CRE Analyst

@CREanalyst1

The commercial real estate industry’s #1 provider of real-world training. Commercial Real Estate and other investing content.

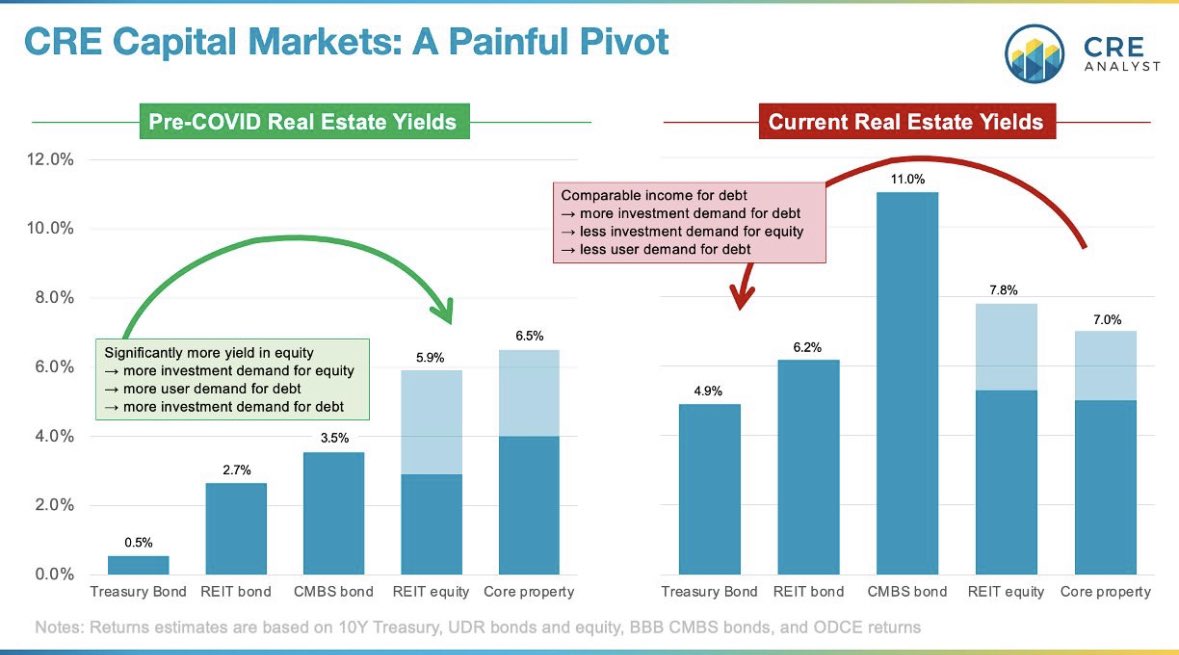

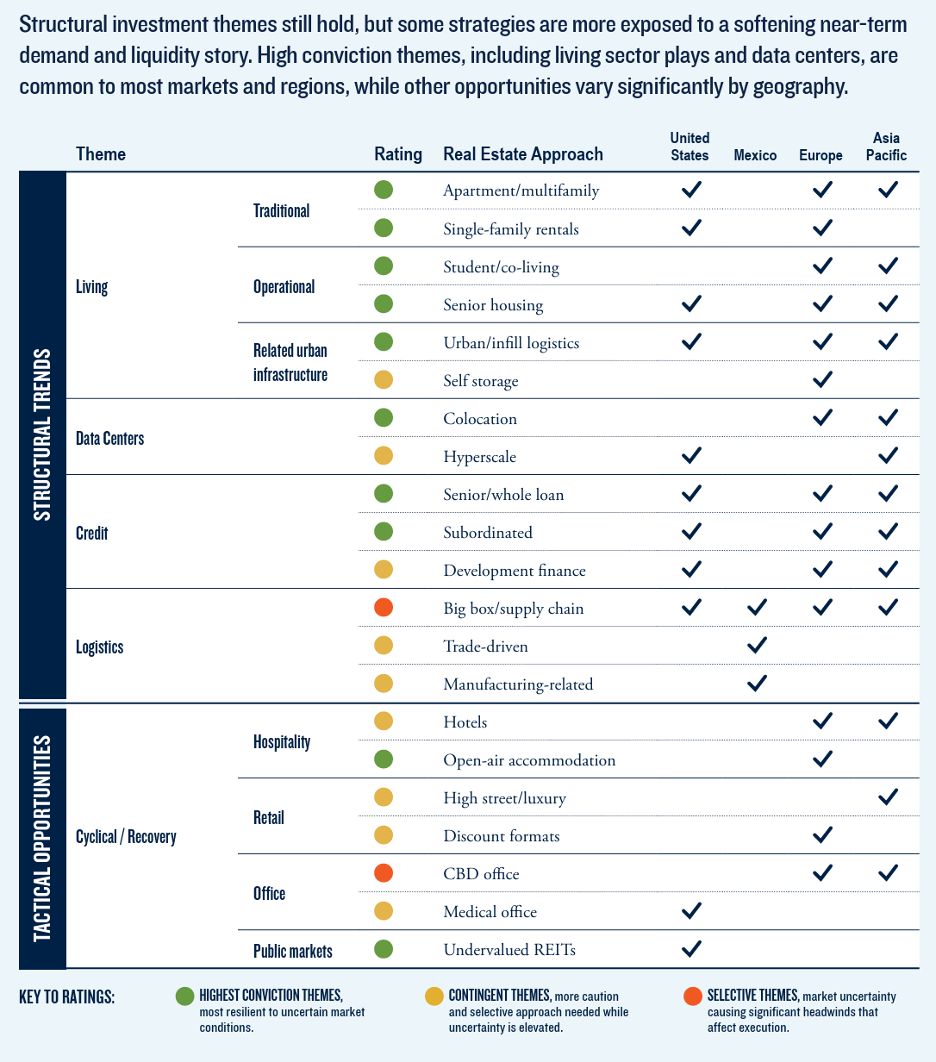

The CRE domino effect... ----- A quick review ----- 1. CRE capital markets were orderly pre-COVID Yields were low, but strong economic growth and mild new supply led investors to take more risk in hopes of getting more returns. Aside from extremely low base rates, relative…

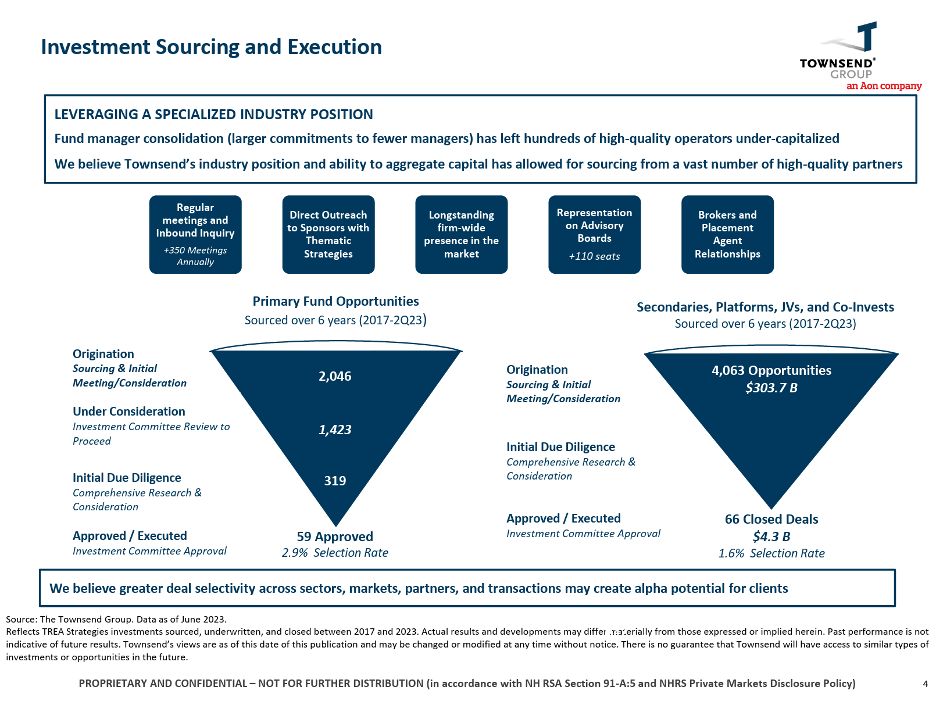

So you want to launch a real estate fund? You’ll have to get past the gatekeepers. One of the biggest? Townsend. They advise on $200B+ of institutional capital, and they focus exclusively on real estate. Recent gatekeeping observations... Fund pitches reviewed: 2,000+…

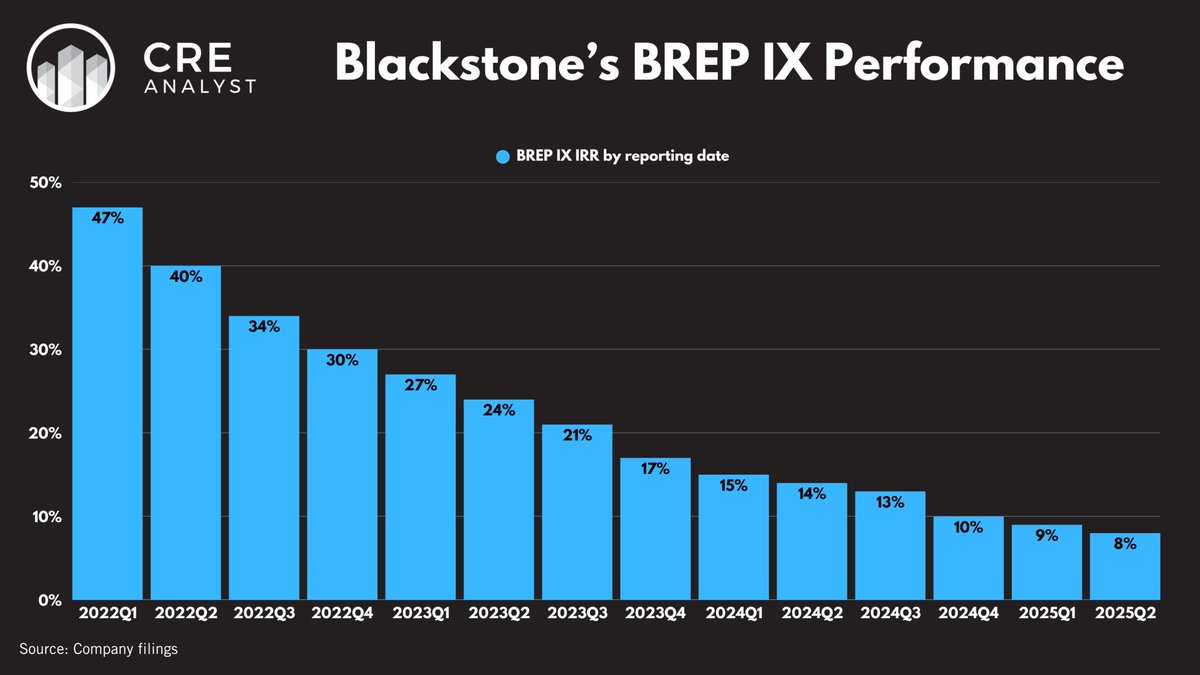

Worried about your bonus disappearing? You're not alone. Here's the basic math that has every sponsor (including Blackstone) in a bad mood: Blackstone just reported their flagship real estate fund dropped from 47% to 8% IRR. Well below the typical 9% promote threshold. As our…

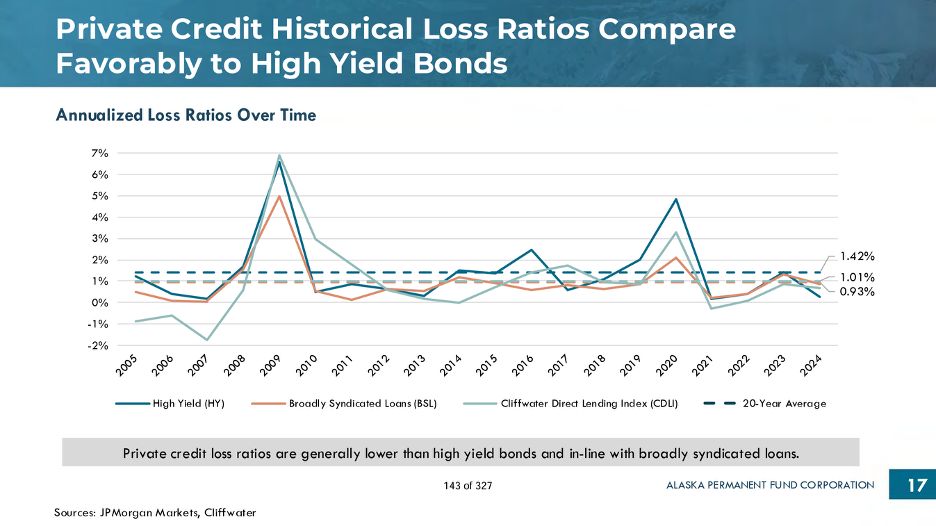

Two fund managers and an allocator walk into a bar: Allocator: "What returns are you targeting?" Core fund: "8% net, with 75% from income." Debt fund: "9% net, all income." Allocator: "Why would I ever invest in equity then?" Core fund: "We're only 40% levered." Debt fund: "But…

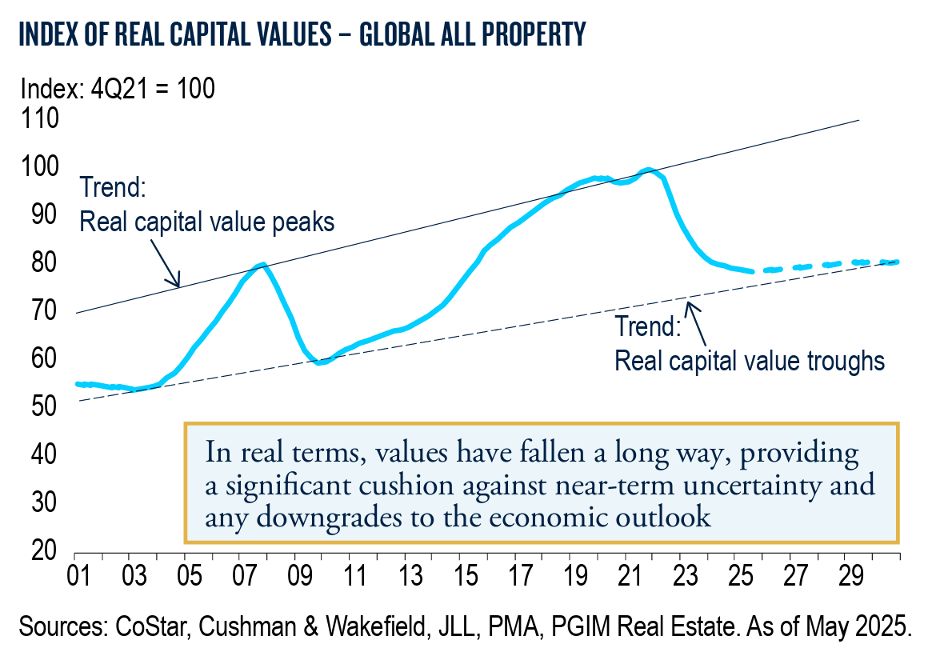

Sometimes a picture (chart) really is worth a thousand words:

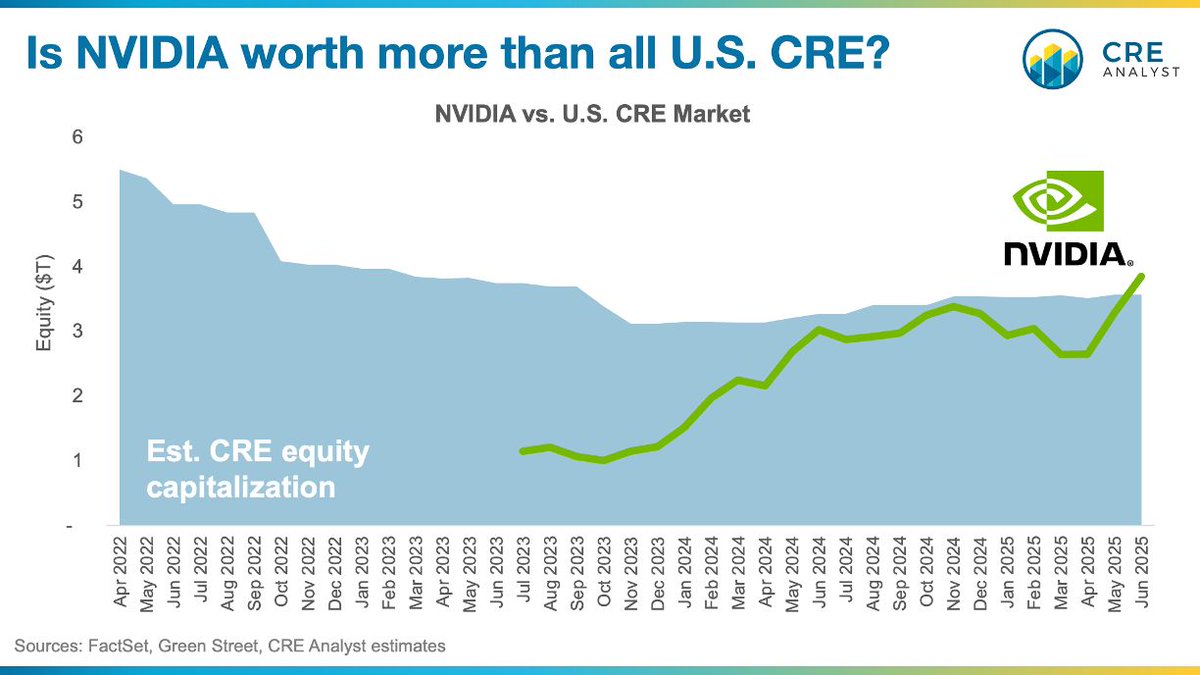

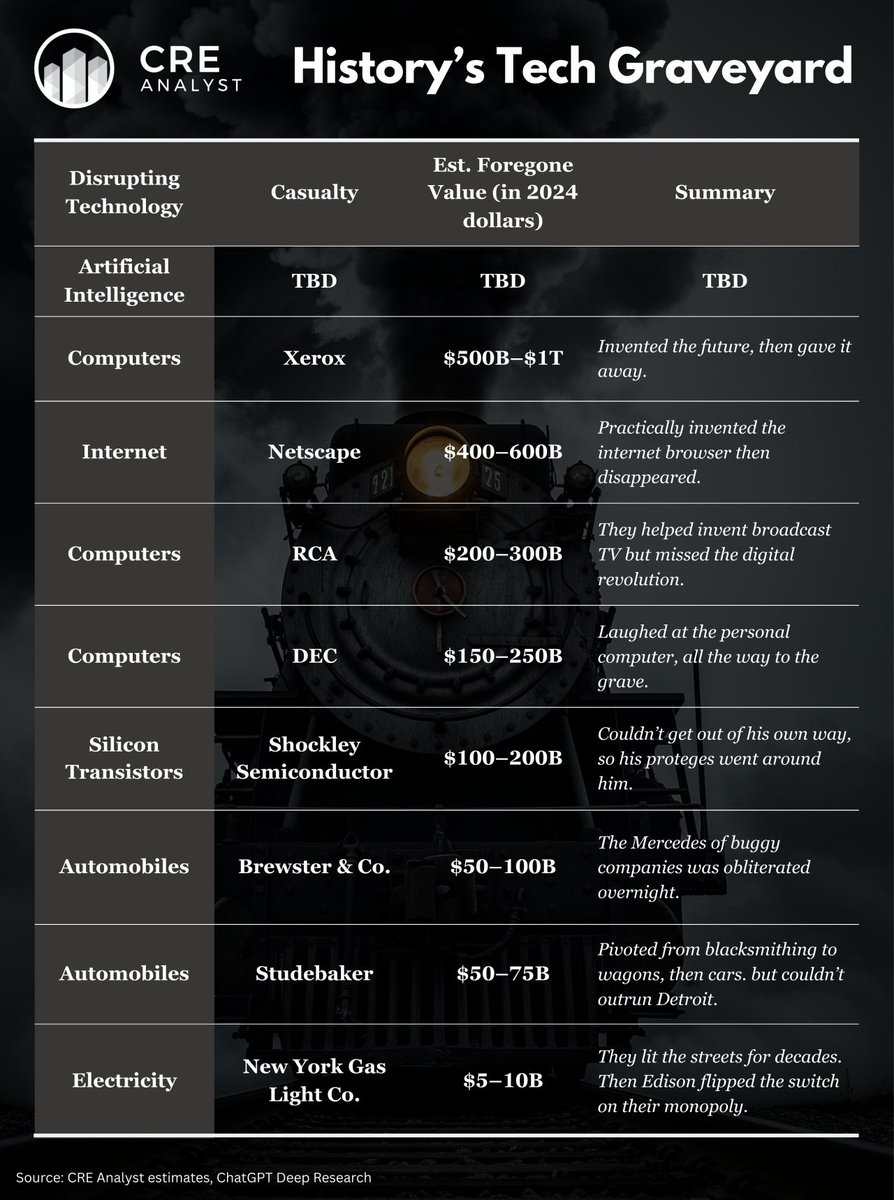

“We tend to overestimate the effect of a technology in the short run and underestimate it in the long run.” Every generation underestimates technological revolution. -- In the 1800s, railroads and steam redefined industry. -- In the early 1900s, the combustion engine upended…

Stephen Schwarzman: “Chad is a generational entrepreneur and represents one of the most incredible success stories we have had the opportunity to partner with at Blackstone.” Most CRE folks know the big names from NYC. Few know the guy from Overland Park who built an $60B data…

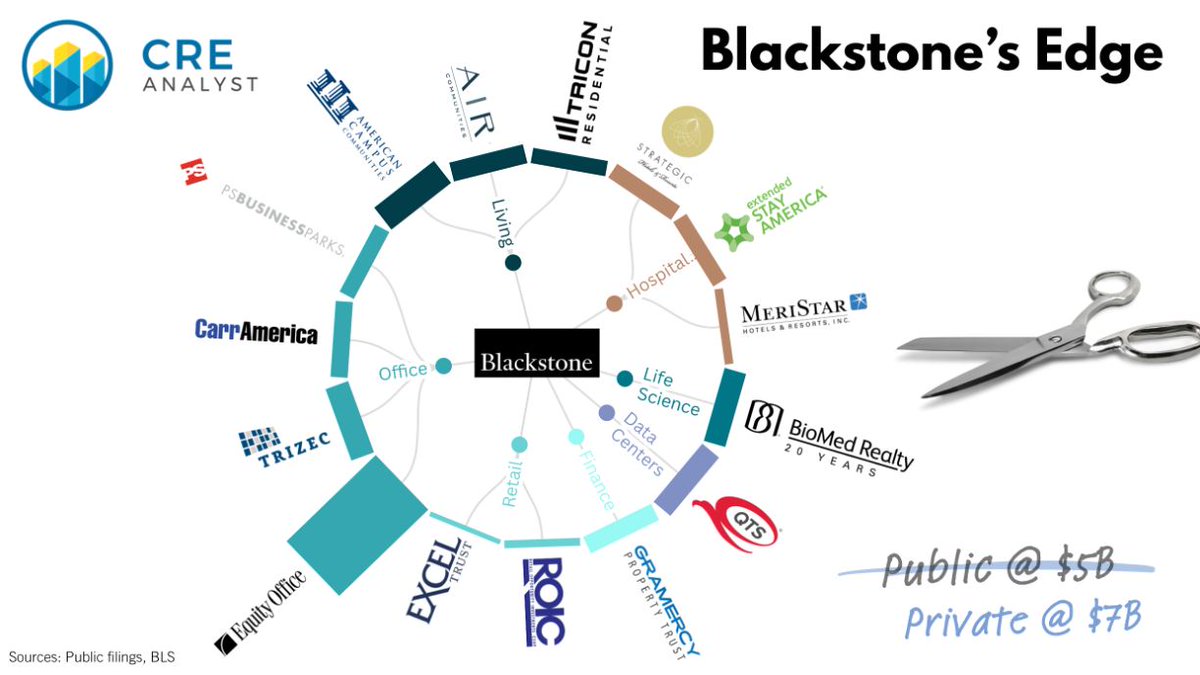

How Blackstone turned an overlooked real estate company into gold [case study] We recently analyzed one of the smartest private equity plays in real estate history: Blackstone's 2021 acquisition of QTS Realty Trust. ---- The Setup ---- QTS by the numbers (pre-acquisition):…

![CREanalyst1's tweet image. How Blackstone turned an overlooked real estate company into gold [case study]

We recently analyzed one of the smartest private equity plays in real estate history: Blackstone's 2021 acquisition of QTS Realty Trust.

---- The Setup ----

QTS by the numbers (pre-acquisition):…](https://pbs.twimg.com/media/Gv1Ir2uWIAAr4LL.jpg)

How did Blackstone become such a dominant force in real estate? By buying mispriced platforms hiding in plain sight. No firm has done more to exploit the disconnect between public and private real estate markets than Blackstone: – 15 REIT privatizations totaling nearly $180B –…

Real estate vs. infrastructure: Are big-ticket infrastructure investments pulling dollars away from traditional real estate sectors? Brookfield delivered this primer to a pension fund last year, which sheds light on the investment opportunities emerging at the intersection of…

I once argued in front of the U.S. Supreme Court and won. I studied at Harvard Law and started in antitrust, not finance. I was a civil rights enforcer before I was a capitalist, serving under a president. I’m a billionaire who favors the shadows, but I once threw a party with…

An increasingly common view? Investor: "We're out on distribution warehouse." Broker: "What?! You bought 10 million square feet over the last few years." Investor: "There's just too much uncertainty, and pricing hasn't reset enough."

Special thanks to the 500 people who signed up for yesterday's webinar with @OxfordEconomics. We covered a lot of ground: Tariffs, deficits, supply-chain bottlenecks, excess uncertainty, and CRE sentiment. If you weren't able to make it, check out the replay here:…

Bear: The return outlook for real estate stinks. Bull: Just means today’s prices aren’t baking in any upside. Bear: The 10-year is at 4.5% and cap rates are 5%. Where’s the upside? Bull: Rent growth. New supply is stalling. Bear: Shouldn’t that be attracting buyers?…

12 reasons James Graaskamp is the father of modern real estate... 1. He pioneered interdisciplinary curriculum: He built one of the first university programs that integrated finance, law, urban planning, environmental science, and ethics into real estate education. 2. He…

Our co-founder and lead instructor, James Ray, was recently interviewed by @jayparsons on his podcast The Rent Roll. Packed discussion about the housing market, the real estate industry, and higher education/training. Check out the origin story of CRE Analyst at 1:14:40!…

David Simon is real estate's honey badger. Here's how he built a $60B empire... From a small family business: Melvin Simon founded a modest Indiana strip-center developer with his brother in 1960, which would evolve into Simon Property Group. Deal-focused, Wall Street training:…

12 books that'll make you fall in love with commercial real estate (and investing) ---- The Intelligent Investor ---- The concept of Margin of Safety anchors valuation, which is the most important skill in real estate. ---- King of Capital ---- An early history of…

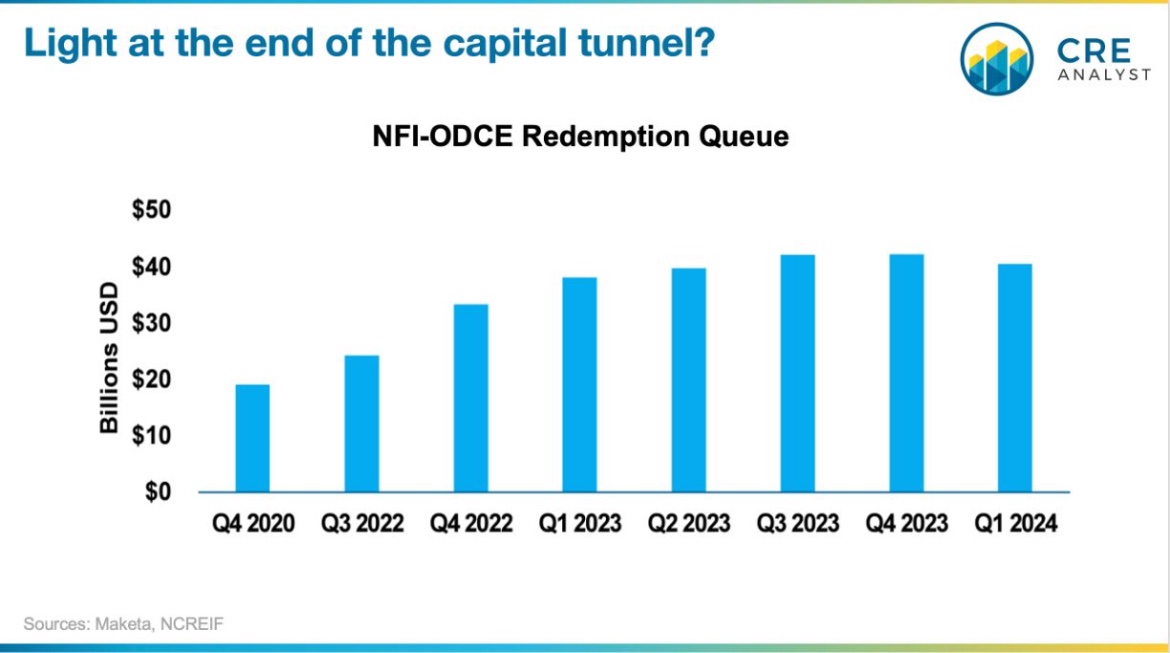

Another green shoot: translating good news from Greek to English for everyday real estate players... ---- What is NFI-ODCE? ---- The NCREIF Fund Index (open end diversified core equity) is an index of 20+ institutional perpetual funds ("core funds") that pensions and…