EagleFangCapital

@CapitalFang

Ex hedge fund analyst. Mostly small-caps. Mostly consumer discretionary. Mostly value. Other thoughts at times. Always opinions. Never investment advice.

Still too early for $WHR as retailer stockpiling of Asian competitors ahead of tariffs, lowers ongoing EPS guidance to $6-8 and cuts dividend to $3.60 annualized payout. North American sales down 4.7% not horrendous given headwinds, but stock gonna go through the rinse cycle.

$WHR reports tonight, $PRPL tomorrow night, $SNBR weds morning. About to find out if it's too early or not.

$WHR reports tonight, $PRPL tomorrow night, $SNBR weds morning. About to find out if it's too early or not.

Some Examples: $PRPL -plant consolidation, deal with $SGI done, gaining share with new product line $SNBR -significant cost cuts of $4ish per share, insider buys above $9 $RH -biz inflection. investment cycle ending. $WHR -paid to wait. Tariffs may help sales but hurt costs.

Add $LOVE to this list. Actually growing sales and balance sheet is solid.

Some Examples: $PRPL -plant consolidation, deal with $SGI done, gaining share with new product line $SNBR -significant cost cuts of $4ish per share, insider buys above $9 $RH -biz inflection. investment cycle ending. $WHR -paid to wait. Tariffs may help sales but hurt costs.

$PLCE - DC

Not only that but it is a relatively modern (<20 yrs old) DC w/~100 double dock doors, automated conveyor system, extensive racking etc.

$PLCE - everyone seems to forget that they OWN a 700K sf DC in Alabama. So my periodic reminder.

$PLCE - seeing select new store openings (closed too many under prior regime) with 3rd party merchandise to differentiate/drive traffic. This plus a strong Prime Week with $AMZN could drive solid sales. Hopefully, realigned some costs as well.

More $CRI - July comps up 2% so far and AUR is positive as well. Back to school off to a solid (and earlier) start. Also encouraging.

$CRI call - said actually invested less in price in Q2 retail than expected due to strong traffic. Don't expect to invest in price in 2H and seeing competitors start to raise prices. Guess that's encouraging.

$CRI call - said actually invested less in price in Q2 retail than expected due to strong traffic. Don't expect to invest in price in 2H and seeing competitors start to raise prices. Guess that's encouraging.

$CRI - solid sales (including positive US SSS). Some GM margin pressure but GM $$ were basically flat year over year. SGA expenses (ex one-time costs) up 10% y/o/y and caused the whole EPS decline, which seems odd. Not sure what it means for $PLCE - some GM pressure maybe.

$CRI - solid sales (including positive US SSS). Some GM margin pressure but GM $$ were basically flat year over year. SGA expenses (ex one-time costs) up 10% y/o/y and caused the whole EPS decline, which seems odd. Not sure what it means for $PLCE - some GM pressure maybe.

$DECK will do over $5B in sales with ~55% gross margin. Strong demand for HOKA/UGG with no pushback on 7/1 price increases. Should have no issues mitigating $185M tariff hit. And $11+ per share in cash with $2.4B buyback. Down 50% from Jan high - i'd think $150-175 reasonable.

$DECK reports a significant Q1 beat on sales and EPS while guiding Q2 inline. Hopefully strong sales trends in HOKA and UGG show up in $GCO Q2 results.

$DECK reports a significant Q1 beat on sales and EPS while guiding Q2 inline. Hopefully strong sales trends in HOKA and UGG show up in $GCO Q2 results.

$PLCE - selling a lot of shorts on $AMZN. Maybe frying a lot of shorts in the market.

$HBI - This stock hasn't moved like others. Guided to 51-55 cents, and pretty sure they embedded a tariff scenario worse than current levels. Happy to add at current levels.

$HBI - beats on revs and EPS. Guided to ~13% operating margin and $300M of FCF on share count of 359M (84 cents per share). Biz on stable footing post Champion sale and just a very simple deleverage story now. Great opportunity sub $5.

$PLCE - seeing select new store openings (closed too many under prior regime) with 3rd party merchandise to differentiate/drive traffic. This plus a strong Prime Week with $AMZN could drive solid sales. Hopefully, realigned some costs as well.

$PLCE 10-Q out. Amazon was over 13% of sales in Q1 and over 60% of the A/R at the end of Q1. $32.2M in sales Q1 '25 vs. $16.5M in Q1 '24. So while Amazon biz almost doubled, rest of biz down 12.6% y/o/y. So it's channel shift and cost structure needs to adapt to this reality!!

$SNBR announced a CFO transition AND said they are on track to EXCEED the $80-100M cost savings target while remaining in compliance with debt covenants. So with 23m ish shares o/s, looking at almost $5 per share in cuts - stock is $6.60. Coiled spring if demand returns!

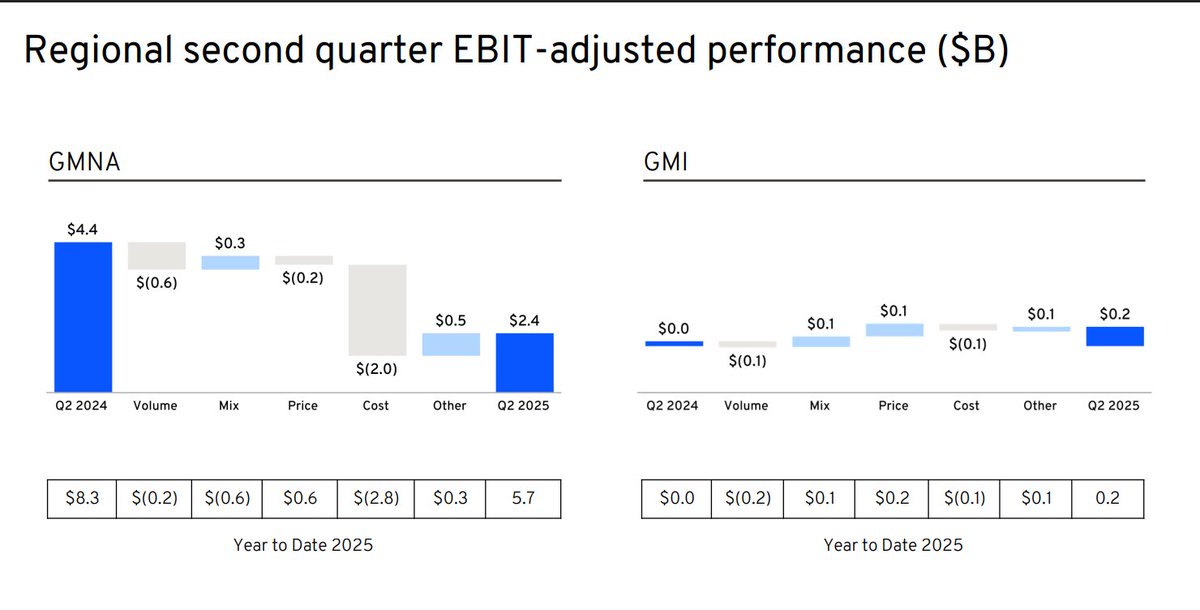

$GM (no position) - tariffs a significant hit to EBIT margins, which will surely result in lower corporate income taxes. On balance, paying more to the US government at the moment. Curious to see how this plays out over time. Impossible to predict.

$AHT - call it 6m shares o/s. $2.6B in floating rate debt. 100bps in rate cuts saves $26m in interest or $4.33 per share. Stock is $6.70. See all my previous tweets on net asset value here (multiples of current stock price). Curious to see if RevPAR holds up in Q2. Monty 4 Life.

$AHT - earnings/conf call were fine. Should see selective asset sales to further deleverage and potential benefits from rate cuts in months ahead as 77% of debt is now effectively floating (less hedging). Nobody cares, but they are much better at pretending to be a real company.

Some Examples: $PRPL -plant consolidation, deal with $SGI done, gaining share with new product line $SNBR -significant cost cuts of $4ish per share, insider buys above $9 $RH -biz inflection. investment cycle ending. $WHR -paid to wait. Tariffs may help sales but hurt costs.

Wonder if it's the time to just say fuck it and buy a basket of housing related stocks that have seen 3.5-4 years of double digit revenue declines while restructuring their cost bases. Akin to buying $HD in spring of 2010 at $30. Fine being a few months early. Coiled springs.

$DPZ - SSS show acceleration in Q2. Perhaps stuffed crust driving a ticket lift (popular in my household). When pizza comps accelerate, one needs to consider it as a sign of consumer trade down. See what others say over the next few weeks.