fund (CBYF), an institutional solution built to invest in bitcoin while seeking a conservative bitcoin yield. Seeking a 4-8% net return in bitcoin, we designed CBYF to lower expected investment and operational risks, which we…

On today's Crypto Mondays by @CoinbaseAM with President @sebastianbea and CIO @MarcelKasumovic, we discuss: 1. Macro: Is a recession looming? Issues impacting the US dollar, like geopolitics and inflation, could provide clarity. 2. US Net International Investments (US NII): The…

Regulations are paving the path for institutional crypto adoption. @CoinbaseAM President @sebastianbea and panelists agreed on this at SAIA's quarterly event: “Crypto Markets in Motion: Regulation, Investment Strategies & the Road Ahead.” Also discussed: Stablecoin legislation…

The first institutional cycle for digital assets requires education and real conversations, and we thank SAIA for leading the way at their most recent quarterly meeting. It was a pleasure to discuss stablecoin utility, the opportunities found from bringing debt markets onchain,…

In 5 years, most of Wall Street could be trading tokenized assets. ICYMI, our CEO Eric Peters joined @JasonYanowitz of @blockworks at Digital Asset Summit 2025 to discuss why institutions are bullish on crypto. Key takeaways: • Career risk for allocating to crypto is fading.…

On this week's Crypto Mondays by @CoinbaseAM with President @sebastianbea and CIO @MarcelKasumovic, we discuss: 1. Market Volatility: Uncertainty is always temporary. Which constructive focus will arise? 2. BTC’s Differentiation: While prices are down, BTC is exhibiting well…

On today's Crypto Mondays by @CoinbaseAM with President @sebastianbea and CIO @MarcelKasumovic, we discuss: 1. Macro: Is a recession looming? 2. Markets: Decentralization trend in US vs China. 3. Micro: Bitcoin's time to shine as digital gold with weaker USD? Watch the full…