Brandon Sello

@BrandonSello

former credit portfolio manager. writing "The Stableyard" on RWAs.

Institutional credit needs room to flourish. Grove is creating a landscape where new ideas and capital can take root. Grove offers asset managers, protocols, and institutions a framework that fosters on-chain yield and capital efficiency—helping the future of institutional credit…

Allocations on @grovedotfinance into institutional credit markets for @SkyEcosystem at $1bn Thank you for your attention to this matter!

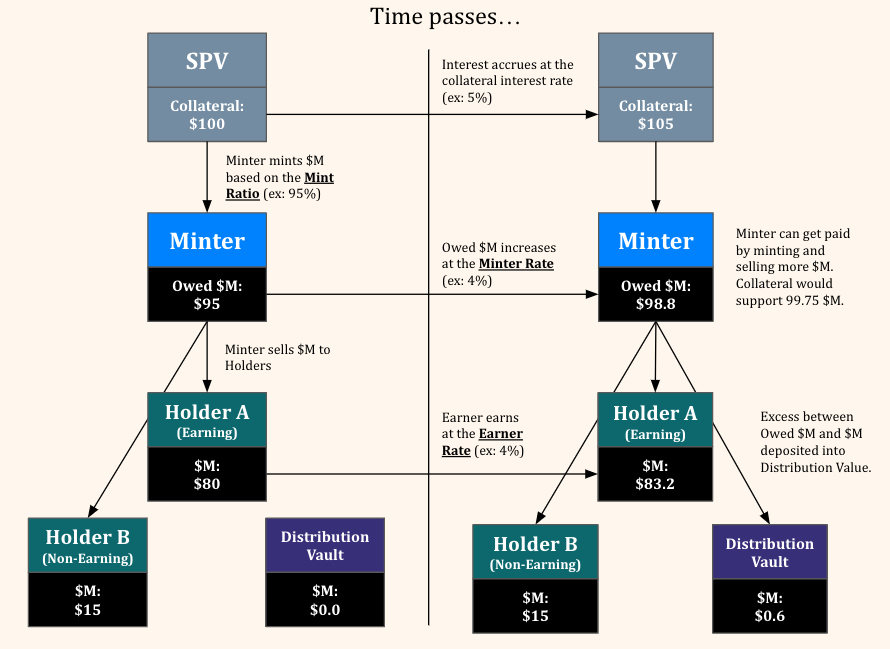

M0 Tackles the Big Problems in Stablecoin Design. A brief on what makes @m0 so innovative. brandonsello.substack.com/p/m0-tackles-t…

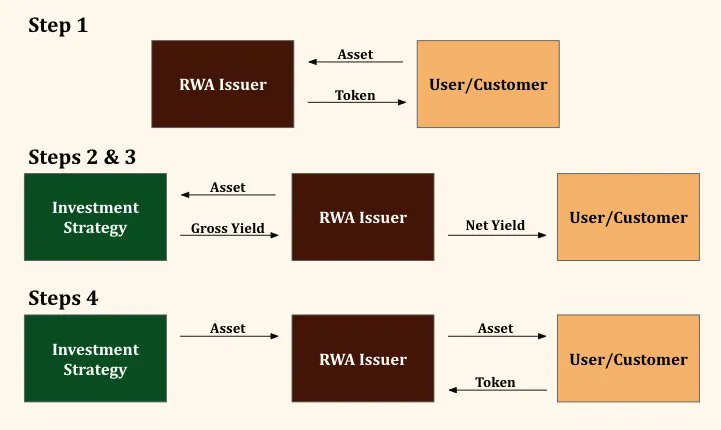

How Some People Will Blow Up Issuing RWAs brandonsello.substack.com/p/how-some-peo…

I know everyone is really bulled up on the Robinhood announcement and tokenized equities, and not to be a bear, but the conversation seems to lack a lot of nuance. I'm a long term bull but I expect near term expectations are WAY too high. So lets take a critical look. So, how…

Basically no one is ready for what’s going to happen in RWAs over the next five years.

x.com/i/article/1937…

This week on the "Stableyard", we're diving in to @OndoFinance's #USDY. I crack open a contract so you don't have to. brandonsello.substack.com/p/usdys-dumb-c…

The second issue of The Stableyard is now live. It's the introductory segment of a series on tokenized treasuries: substack.com/@brandonsello/…

The first issue of the Stableyard is out now. Bi-weekly Thursday mornings going forward! What You Really Own When You Own a Stablecoin open.substack.com/pub/brandonsel…