Bryan Cutsinger

@BryanPCutsinger

AP at @faubusiness | AE at @_PublicChoice | Fellow at @AIER’s @SoundMoneyProj | Monetary History & Political Economy | Views my own

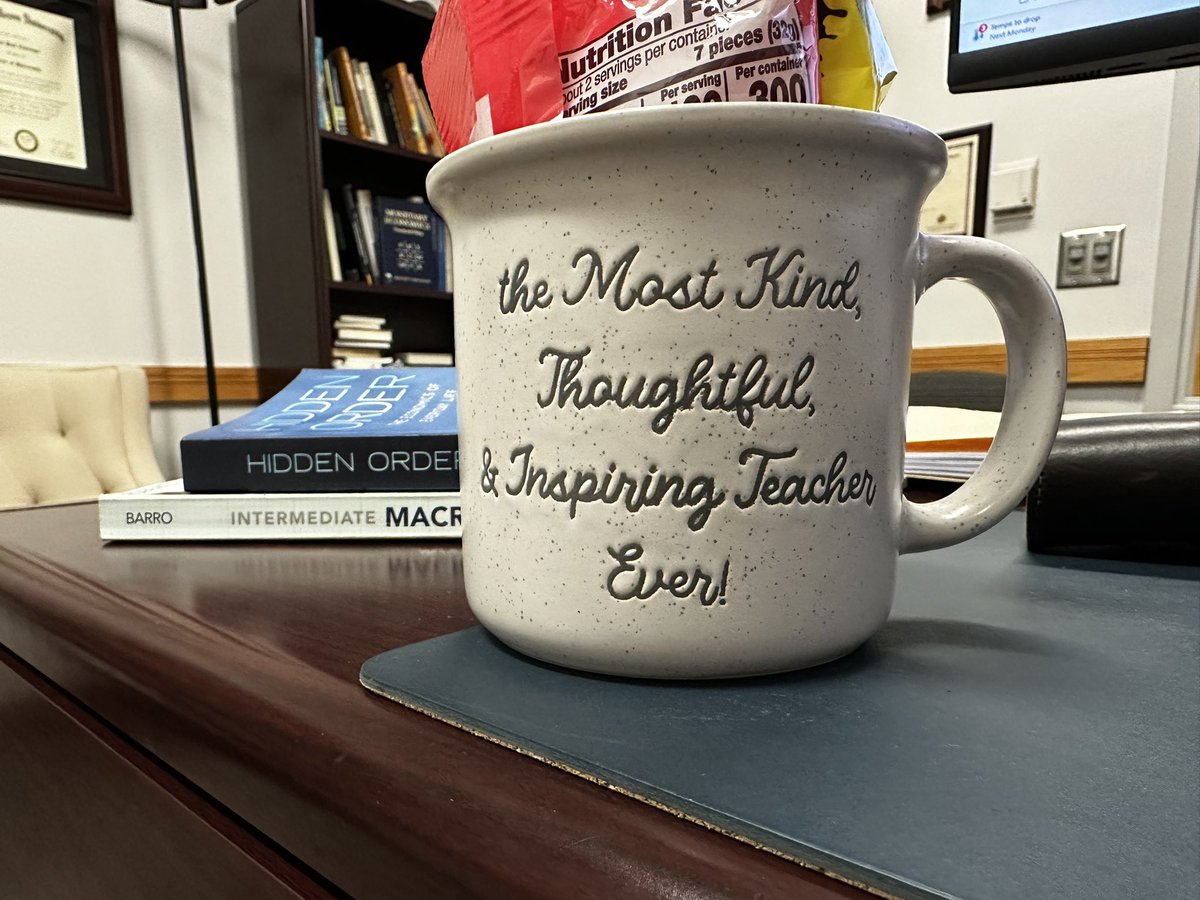

One of my students from last semester dropped by my office today to give me this gift. I’m truly blessed with amazing students. Thankful everyday that I get to share my love of economics with them.

Yesterday, @Marian_L_Tupy and @PeterBoettke published an excellent op-ed in @WSJopinion making a simple but powerful point: AI can’t replace markets ⚖️🤖 🔗 wsj.com/opinion/algori… One of the most misguided ideas I’ve seen in the past decade is that central planning is (or soon…

AI Can’t Replace Free Markets by @Marian_L_Tupy and @PeterBoettke wsj.com/opinion/algori…

What happens when you subsidize an inferior input? wsj.com/opinion/the-re…

RIP Ed Feulner. Through co-founding @RepublicanStudy & the @Heritage foundation, his influence on the conservative movement, from developing policy for the Reagan Administration through the Trump Administration today, can't be overstated. A kind soul who will be missed dearly.

Dr. Edwin J. Feulner was more than a leader—he was a visionary, a builder, and a patriot of the highest order. The Heritage Foundation will honor Ed’s life the best way we know how: by carrying his mission forward with courage, integrity, and determination. We will never forget…

This may be the best explainer of this complicated point I've see yet. Thanks to @DominicJPino and @BryanPCutsinger for the excellent work.

I wrote in March that I expect tariffs to have a negligible effect on inflation, even though tariffs do raise prices. I explain why this apparent contradiction is no such thing, with some help from @BryanPCutsinger, in this new piece @NRO nationalreview.com/2025/07/why-ta…

I wrote in March that I expect tariffs to have a negligible effect on inflation, even though tariffs do raise prices. I explain why this apparent contradiction is no such thing, with some help from @BryanPCutsinger, in this new piece @NRO nationalreview.com/2025/07/why-ta…

🎉 MILESTONE ALERT! Congratulations to @DavidBeckworth and the entire @Macro_Musings team for reaching 500 EPISODES! From Nobel Prize winners to Fed officials, David and his team have pulled back the curtain on macro issues that shape our world. Here's to the next 500! 📸 This…

📊 New research settles the inflation debate: @DavidBeckworth and @Pat_Horan92 found that 85% of 2021-22 inflation came from excess demand, not supply shocks. Translation: When you flood an economy already at capacity, you get higher prices, not more stuff. What does that mean…

It’s a shame that for many “free banking” is identified with antebellum U.S. state banking laws bearing that misleading title, for the term and counterparts (“la banque libre,” “bankfreiheit,” etc.) also refers to banking systems truly unhampered by misguided regulations. 1/

“Comparing the world of stablecoin to the world of 19th century free-banking wildcats is becoming a well-worn tradition… There are so many ways that the comparison fails, not least the heterogeneity of the free-banking experience…and the vast existence today of a federal bank…

Recent analysis of Federal Reserve policy during 2020-2024 reveals significant gaps between official narratives and economic evidence regarding the post-pandemic inflation surge. - Myth 1: The Inflation Surge Was "Exogenous" and Beyond Fed Control - Reality: Excessive monetary…

Whoopee! I get to talk to Tyler about how the US recovered from the Great Depression, and how the New Deal influenced that recovery. Come and listen! cato.org/events/false-d…

Can't have a case of the Mondays if you work 7 days a week.

You don’t hate Mondays.. you hate being exploited by capitalism

I chat with @GeorgeSelgin about his important new book False Dawn: The New Deal and the Promise of Recovery, 1933–1947. econjwatch.org/podcast/george…

Research shows the Fed's own projections reveal they were systematically wrong about inflation through 2021, consistently expecting it to fall without policy changes, even as data showed otherwise. FOMC members kept predicting inflation would slow to just 1.9-2.7% in the…

New working paper with @Pat_Horan92 where we provide a new decomposition of the inflation surge. Using a New Keynesian model, we show most of the inflation was caused by aggregate demand shocks. We also do a @jasonfurman decomposition with similar results (1/3) @JohnHCochrane

🚨🚨🚨 Friends, I am pleased to report a novel finding: Demand curves slope down! New paper: “Did California's Fast Food Minimum Wage Reduce Employment?” By @jeffreypclemens, Olivia Edwards & Jonathan Meer. Link: nber.org/papers/w34033