Oh Come On!

@BluthCapital

“There’s always 💵 in the 🍌 stand.” -GOB Sr. || “Do you have any idea how lucky you are to have thousands of people who can tell you you’re wrong?” - Kahneman

He didn’t just hate the railway as such; he hated the way it flattered people with the illusion of progress. What was the point of scientific advance without moral advance? The railway would merely permit more people to move about, meet & be stupid together. -Julian Barnes $TWTR

Today we'll get the market to apply the price movement of the least expensive Mag7 $GOOG to 6 other cos that face completely different markets, valuations, and capabilities. And then whatever $TSLA chooses to lie about, having fired key staff, stockpiling CTs, dropping price.

Bondi having to bail on a human trafficking conference the day it comes out that she told her boss he was in the Epstein files *months ago* says everything you’ll ever need to know about the RW anti-trafficking movement

$CMG broke below LT channel, may spend the next 1-2 yrs in the downtrend one.

$CMG Earnings: - Total revenue increased 3.0% to $3.1 billion - Comparable restaurant sales decreased 4.0% - Operating margin was 18.2%, a decrease from 19.7% - Restaurant level operating margin1 was 27.4%, a decrease from 28.9% - Diluted earnings per share was $0.32, a 3.0%…

I love when megacaps beat by 2c and twitterverse is all "totally crushed earnings" "blowout" etc. I'm long GOOG. Strong Q. The main takeaway is AI isn't a problem.

Dude spent the last 6 months relentlessly trashing $goog and now that the stock’s clawed its way back near all time highs he’s done a complete 180 and flipped bullish. What an absolute clown

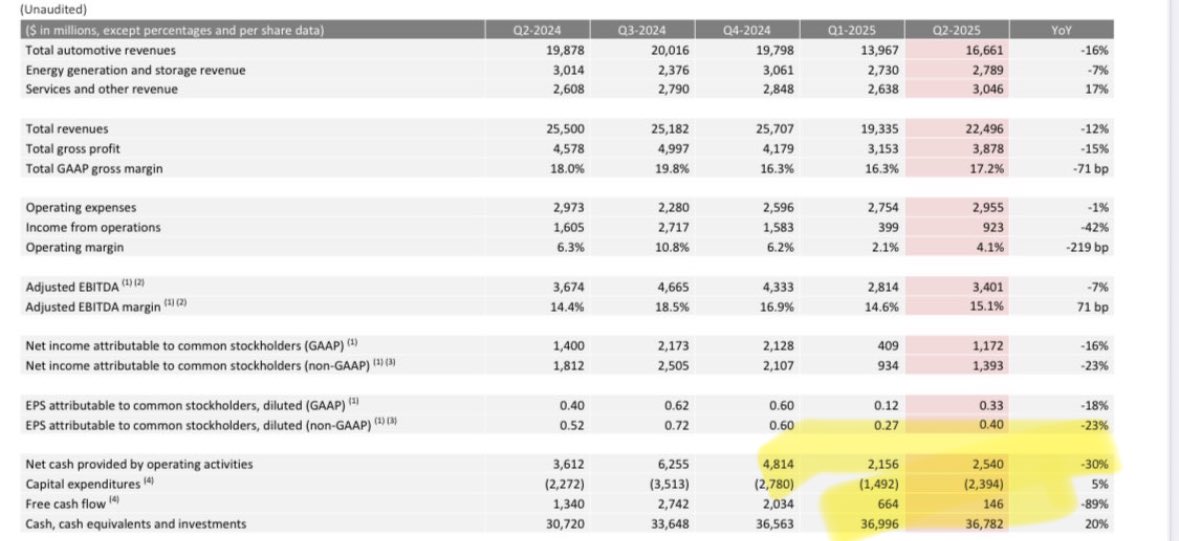

$TSLA my god this is brutal, literally the only item up YoY is services and other revenue LOOL

Somehow last Q, as an OEM w long term commitments, Capex fell by $1B amidst a terrible Q. Next Q capex right back up by $1B. Anyone who knows anything about manufacturing knows this rapid variability on demand is impossible with fraud. $TSLA

Mag7 longs have the exact same thesis as TSLA longs: Levered beta and option flows. 40x earnings and 100x earnings is the same fundamental thesis: greater fool.

$GM made eight times as much Adj EPS as $TSLA last Q. $2.53 vs 40c. At 1/7th the stock price = 58x better bargain AND Tesla has worse growth.

$TSLA "Energy" dropped year-over-year too. Remember when THAT was "the new growth story"?

$TSLA is honestly incredible: losing its first mover advantage and subsidies, business is deteriorating in every way, CEO is crashing out, competitors in every major line of business including the most hyped...and still trading at 200x forward.

$TSLA is $330/share and had an EPS of 40c, as a car maker, with rev *down* YoY. At a 10 PE (no growth, automaker, loses money after subsidies go away) it's $16/share.

$GOOGL beats earnings - goes red. $TSLA double miss - goes green. STONKS. 📈

Imagine not selling in your tax protected accounts right now. $6350 then write puts at $6000 strike and take delivery if needed.

Toyota is up +8% on the news of a 15% tariff. Why? It's simple. Ford, GM, Tesla, and all the other American manufacturers are going to be paying 50% more for their steel, 50% more for their copper, 25% more for their Canadian production, 25% more for their Mexican production,…