CFO Confidential

@CFOConfidential

Anon CFOs | Sharing what real finance teams whisper. Shadow strategies. Cash tools. Capital stack plays. 🔻 http://cfoconfidential.io

The finance content no one else will publish I’m a sitting CFO writing anonymously about – grey-zone strategy – capital structure games – building real wealth behind the curtain 🎯 cfoconfidential.io

The majority of short-term rental owners don’t understand their depreciation rules. 39 years vs 27.5 years matters. Get it wrong and you’re overpaying or facing a messy IRS audit.

Another 80s icon gone. Hall of Famer. 10x All Star, 9x Gold Glove, 1x NL MVP. The best Second Baseman of his era. Lou Whittaker 2nd best. Then Alomar, Kent, Biggio in the 90s. Pedroia, Cano, Utley 2000s. Altuve 2010s.

We are deeply saddened by the passing of Hall of Famer Ryne Sandberg. The beloved Cubs second baseman was a five-tool model of consistency in the 1980s and early ’90s, making 10 consecutive All-Star teams and winning 9 straight Gold Glove awards. On June 23, 1984, a national TV…

The first CFOs who master agentic AI will set the new standard for speed and precision.

Agentic AI is no longer a concept—it’s live. These systems plan, execute, and adapt across departments. Finance teams ignoring agentic workflows risk being outpaced by those who don’t just adopt but redesign around them.

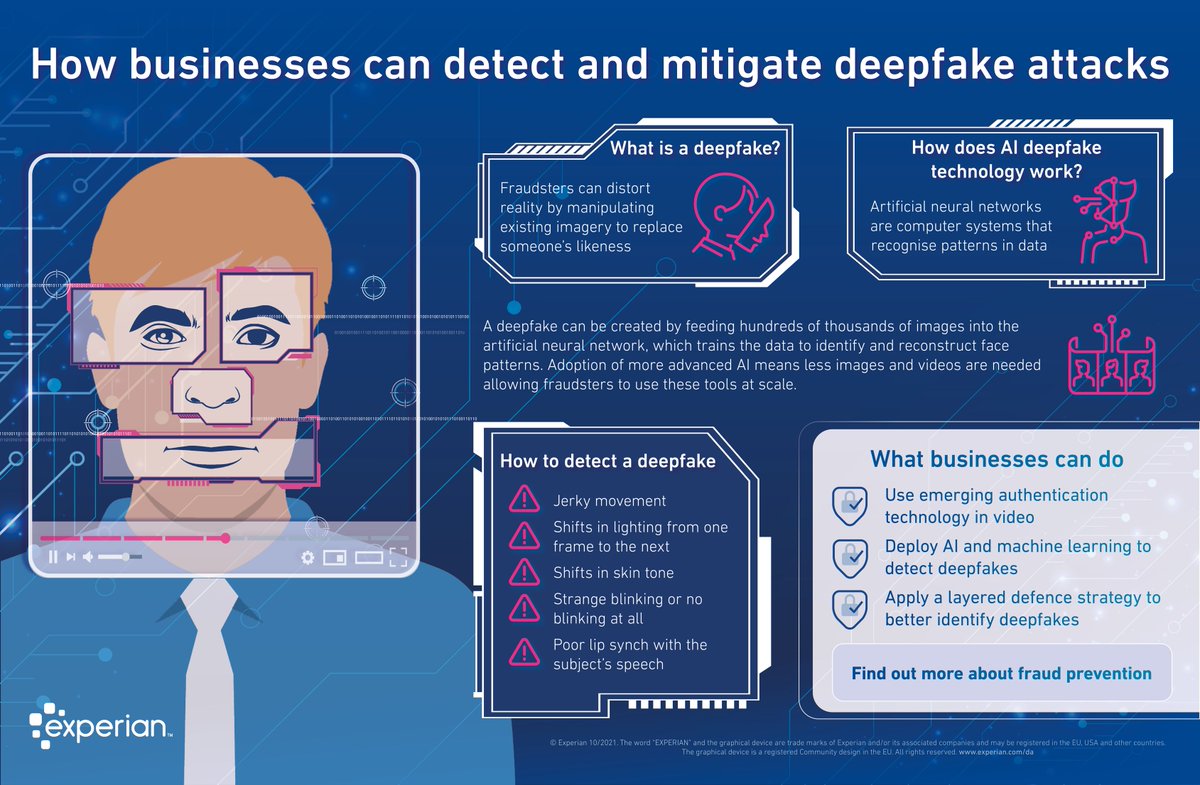

Fraudsters are now using AI‑generated video and audio to fool ID checks and bypass KYC systems. Deepfake attacks now account for 1 in every 20 identity failures. If your team assumes facial recognition equals trust, you’re already exposed.

Every system in your company is either reducing complexity or compounding it. The fastest way to improve performance is to find what’s slowing decisions down and eliminate it.

The future CFO isn’t a gatekeeper. They’re a navigator. The board wants a compass, not a calculator.

Don’t confuse tooling with transformation. The best firms start with the process. Only then do they pick the tech.

Most AI models can’t explain their own answers. In regulated industries, that’s not just a bug. It’s a liability.

Tax planning isn’t just about minimizing what you owe. It’s about maximizing your options. Flexibility is worth more than deductions when the rules are changing fast.

Firms that treat finance as a cost center will be eaten by firms that use it as a decision engine. The value isn’t in tracking what happened. It’s in controlling what happens next.

Quantum computing isn’t a finance tool. It’s a threat model. The encryption used in every contract, payment, and vault is built for today not for what’s coming.

Passive activity rules are being misapplied by thousands of real estate investors. If your time, use, or classification is off, the deductions won’t hold up. Clean documentation is your best defense.

Hiring analysts who can code is no longer optional. You don’t need a dev team. You need people who can build prototypes, automate reports, and test assumptions.

Smart contracts will change the role of the controller. Reconciliations, payouts, and covenant triggers will all be on-chain. It won’t be about reviewing terms. It’ll be about designing them.

Short-term rental investors often don’t realize they’re running a business. Different depreciation schedules, different tax treatment, different liabilities. Most of them are flying blind.

Finance leaders love dashboards. But insight isn’t the goal. Influence is. If your reporting doesn’t drive action, you’ve just created prettier noise.

Most AI failures won’t look like breakdowns. They’ll look like quiet, confident mistakes. The cost isn’t just financial. It’s the slow erosion of trust in the numbers.

Deepfakes are no longer a novelty. AI can create fake videos from a photo and seconds of audio. This doesn’t just impact politics. It affects contracts, due diligence, and identity verification.